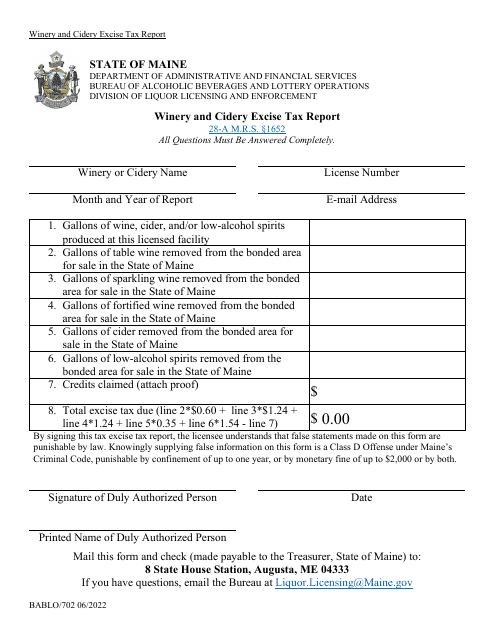

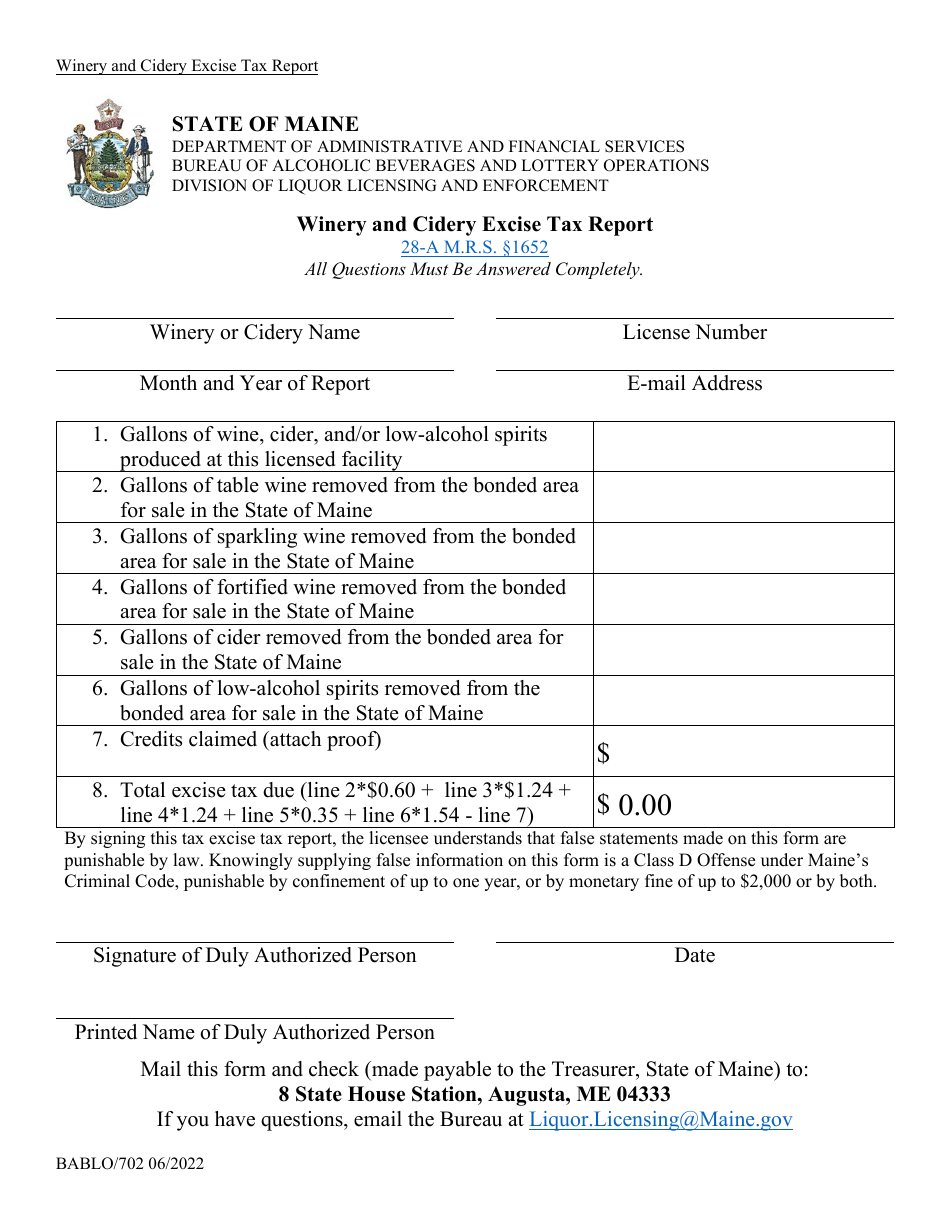

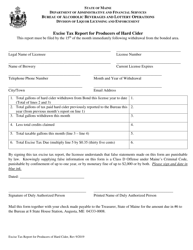

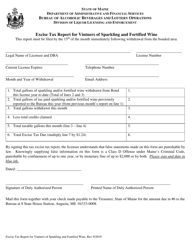

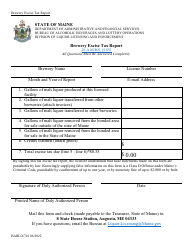

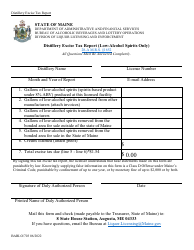

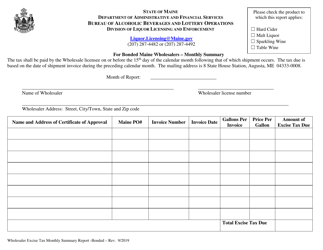

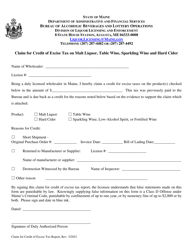

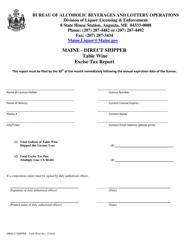

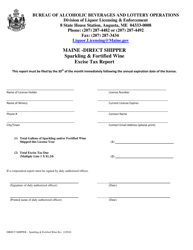

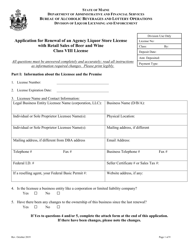

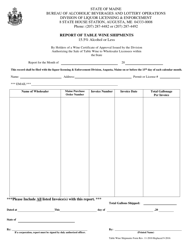

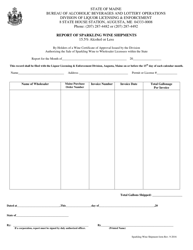

Form BABLO / 702 Winery and Cidery Excise Tax Report - Maine

What Is Form BABLO/702?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

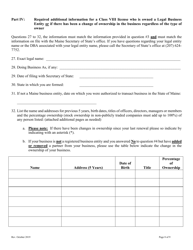

Q: What is the BABLO/702 Winery and Cidery Excise Tax Report?

A: The BABLO/702 Winery and Cidery Excise Tax Report is a tax report specifically for wineries and cideries in Maine.

Q: Who is required to file the BABLO/702 Winery and Cidery Excise Tax Report?

A: Winery and cidery owners in Maine are required to file the BABLO/702 Winery and Cidery Excise Tax Report.

Q: What is the purpose of the BABLO/702 Winery and Cidery Excise Tax Report?

A: The BABLO/702 Winery and Cidery Excise Tax Report is used to report and pay excise taxes on wine and cider produced in Maine.

Q: When is the deadline to file the BABLO/702 Winery and Cidery Excise Tax Report?

A: The deadline to file the BABLO/702 Winery and Cidery Excise Tax Report is typically on a quarterly basis, with specific due dates provided by the Maine Bureau of Alcoholic Beverages and Lottery Operations (BABLO).

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BABLO/702 by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.