This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8854

for the current year.

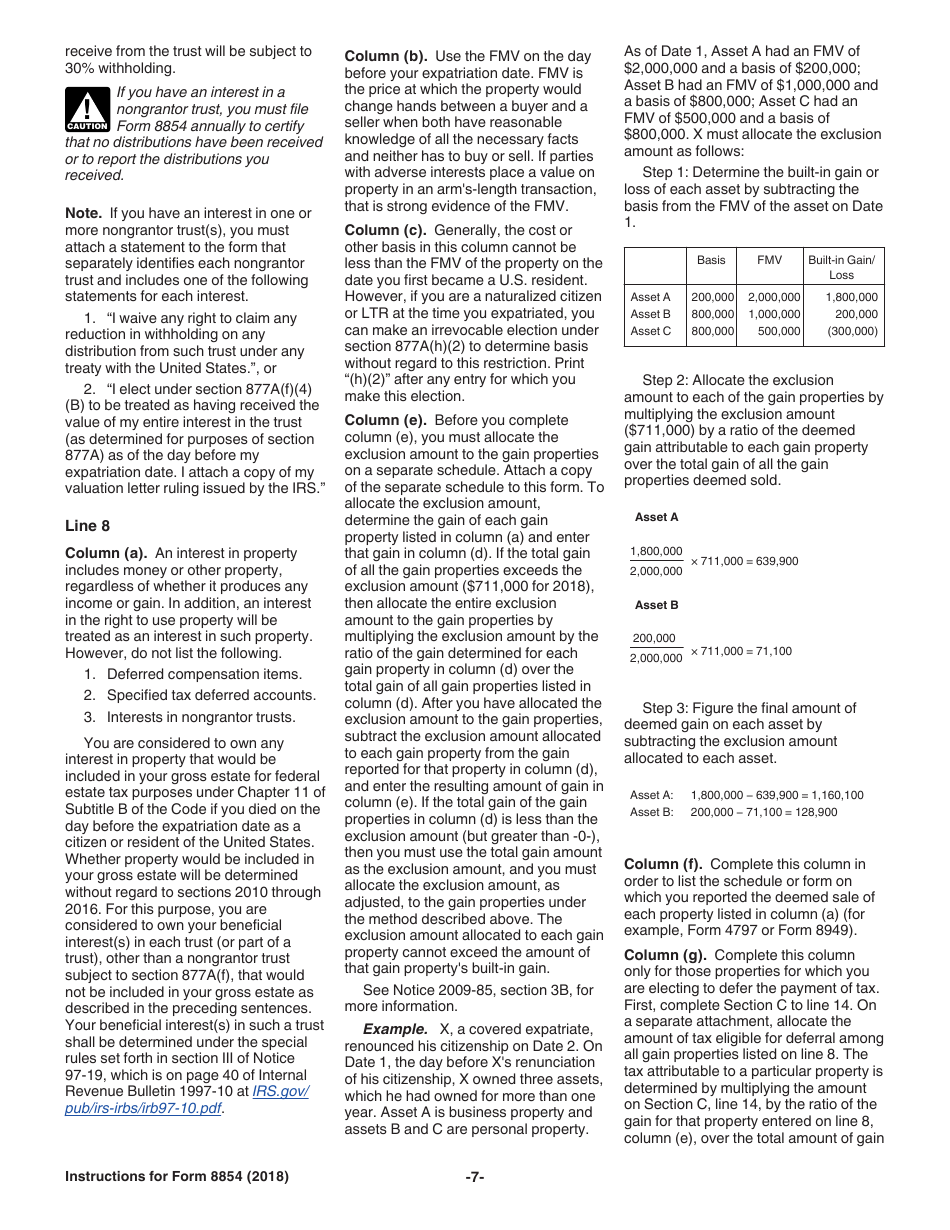

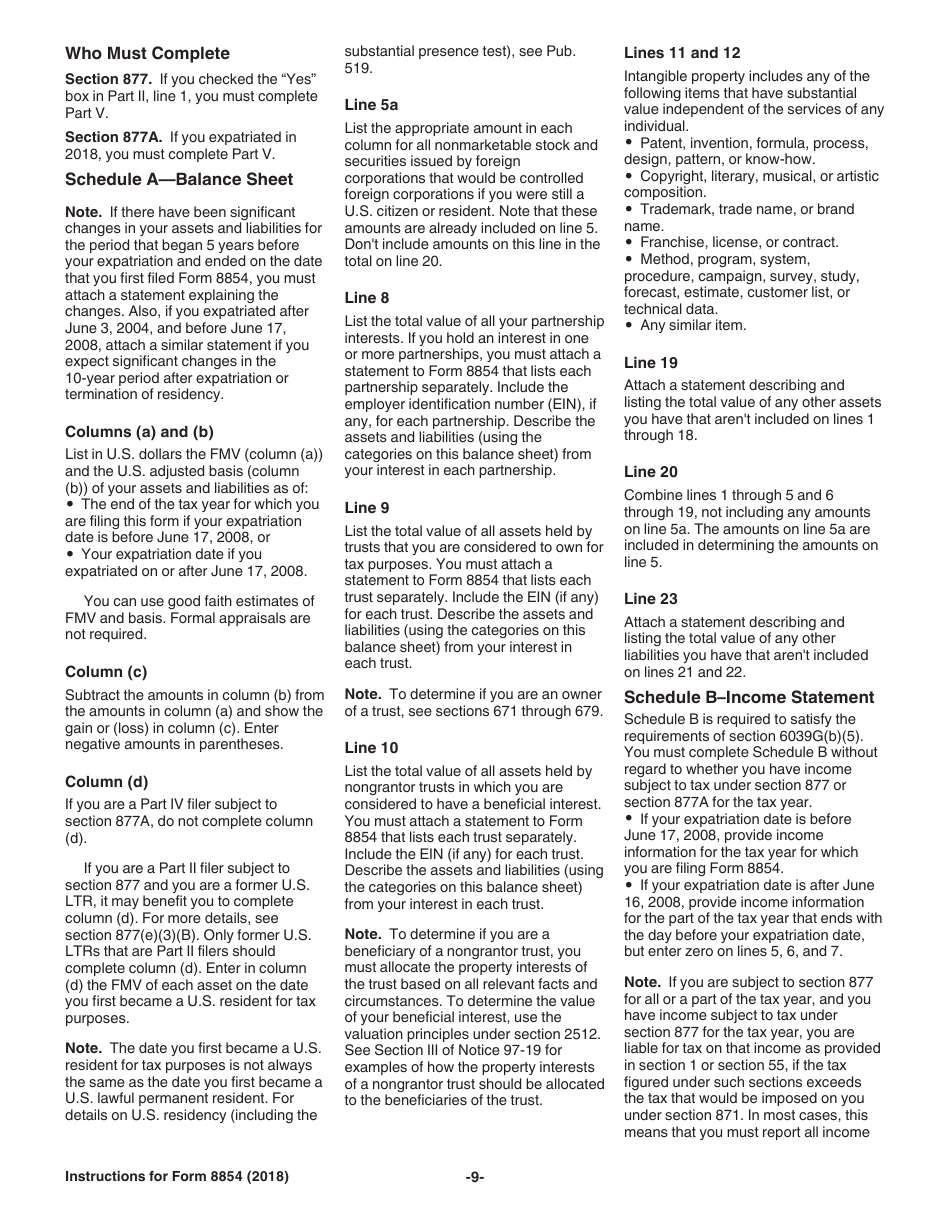

Instructions for IRS Form 8854 Initial and Annual Expatriation Statement

This document contains official instructions for IRS Form 8854 , Initial and Annual Expatriation Statement - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8854 is available for download through this link.

FAQ

Q: What is IRS Form 8854?

A: IRS Form 8854 is the Initial and Annual Expatriation Statement.

Q: Who needs to file IRS Form 8854?

A: U.S. citizens who have renounced their citizenship or long-term residents who have ended their U.S. residency status need to file IRS Form 8854.

Q: When should IRS Form 8854 be filed?

A: The form should be filed with the IRS on the date of expatriation or termination of residency.

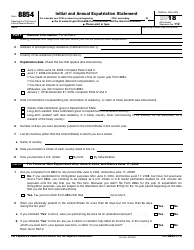

Q: What information is required on IRS Form 8854?

A: The form requires information about your income, assets, and other financial information for the year of expatriation or termination of residency.

Q: Are there any penalties for not filing IRS Form 8854?

A: Yes, there are penalties for failing to file IRS Form 8854, including a potential loss of certain tax benefits.

Instruction Details:

- This 10-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.