This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC376

for the current year.

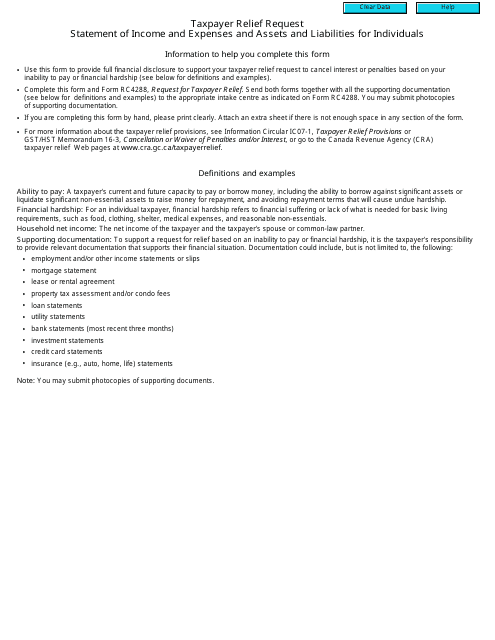

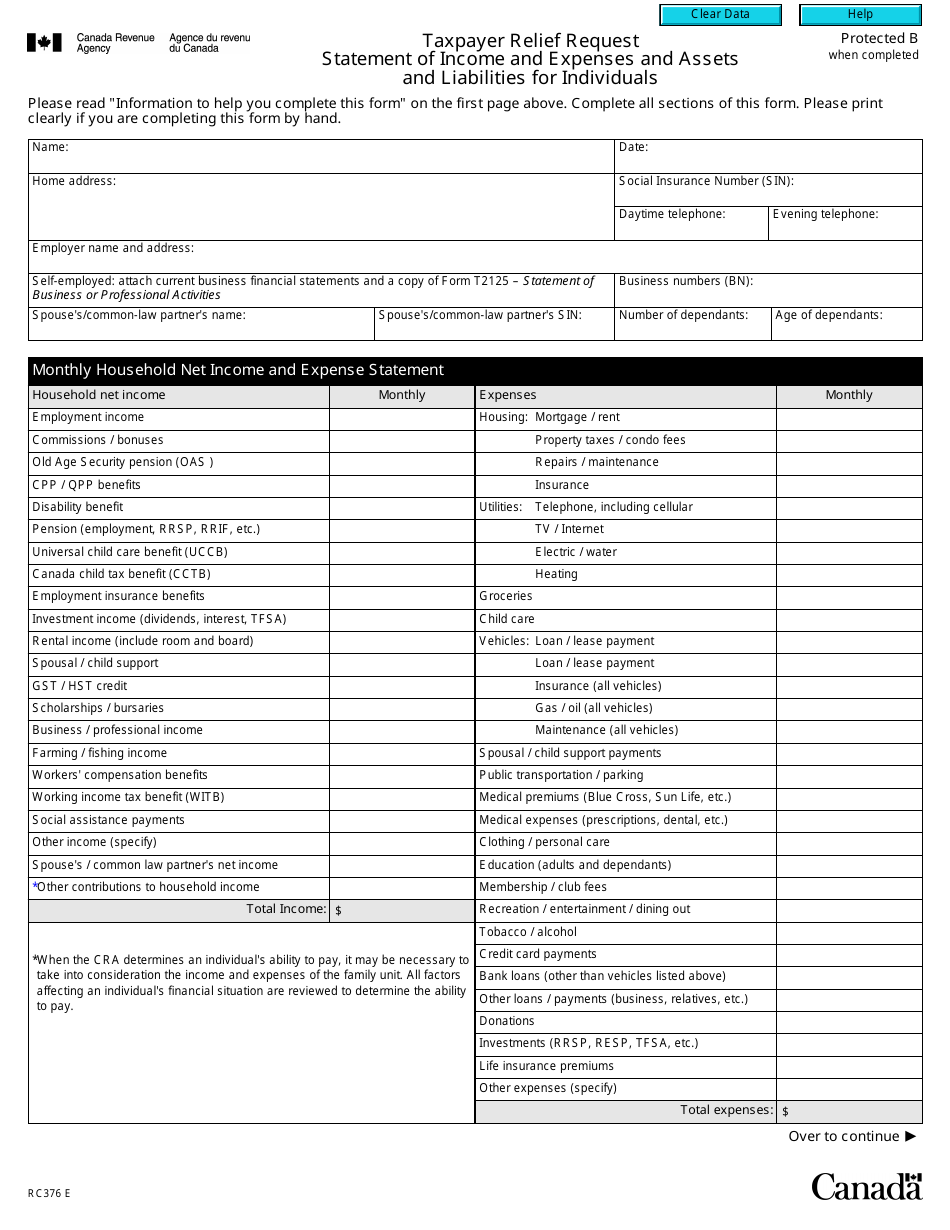

Form RC376 Taxpayer Relief Request - Statement of Income and Expenses and Assets and Liabilities for Individuals - Canada

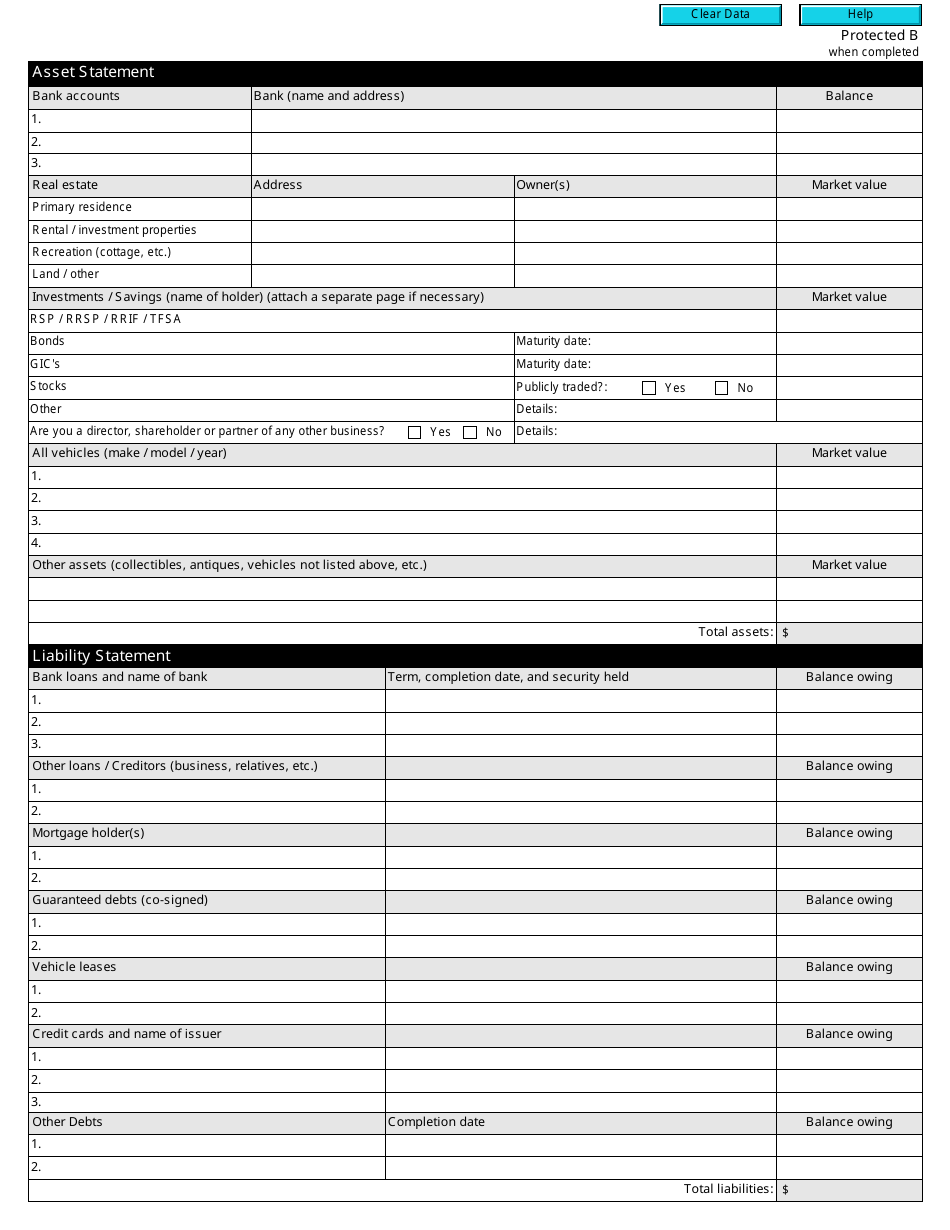

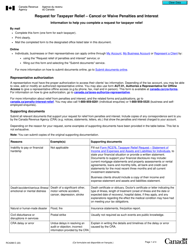

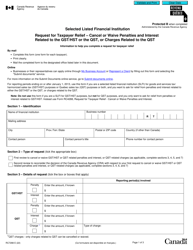

Form RC376, also known as the Taxpayer Relief Request - Statement of Income and Expenses and Assets and Liabilities for Individuals, is used in Canada to request relief from certain tax obligations. It provides a platform for individuals to provide the Canada Revenue Agency with details of their income, expenses, assets, and liabilities in order to support their request for relief from penalties, interest, or other tax-related matters.

The Form RC376 Taxpayer Relief Request - Statement of Income and Expenses and Assets and Liabilities for Individuals in Canada is filed by individual taxpayers who are requesting relief from certain tax obligations or penalties.

FAQ

Q: What is Form RC376?

A: Form RC376 is a Taxpayer Relief Request form in Canada.

Q: What is the purpose of Form RC376?

A: The purpose of Form RC376 is to provide a statement of income and expenses, as well as assets and liabilities, for individuals in relation to a taxpayer relief request.

Q: Who should use Form RC376?

A: Individuals who want to request taxpayer relief in Canada should use Form RC376.

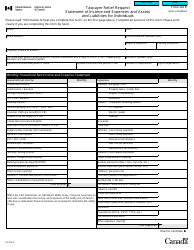

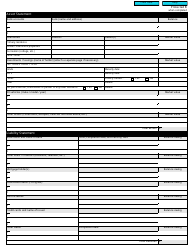

Q: What information is required in Form RC376?

A: Form RC376 requires individuals to provide details of their income, expenses, assets, and liabilities.

Q: Is Form RC376 only applicable for individuals?

A: Yes, Form RC376 is specifically designed for individuals.

Q: What happens after submitting Form RC376?

A: After submitting Form RC376, CRA will review the information provided and assess the taxpayer relief request.

Q: Is there a deadline for submitting Form RC376?

A: There is no specific deadline for submitting Form RC376, but it is recommended to submit it as soon as possible after the circumstances that warrant the taxpayer relief.

Q: Is there a fee for submitting Form RC376?

A: No, there is no fee for submitting Form RC376.