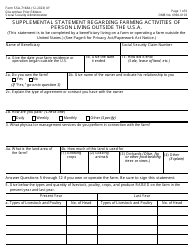

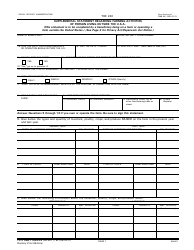

This version of the form is not currently in use and is provided for reference only. Download this version of

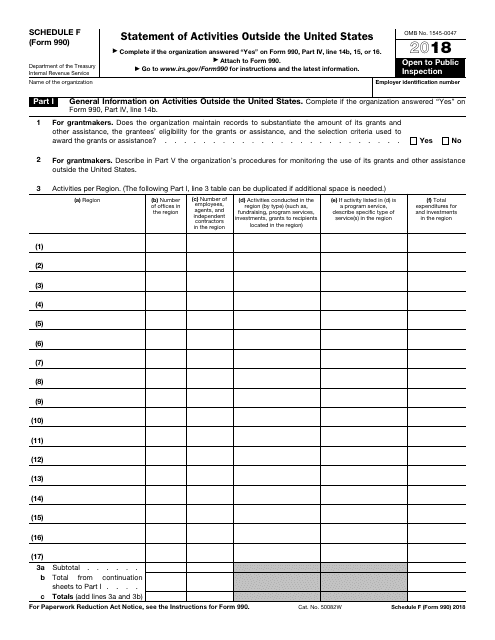

IRS Form 990 Schedule F

for the current year.

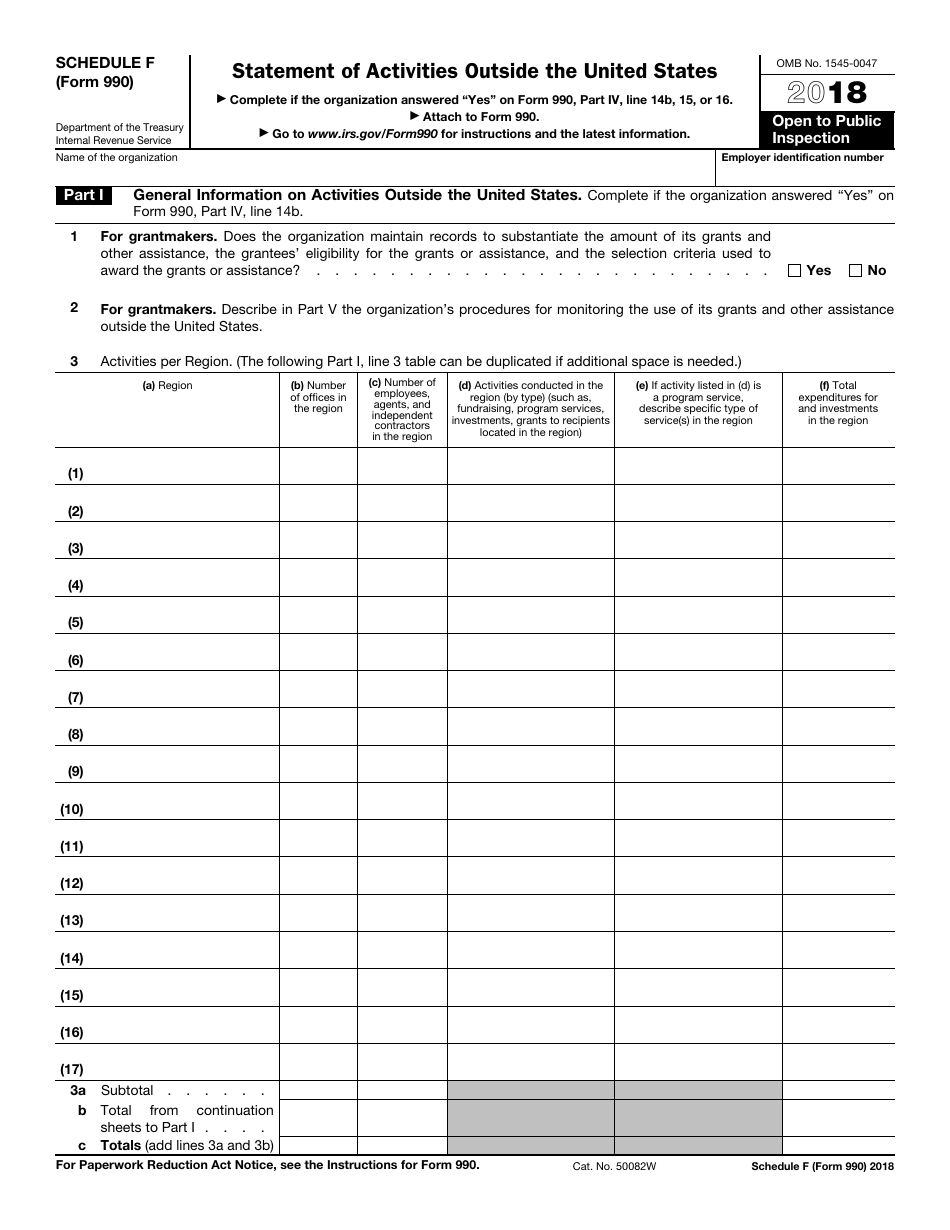

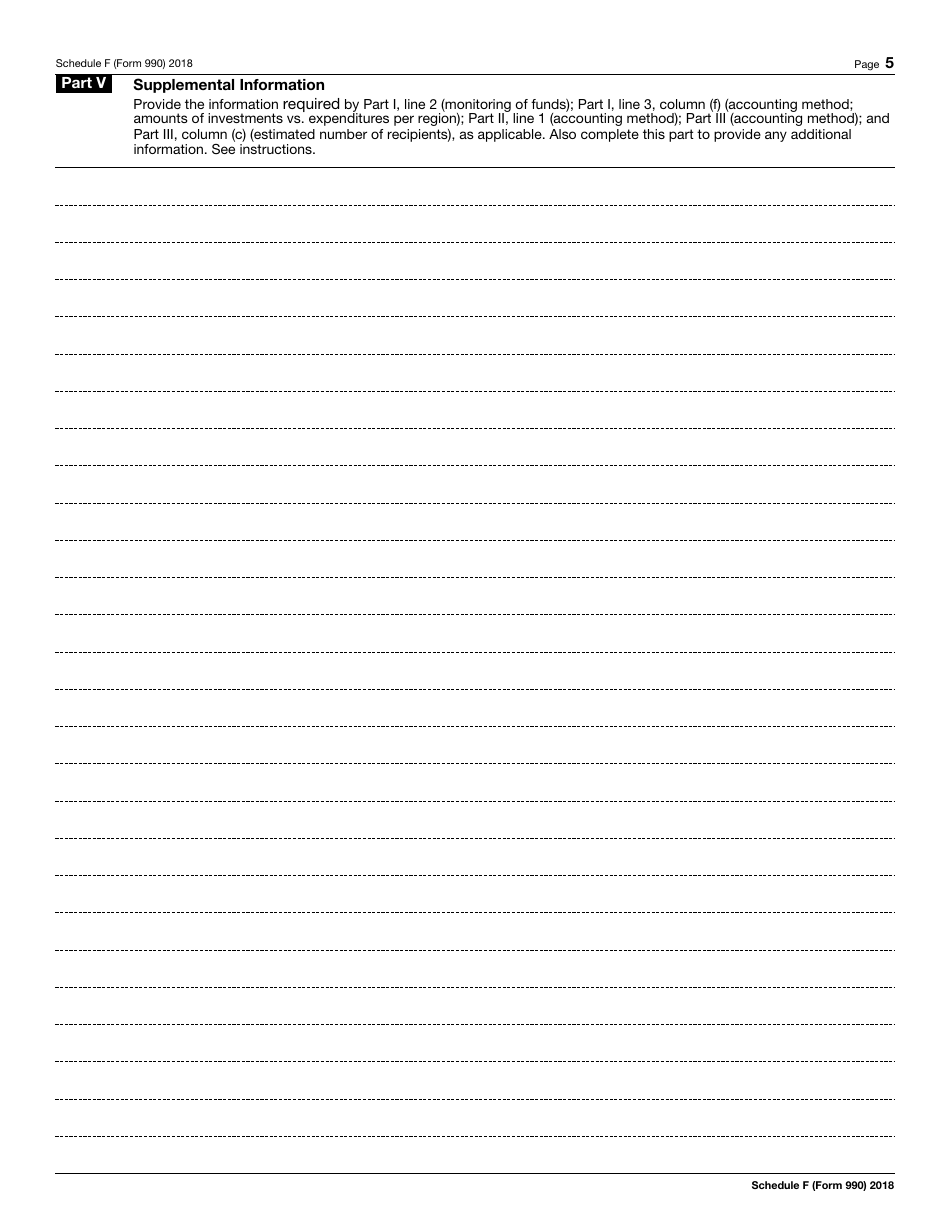

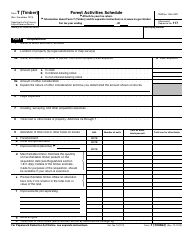

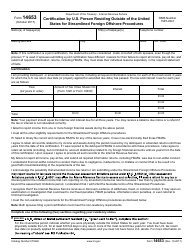

IRS Form 990 Schedule F Statement of Activities Outside the United States

What Is IRS Form 990 Schedule F?

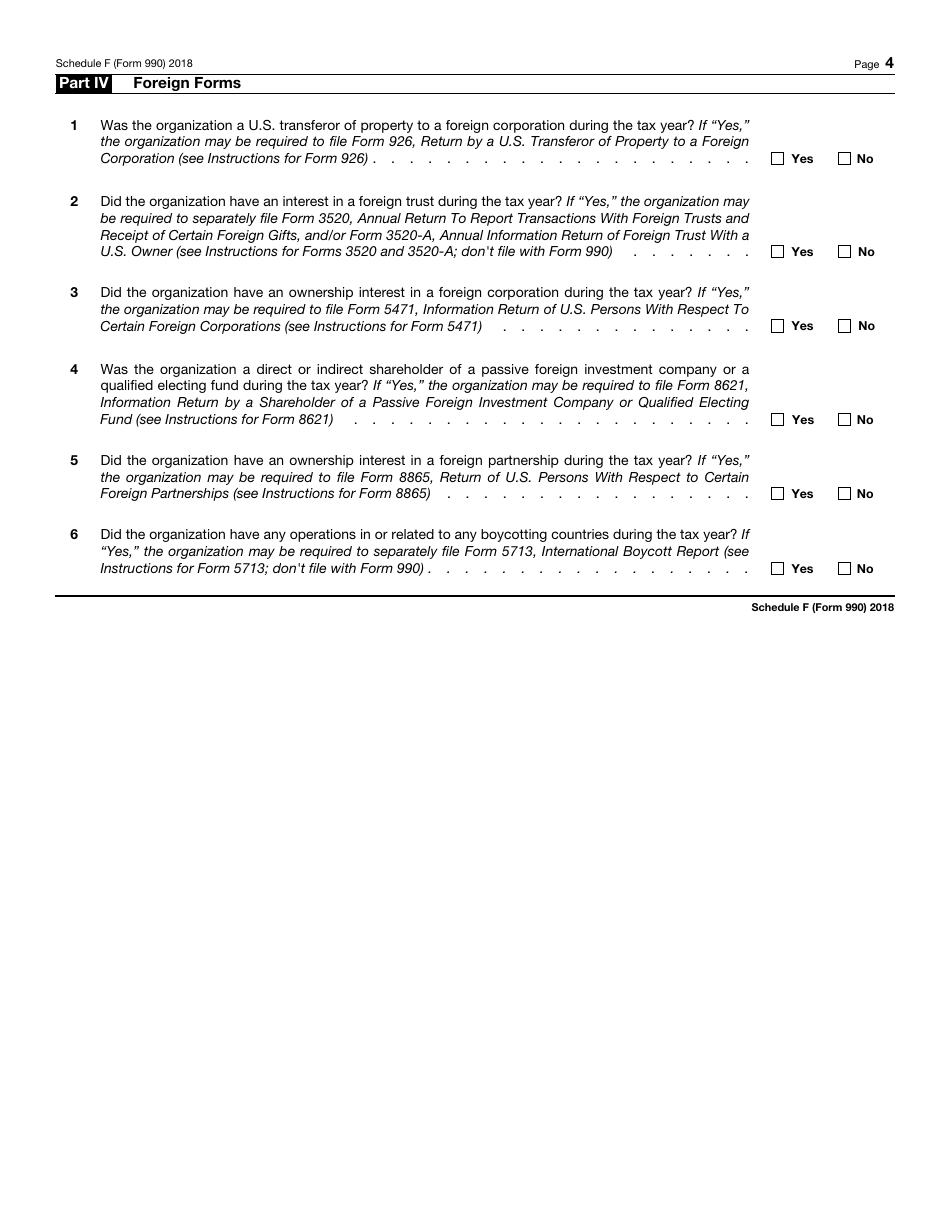

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 990, Return of Organization Exempt From Income Tax. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 990 Schedule F?

A: IRS Form 990 Schedule F is a tax form used by tax-exempt organizations to report their activities outside the United States.

Q: Who needs to file IRS Form 990 Schedule F?

A: Tax-exempt organizations that engage in activities outside the United States need to file IRS Form 990 Schedule F.

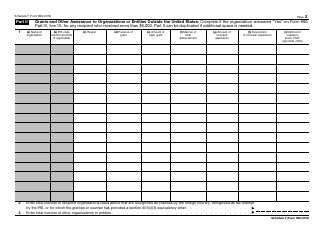

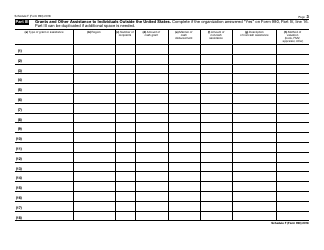

Q: What information is reported on IRS Form 990 Schedule F?

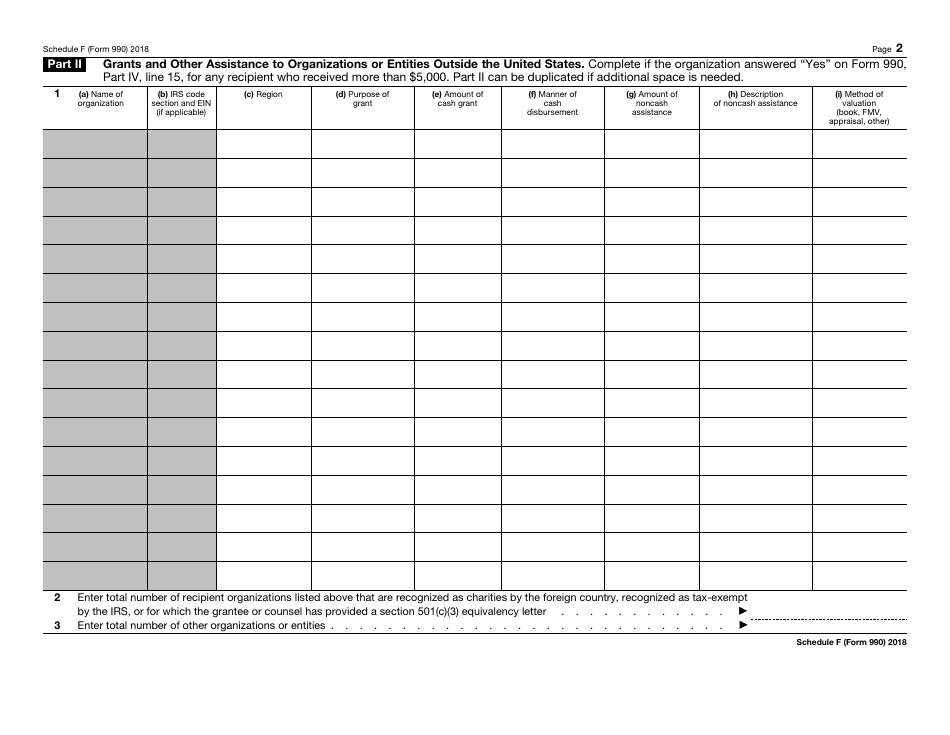

A: IRS Form 990 Schedule F requires organizations to report their activities, grants, and expenditures outside the United States.

Q: Why is IRS Form 990 Schedule F important?

A: IRS Form 990 Schedule F provides transparency and accountability for tax-exempt organizations' foreign activities.

Q: What is the purpose of Schedule F on Form 990?

A: The purpose of Schedule F on Form 990 is to report the activities of tax-exempt organizations outside the United States.

Q: Is IRS Form 990 Schedule F required for all tax-exempt organizations?

A: No, IRS Form 990 Schedule F is only required for tax-exempt organizations that have activities outside the United States.

Form Details:

- A 5-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990 Schedule F through the link below or browse more documents in our library of IRS Forms.