This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2 Schedule 502

for the current year.

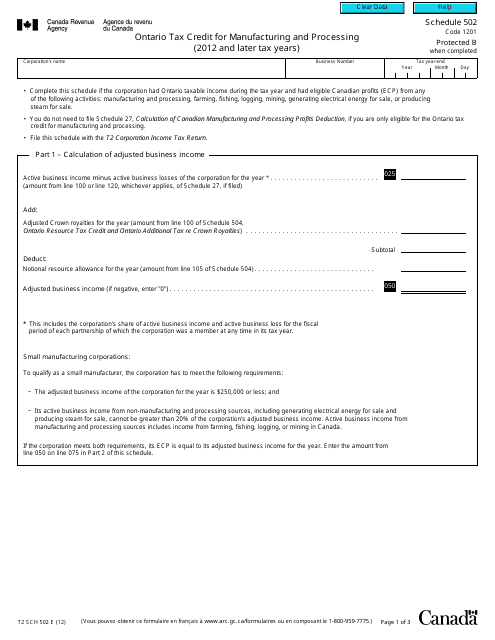

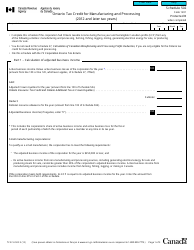

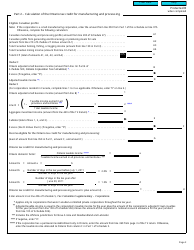

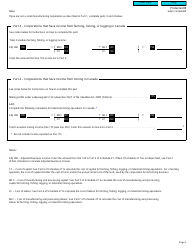

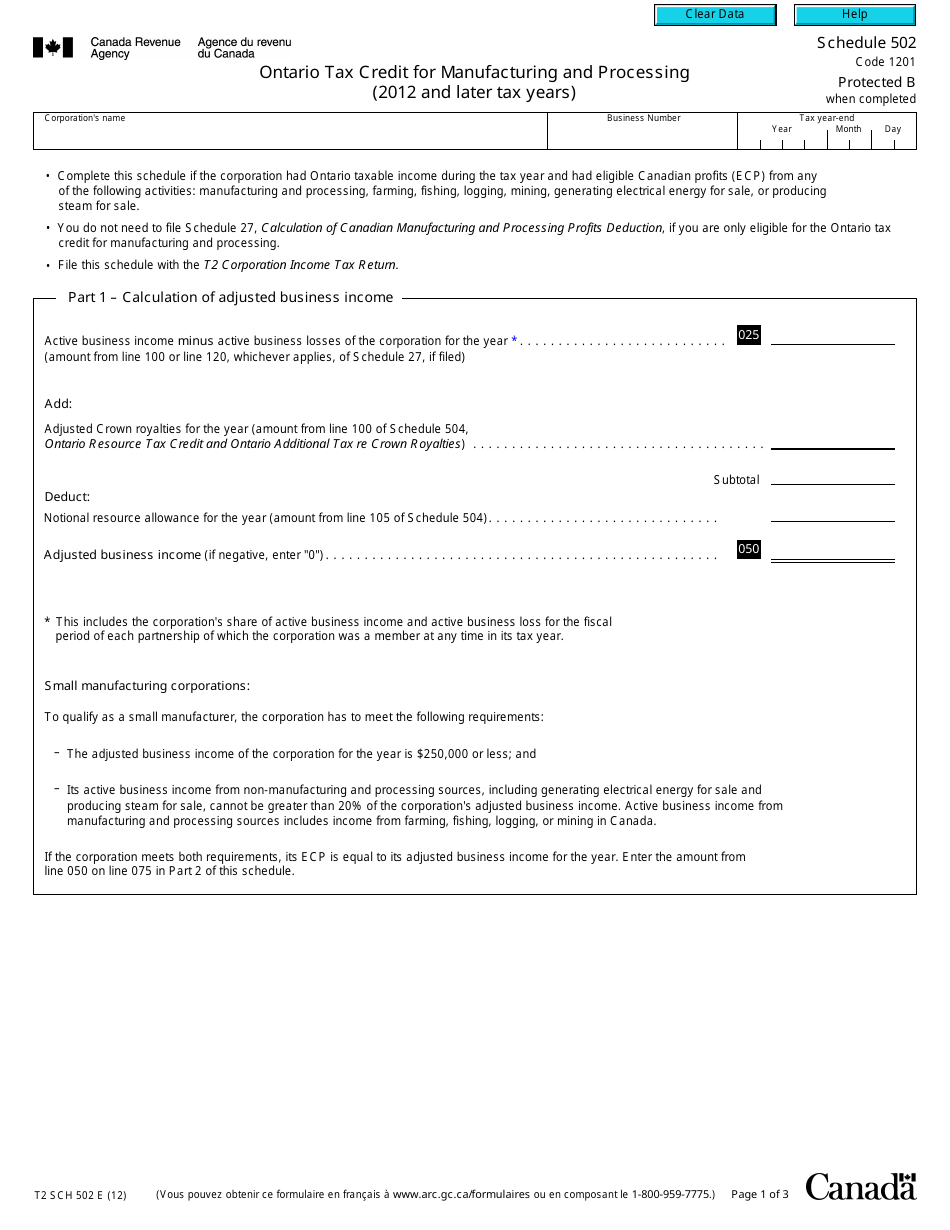

Form T2 Schedule 502 Ontario Tax Credit for Manufacturing and Processing (2012 and Later Tax Years) - Canada

Form T2 Schedule 502 Ontario Tax Credit for Manufacturing and Processing (2012 and Later Tax Years) in Canada is used to claim tax credits for eligible corporations in Ontario that are engaged in manufacturing or processing activities.

The Form T2 Schedule 502 Ontario Tax Credit for Manufacturing and Processing in Canada is typically filed by businesses who are eligible for this tax credit.

FAQ

Q: What is Form T2 Schedule 502?

A: Form T2 Schedule 502 is a tax form in Canada for claiming the Ontario Tax Credit for Manufacturing and Processing expenses.

Q: Who is eligible to claim the Ontario Tax Credit for Manufacturing and Processing?

A: Canadian corporations that carry out manufacturing or processing activities in Ontario are eligible to claim this tax credit.

Q: What is the purpose of the Ontario Tax Credit for Manufacturing and Processing?

A: The purpose of this tax credit is to encourage and support the growth of the manufacturing and processing sector in Ontario.

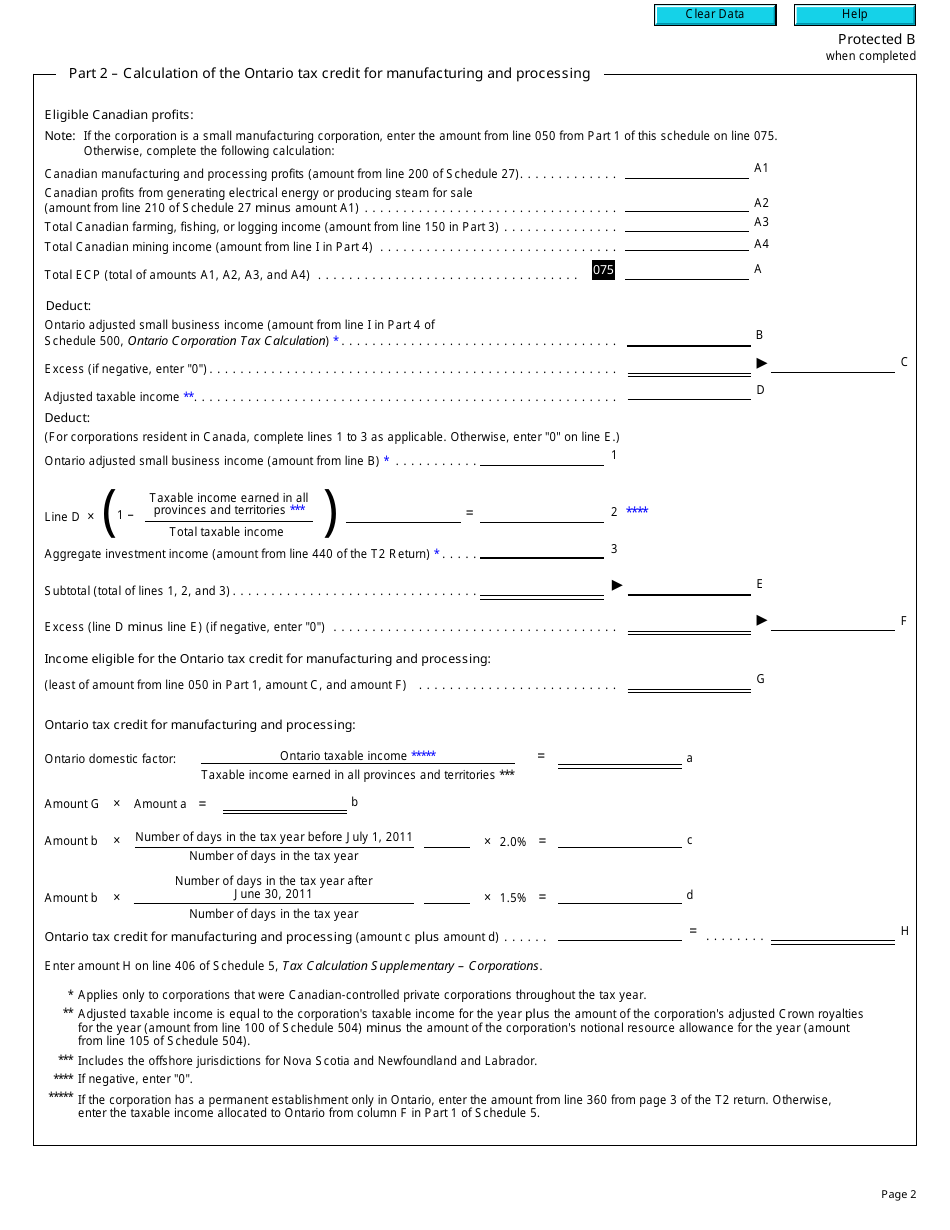

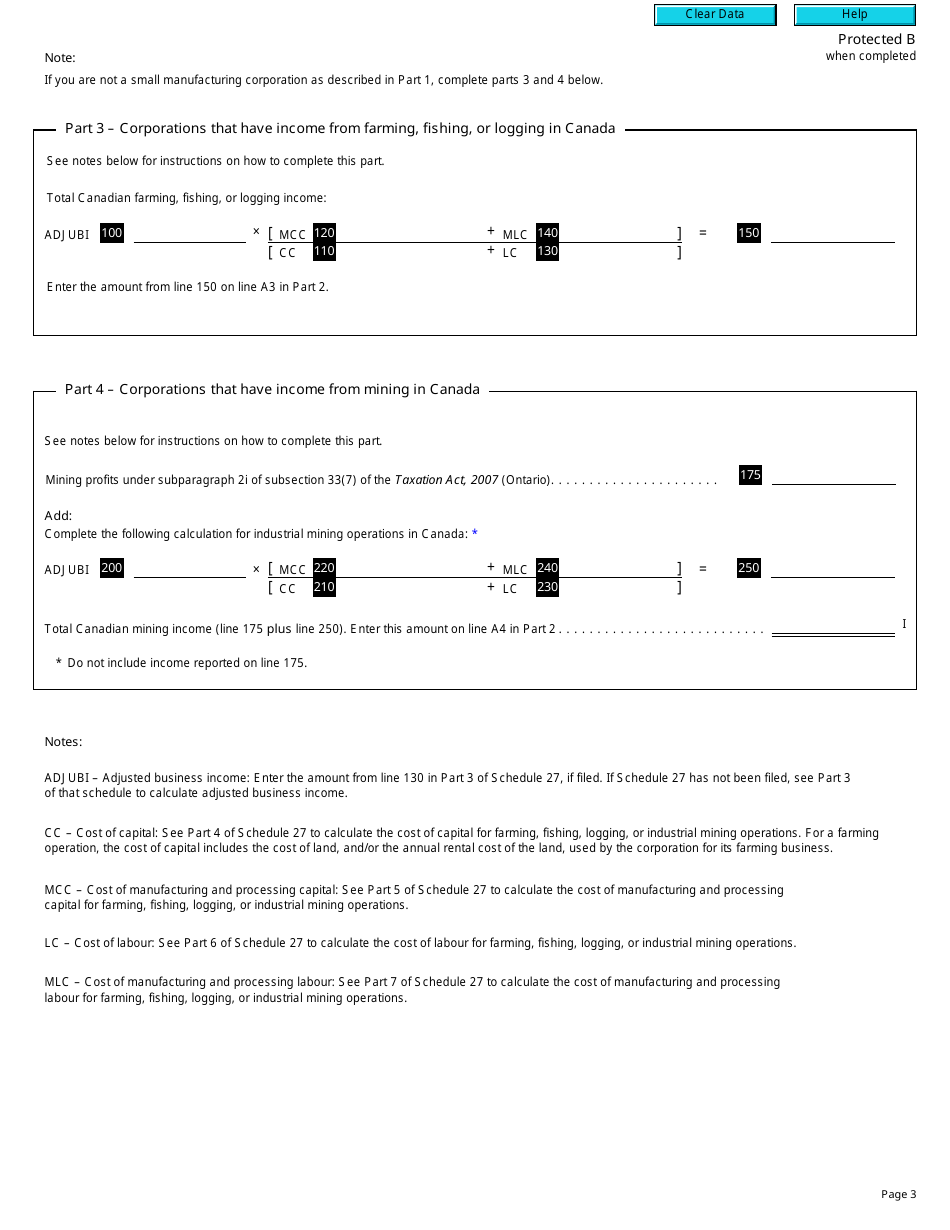

Q: What expenses can be claimed under the Ontario Tax Credit for Manufacturing and Processing?

A: Eligible expenses include labor costs, energy costs, and some production-related overhead costs directly related to manufacturing or processing activities.

Q: What is the benefit of claiming the Ontario Tax Credit for Manufacturing and Processing?

A: By claiming this tax credit, eligible corporations can reduce their federal and provincial income tax liabilities.

Q: Is there a deadline for filing Form T2 Schedule 502?

A: Yes, corporations must file this form with their T2 corporate tax return by the due date, which is generally six months after the end of their taxation year.