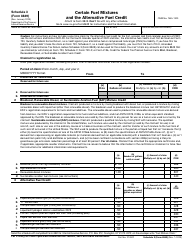

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 6251

for the current year.

Instructions for IRS Form 6251 Alternative Minimum Tax - Individuals

This document contains official instructions for IRS Form 6251 , Alternative Minimum Tax - Individuals - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 6251 is available for download through this link.

FAQ

Q: What is IRS Form 6251?

A: IRS Form 6251, also known as Alternative Minimum Tax (AMT) - Individuals, is a tax form used to calculate an individual's alternative minimum tax liability.

Q: Who needs to file IRS Form 6251?

A: Individuals who meet certain criteria, such as having significant amounts of tax preference items or adjustments, may need to file IRS Form 6251.

Q: What is the purpose of IRS Form 6251?

A: The purpose of IRS Form 6251 is to determine whether an individual owes any alternative minimum tax in addition to their regular income tax.

Q: How do I fill out IRS Form 6251?

A: To fill out IRS Form 6251, you will need to follow the instructions provided with the form. You will need to gather information about your income, deductions, and applicable tax preference items.

Q: When is the deadline to file IRS Form 6251?

A: The deadline to file IRS Form 6251 is usually the same as the deadline to file your regular income tax return, which is April 15th, unless it falls on a weekend or holiday.

Q: What happens if I owe alternative minimum tax?

A: If you determine that you owe alternative minimum tax after filling out IRS Form 6251, you will be required to pay the additional tax amount along with your regular income tax.

Q: Can I avoid alternative minimum tax?

A: There are certain strategies and deductions that may help reduce your alternative minimum tax liability, but it is recommended to consult a tax professional for personalized advice.

Q: Do I need to file IRS Form 6251 every year?

A: You only need to file IRS Form 6251 if you meet the criteria for owing alternative minimum tax. It is not required for every taxpayer.

Q: What should I do if I have more questions about IRS Form 6251?

A: If you have more questions or need further assistance with IRS Form 6251, it is recommended to consult a tax professional or contact the IRS directly.

Instruction Details:

- This 15-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.