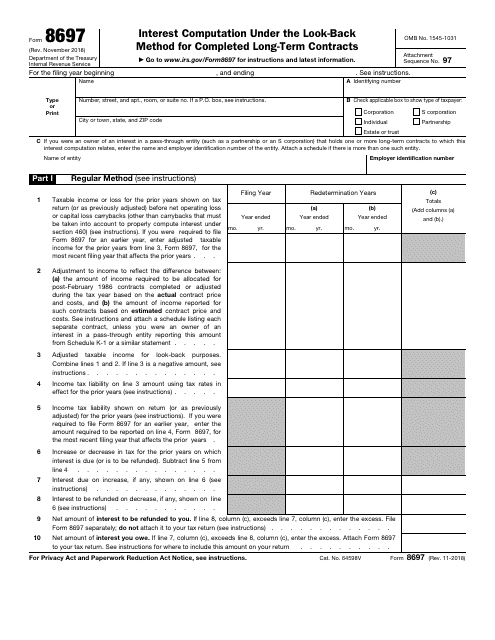

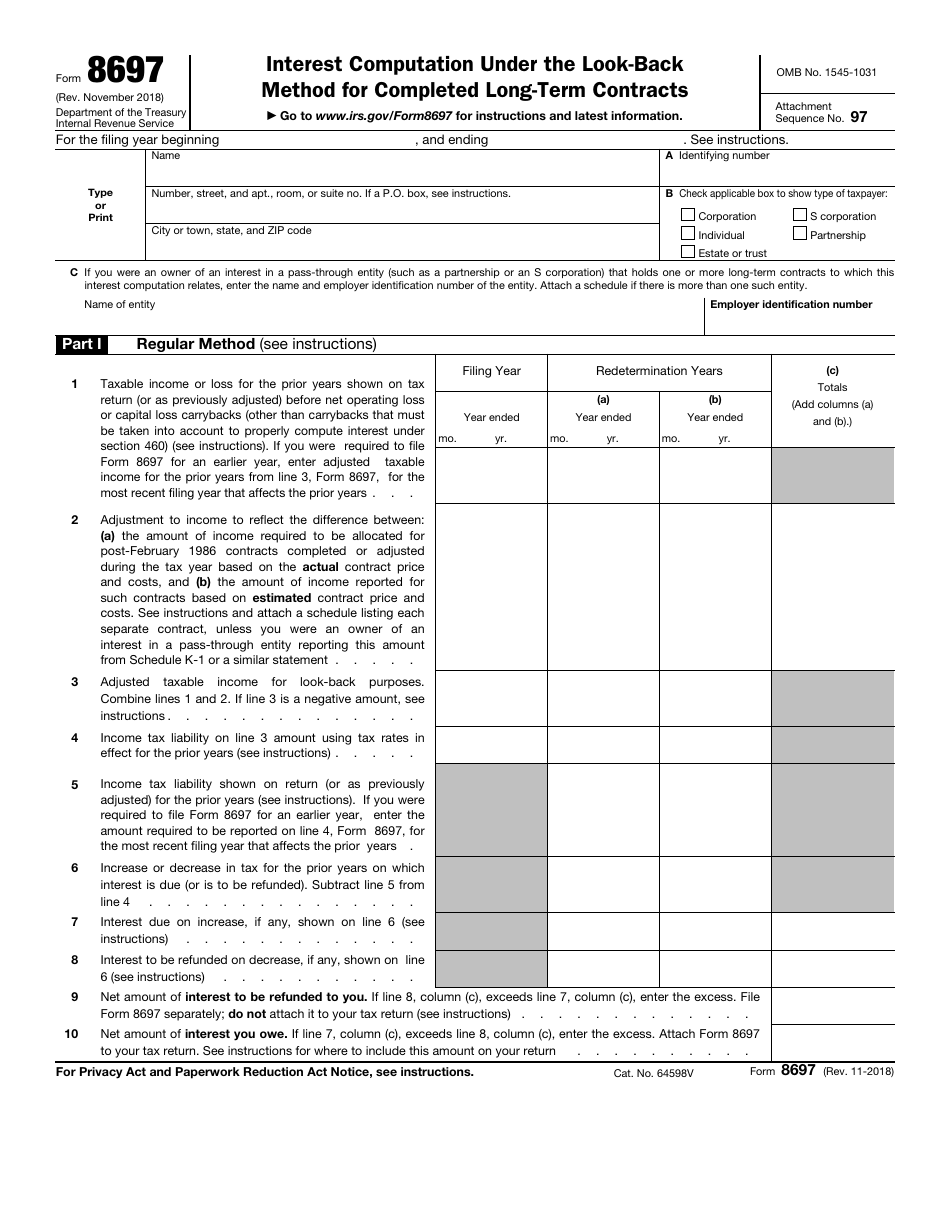

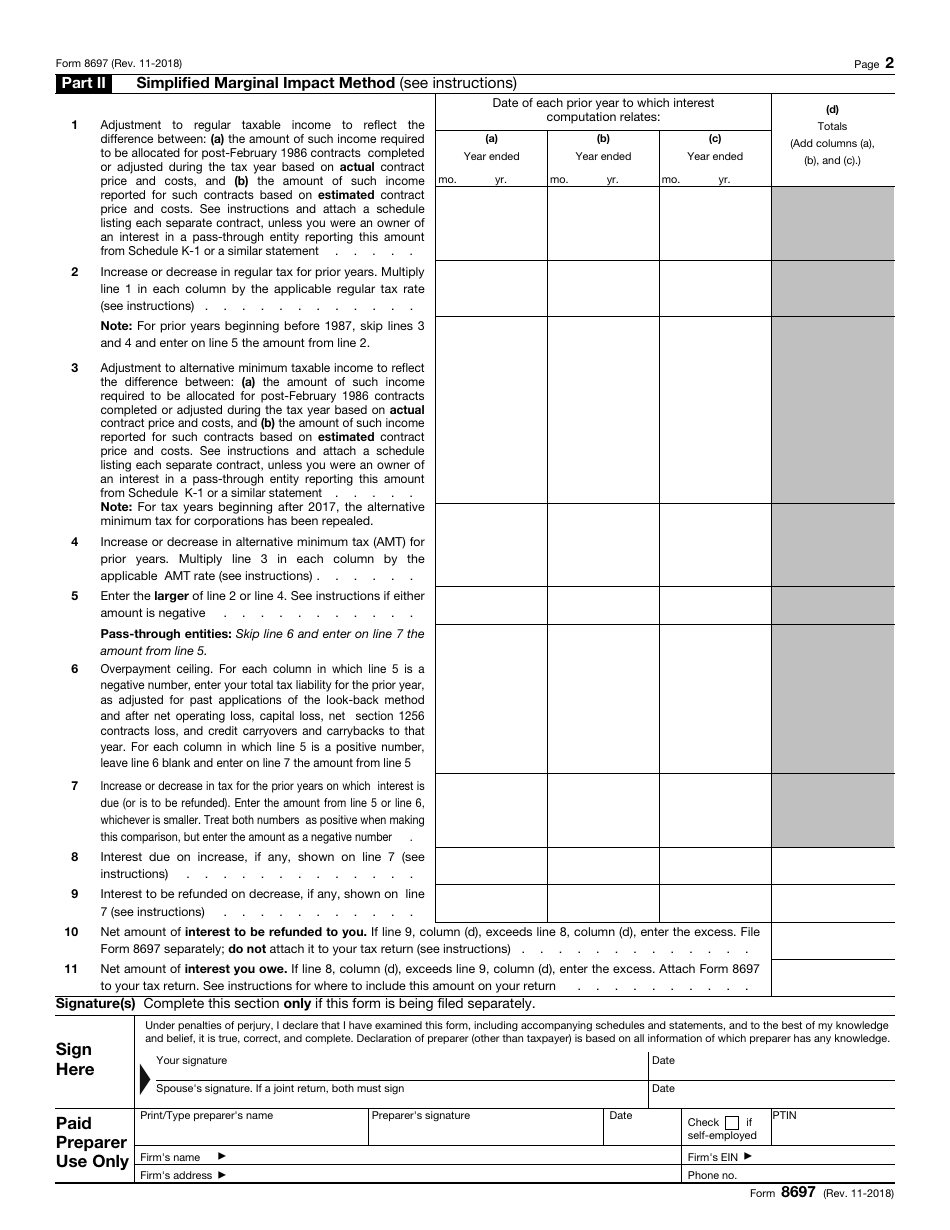

IRS Form 8697 Interest Computation Under the Look-Back Method for Completed Long-Term Contracts

What Is IRS Form 8697?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2018. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8697?

A: IRS Form 8697 is used to compute interest under the Look-Back Method for completed long-term contracts.

Q: What is the Look-Back Method for completed long-term contracts?

A: The Look-Back Method is a way to calculate interest on completed long-term contracts.

Q: When is IRS Form 8697 required?

A: IRS Form 8697 is required when computing interest for completed long-term contracts.

Q: How do I fill out IRS Form 8697?

A: You will need to provide information on the long-term contract and calculate interest using the Look-Back Method.

Q: Are there any penalties for not filing IRS Form 8697?

A: Failure to file IRS Form 8697 may result in penalties or interest charges.

Q: Can I file IRS Form 8697 electronically?

A: Yes, you can file IRS Form 8697 electronically if you are using tax preparation software or filing through the IRS's e-file system.

Q: What other forms or documents may be required along with IRS Form 8697?

A: Other forms and documents that may be required include Schedule C, Form 6252, and Form 4797.

Q: Is IRS Form 8697 only applicable to the United States?

A: Yes, IRS Form 8697 is specific to the United States tax system.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8697 through the link below or browse more documents in our library of IRS Forms.