This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8379

for the current year.

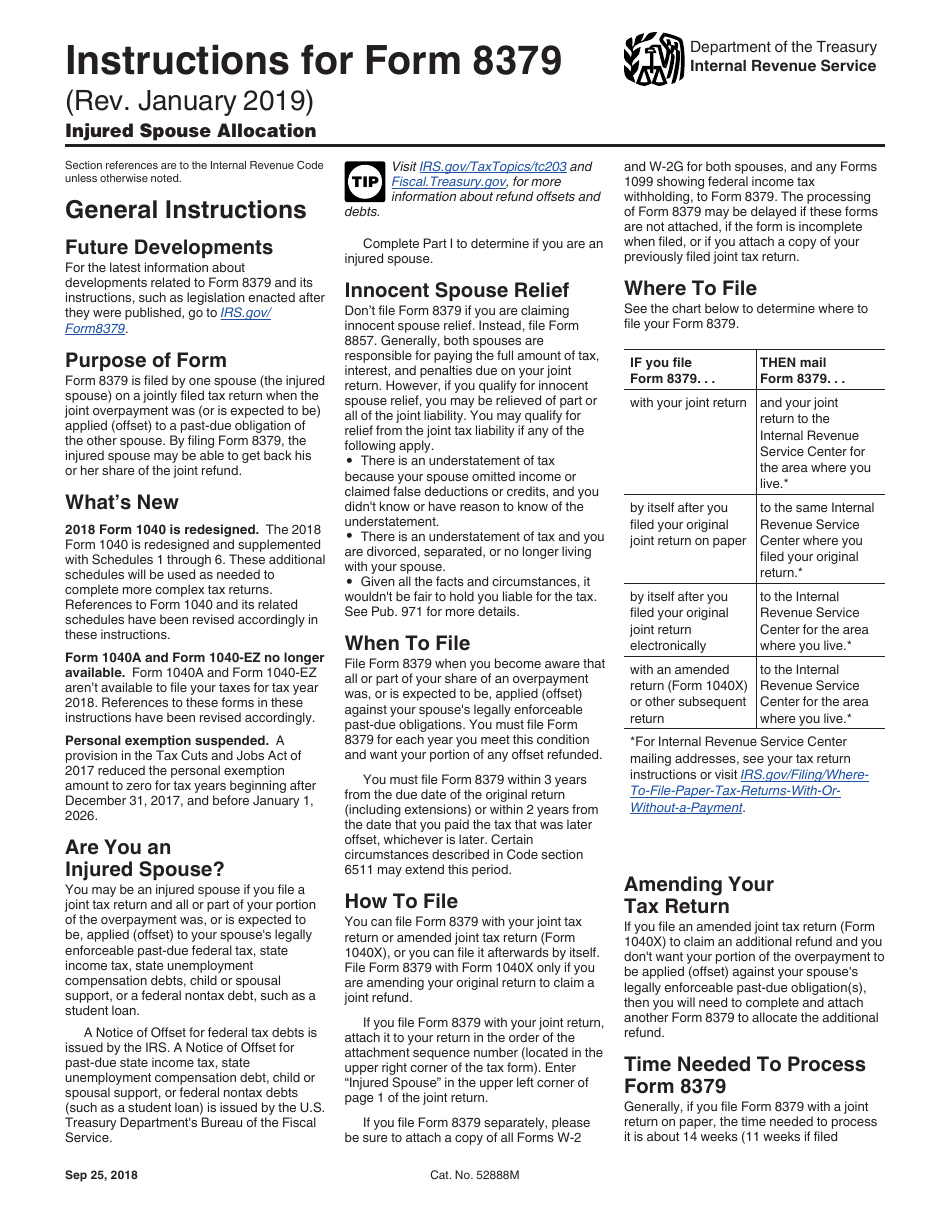

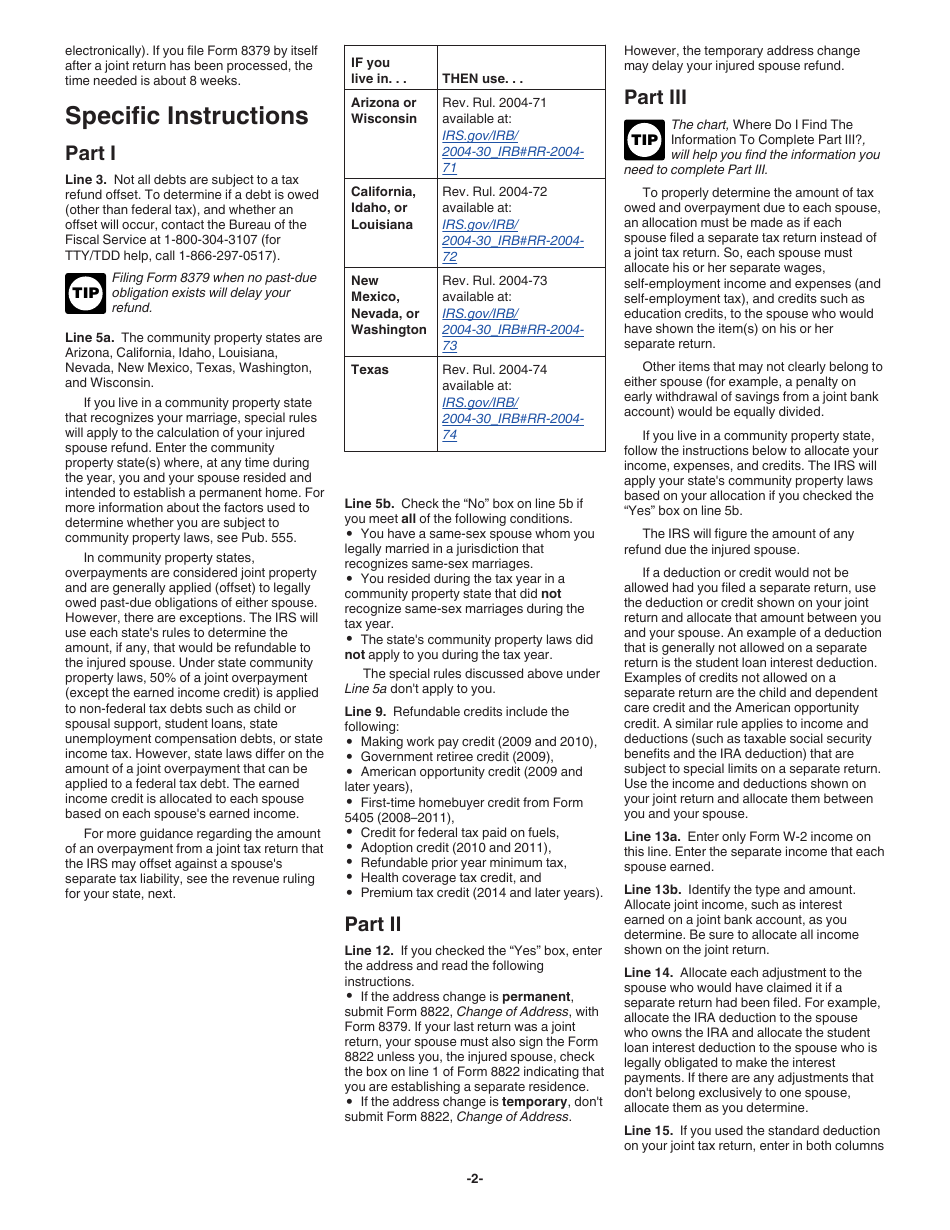

Instructions for IRS Form 8379 Injured Spouse Allocation

This document contains official instructions for IRS Form 8379 , Injured Spouse Allocation - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8379 is available for download through this link.

FAQ

Q: What is IRS Form 8379?

A: IRS Form 8379 is the Injured Spouse Allocation Form.

Q: What is the purpose of Form 8379?

A: The purpose of Form 8379 is to allocate the overpayment of a joint tax return between the injured spouse and the debtor spouse.

Q: Who should use Form 8379?

A: Form 8379 should be used by an injured spouse who wants to claim their share of a joint tax refund.

Q: How do I fill out Form 8379?

A: You need to provide personal information, income details, and allocate the amounts on the form based on your circumstances.

Q: Is there a deadline for filing Form 8379?

A: Yes, you should file Form 8379 as soon as possible after you know that all or part of your refund is at risk of being applied to your spouse's debt.

Q: What happens after I submit Form 8379?

A: The IRS will review your form and allocate the overpayment according to your allocation percentages.

Q: Can Form 8379 help protect my share of the tax refund?

A: Yes, by filing Form 8379, you can protect your share of the tax refund from being offset by your spouse's debt.

Q: Can I e-file Form 8379?

A: Currently, the IRS does not support e-filing of Form 8379, so you must mail it in.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.