This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 6765

for the current year.

Instructions for IRS Form 6765 Credit for Increasing Research Activities

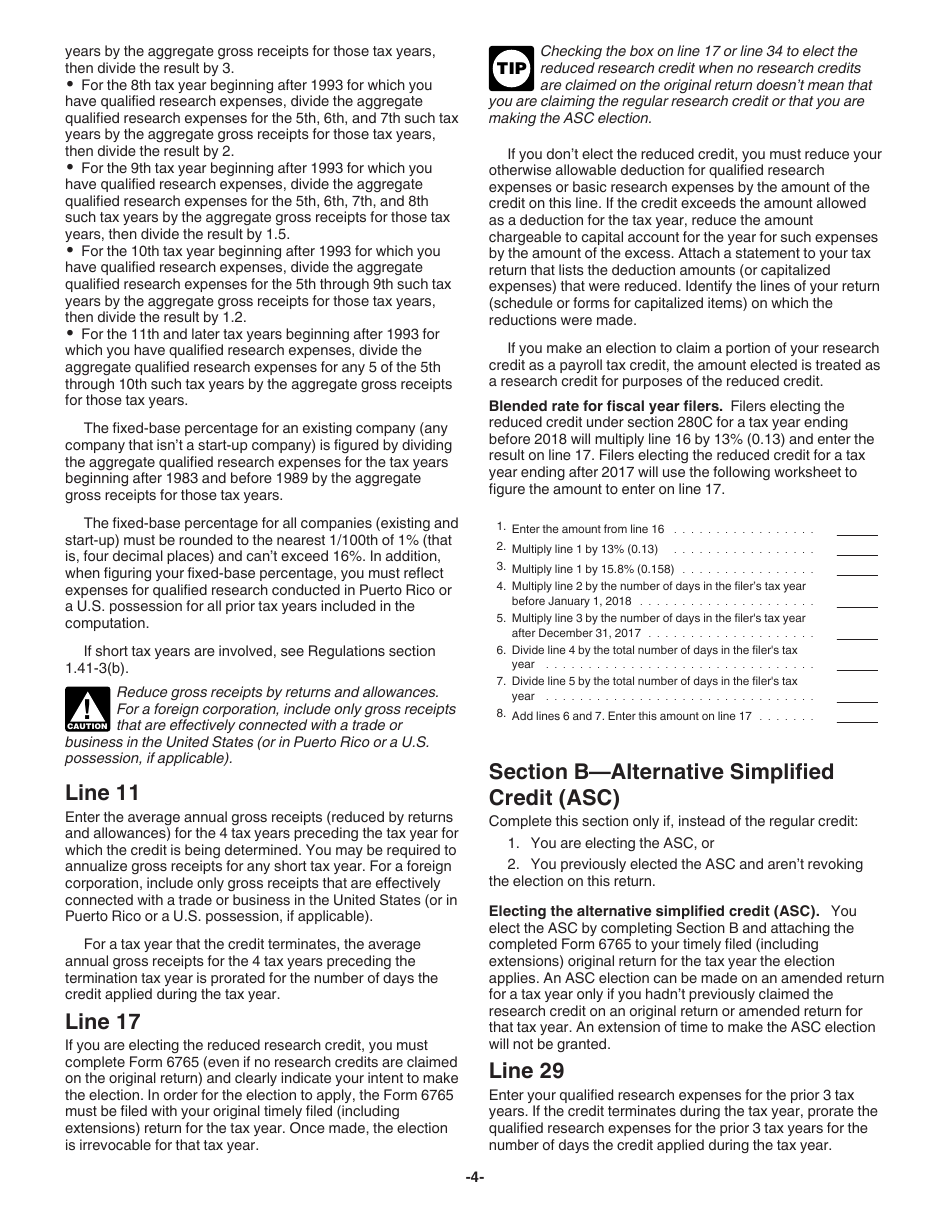

Instructions for IRS Form 6765, Credit for Increasing Research Activities , is a document you may use to figure out how to properly complete IRS Form 6765. This form allows you to claim the research credit (credit for increasing research activities), to claim a certain amount of credit as a payroll tax credit, and to elect the reduced credit under the Internal Revenue Code section 280C.

The research credit can be claimed if you discover information technological in nature. You may claim this tax incentive tailored to reverse the decline in American research and implemented to encourage innovation throughout the economy and to keep technical jobs in the country. Use the Instructions if your business develops and designs new processes and products, enhances and improves upon existing products and prototypes.

Fill out IRS Form 6765 if you intend to use credit to develop an improved or new business component. Indicate whether you claim the regular credit or elect the alternative simplified credit. Enter the amounts you paid to cover the cost of supplies, rental or lease of computers, wages for qualified services, and basic research payments to qualified organizations.

Instructions for IRS Form 6765 were released on December 1, 2018 , by the Internal Revenue Service . You may download a PDF version of the Form 6765 instructions via the link below.

Where to Mail IRS Form 6765?

Attach Form 6765 to your original tax return. The address depends on your state and the attachment of a check or money order. Find the mailing address for both your tax return and IRS Form 6765 in the Instructions for IRS Form 1040 and Form 1040-SR.

When to File IRS Form 6765?

Mail Form 6765 with your income tax return - by April 15, 2020. If you submit the documentation after this date, you may be subject to interest and penalties.