This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST190

for the current year.

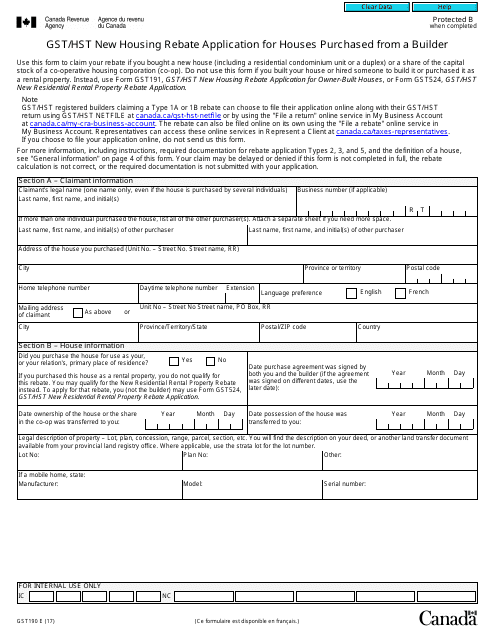

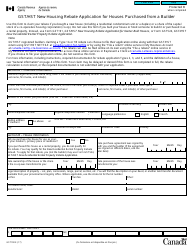

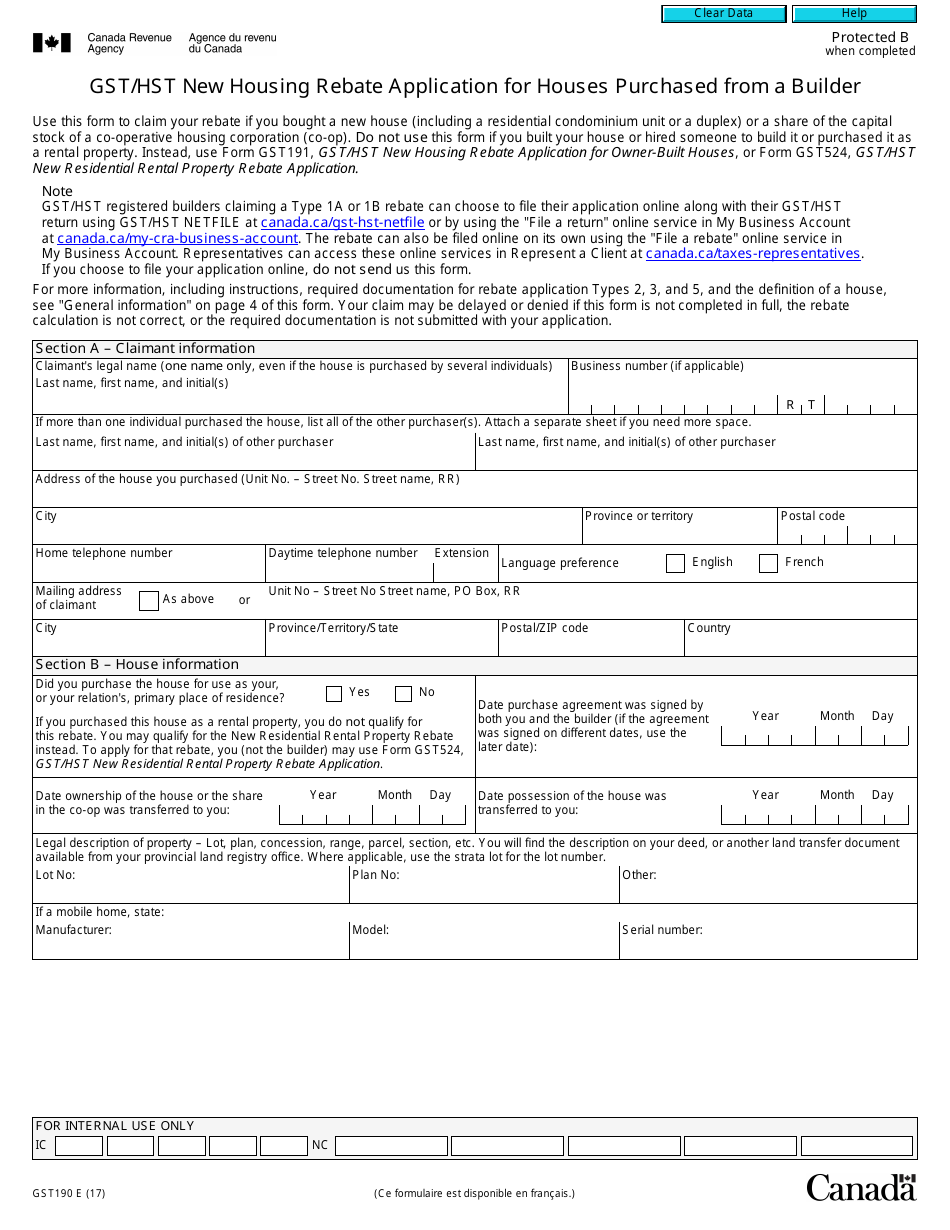

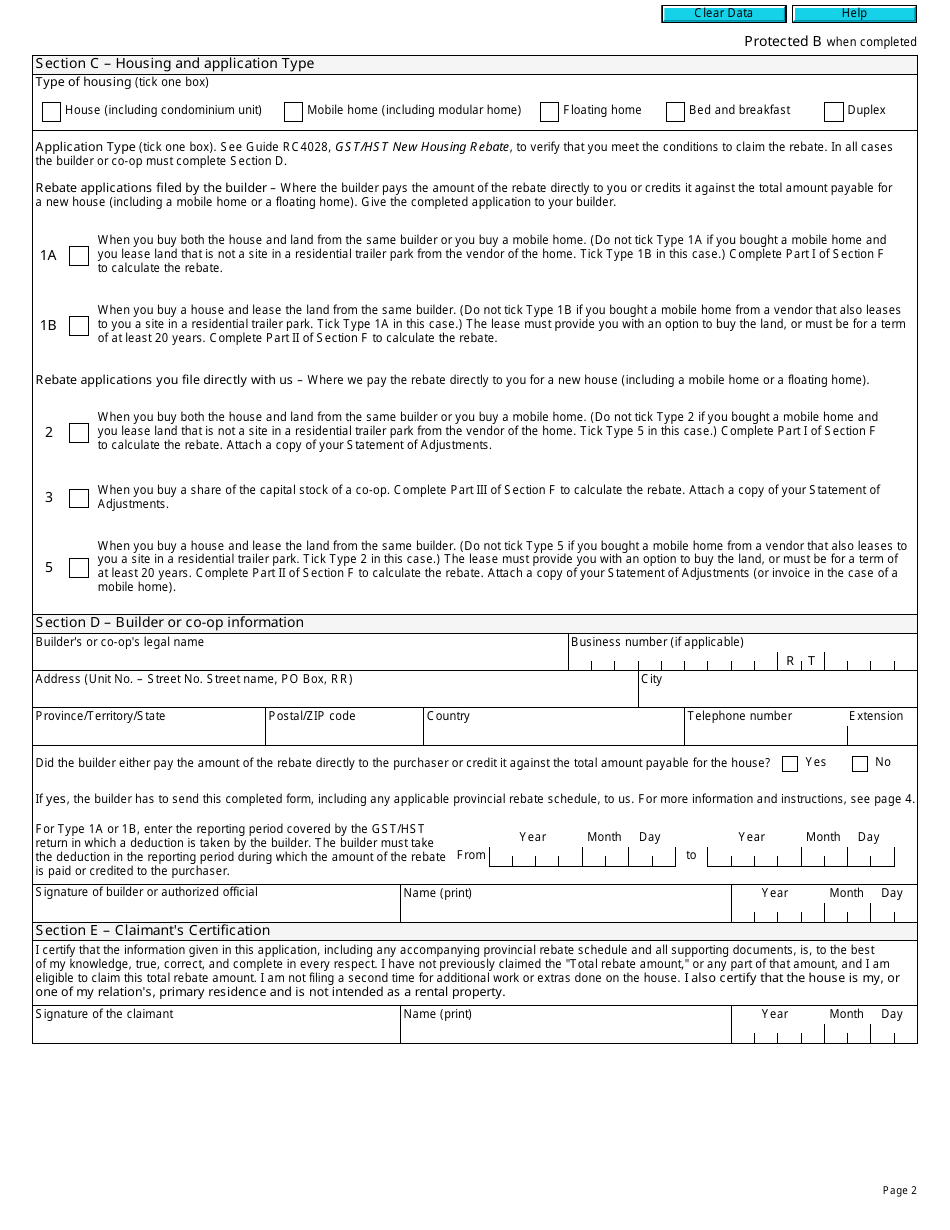

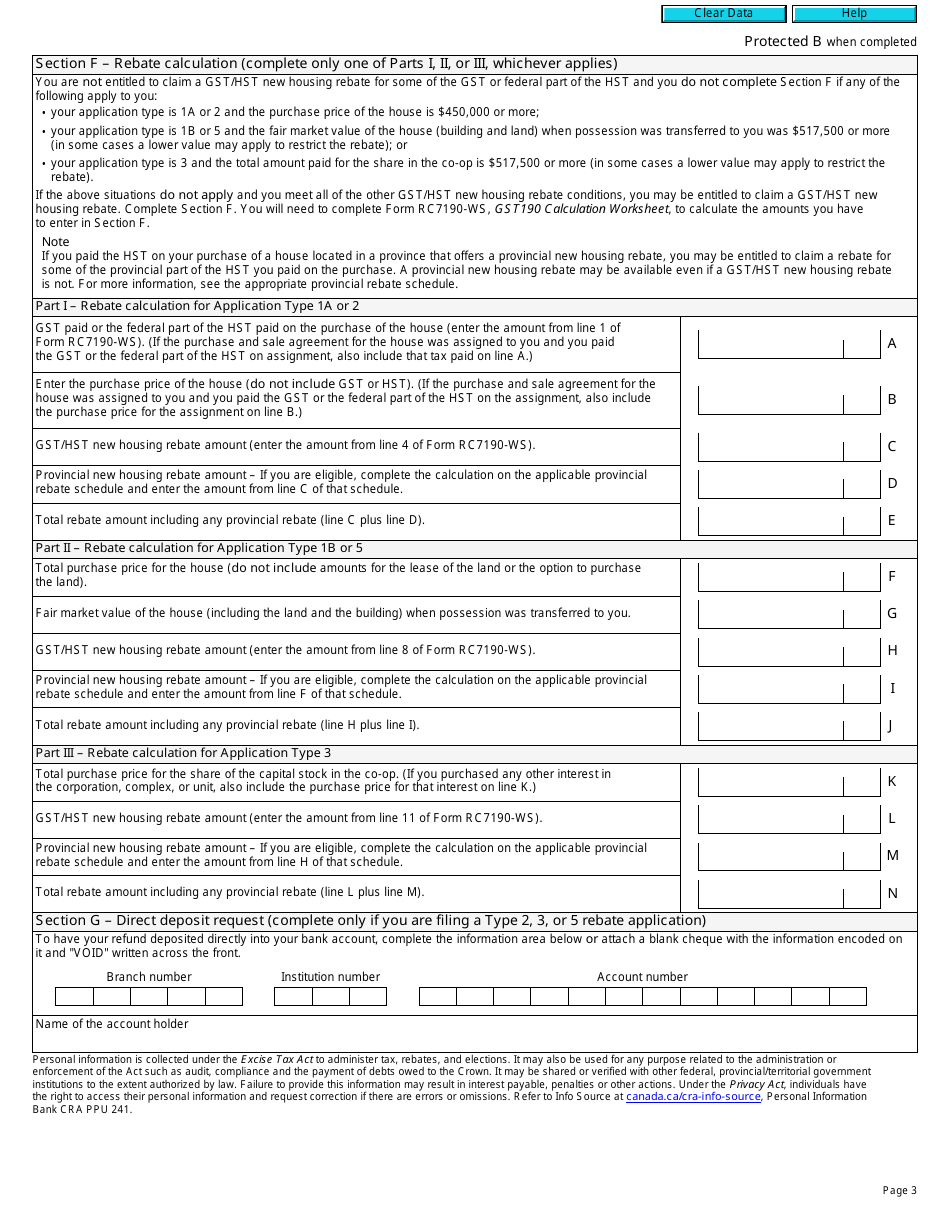

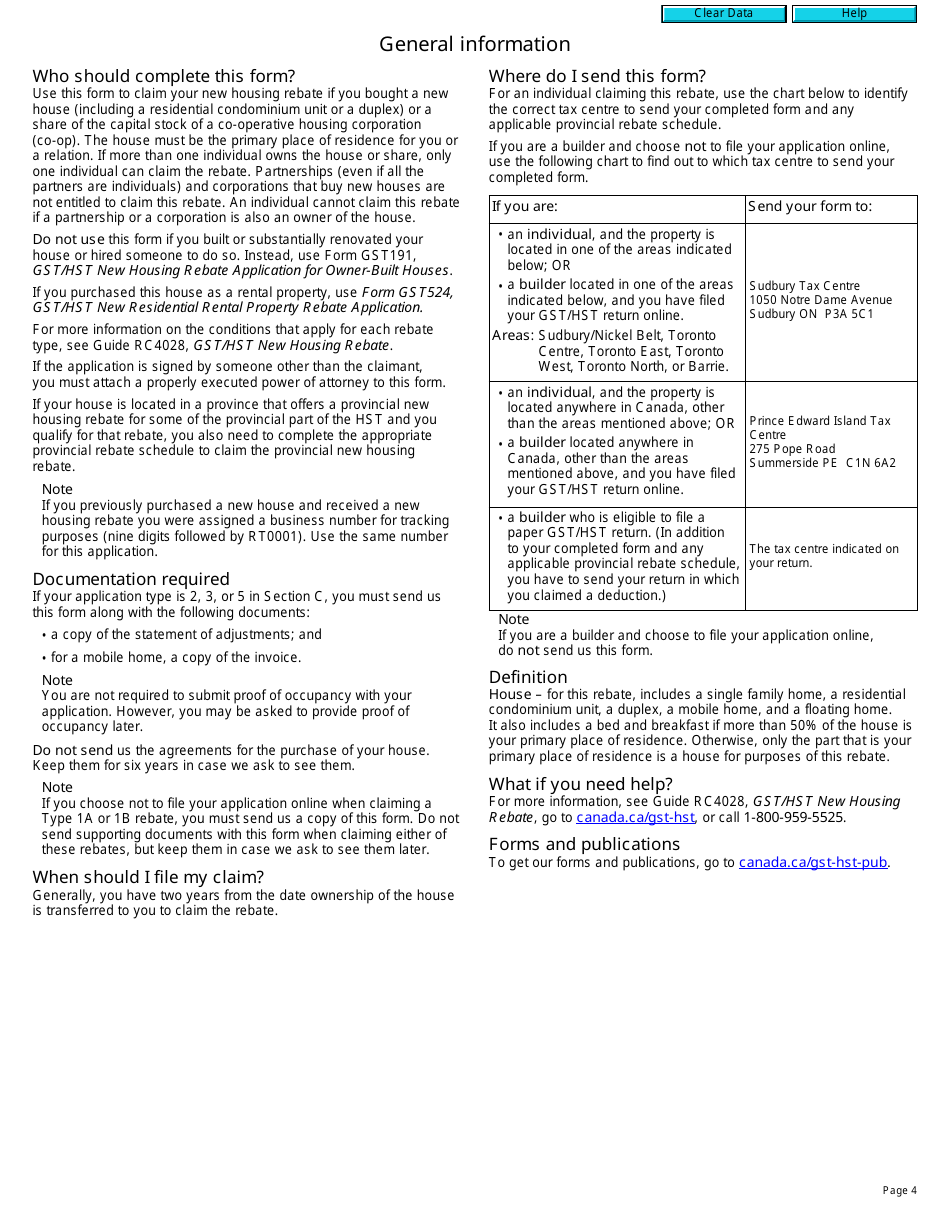

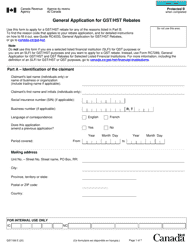

Form GST190 Gst / Hst New Housing Rebate Application for Houses Purchased From a Builder - Canada

Form GST190 is the GST/HST New Housing Rebate Application for houses purchased from a builder in Canada. It is used to apply for a rebate if you bought a newly constructed or substantially renovated home and paid GST or HST on the purchase.

The purchaser of the new house files the Form GST190 GST/HST New Housing Rebate Application in Canada.

FAQ

Q: What is Form GST190?

A: Form GST190 is the GST/HST New Housing Rebate Application for Houses Purchased From a Builder in Canada.

Q: Who can use Form GST190?

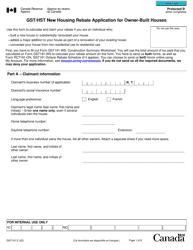

A: This form can be used by individuals who have purchased a new house from a builder and are eligible for the GST/HST new housing rebate.

Q: What is the purpose of Form GST190?

A: The purpose of this form is to apply for the GST/HST new housing rebate for houses purchased from a builder in Canada.

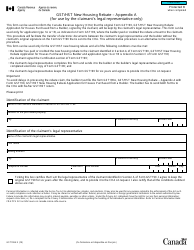

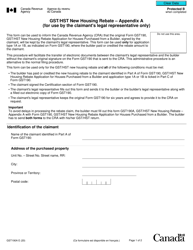

Q: What information is required on Form GST190?

A: Form GST190 requires information about the property, the builder, and the purchase price, as well as supporting documents.

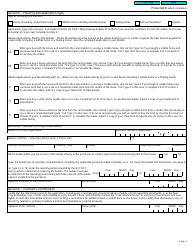

Q: What are the eligibility criteria for the GST/HST new housing rebate?

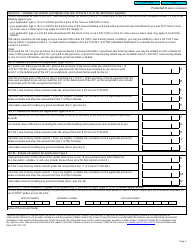

A: To be eligible for the rebate, you must meet certain criteria, including being a Canadian resident, purchasing a new house from a builder, and meeting the qualifying conditions.

Q: What are the qualifying conditions for the GST/HST new housing rebate?

A: The qualifying conditions include the property being used as a primary place of residence, the purchase price being less than a specified threshold, and the house being intended for residential use.

Q: When should I submit Form GST190?

A: You should submit Form GST190 within two years after the date of purchase or occupancy of the house, whichever comes later.

Q: What happens after I submit Form GST190?

A: After submitting Form GST190, the Canada Revenue Agency will assess your application and determine your eligibility for the GST/HST new housing rebate.

Q: Is there a time limit for receiving the GST/HST new housing rebate?

A: Yes, you must apply for the rebate within two years of the date of purchase or occupancy of the house, whichever comes later.