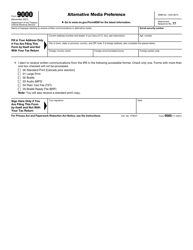

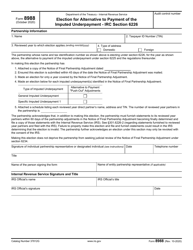

This version of the form is not currently in use and is provided for reference only. Download this version of

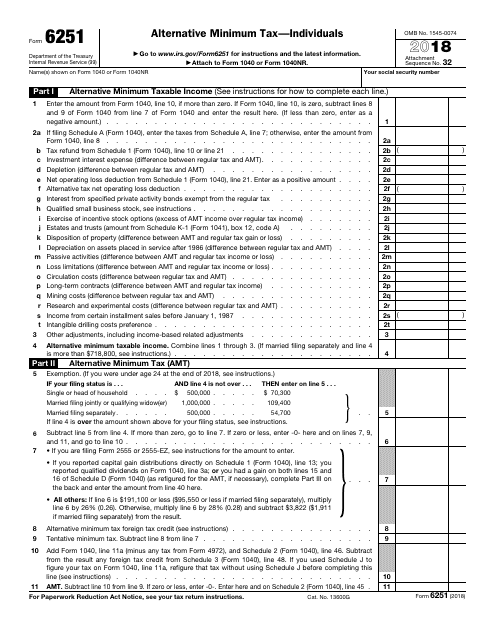

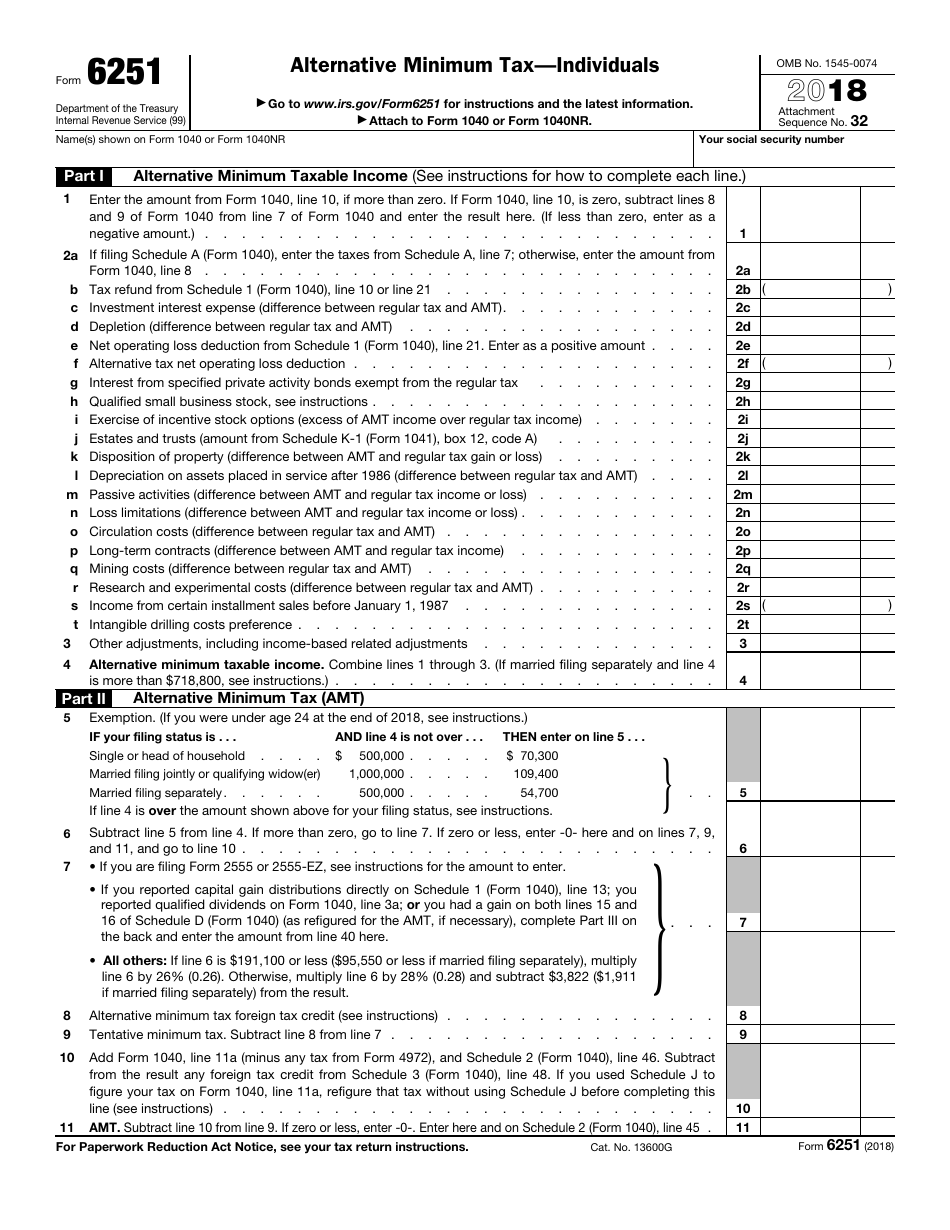

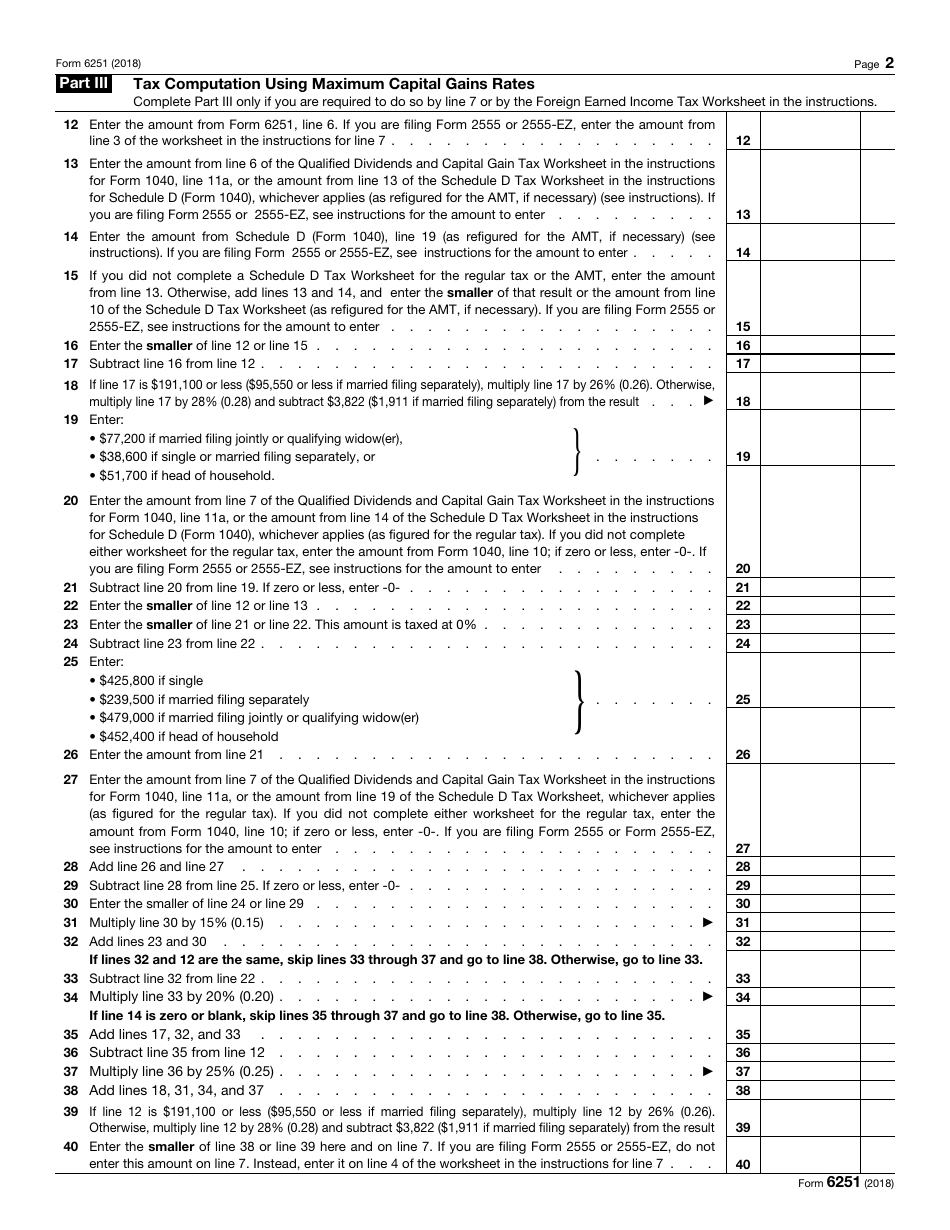

IRS Form 6251

for the current year.

IRS Form 6251 Alternative Minimum Tax - Individuals

What Is IRS Form 6251?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 6251?

A: IRS Form 6251 is the form used to calculate the Alternative Minimum Tax (AMT) for individuals.

Q: Who needs to file IRS Form 6251?

A: Individuals who meet certain criteria may need to file IRS Form 6251 to determine if they owe the Alternative Minimum Tax.

Q: What is the Alternative Minimum Tax?

A: The Alternative Minimum Tax (AMT) is a separate tax system that sets a minimum level of tax that certain individuals must pay, regardless of their regular tax liability.

Q: How do I fill out IRS Form 6251?

A: IRS Form 6251 involves calculating various adjustments and preferences to determine if you owe the Alternative Minimum Tax. It is recommended to consult a tax professional or use tax software to ensure accurate completion.

Q: What are some common triggers for the Alternative Minimum Tax?

A: Some common triggers for the Alternative Minimum Tax include high deductions, large incentive stock options, and certain tax preference items.

Q: What happens if I owe the Alternative Minimum Tax?

A: If you owe the Alternative Minimum Tax, you will need to pay the additional tax amount in addition to your regular tax liability.

Q: Can the Alternative Minimum Tax be reduced or eliminated?

A: There are certain exemptions, deductions, and credits available that may reduce or eliminate the Alternative Minimum Tax. Consult a tax professional or use tax software to explore your options.

Q: Is IRS Form 6251 the same as my regular tax return?

A: No, IRS Form 6251 is separate from your regular tax return. It is an additional form used specifically for calculating the Alternative Minimum Tax.

Q: What if I don't file IRS Form 6251 when required?

A: If you are required to file IRS Form 6251 and fail to do so, you may be subject to penalties and interest on the unpaid tax amount.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 6251 through the link below or browse more documents in our library of IRS Forms.