This version of the form is not currently in use and is provided for reference only. Download this version of

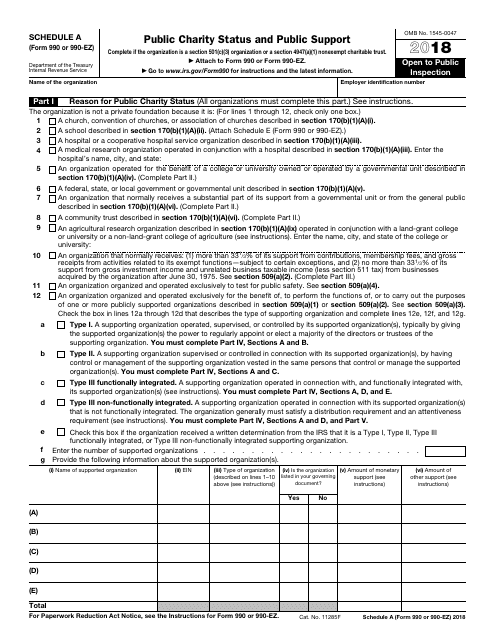

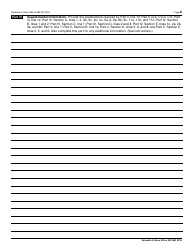

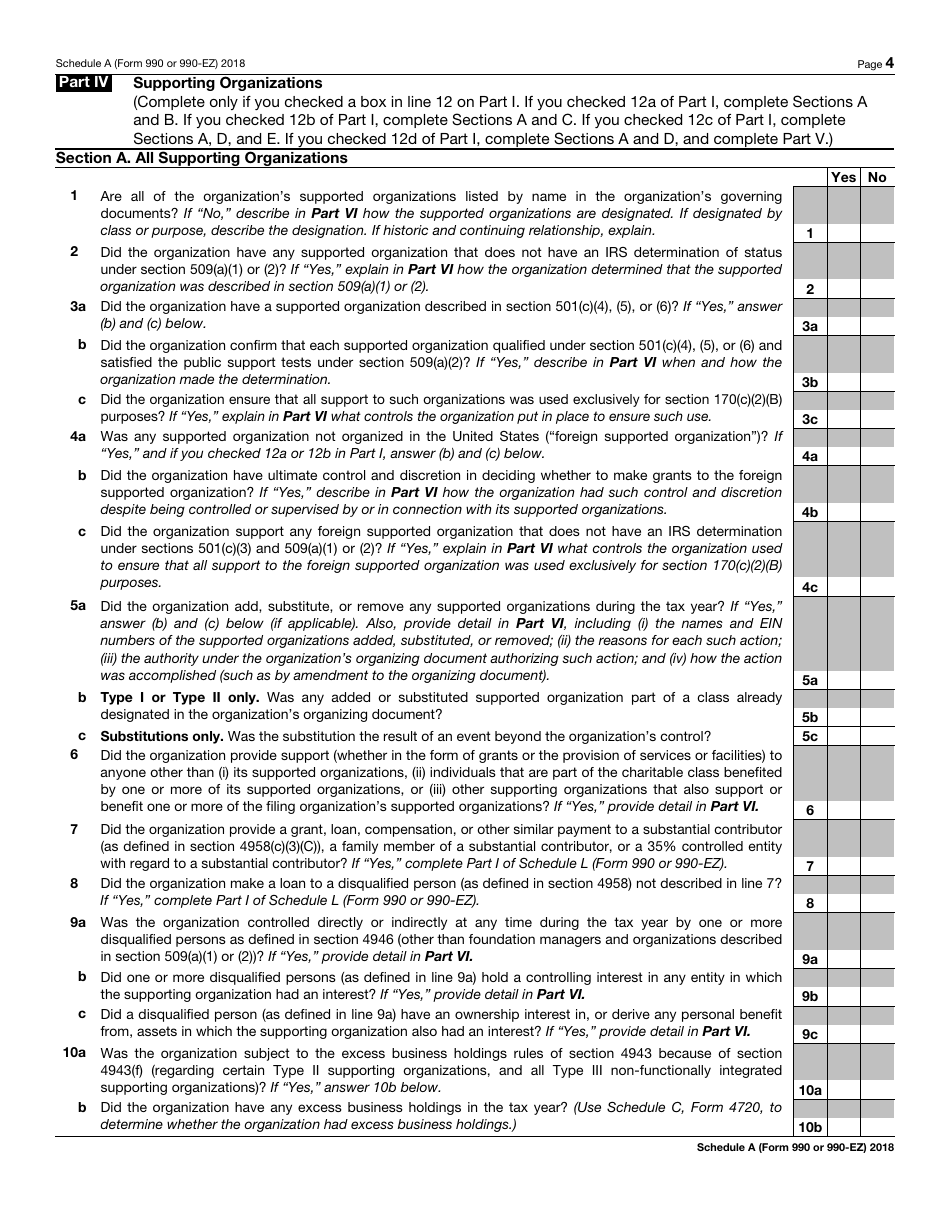

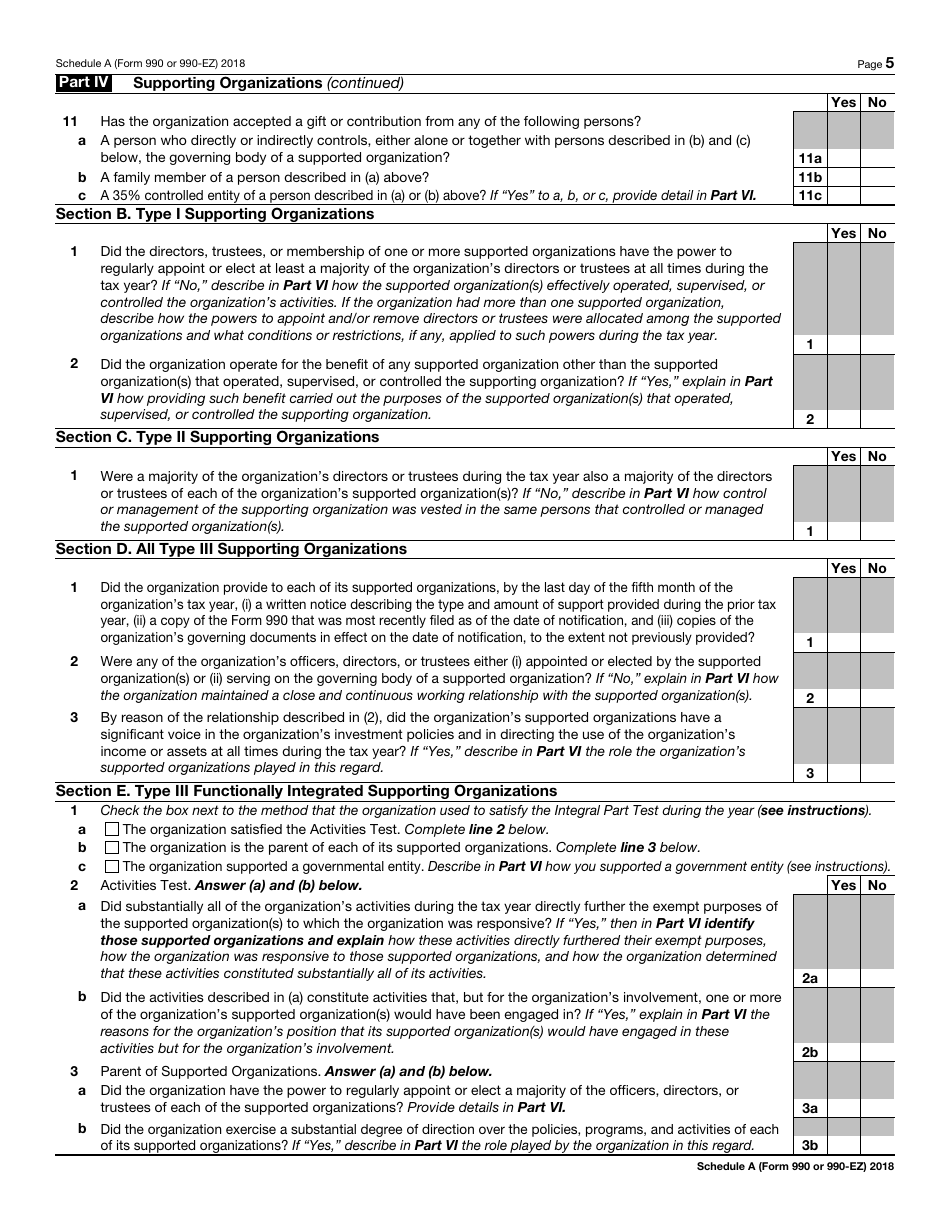

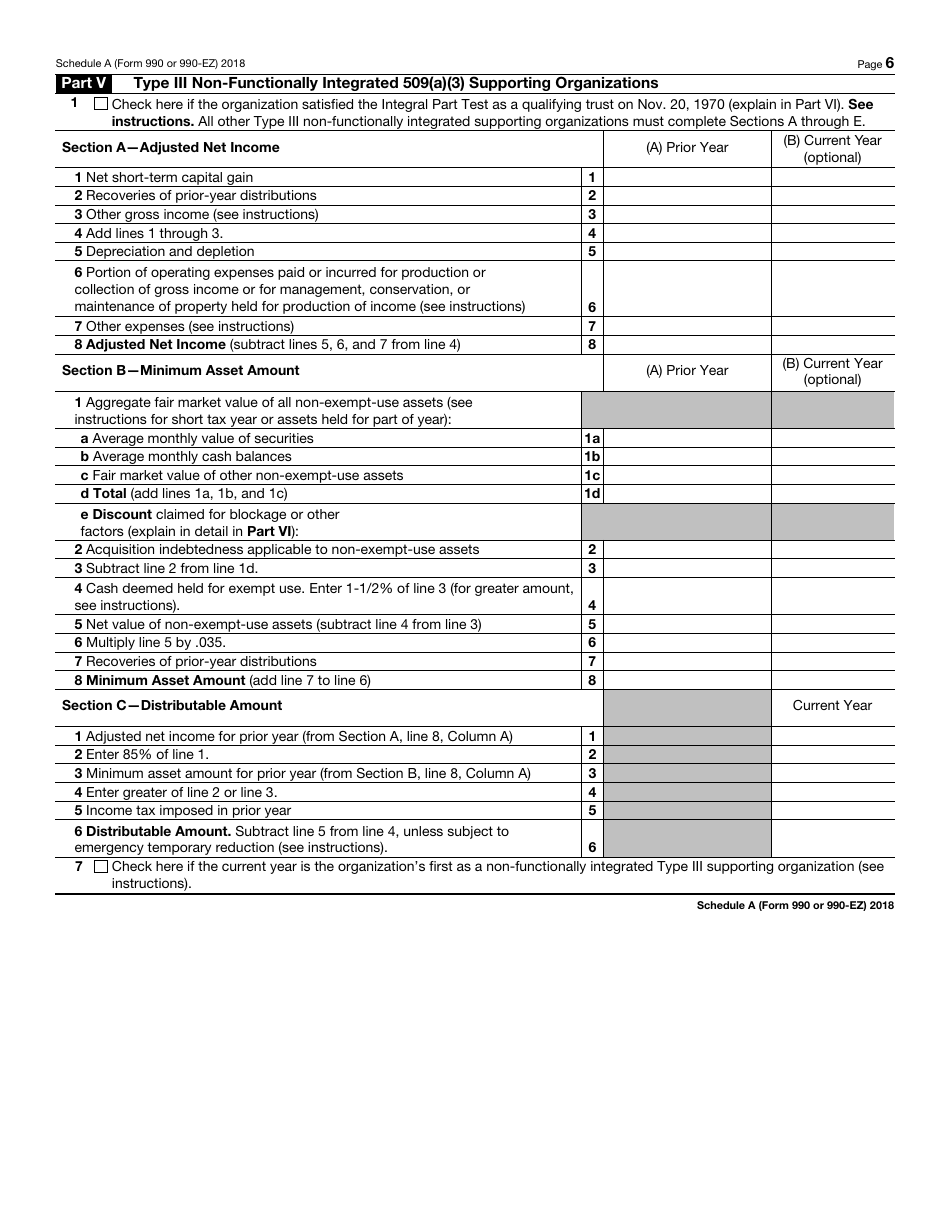

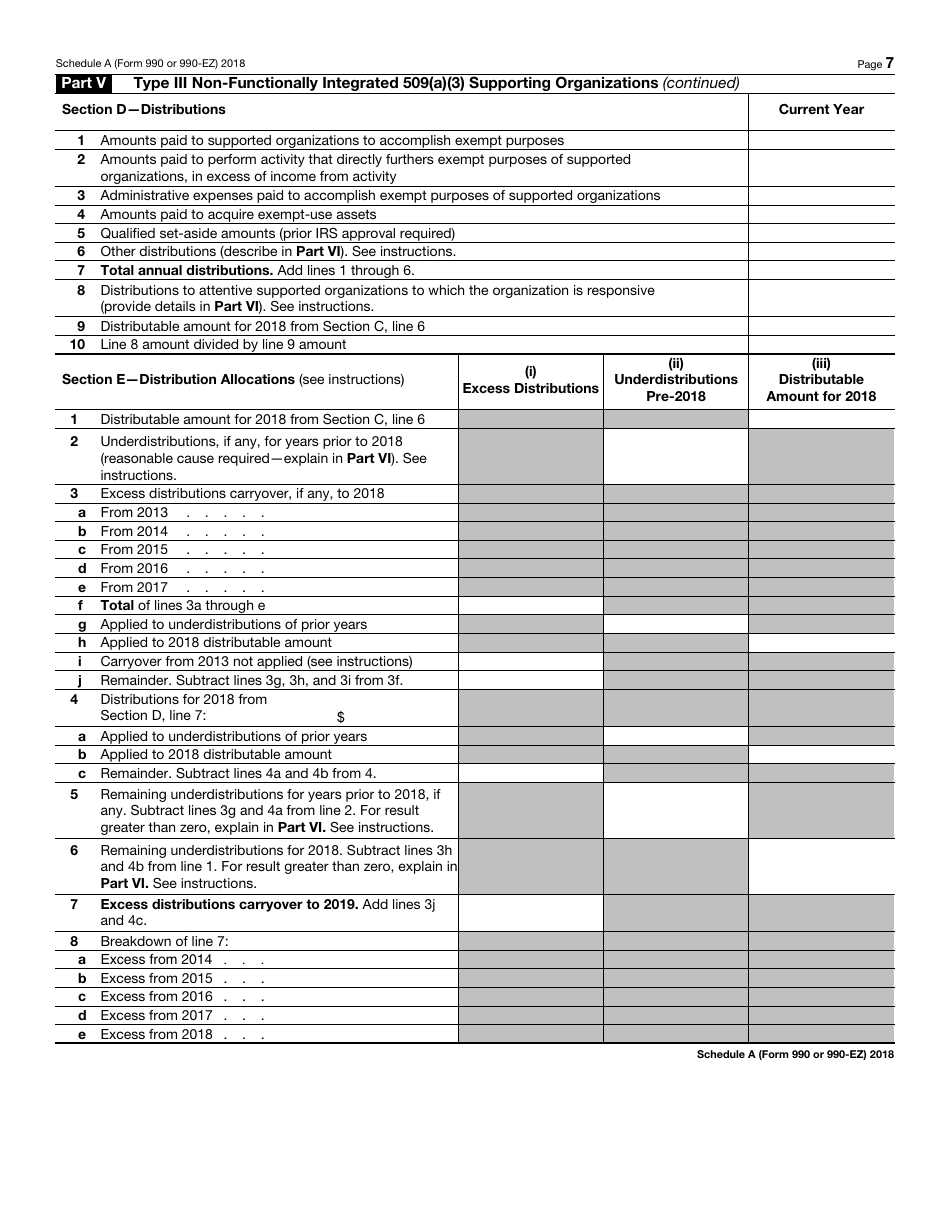

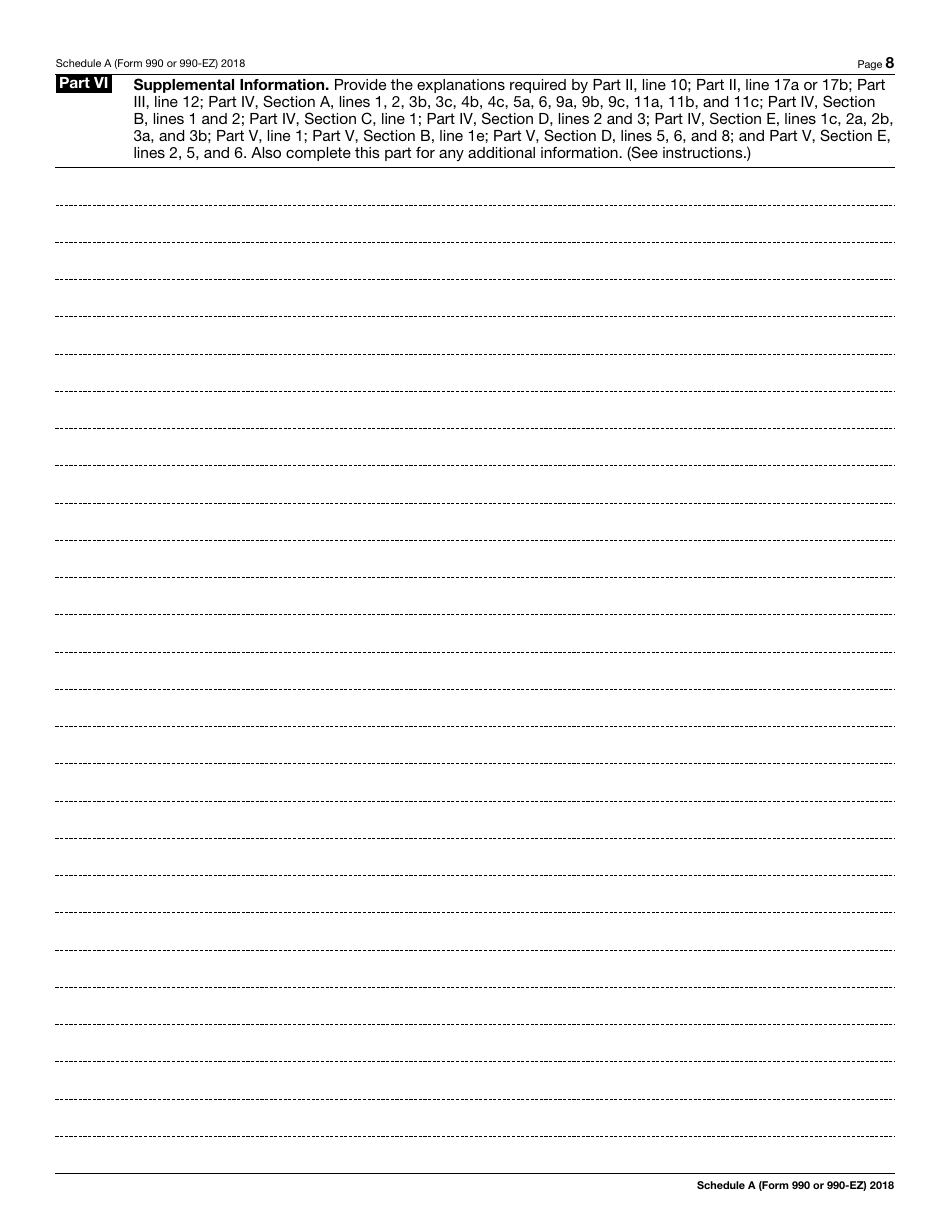

IRS Form 990 (990-EZ) Schedule A

for the current year.

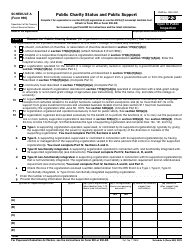

IRS Form 990 (990-EZ) Schedule A Public Charity Status and Public Support

What Is IRS Form 990 (990-EZ) Schedule A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 990, and IRS Form 990-EZ. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is Form 990?

A: Form 990 is a tax form used by tax-exempt organizations to provide financial information to the IRS.

Q: What is Schedule A?

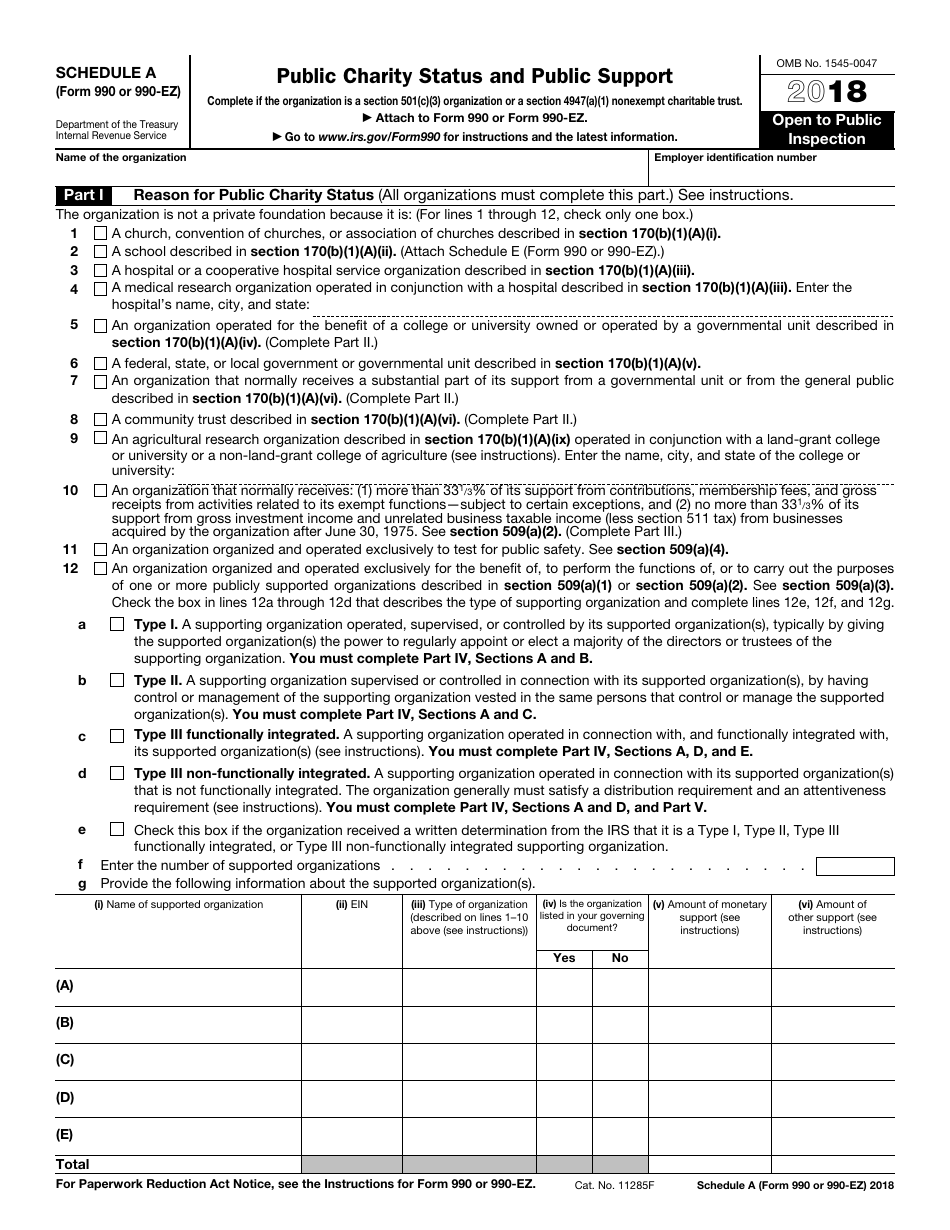

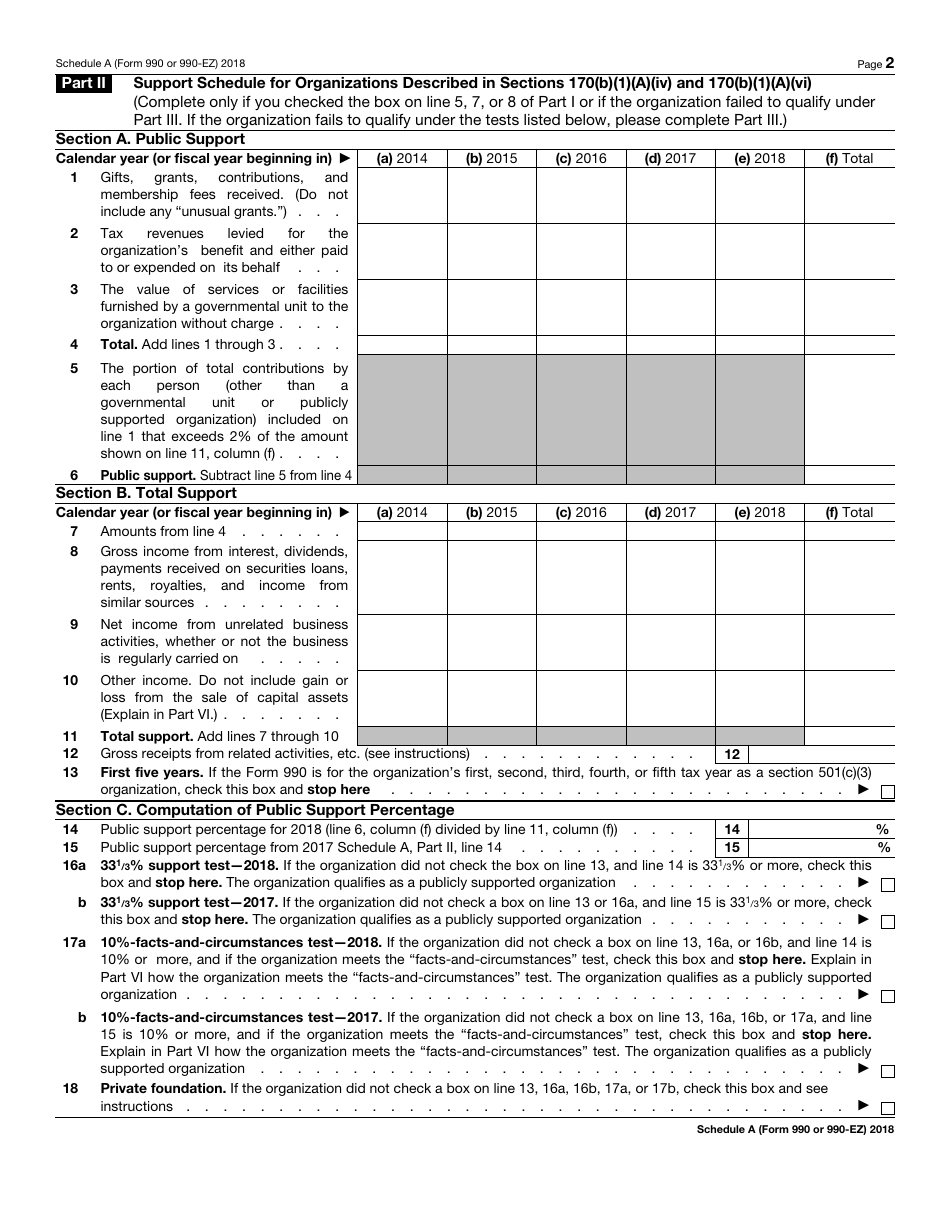

A: Schedule A is a part of Form 990 (990-EZ) that is used to determine an organization's public charity status and public support.

Q: What is public charity status?

A: Public charity status refers to the classification of an organization as a public charity, as opposed to a private foundation. Public charities receive a significant amount of their support from the general public and have a broad base of support.

Q: Why is public charity status important?

A: Public charity status is important because it allows organizations to receive more favorable tax treatment and enjoy certain benefits, such as the ability to receive tax-deductible contributions.

Q: What is public support?

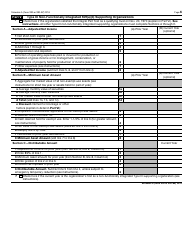

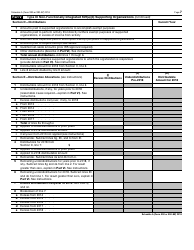

A: Public support refers to the financial support received by a public charity from the general public, including contributions, grants, and membership fees.

Q: What information do I need to provide on Schedule A?

A: You will need to provide information about your organization's public support and calculate various percentages to determine your public charity status.

Q: Do all tax-exempt organizations need to file Schedule A?

A: No, not all tax-exempt organizations need to file Schedule A. This schedule is only required for organizations that are classified as public charities.

Form Details:

- A 8-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990 (990-EZ) Schedule A through the link below or browse more documents in our library of IRS Forms.