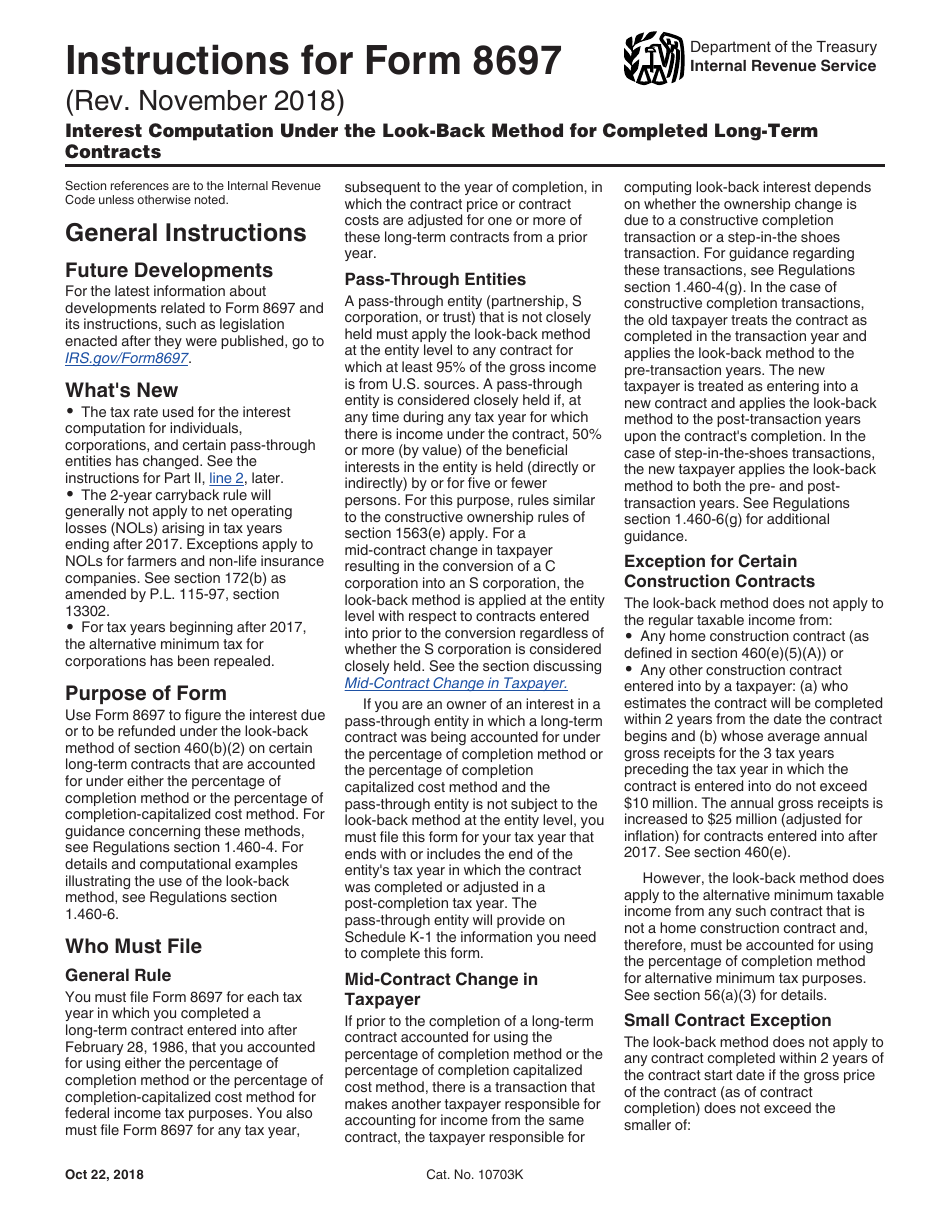

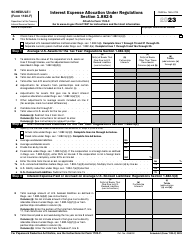

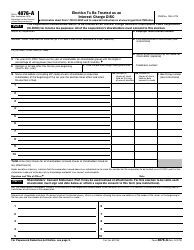

Instructions for IRS Form 8697 Interest Computation Under the Look-Back Method for Completed Long-Term Contracts

This document contains official instructions for IRS Form 8697 , Interest Computation Under the Look-Back Method for Completed Long-Term Contracts - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8697 is available for download through this link.

FAQ

Q: What is IRS Form 8697?

A: IRS Form 8697 is used to calculate interest under the look-back method for completed long-term contracts.

Q: What is the look-back method?

A: The look-back method is a way of calculating interest on a completed long-term contract by determining the excess of cumulative contract costs over cumulative contract revenue.

Q: Who needs to file IRS Form 8697?

A: Taxpayers who have completed long-term contracts and need to calculate interest using the look-back method must file Form 8697.

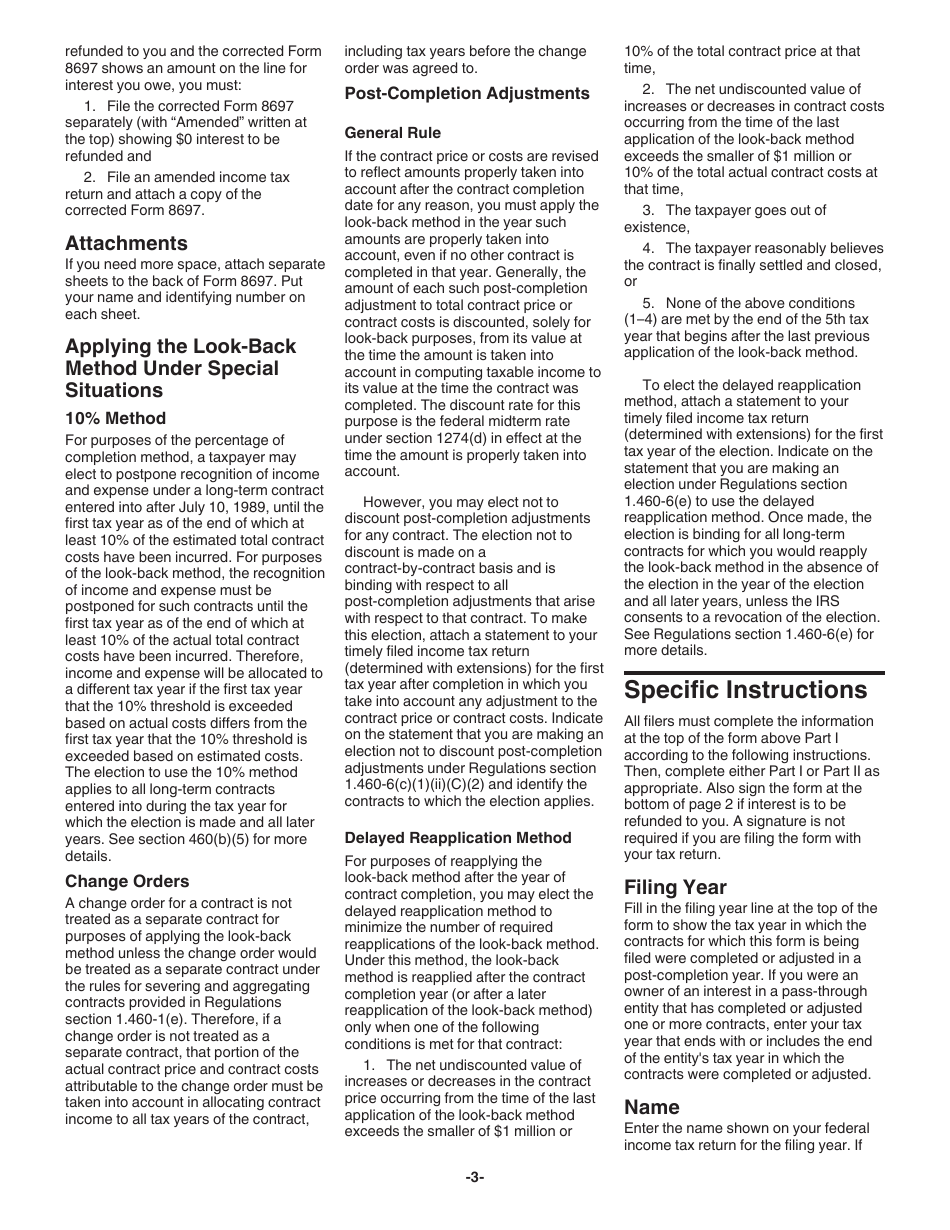

Q: How do I complete IRS Form 8697?

A: To complete Form 8697, you'll need to provide specific information about the completed long-term contract, such as cumulative contract costs, cumulative contract revenue, and the applicable interest rate.

Q: Are there any special rules or requirements for filing IRS Form 8697?

A: Yes, there are specific rules and requirements that must be followed when filing Form 8697. It's recommended to carefully review the instructions or consult a tax professional for guidance.

Q: Can I e-file IRS Form 8697?

A: No, as of now, Form 8697 cannot be e-filed. It must be filed by mail to the address provided in the instructions.

Q: What should I do if I have questions or need assistance with IRS Form 8697?

A: If you have questions or need assistance with Form 8697, you can contact the IRS for support. You may also consider consulting a tax professional for guidance.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.