This version of the form is not currently in use and is provided for reference only. Download this version of

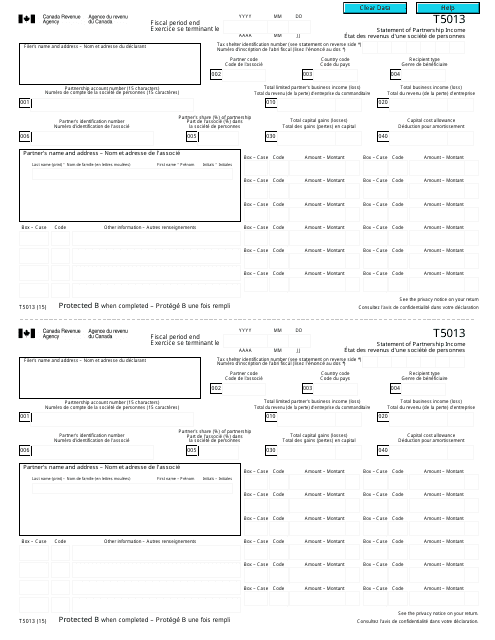

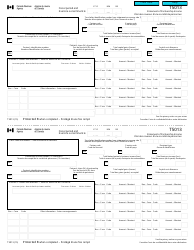

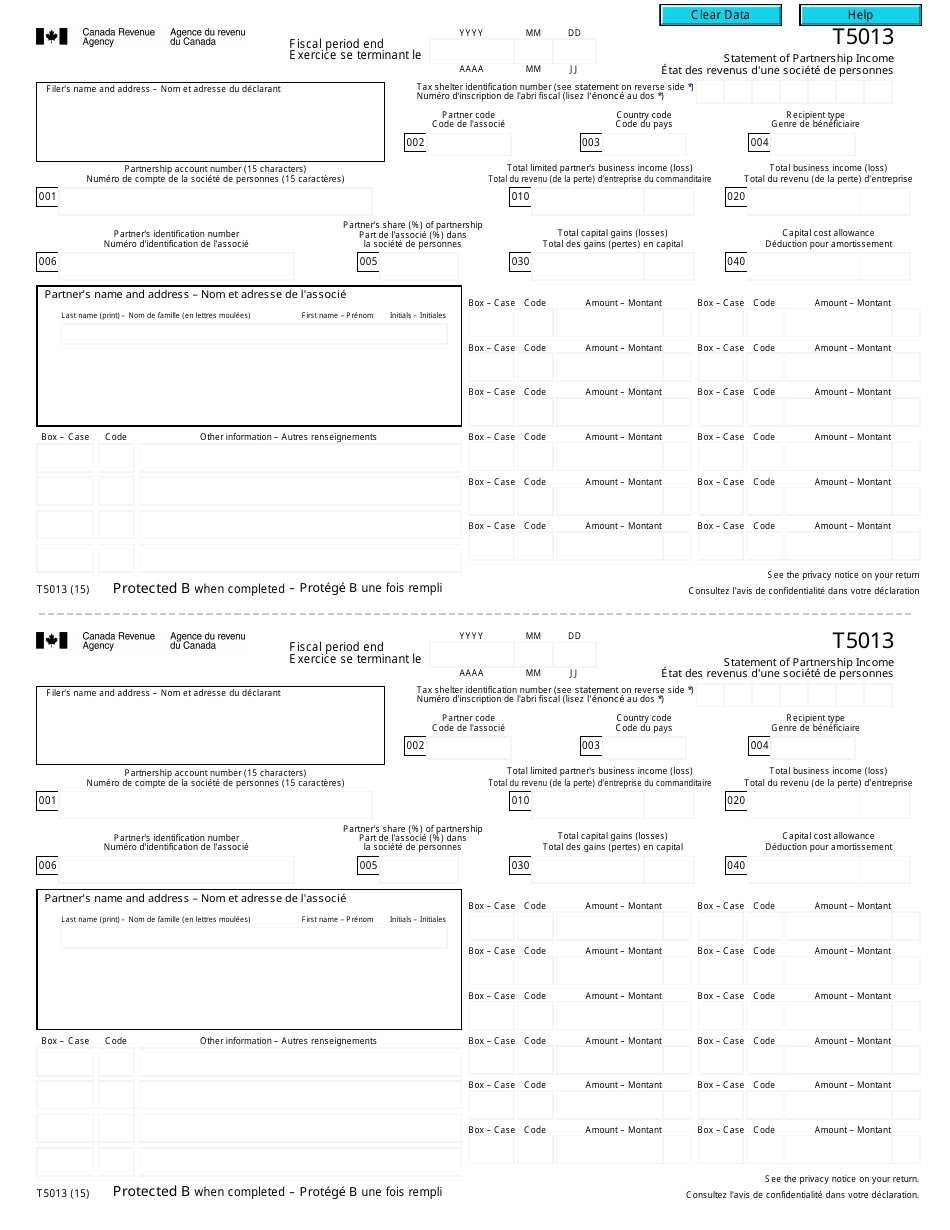

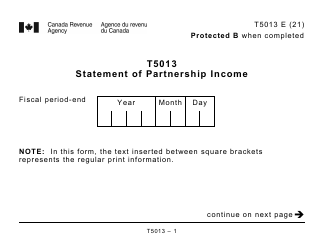

Form T5013

for the current year.

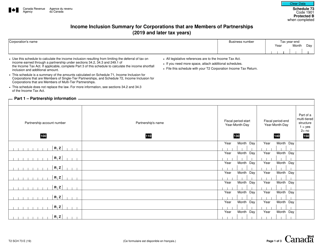

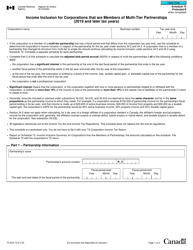

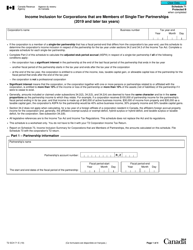

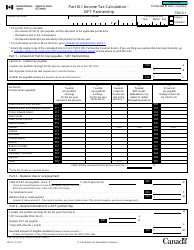

Form T5013 Statement of Partnership Income - Canada (English / French)

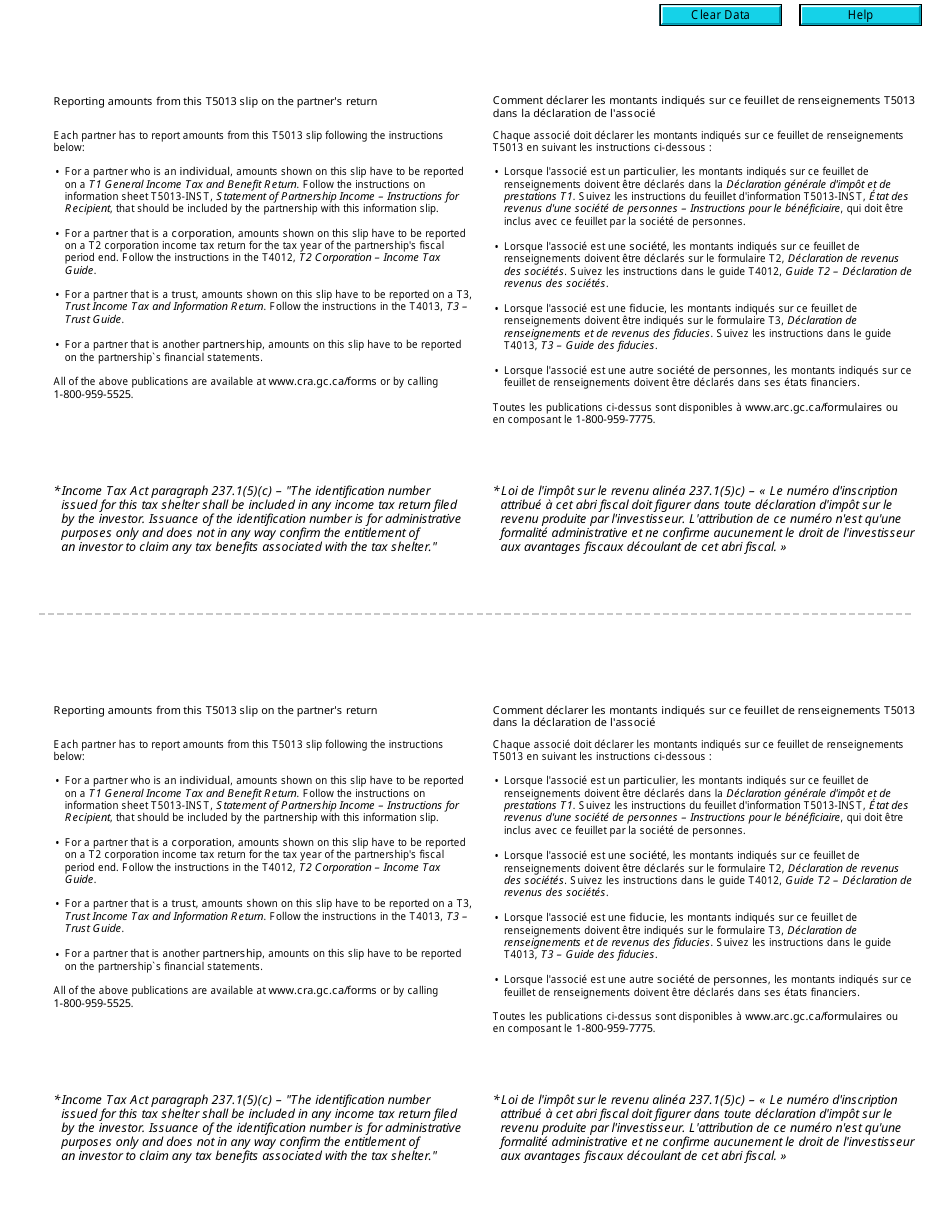

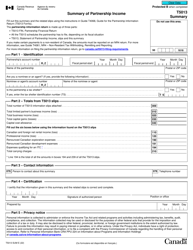

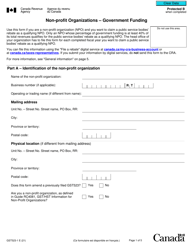

Form T5013, Statement of Partnership Income, is used in Canada to report the income, expenses, and other relevant information of a partnership. This form is filed by partnerships resident in Canada or partnerships that carry on business in Canada to report their income and distribute partnership income to partners. It helps the Canada Revenue Agency (CRA) to determine the taxable income of the partnership and its partners. The form is available in both English and French to ensure accessibility for all taxpayers.

The Form T5013 Statement of Partnership Income in Canada is filed by partnerships, not by individual partners.

FAQ

Q: What is Form T5013?

A: Form T5013 is a statement of partnership income in Canada.

Q: What is the purpose of Form T5013?

A: The purpose of Form T5013 is to report partnership income and expenses.

Q: Who needs to file Form T5013?

A: Partnerships registered in Canada need to file Form T5013.

Q: Is Form T5013 available in both English and French?

A: Yes, Form T5013 is available in both English and French.

Q: When is the deadline to file Form T5013?

A: The deadline to file Form T5013 is generally within six months of the partnership's fiscal year-end.

Q: What information is required on Form T5013?

A: Form T5013 requires information about the partnership's income, expenses, and partners.

Q: Are there any penalties for not filing Form T5013?

A: Yes, there are penalties for not filing Form T5013, including late filing penalties and penalties for inaccurate or incomplete information.

Q: Can I file Form T5013 electronically?

A: Yes, you can file Form T5013 electronically using the CRA's My Business Account or Represent a Client services.

Q: Can I amend Form T5013 after filing?

A: Yes, you can amend Form T5013 after filing by submitting a T5013A form and indicating the changes.