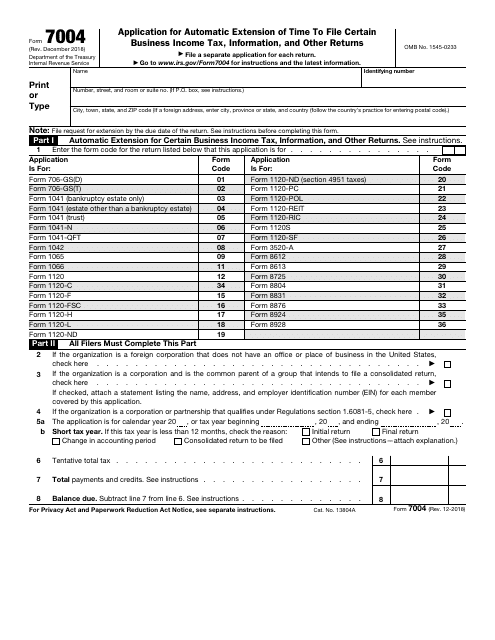

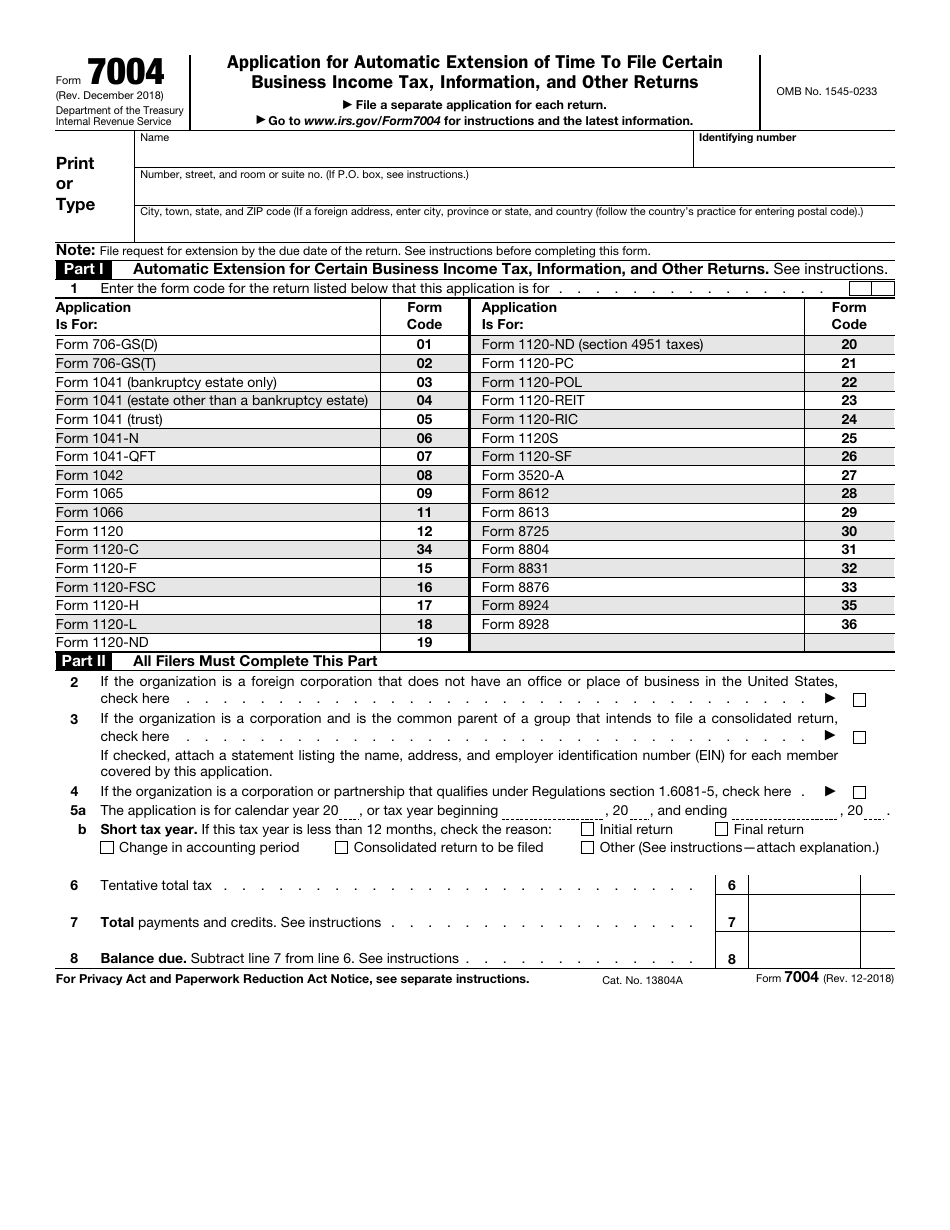

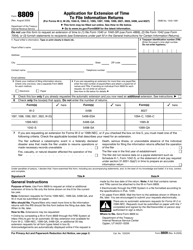

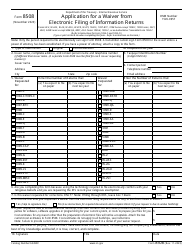

IRS Form 7004 Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns

What Is IRS Form 7004?

IRS Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns, is a formal request filled out by a taxpayer to ask for extra time to prepare various business tax returns.

Alternate Names:

- Extension Form 7004;

- 7004 Tax Form;

- Federal Form 7004.

Once you understand you are unable to submit an income statement on time, you can ask fiscal authorities for a filing extension by warning them about an upcoming delay.

This application was released by the Internal Revenue Service (IRS) in - older editions of the instrument are now outdated. Download an IRS Form 7004 fillable version via the link below.

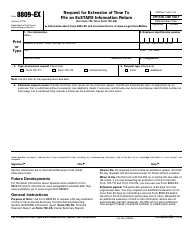

What Is Form 7004 Used For?

Submit a 7004 Tax Form to inform tax organs about the late filing of a tax return on behalf of your business. Whatever the reason is, if you cannot submit the paperwork before the deadline for a particular tax document, you are strongly recommended to notify the IRS about it otherwise your organization will be subject to fines and penalties inevitable in the event of late filing. Make sure you read the guidelines on the first page of the form to confirm the extension request is possible in your case and submit the papers before the due date for the tax return in question.

Form 7004 Instructions

The IRS Form 7004 Instructions are as follows:

-

Identify your business - state its name, taxpayer identification number, and correspondence address . Examine the list of codes that correspond to the forms you are planning to submit this application for - write down the code that applies in your case.

-

Confirm whether the entity's main place of business is situated abroad and whether you will submit a consolidated tax return - you will have to provide information on every member of the group this statement covers.

-

Check the box to certify your entity qualifies for an extension as a partnership or corporation, specify the tax year or calendar year the extension is for, and explain the reasons to outline a shorter tax period if necessary.

-

Calculate the total tax and the amount of credits and payments and subtract the latter number from the former to enter the balance due . Your calculations should be as accurate as possible.

Where to File Form 7004?

IRS Form 7004 mailing address depends on the address of the form you are asking a filing extension for:

-

File an application for Forms 706-GS(D) and 706-GS(T) with the Department of the Treasury, IRS Center, Kansas City, MO 64999-0019 .

-

If you are located in Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, or Wyoming, submit an extension request forForms 1041 and 1120-H to the Department of the Treasury, IRS Center, Ogden, UT 84201-0045 . Businesses from other states are expected to send the papers to the Department of the Treasury, IRS Center, Kansas City, MO 64999-0019 ; in case you manage your business from abroad, file the form with the IRS Center, P.O. Box 409101, Ogden, UT 84409 .

-

Extension requests for Forms 1041-QFT, 8725, 8831, 8876, 8924, and 8928 must be submitted to the Department of the Treasury, IRS Center, Kansas City, MO 64999-0019 .

-

File an application for Forms 1042, 1120-F, 1120-FSC, 3520-A, and 8804 with the IRS Center, P.O. Box 409101, Ogden, UT 84409 .

-

You must send a request for an extension for Forms 1066, 1120-C, and 1120-PC to the Department of the Treasury, IRS Center, Ogden, UT 84201-0045 . Submit the paperwork to the IRS Center, P.O. Box 409101, Ogden, UT 84409 if you conduct your operations outside of the United States.

-

Applications for Forms 1041-N, 1120-POL, 1120-L, 1120-ND, and 1120-SF must be sent to the Department of the Treasury, IRS Center, Ogden, UT 84409-0045 .

-

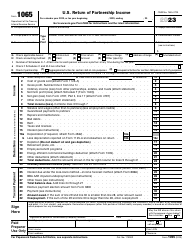

If you operate in Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, or Wisconsin, submit an Extension Form 7004 for Forms 1065, 1120, 1120-REIT, 1120-RIC, 1120-S, 8612, and 8613 to the Department of the Treasury, IRS Center, Kansas City, MO 64999–0019 . Send the paperwork to the Department of the Treasury, IRS Center, Ogden, UT 84201-0045 if your assets are $10 million or more. Organizations from all other states must file the papers with the Department of the Treasury, IRS Center, Ogden, UT 84201-0045 .

-

Submit a 7004 Tax Form for Forms 1065, 1120, 1120-L, 1120-ND, 1120-REIT, 1120-RIC, 1120-S, 1120-SF, 8612, and 8613 to the IRS Center, P.O. Box 409101, Ogden, UT 84409 if you operate abroad .