This version of the form is not currently in use and is provided for reference only. Download this version of

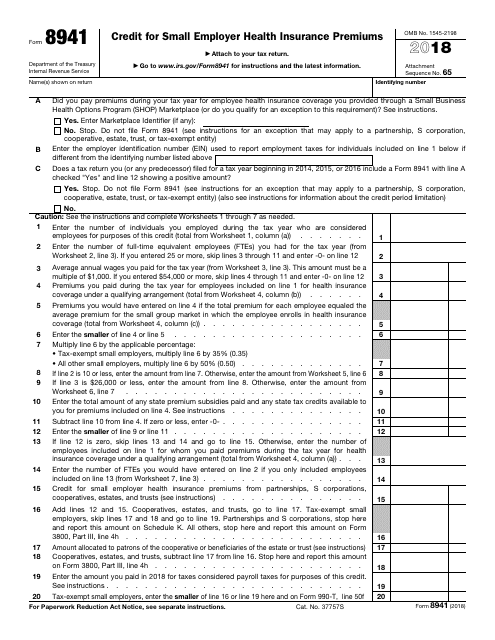

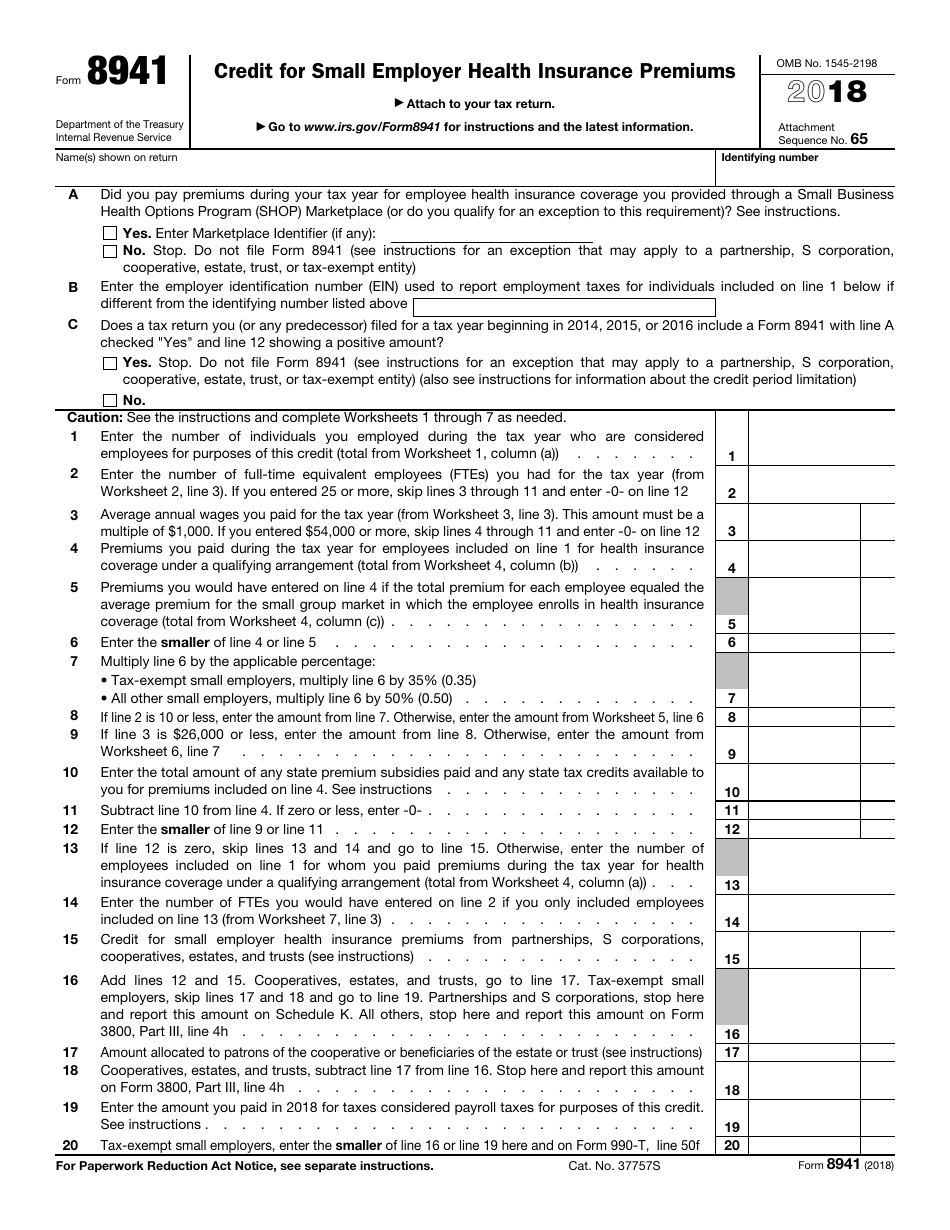

IRS Form 8941

for the current year.

IRS Form 8941 Credit for Small Employer Health Insurance Premiums

What Is IRS Form 8941?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8941?

A: IRS Form 8941 is a form used by small employers to claim the Credit for Small EmployerHealth Insurance Premiums.

Q: Who can use IRS Form 8941?

A: Small employers who meet certain requirements can use IRS Form 8941 to claim the Credit for Small Employer Health Insurance Premiums.

Q: What is the purpose of IRS Form 8941?

A: The purpose of IRS Form 8941 is to calculate and claim the Credit for Small Employer Health Insurance Premiums.

Q: What is the Credit for Small Employer Health Insurance Premiums?

A: The Credit for Small Employer Health Insurance Premiums is a tax credit for eligible small employers who provide health insurance coverage to their employees.

Q: How can I qualify for the Credit for Small Employer Health Insurance Premiums?

A: To qualify for the Credit for Small Employer Health Insurance Premiums, you must be a small employer with fewer than 25 full-time equivalent employees, pay average annual wages of less than $55,000 per employee, and contribute a uniform percentage of at least 50% of the premium cost.

Q: What expenses are eligible for the credit?

A: The premiums you pay for qualifying employee health insurance coverage are eligible for the credit.

Q: How do I calculate the credit amount?

A: You can use IRS Form 8941 to calculate the credit amount based on the information you provide about your employees and their health insurance coverage.

Q: How do I claim the credit on my tax return?

A: You will need to include the calculated credit amount from IRS Form 8941 on your annual tax return, along with any other required documentation.

Q: Is the credit refundable?

A: No, the Credit for Small Employer Health Insurance Premiums is not refundable. It can only be used to offset your tax liability.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8941 through the link below or browse more documents in our library of IRS Forms.