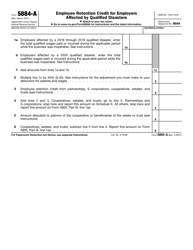

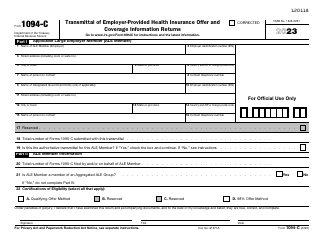

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8941

for the current year.

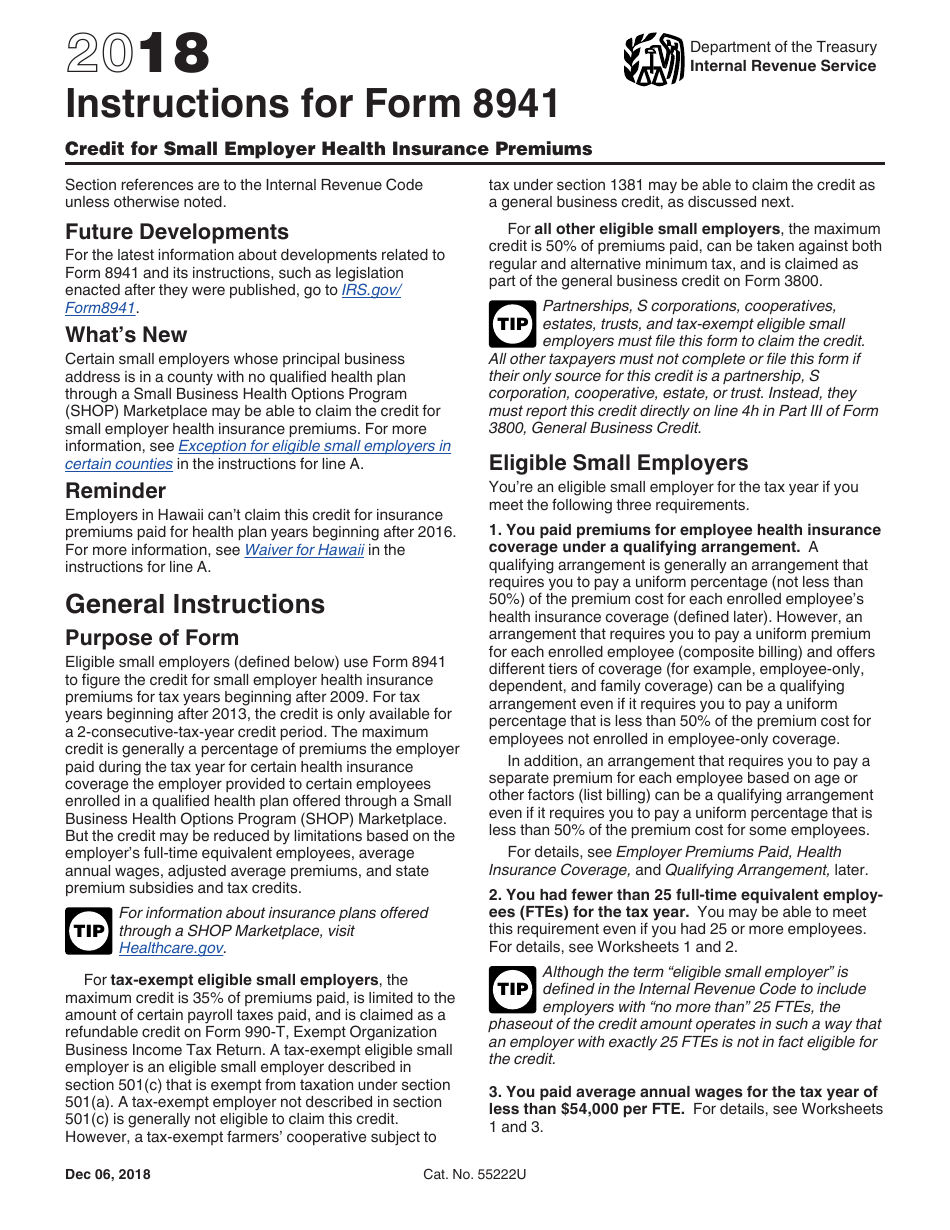

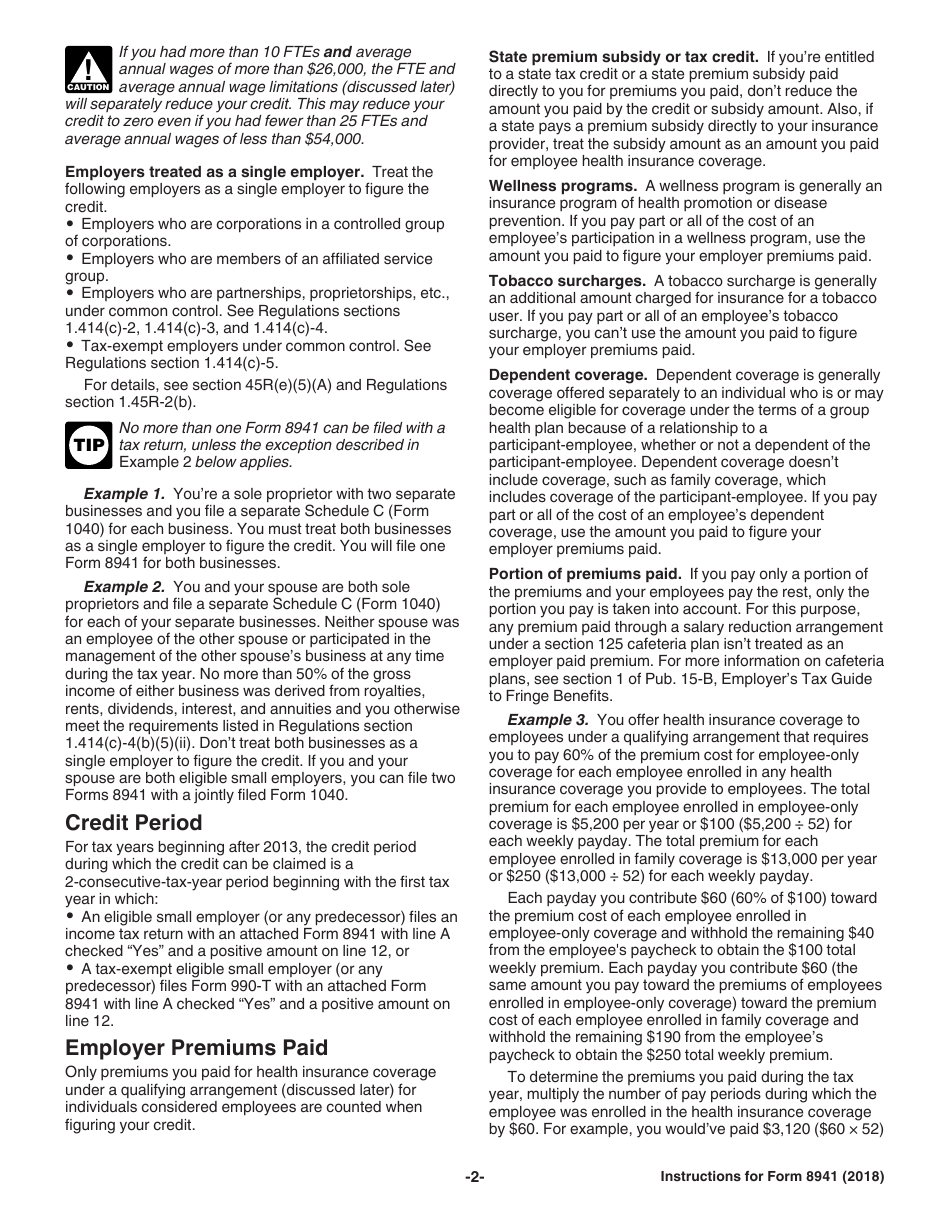

Instructions for IRS Form 8941 Credit for Small Employer Health Insurance Premiums

This document contains official instructions for IRS Form 8941 , Credit for Small Employer Health Insurance Premiums - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8941 is available for download through this link.

FAQ

Q: What is IRS Form 8941?

A: IRS Form 8941 is a form used to calculate the credit for small employer health insurance premiums.

Q: Who needs to file IRS Form 8941?

A: Small employers who provide health insurance coverage to their employees may need to file IRS Form 8941.

Q: What is the purpose of IRS Form 8941?

A: The purpose of IRS Form 8941 is to determine the amount of the credit a small employer may claim for providing health insurance coverage to its employees.

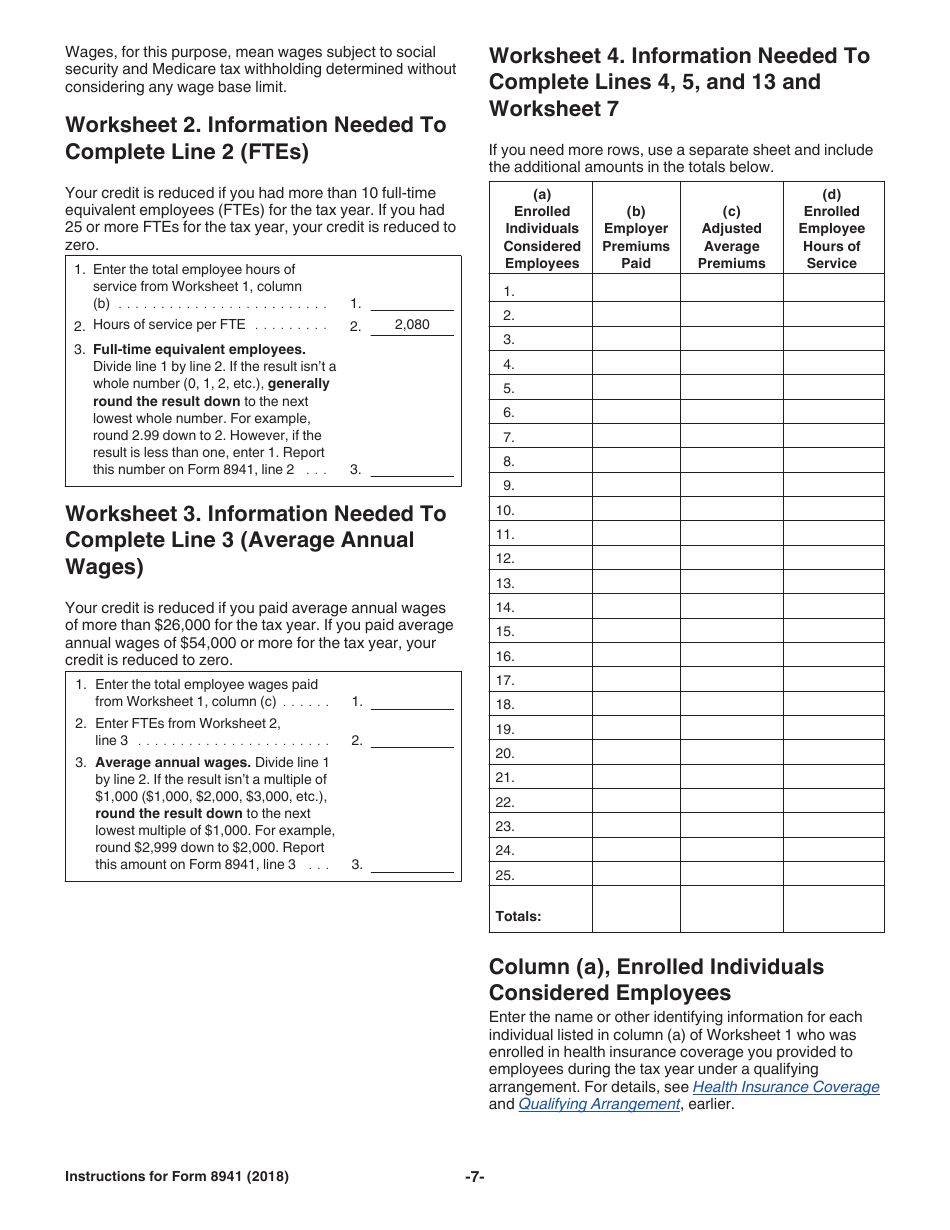

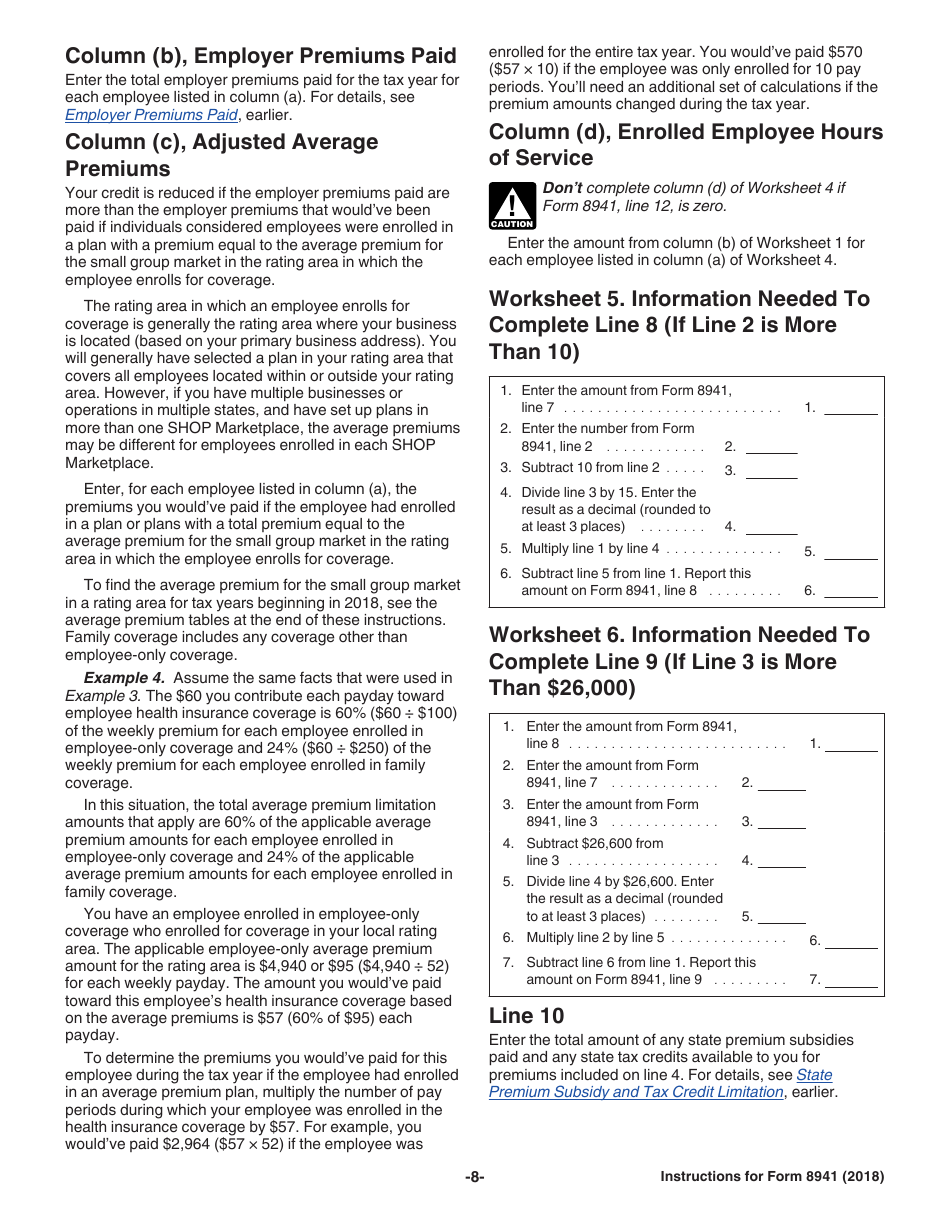

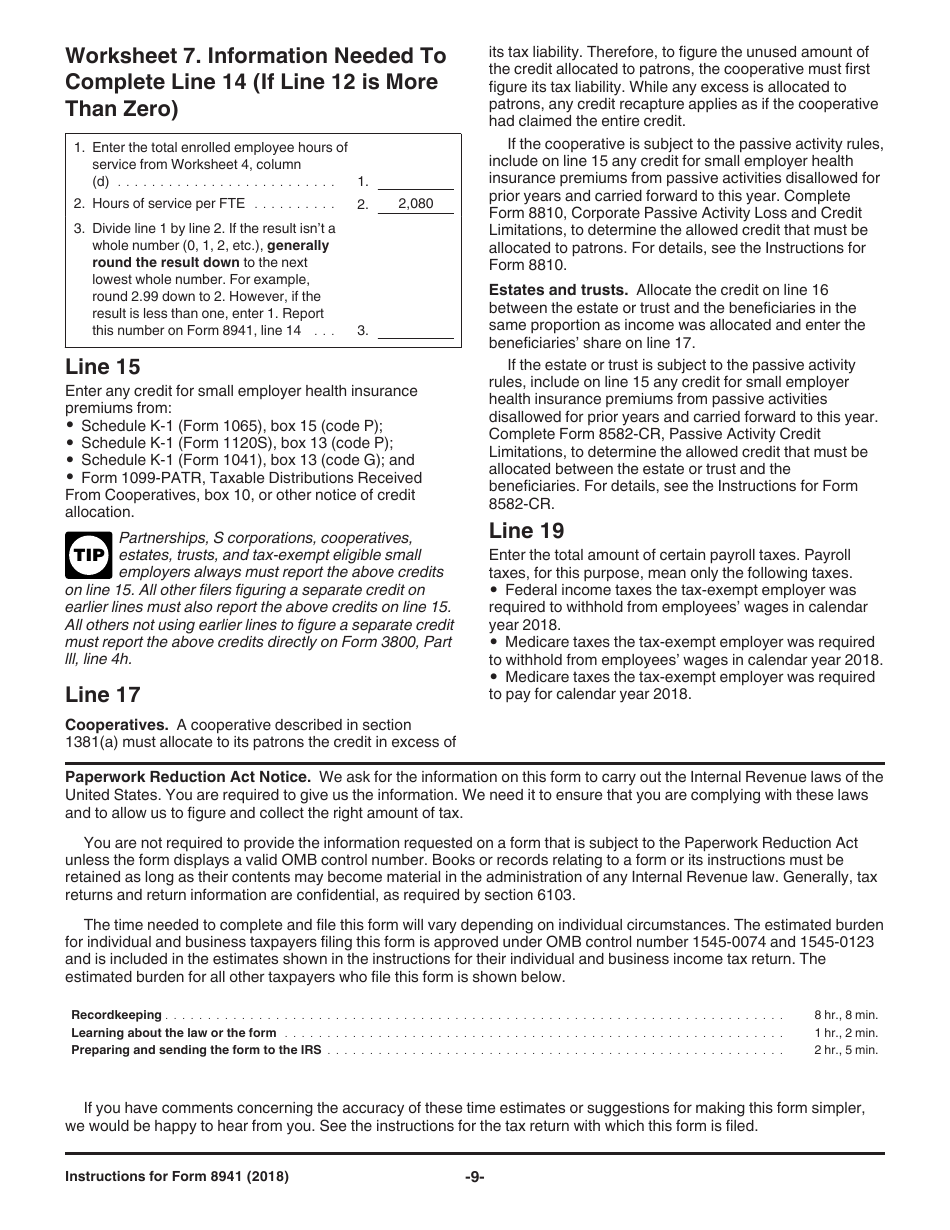

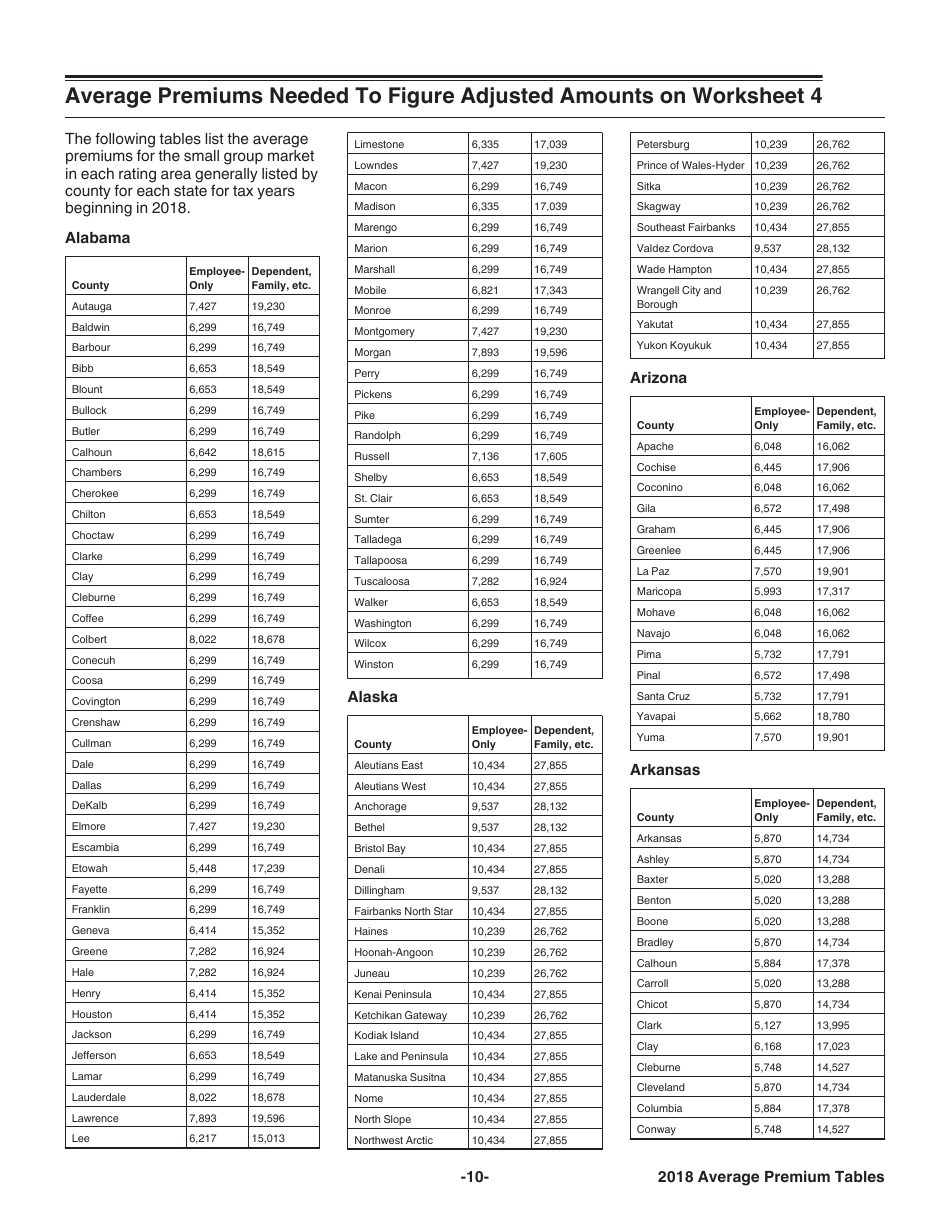

Q: What information is required on IRS Form 8941?

A: IRS Form 8941 requires information about the employer, the number of employees, the amount of health insurance premiums paid, and other related details.

Q: What is the credit for small employer health insurance premiums?

A: The credit for small employer health insurance premiums is a tax credit that small employers can claim for providing health insurance coverage to their employees.

Q: How is the credit for small employer health insurance premiums calculated?

A: The credit for small employer health insurance premiums is calculated using a specific formula that takes into account the number of employees and the amount of health insurance premiums paid.

Q: When is the deadline to file IRS Form 8941?

A: The deadline to file IRS Form 8941 is usually the same as the deadline to file the employer's federal tax return, which is usually April 15th.

Q: Can I claim both the credit for small employer health insurance premiums and the Small Business Health Care Tax Credit?

A: No, you cannot claim both the credit for small employer health insurance premiums and the Small Business Health Care Tax Credit. You must choose one or the other.

Q: Can I carry forward any unused credit for small employer health insurance premiums?

A: No, any unused credit for small employer health insurance premiums cannot be carried forward to future years. It can only be used to offset the employer's tax liability for the current year.

Instruction Details:

- This 30-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.