This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8903

for the current year.

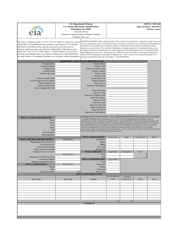

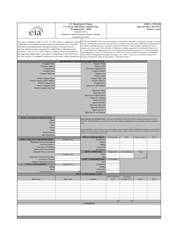

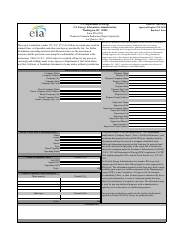

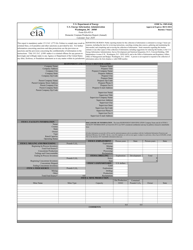

Instructions for IRS Form 8903 Domestic Production Activities Deduction

This document contains official instructions for IRS Form 8903 , Domestic Production Activities Deduction - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8903 is available for download through this link.

FAQ

Q: What is IRS Form 8903?

A: IRS Form 8903 is a tax form used to claim the Domestic Production Activities Deduction.

Q: Who can use IRS Form 8903?

A: Any taxpayer engaged in a qualifying production activity in the United States can use IRS Form 8903.

Q: What is the Domestic Production Activities Deduction?

A: The Domestic Production Activities Deduction is a tax deduction designed to incentivize domestic production and business activities.

Q: How do I qualify for the Domestic Production Activities Deduction?

A: To qualify for the deduction, you must engage in qualifying production activities, such as manufacturing, construction, or certain engineering or architectural services.

Q: What expenses can be deducted using IRS Form 8903?

A: Expenses related to the qualifying production activities, such as wages, supplies, and qualified production property costs, can be deducted using IRS Form 8903.

Q: How do I file IRS Form 8903?

A: You can file IRS Form 8903 along with your annual tax return. Follow the instructions provided on the form to ensure accurate filing.

Q: When is the deadline to file IRS Form 8903?

A: The deadline to file IRS Form 8903 is the same as the deadline for filing your annual tax return, which is typically April 15th of each year.

Q: Can I claim the Domestic Production Activities Deduction for previous tax years?

A: Yes, you can file an amended tax return to claim the deduction for previous tax years if you meet the eligibility requirements.

Q: Is professional assistance required to fill out IRS Form 8903?

A: While professional assistance is not required, it is recommended to seek advice from a tax professional or accountant to ensure accurate completion of the form.

Instruction Details:

- This 14-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.