This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8863

for the current year.

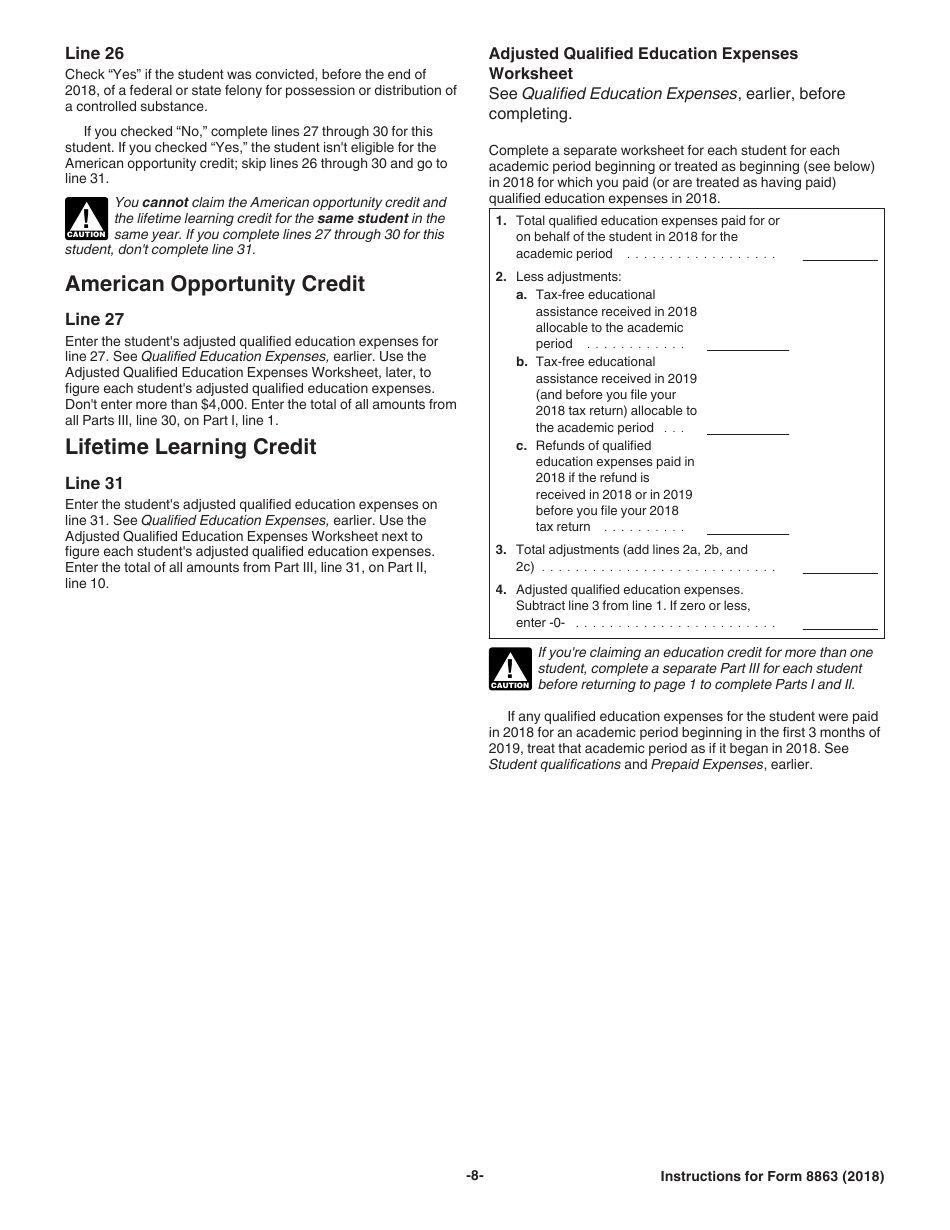

Instructions for IRS Form 8863 Education Credits (American Opportunity and Lifetime Learning Credits)

This document contains official instructions for IRS Form 8863 , Education Credits (American Opportunity and Lifetime Learning Credits) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8863 is available for download through this link.

FAQ

Q: What is IRS Form 8863?

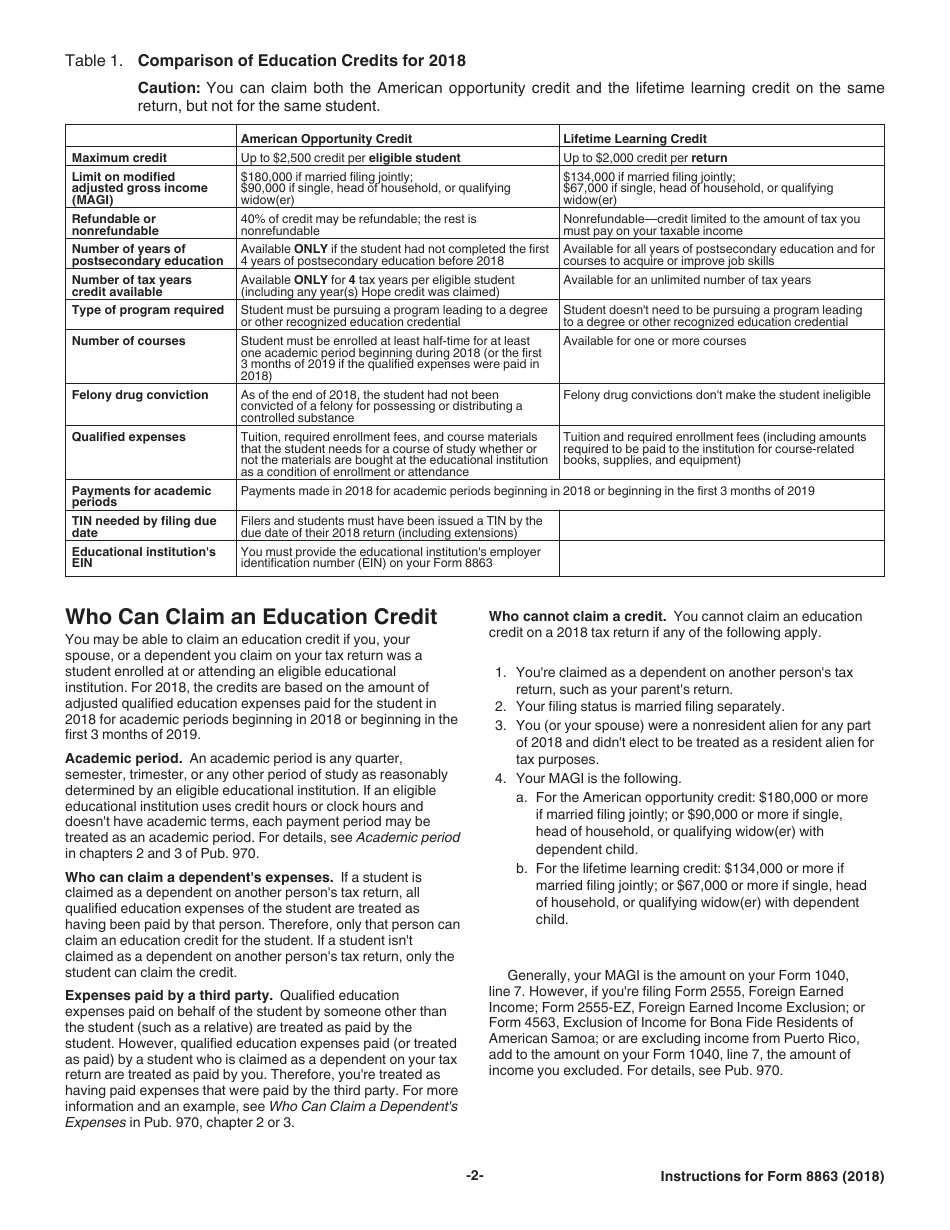

A: IRS Form 8863 is a tax form used to claim education credits, such as the American Opportunity Credit or the Lifetime Learning Credit.

Q: What are education credits?

A: Education credits are tax benefits designed to help offset the costs of higher education expenses.

Q: What is the American Opportunity Credit?

A: The American Opportunity Credit is a tax credit that can be claimed for qualified education expenses paid for an eligible student.

Q: What is the Lifetime Learning Credit?

A: The Lifetime Learning Credit is a tax credit that can be claimed for qualified education expenses paid for an eligible student.

Q: Who is eligible to claim education credits?

A: Taxpayers who have incurred qualified education expenses for themselves, their spouse, or a dependent may be eligible to claim education credits.

Q: What expenses qualify for education credits?

A: Qualifying expenses may include tuition, fees, and other related expenses for eligible post-secondary education.

Q: Do I need to provide documentation for education expenses?

A: Yes, you should keep records and documentation of your education expenses in case of an audit.

Q: Is there an income limit to claim education credits?

A: Yes, there are income limits for claiming education credits. Consult the IRS guidelines or a tax professional for specific details.

Q: When is the deadline to file IRS Form 8863?

A: The deadline to file IRS Form 8863 usually aligns with the general tax filing deadline, which is typically April 15th.

Instruction Details:

- This 8-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.