This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990 Schedule F

for the current year.

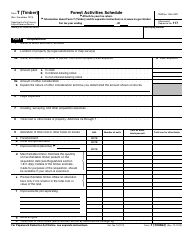

Instructions for IRS Form 990 Schedule F Statement of Activities Outside the United States

This document contains official instructions for IRS Form 990 Schedule F, Statement of Activities Outside the United States - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 Schedule F is available for download through this link.

FAQ

Q: What is IRS Form 990 Schedule F?

A: IRS Form 990 Schedule F is a statement of activities outside the United States.

Q: Who needs to fill out IRS Form 990 Schedule F?

A: Non-profit organizations that engage in activities outside the United States need to fill out IRS Form 990 Schedule F.

Q: What information is required on IRS Form 990 Schedule F?

A: IRS Form 990 Schedule F requires information about the non-profit organization's activities outside the United States, including grants given, funds spent, and organizations or individuals involved.

Q: Are there any specific instructions for filling out IRS Form 990 Schedule F?

A: Yes, there are specific instructions provided by the IRS for filling out IRS Form 990 Schedule F. Please refer to the official instructions for detailed guidance.

Q: When is the deadline for filing IRS Form 990 Schedule F?

A: The deadline for filing IRS Form 990 Schedule F is the same as the deadline for filing Form 990. For most organizations, the deadline is the 15th day of the 5th month after the end of their fiscal year.

Q: What happens if I don't file IRS Form 990 Schedule F?

A: Failure to file IRS Form 990 Schedule F or any required tax forms may result in penalties or the loss of tax-exempt status for the organization.

Q: Can I get an extension to file IRS Form 990 Schedule F?

A: Yes, organizations can request an extension to file IRS Form 990 Schedule F by submitting Form 8868, Application for Extension of Time to File an Exempt Organization Return.

Q: Are there any fees associated with filing IRS Form 990 Schedule F?

A: There are no fees associated with filing IRS Form 990 Schedule F.

Q: Can I e-file IRS Form 990 Schedule F?

A: As of now, e-filing is not available for IRS Form 990 Schedule F. The form must be filed by mail.

Instruction Details:

- This 5-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.