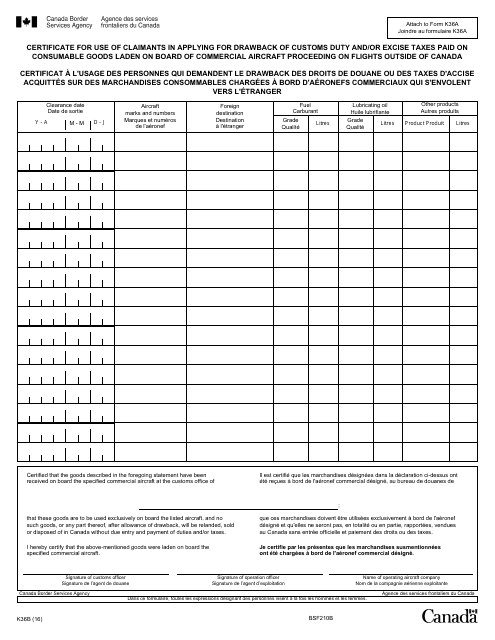

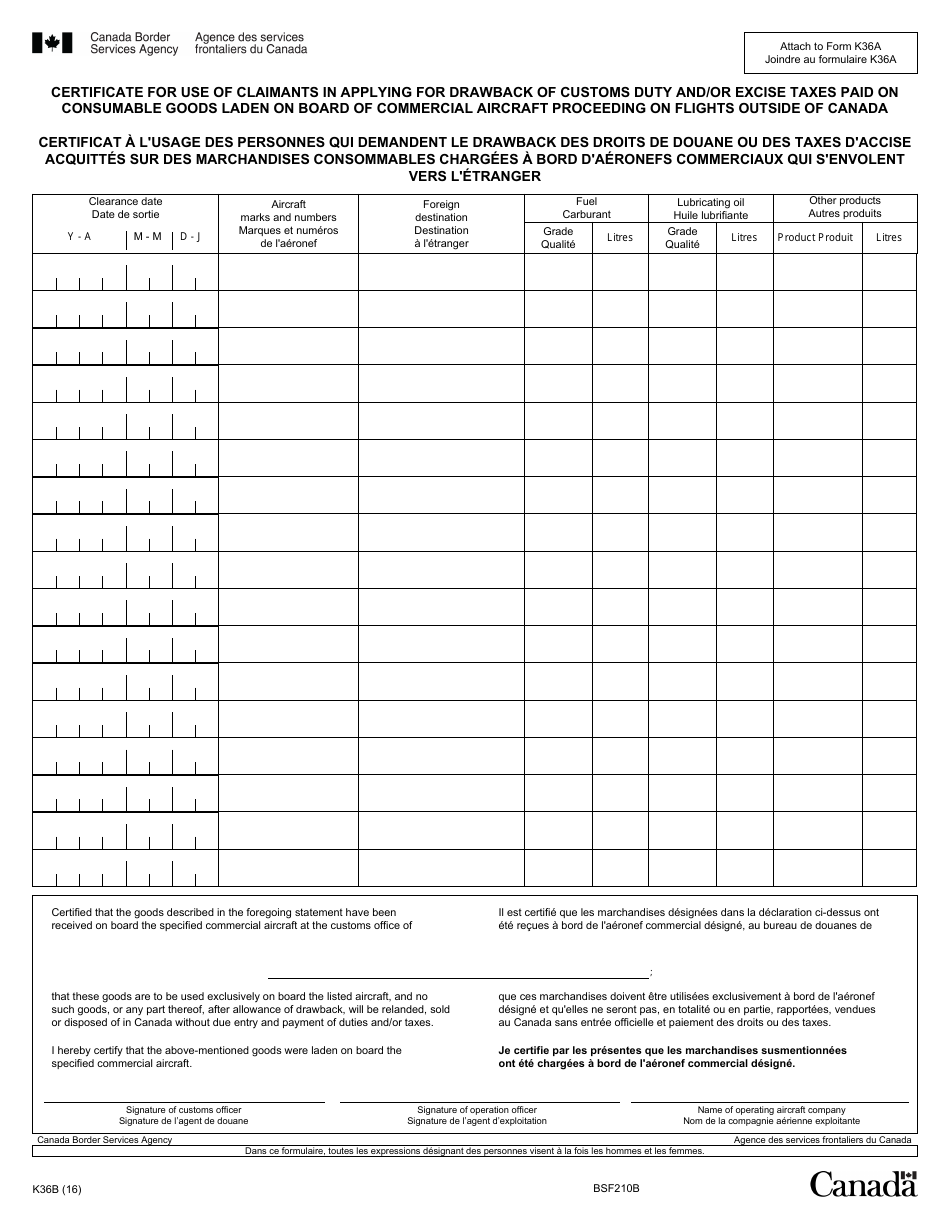

Form K36B Certificate for Use of Claimants in Applying for Drawback of Customs Duty and / or Excise Taxes Paid on Consumable Goods Laden on Board Commercial Aircraft Proceeding on Flights Outside of Canada - Canada (English / French)

The Form K36B Certificate is used by claimants to apply for drawback of customs duty and/or excise taxes paid on consumable goods loaded on commercial aircraft proceeding on flights outside of Canada. It is used in Canada and is available in both English and French.

The form K36B Certificate can be filed by the claimants in Canada (English/French).

FAQ

Q: What is a Form K36B Certificate?

A: Form K36B Certificate is a document used by claimants to apply for drawback of customs duty and/or excise taxes paid on consumable goods loaded on board commercial aircraft for flights outside of Canada.

Q: Who can use Form K36B Certificate?

A: Claimants who have paid customs duty and/or excise taxes on consumable goods loaded on board commercial aircraft for flights outside of Canada can use Form K36B Certificate.

Q: What is the purpose of Form K36B Certificate?

A: The purpose of Form K36B Certificate is to claim a drawback of customs duty and/or excise taxes paid on consumable goods loaded on board commercial aircraft for flights outside of Canada.

Q: Is Form K36B Certificate available in English and French?

A: Yes, Form K36B Certificate is available in both English and French versions.

Q: Do I need to provide any supporting documents with Form K36B Certificate?

A: Yes, claimants need to provide supporting documents such as commercial aircraft loading records and proof of payment for customs duty and/or excise taxes.

Q: Can I submit Form K36B Certificate electronically?

A: No, Form K36B Certificate cannot be submitted electronically. It must be submitted by mail or in person to the CBSA office.

Q: What is the deadline to submit Form K36B Certificate?

A: Form K36B Certificate must be submitted within one year from the date of exportation of the goods from Canada.

Q: Is there any fee for submitting Form K36B Certificate?

A: No, there is no fee for submitting Form K36B Certificate.