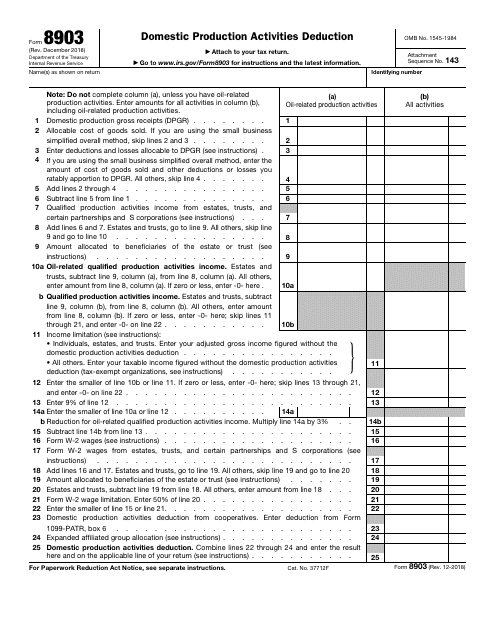

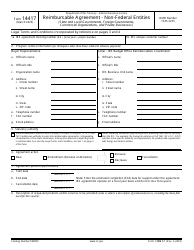

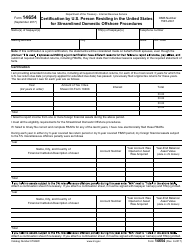

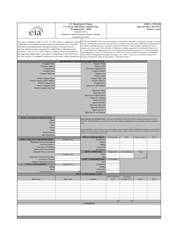

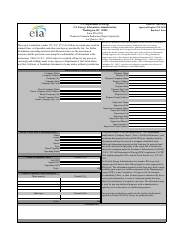

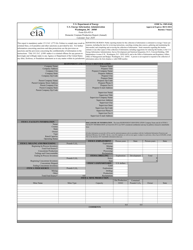

IRS Form 8903 Domestic Production Activities Deduction

What Is IRS Form 8903?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2018. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8903?

A: IRS Form 8903 is a tax form used to claim the Domestic Production Activities Deduction.

Q: What is the Domestic Production Activities Deduction?

A: The Domestic Production Activities Deduction is a tax deduction for businesses engaged in certain domestic production activities.

Q: Who is eligible to claim the Domestic Production Activities Deduction?

A: Businesses engaged in qualifying production activities in the United States are eligible to claim the deduction.

Q: What types of production activities qualify for the deduction?

A: Qualifying production activities include manufacturing, construction, engineering, software development, and certain other specified activities.

Q: How can I claim the Domestic Production Activities Deduction?

A: To claim the deduction, you need to fill out IRS Form 8903 and include it with your business tax return.

Q: Are there any limits or restrictions for claiming the deduction?

A: Yes, there are various limitations and restrictions on the amount that can be claimed for the Domestic Production Activities Deduction. It is recommended to consult with a tax professional for specific guidance.

Q: Is the Domestic Production Activities Deduction available in Canada?

A: No, the Domestic Production Activities Deduction is specific to the United States and is not available in Canada.

Q: Is there a deadline for claiming the Domestic Production Activities Deduction?

A: The deadline for claiming the Domestic Production Activities Deduction is the same as the deadline for filing your business tax return, which is typically April 15th.

Q: Can I claim the Domestic Production Activities Deduction for previous years?

A: No, the deduction can only be claimed for the tax year in which the qualifying production activities occurred.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8903 through the link below or browse more documents in our library of IRS Forms.