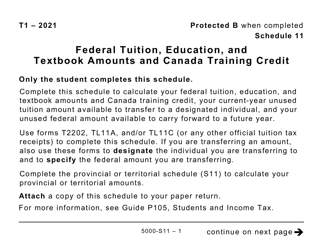

This version of the form is not currently in use and is provided for reference only. Download this version of

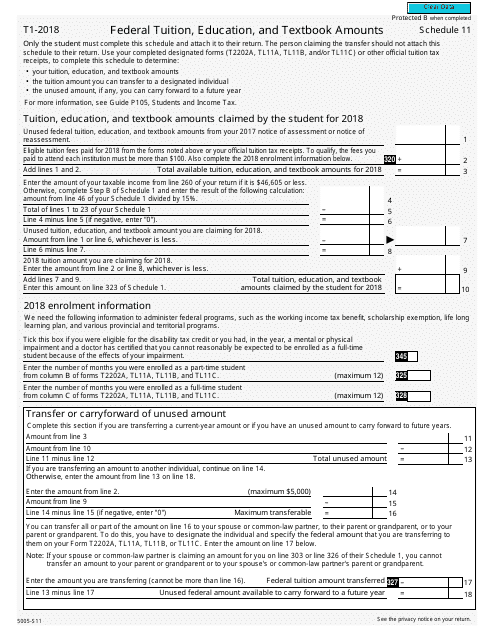

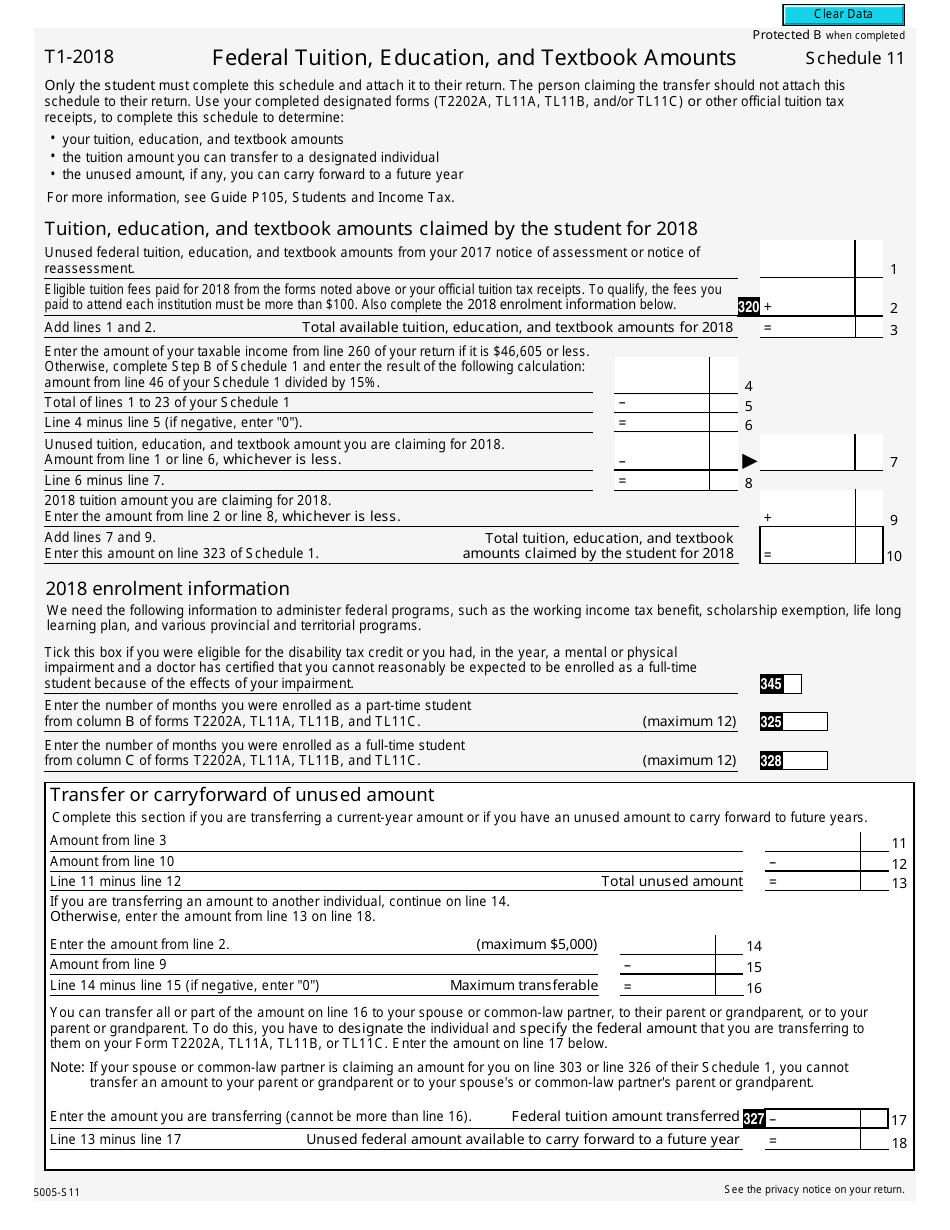

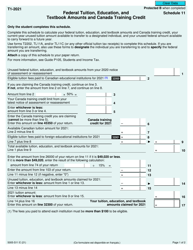

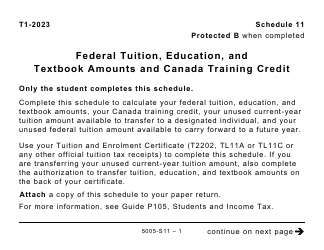

Form 5005-S11 Schedule 11

for the current year.

Form 5005-S11 Schedule 11 Federal Tuition, Education, and Textbook Amounts - Canada

This fillable " Federal Tuition, Education, And Textbook Amounts " is a document issued by the Canadian Revenue Agency specifically for Canada residents.

Download the PDF by clicking the link below and complete it directly in your browser or through the Adobe Desktop application.

FAQ

Q: What is Form 5005-S11?

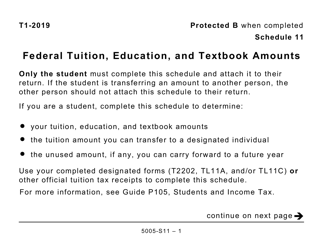

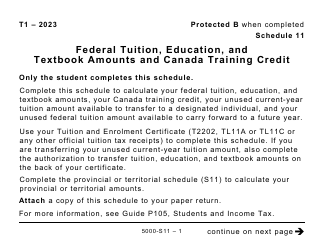

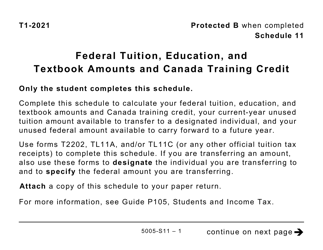

A: Form 5005-S11 is Schedule 11 for reporting federal tuition, education, and textbook amounts in Canada.

Q: What is the purpose of Form 5005-S11?

A: Form 5005-S11 is used to claim education-related tax credits on your federal tax return in Canada.

Q: What are the tuition, education, and textbook amounts?

A: These amounts represent expenses you incurred for post-secondary education and can be used to reduce your taxable income.

Q: Who can claim the tuition, education, and textbook amounts?

A: Students or their spouses or common-law partners can claim these amounts if they meet certain criteria.

Q: How do I fill out Form 5005-S11?

A: You need to enter the relevant amounts from your T2202A or TL11A forms onto the schedule and follow the instructions provided.