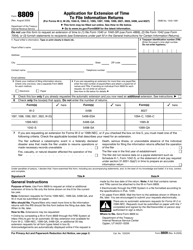

Instructions for IRS Form 7004 Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns

This document contains official instructions for IRS Form 7004 , Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 7004 is available for download through this link.

FAQ

Q: What is IRS Form 7004?

A: IRS Form 7004 is an application for automatic extension of time to file certain business income tax, information, and other returns.

Q: Who should use IRS Form 7004?

A: Any business entity, including corporations, partnerships, LLCs, and certain trusts, that needs extra time to file their tax returns can use IRS Form 7004.

Q: What types of tax returns can be extended using Form 7004?

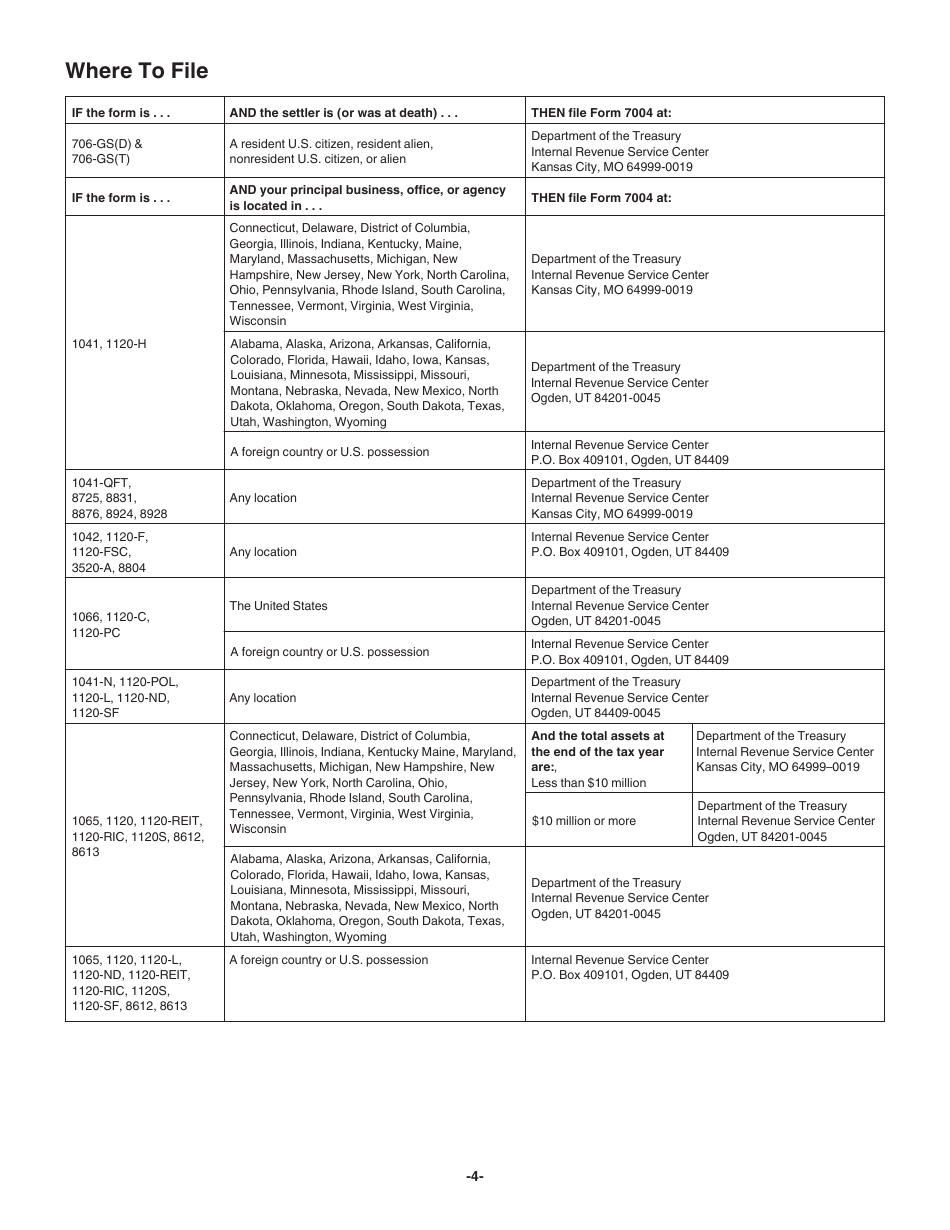

A: Form 7004 can be used to extend the filing due date for various business income tax returns, including Form 1120, Form 1065, Form 1041, and more.

Q: How long of an extension does Form 7004 provide?

A: Form 7004 generally provides a 6-month extension for most business tax returns, with some exceptions.

Q: What information is required on Form 7004?

A: Form 7004 requires basic information about the business entity, the type of tax return being extended, and an estimate of the total tax liability.

Q: What is the deadline for filing Form 7004?

A: The deadline for filing Form 7004 is the same as the original due date of the tax return that is being extended.

Q: Does filing Form 7004 extend the time to pay taxes?

A: No, Form 7004 only provides an extension to file the tax return, not to pay any taxes owed. Payment must still be made by the original due date to avoid penalties and interest.

Q: Are there any fees or penalties associated with filing Form 7004?

A: There are generally no fees for filing Form 7004, but penalties may apply if the form is filed late or if the tax payment isn't made by the original due date.

Q: Can Form 7004 be filed multiple times for the same tax return?

A: No, Form 7004 can only be filed once for each tax return. Additional extensions may be granted in certain situations, but they require a different form and specific justification.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.