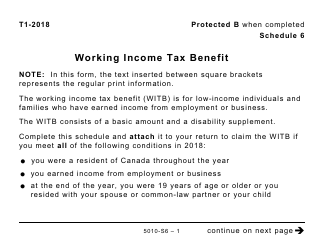

This version of the form is not currently in use and is provided for reference only. Download this version of

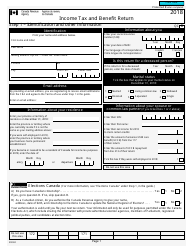

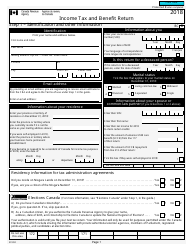

Form 5005-S6 Schedule 6

for the current year.

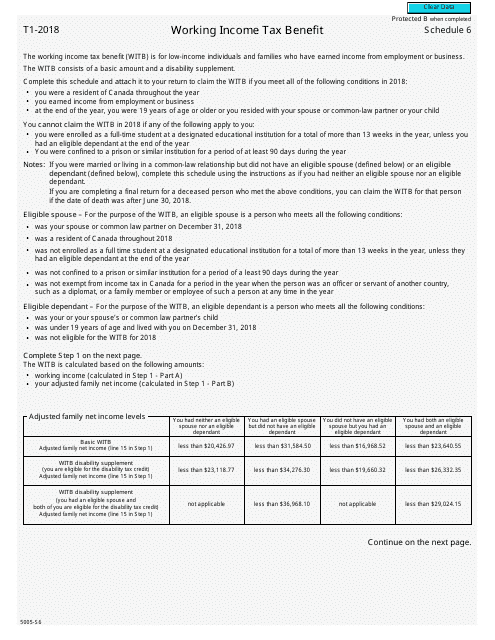

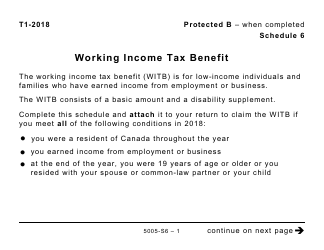

Form 5005-S6 Schedule 6 Working Income Tax Benefit - Canada

Form 5005-S6 Schedule 6 Working Income Tax Benefit - Canada is used to claim the Working Income Tax Benefit (WITB), which is a refundable tax credit for individuals and families with low-income who are in the workforce. It is designed to provide financial assistance and help reduce poverty.

Individuals who are eligible for the Working Income Tax Benefit in Canada would file the Form 5005-S6 Schedule 6.

FAQ

Q: What is Form 5005-S6 Schedule 6?

A: Form 5005-S6 Schedule 6 is a document used in Canada for claiming the Working Income Tax Benefit.

Q: What is the Working Income Tax Benefit?

A: The Working Income Tax Benefit is a tax credit designed to provide financial assistance to low-income individuals and families who are working.

Q: Who is eligible for the Working Income Tax Benefit?

A: Individuals and families with low-income who have employment income may be eligible for the Working Income Tax Benefit.

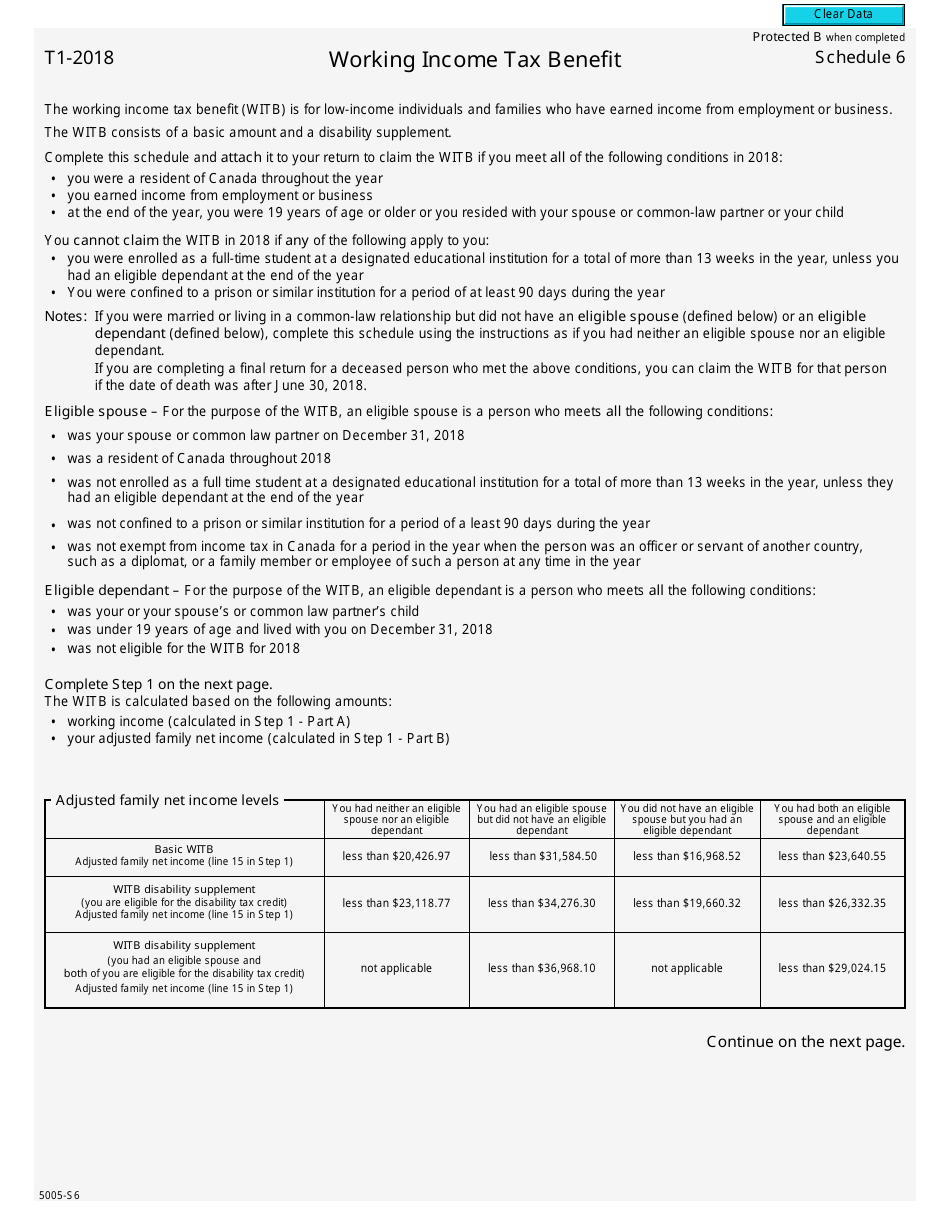

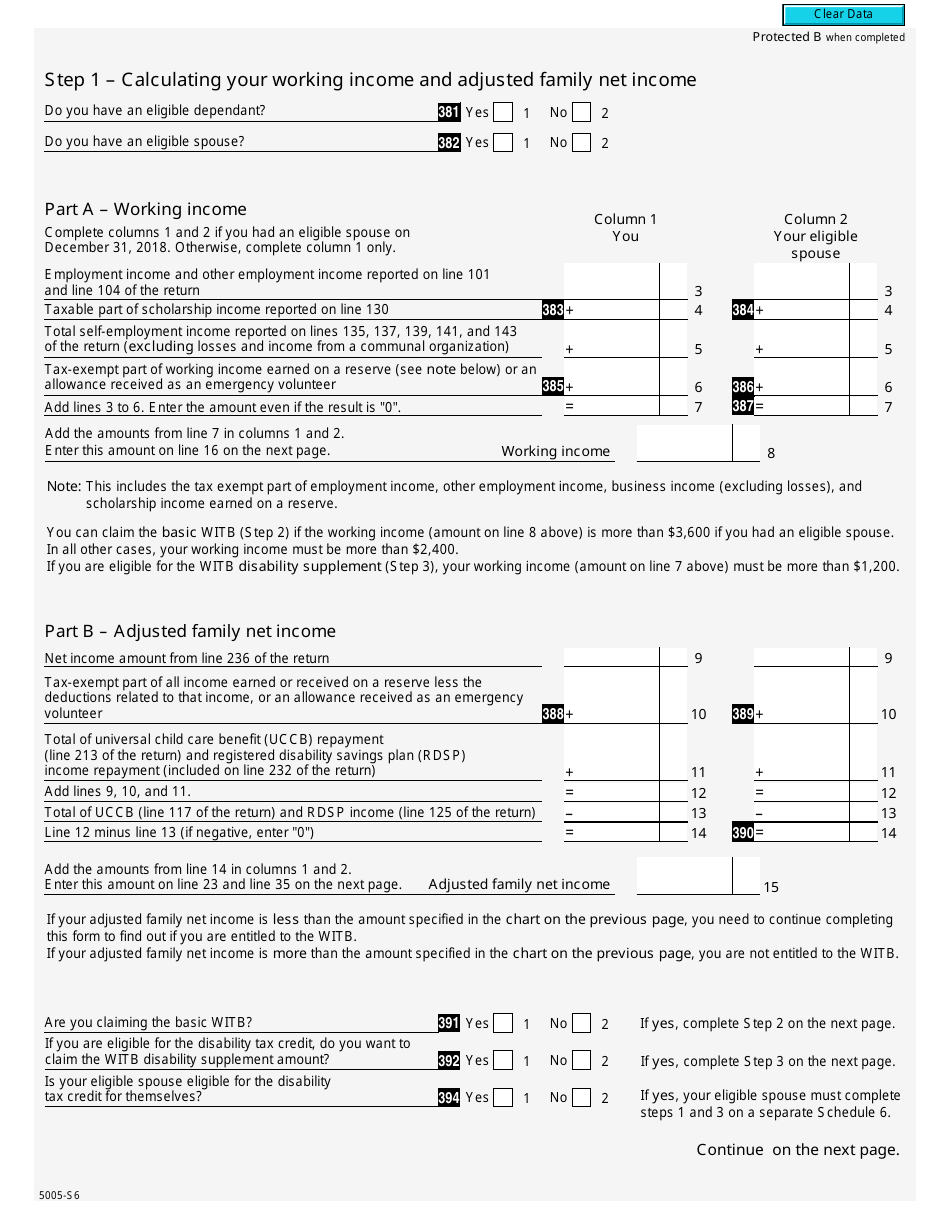

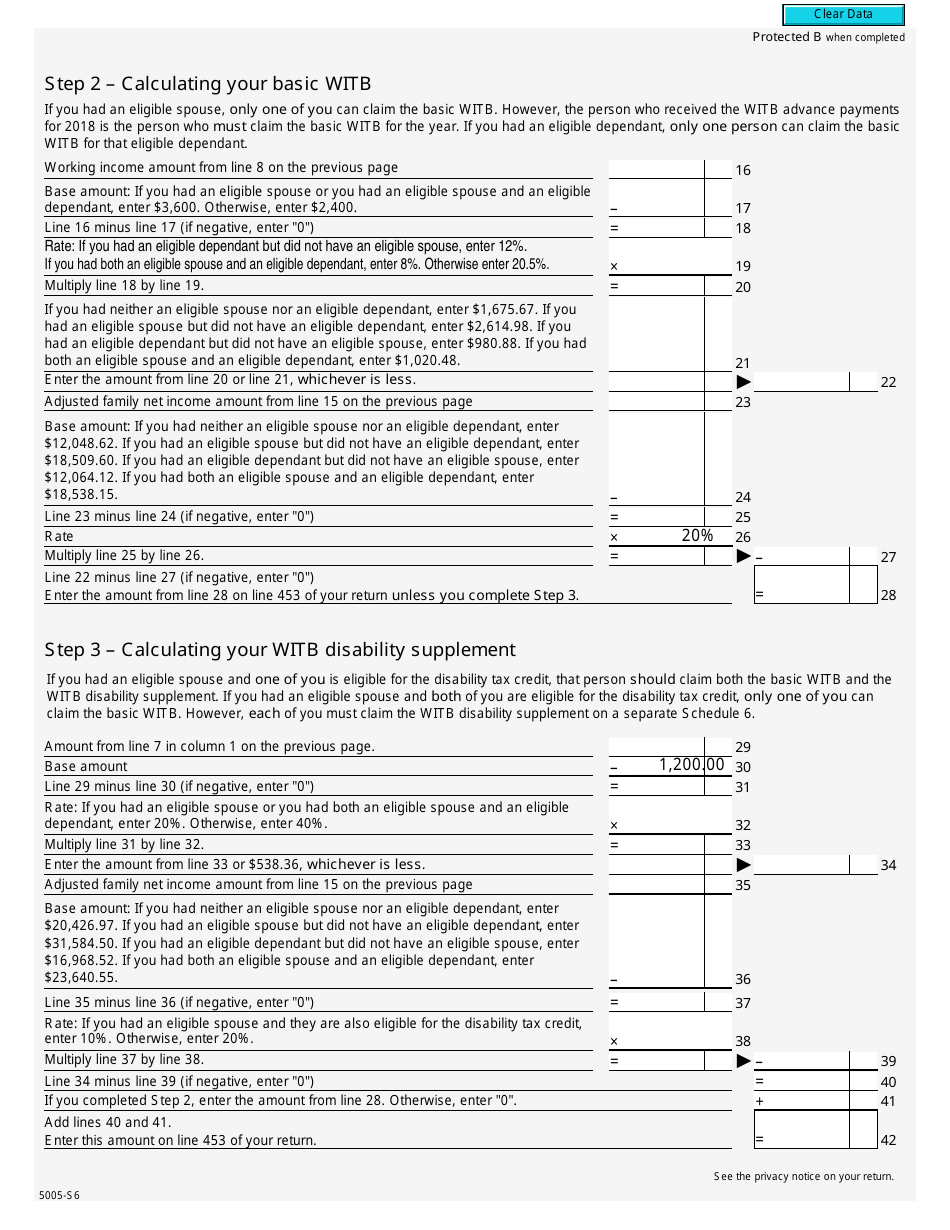

Q: What information is required to complete Form 5005-S6 Schedule 6?

A: To complete Form 5005-S6 Schedule 6, you will need to provide information such as your employment income, the number of weeks worked, and any eligible work-related expenses.

Q: How do I claim the Working Income Tax Benefit?

A: To claim the Working Income Tax Benefit, you must complete Form 5005-S6 Schedule 6 and include it with your personal income tax return.

Q: Is the Working Income Tax Benefit the same as the Canada Child Benefit?

A: No, the Working Income Tax Benefit is separate from the Canada Child Benefit. They are different programs with different eligibility criteria.