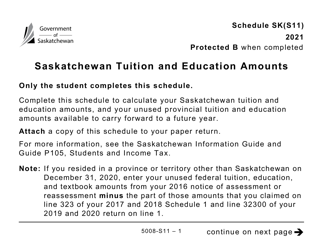

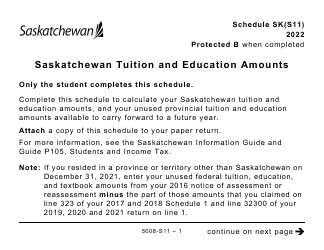

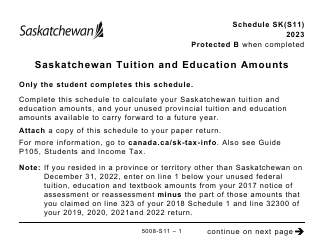

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5008-S11 Schedule SK(S11)

for the current year.

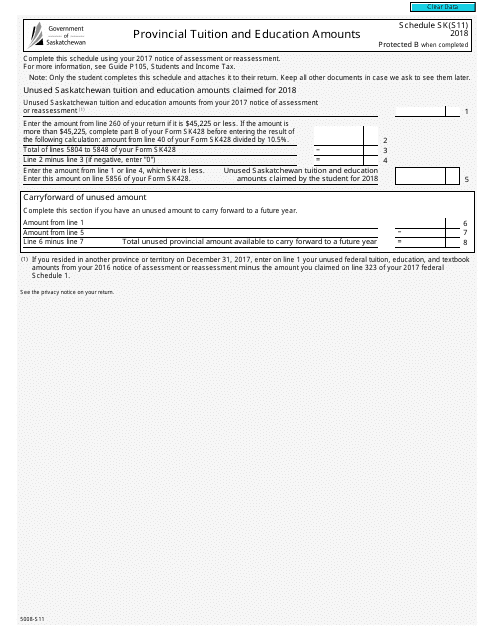

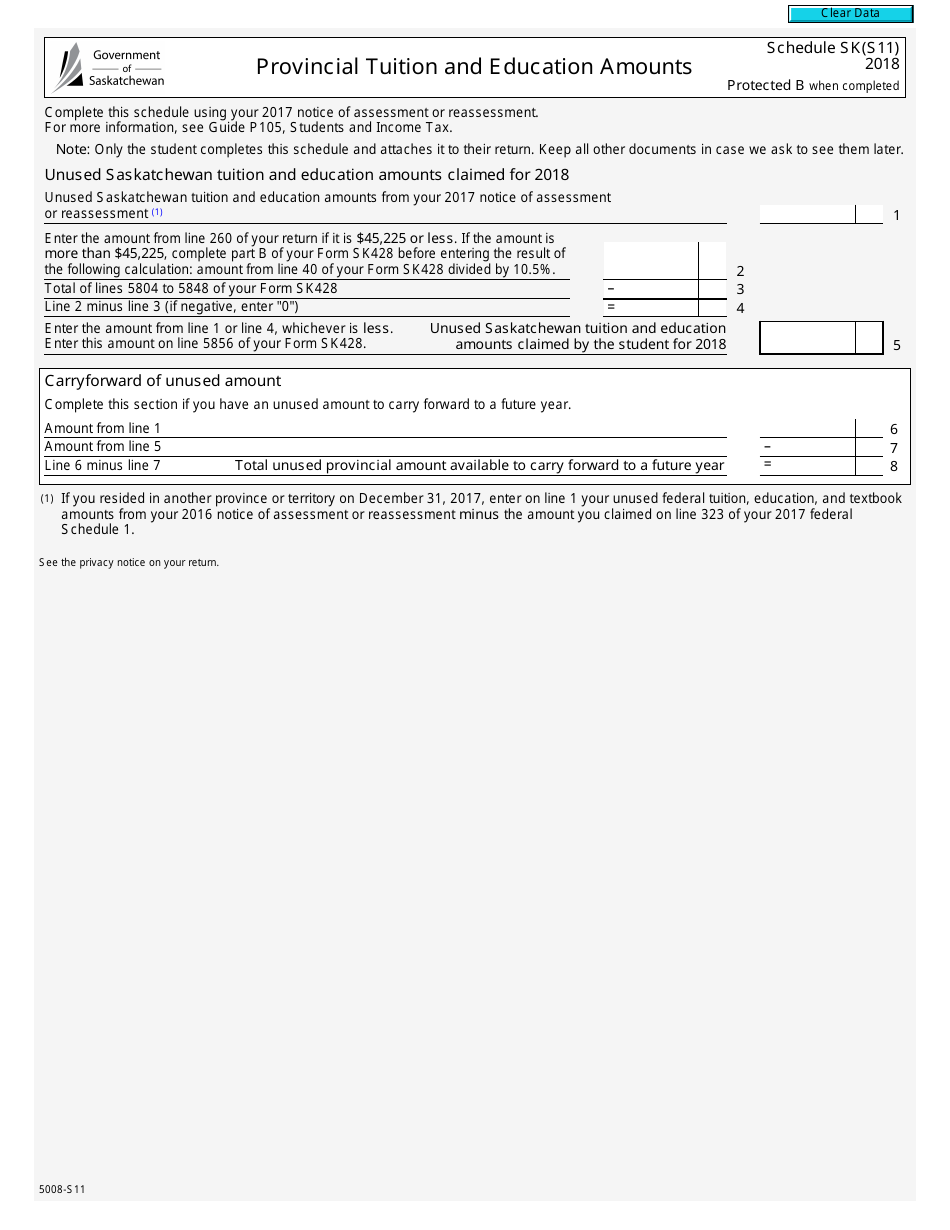

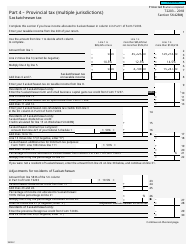

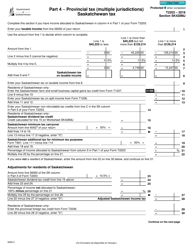

Form 5008-S11 Schedule SK(S11) Provincial Tuition and Education Amounts - Canada

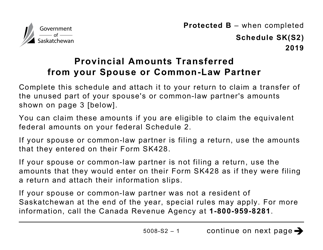

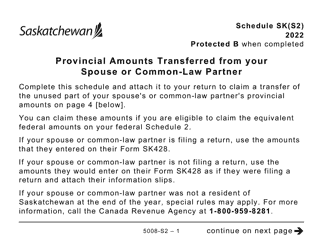

Form 5008-S11 Schedule SK(S11) Provincial Tuition and Education Amounts in Canada is used to claim the provincial tuition and education amounts for Saskatchewan residents. It allows individuals to calculate and claim the amount of tuition and education expenses that can be deducted or transferred to their spouse or common-law partner.

The individual taxpayer or their authorized representative files the Form 5008-S11 Schedule SK(S11) Provincial Tuition and Education Amounts - Canada.

FAQ

Q: What is Form 5008-S11?

A: Form 5008-S11 is a tax form in Canada.

Q: What is Schedule SK(S11)?

A: Schedule SK(S11) is a part of Form 5008-S11.

Q: What are Provincial Tuition and Education Amounts?

A: Provincial Tuition and Education Amounts are deductions that can be claimed on your tax return.

Q: Who can claim Provincial Tuition and Education Amounts?

A: Generally, students or their parents can claim these amounts.

Q: What information is required for Schedule SK(S11)?

A: Schedule SK(S11) requires information about your tuition and education expenses.

Q: How do I file Form 5008-S11?

A: You can file Form 5008-S11 along with your tax return.

Q: Can I claim Provincial Tuition and Education Amounts in the USA?

A: No, Provincial Tuition and Education Amounts can only be claimed in Canada.