This version of the form is not currently in use and is provided for reference only. Download this version of

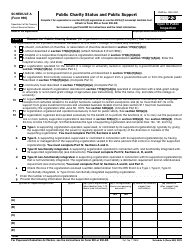

Instructions for IRS Form 990, 990-EZ Schedule A

for the current year.

Instructions for IRS Form 990, 990-EZ Schedule A Public Charity Status and Public Support

This document contains official instructions for IRS Form 990 Schedule A and IRS Form 990-EZ Schedule A . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 (990-EZ) Schedule A is available for download through this link.

FAQ

Q: What is IRS Form 990?

A: IRS Form 990 is a tax form used by tax-exempt organizations to report their financial information to the Internal Revenue Service (IRS).

Q: What is IRS Form 990-EZ?

A: IRS Form 990-EZ is a simplified version of Form 990, intended for smaller organizations with less revenue and assets.

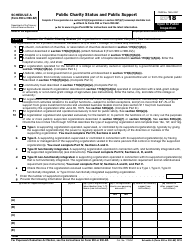

Q: What is Schedule A?

A: Schedule A is a section of IRS Form 990-EZ that organizations must complete if they want to establish their public charity status and demonstrate public support.

Q: What is public charity status?

A: Public charity status is a designation given to organizations that receive a significant portion of their support from the general public or government sources.

Q: Why is public support important?

A: Public support is important for organizations to maintain their tax-exempt status and receive favorable tax treatment.

Q: What information is required in Schedule A?

A: Schedule A requires organizations to provide details about their public support, including contributions, grants, and revenues.

Q: Who needs to fill out Schedule A?

A: Organizations using IRS Form 990-EZ must complete Schedule A if they want to establish their public charity status and demonstrate public support.

Q: Are there any filing deadlines for Form 990 and Schedule A?

A: Yes, the deadline for filing Form 990 and Schedule A depends on the organization's fiscal year. It is generally due by the 15th day of the 5th month after the end of the fiscal year.

Q: Can I file Form 990 or Schedule A electronically?

A: Yes, the IRS encourages organizations to file Form 990 and Schedule A electronically using the IRS e-file system.

Q: What happens if I don't file Form 990 or Schedule A?

A: Failure to file Form 990 and Schedule A can result in penalties and may jeopardize the organization's tax-exempt status.

Instruction Details:

- This 19-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.