This version of the form is not currently in use and is provided for reference only. Download this version of

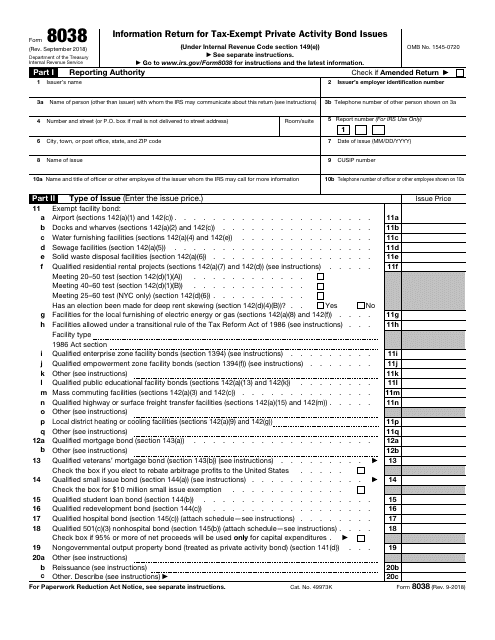

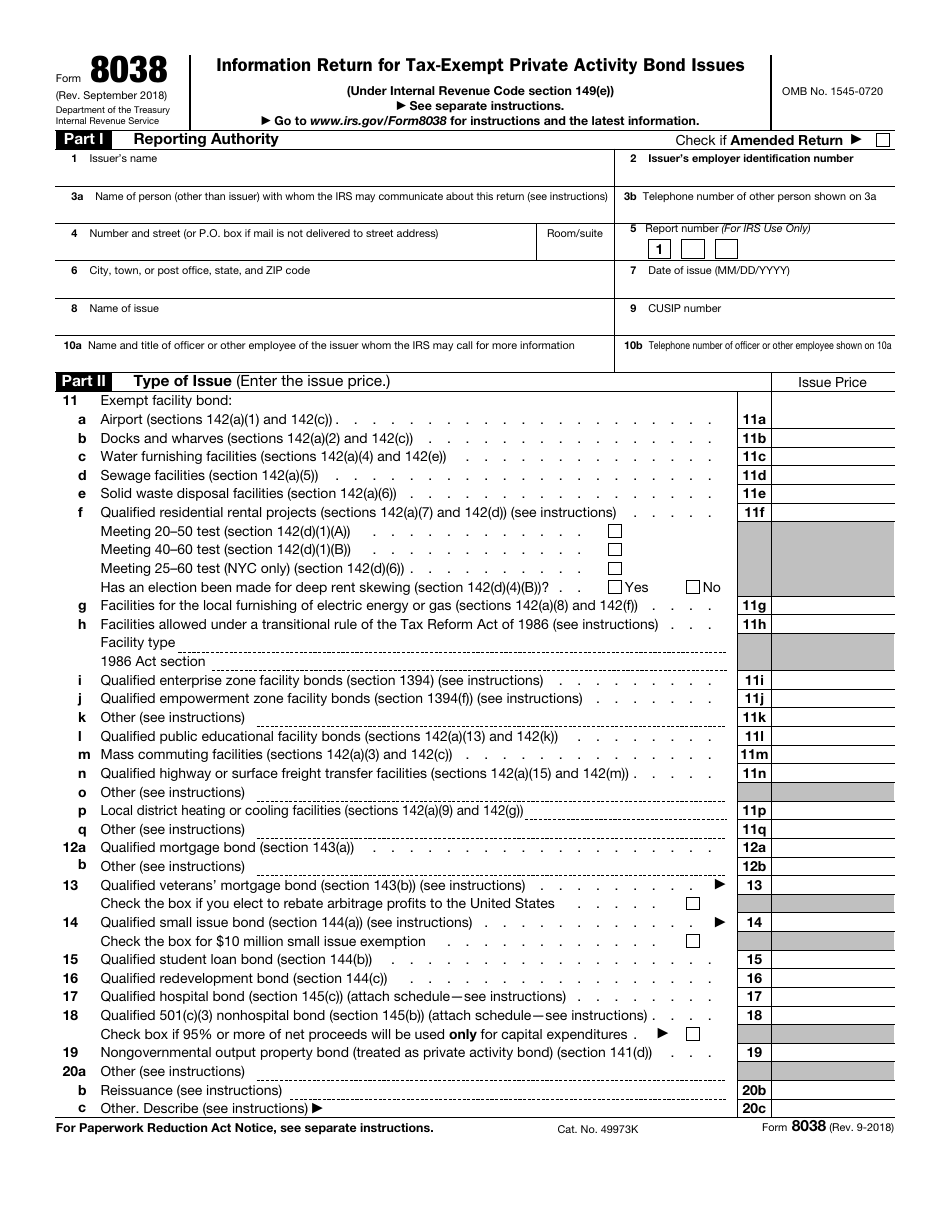

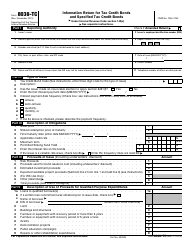

IRS Form 8038

for the current year.

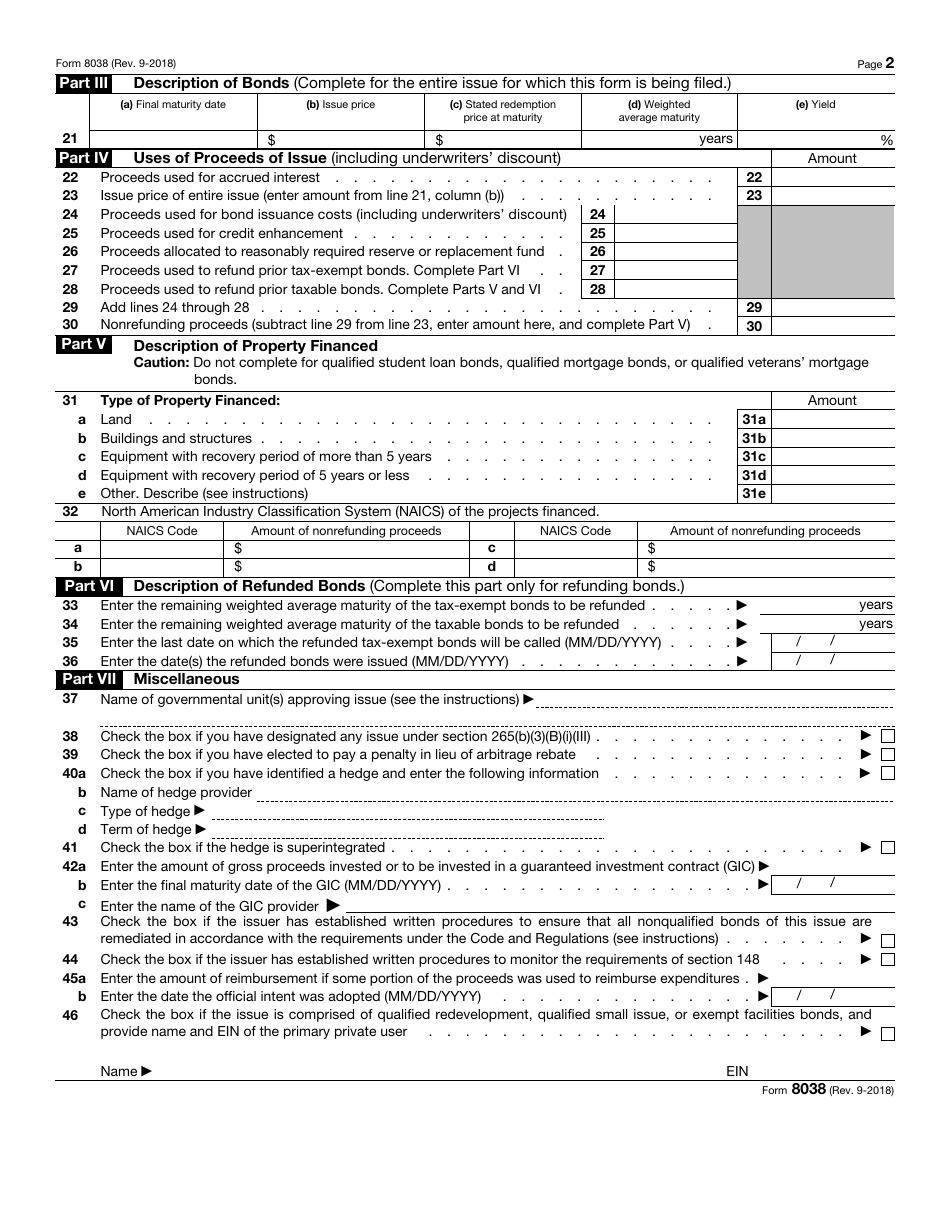

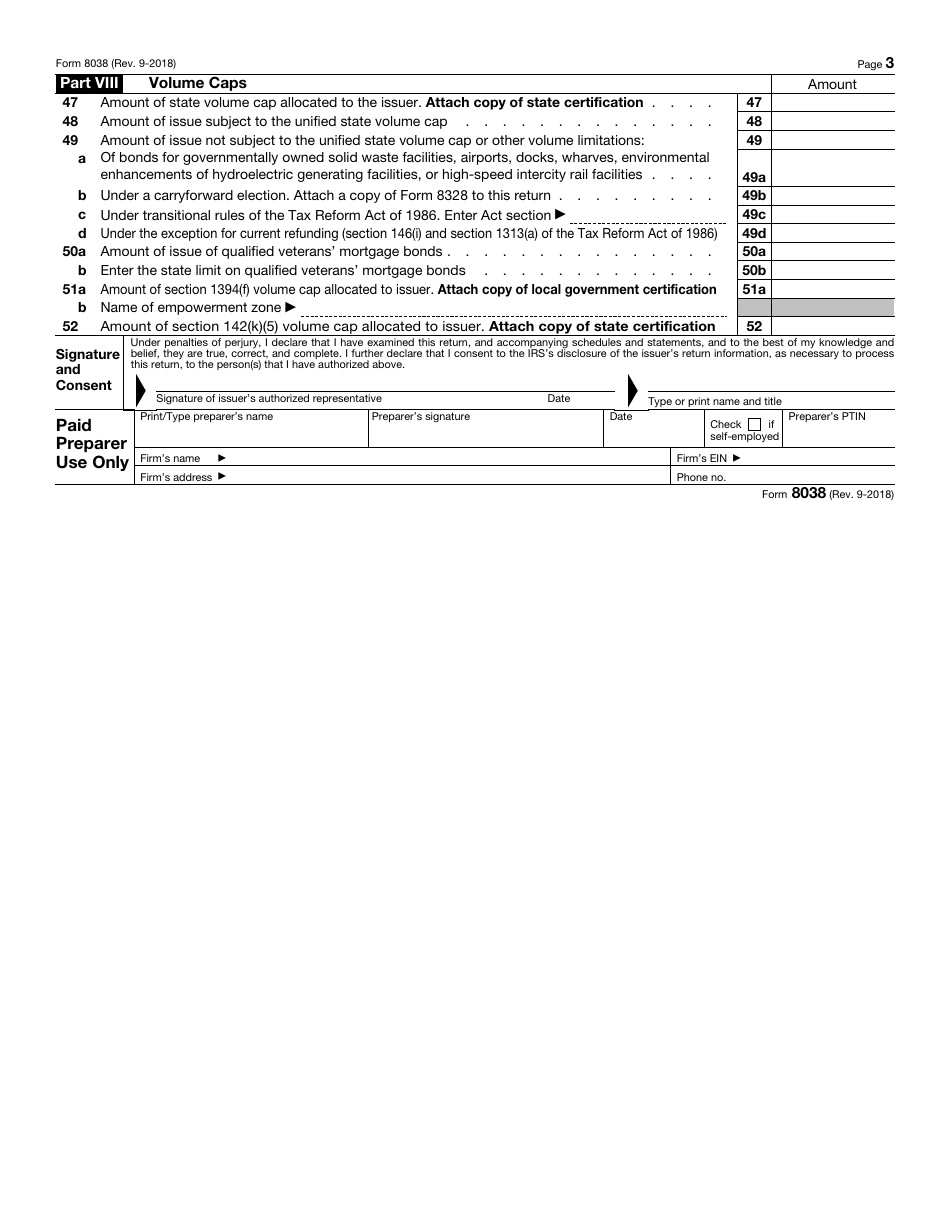

IRS Form 8038 Information Return for Tax-Exempt Private Activity Bond Issues

What Is IRS Form 8038?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on September 1, 2018. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8038?

A: IRS Form 8038 is an information return for tax-exempt private activity bond issues.

Q: Who needs to file IRS Form 8038?

A: Anyone who issues tax-exempt private activity bonds needs to file IRS Form 8038.

Q: What is the purpose of filing IRS Form 8038?

A: The purpose of filing IRS Form 8038 is to report information about tax-exempt private activity bond issues to the Internal Revenue Service (IRS).

Q: What information is required on IRS Form 8038?

A: IRS Form 8038 requires information about the issuer of the bonds, the amount of the bonds, the projects financed by the bonds, and other relevant details.

Q: When is IRS Form 8038 due?

A: IRS Form 8038 is generally due within 180 days after the close of the calendar year in which the bonds were issued.

Q: Are there any penalties for not filing IRS Form 8038?

A: Yes, there can be penalties for not filing IRS Form 8038, including monetary penalties and potential loss of tax-exempt status for the bonds.

Q: Can IRS Form 8038 be filed electronically?

A: Yes, IRS Form 8038 can be filed electronically using the IRS's Modernized e-File system.

Q: Is IRS Form 8038 required for all types of bonds?

A: No, IRS Form 8038 is specifically for tax-exempt private activity bonds.

Q: What is a tax-exempt private activity bond?

A: A tax-exempt private activity bond is a bond issued by a government entity to finance private projects that serve a public purpose, such as affordable housing or infrastructure development.

Form Details:

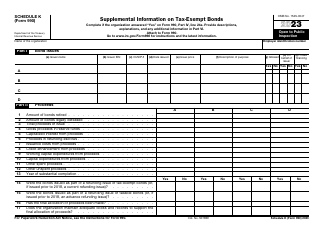

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8038 through the link below or browse more documents in our library of IRS Forms.