This version of the form is not currently in use and is provided for reference only. Download this version of

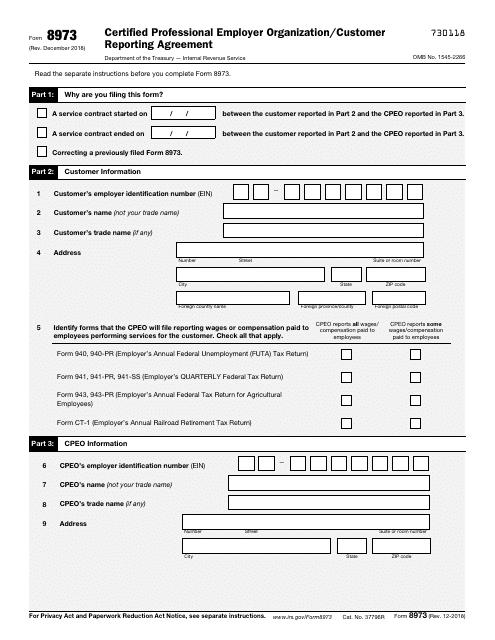

IRS Form 8973

for the current year.

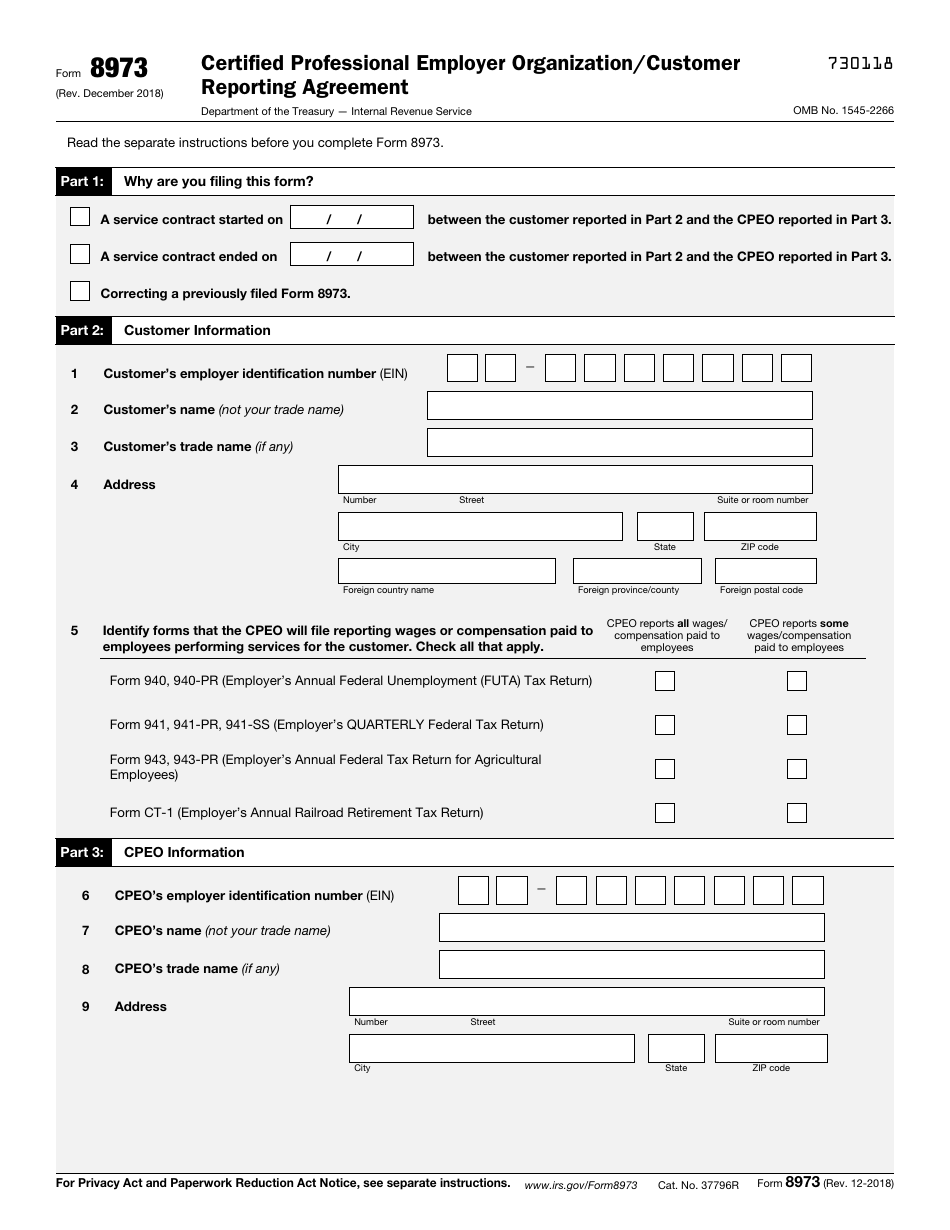

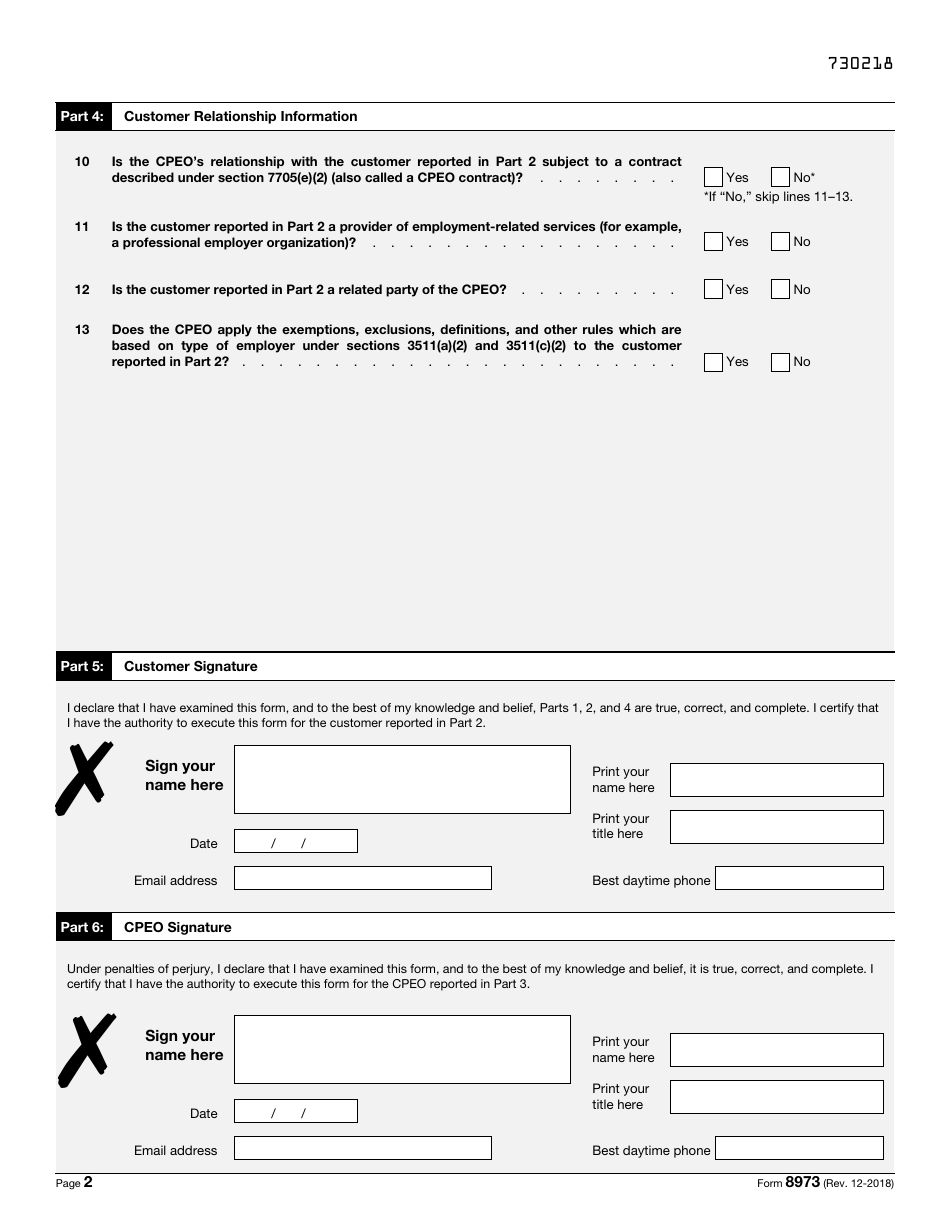

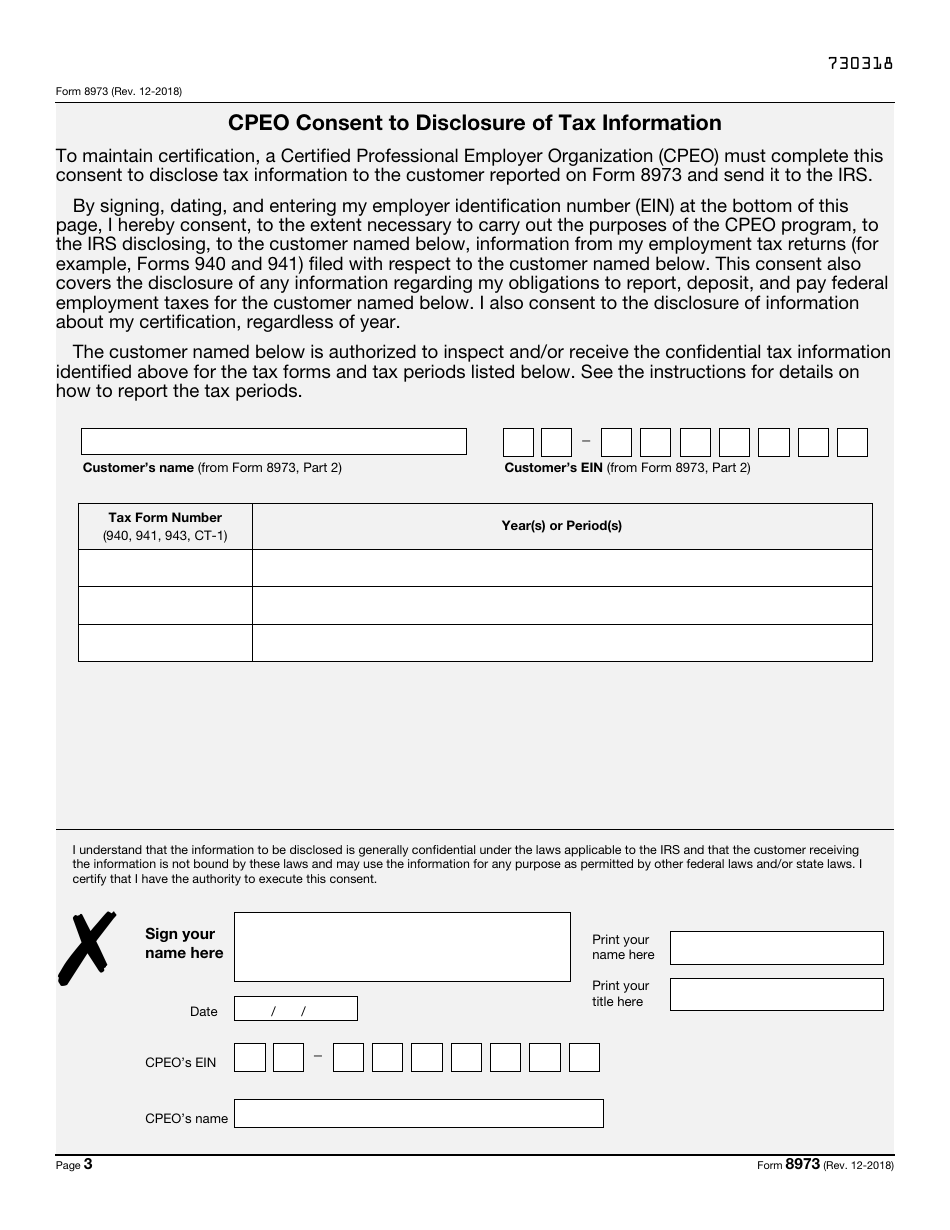

IRS Form 8973 Certified Professional Employer Organization / Customer Reporting Agreement

What Is IRS Form 8973?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2018. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8973?

A: IRS Form 8973 is the Certified Professional Employer Organization/Customer Reporting Agreement.

Q: Who needs to file IRS Form 8973?

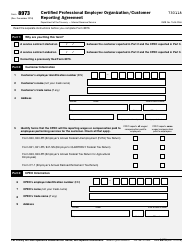

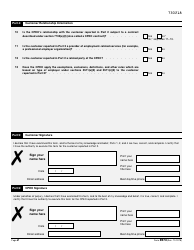

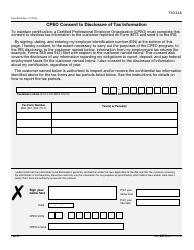

A: Certified Professional Employer Organizations (CPEOs) and their customers need to file IRS Form 8973.

Q: What is a Certified Professional Employer Organization (CPEO)?

A: A Certified Professional Employer Organization (CPEO) is an organization that provides employment tax services to other businesses and meets specific IRS criteria.

Q: What is the purpose of filing IRS Form 8973?

A: The purpose of filing IRS Form 8973 is to establish the reporting requirements and responsibilities between the CPEO and its customers.

Q: Are there any penalties for not filing IRS Form 8973?

A: Yes, there can be penalties for not filing IRS Form 8973. It is important to consult with a tax professional or refer to the official IRS guidelines for more information on specific penalties.

Q: Is IRS Form 8973 required every year?

A: No, IRS Form 8973 is not required to be filed every year. It needs to be filed when a CPEO and its customer enter into a reporting agreement or when there are changes to an existing reporting agreement.

Q: Can a customer terminate a reporting agreement with a CPEO?

A: Yes, a customer can terminate a reporting agreement with a CPEO. The termination process and any obligations after termination should be outlined in the reporting agreement.

Q: What information is required to be reported on IRS Form 8973?

A: IRS Form 8973 requires the reporting of specific information related to the CPEO and its customers, including names, addresses, and EINs (Employer Identification Numbers).

Q: Can a CPEO have multiple reporting agreements with different customers?

A: Yes, a CPEO can have multiple reporting agreements with different customers. Each reporting agreement should be filed separately and include the relevant information for each customer.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8973 through the link below or browse more documents in our library of IRS Forms.