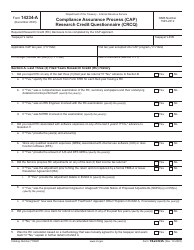

This version of the form is not currently in use and is provided for reference only. Download this version of

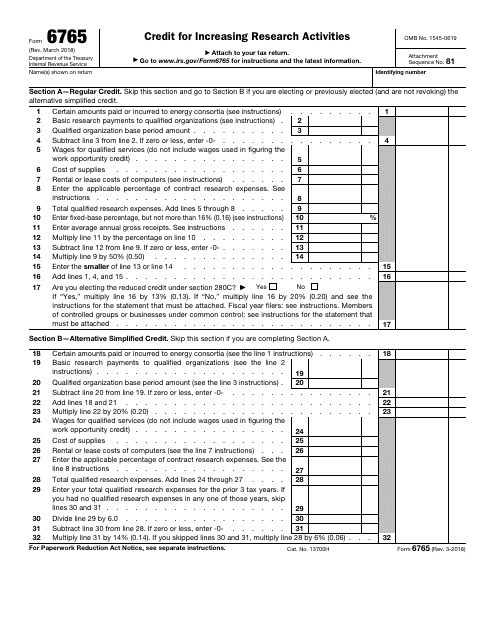

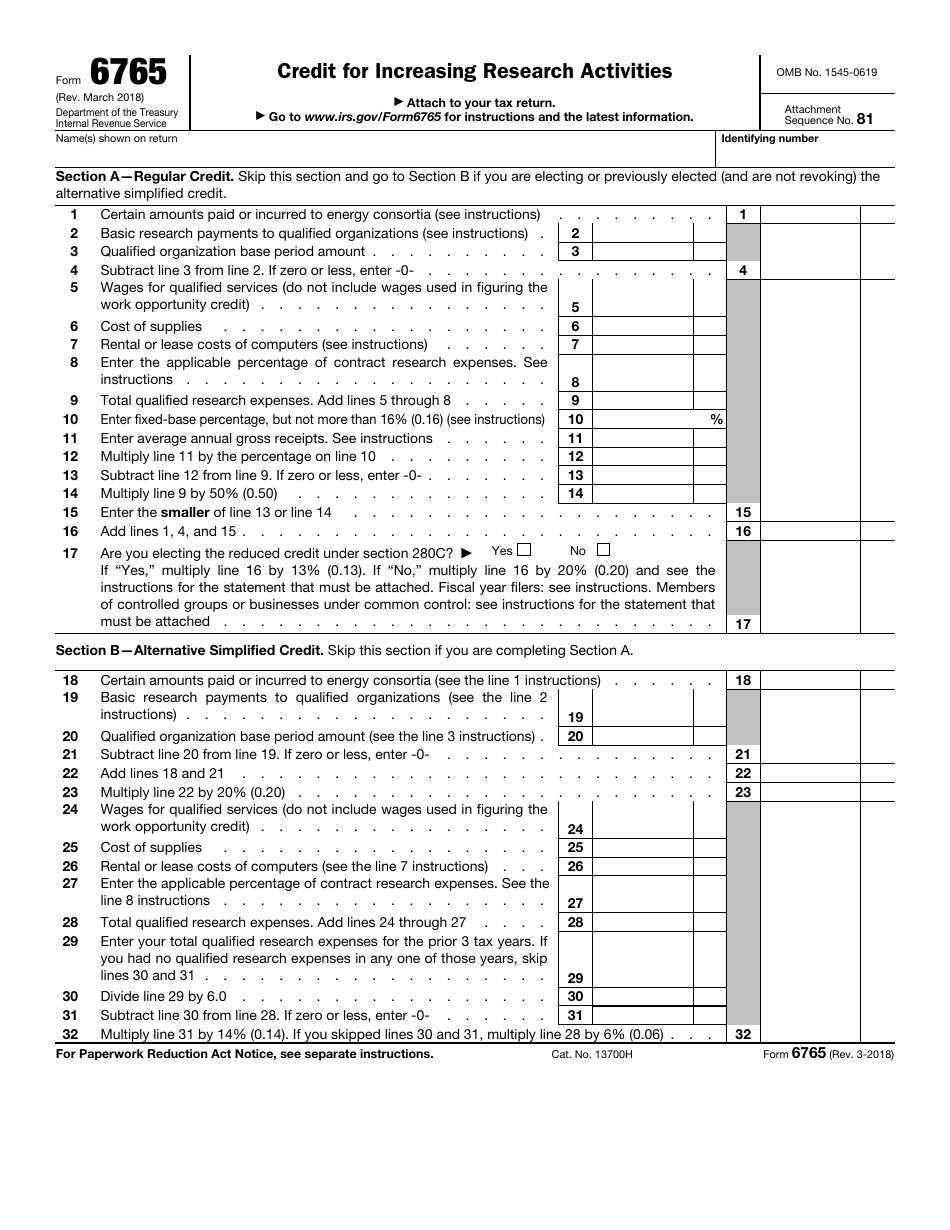

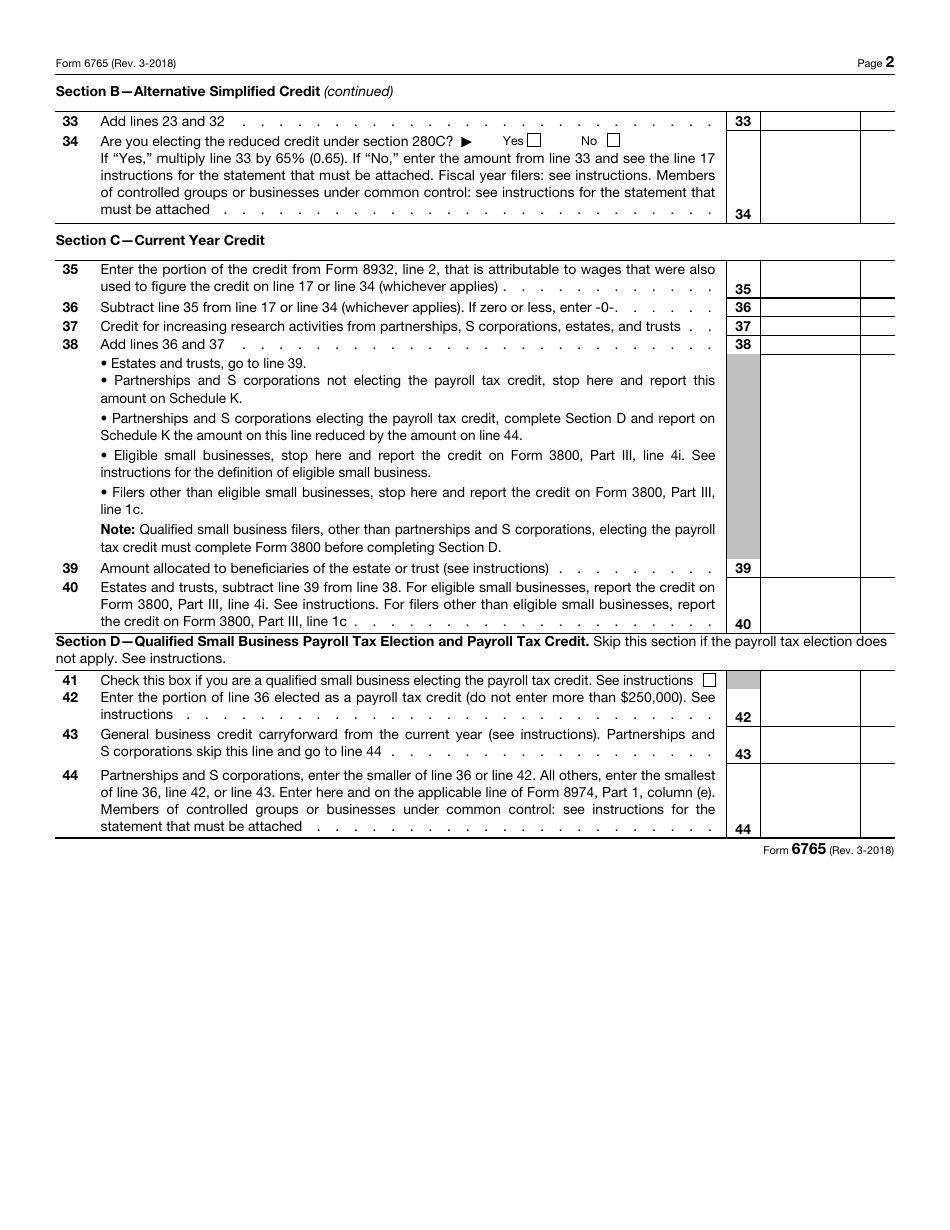

IRS Form 6765

for the current year.

IRS Form 6765 Credit for Increasing Research Activities

What Is IRS Form 6765?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on March 1, 2018. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 6765?

A: IRS Form 6765, Credit for Increasing Research Activities, is a tax form used to claim a tax credit for qualified research expenses.

Q: Who can use IRS Form 6765?

A: Any taxpayer who incurs eligible research expenses can use IRS Form 6765 to claim the Research and Development (R&D) tax credit.

Q: What is the purpose of IRS Form 6765?

A: The purpose of IRS Form 6765 is to calculate and claim the R&D tax credit, which provides an incentive for businesses to invest in research and development activities.

Q: What are qualified research expenses?

A: Qualified research expenses are the costs incurred by a taxpayer for qualified research activities, including wages, supplies, and contract research expenses.

Q: How do I use IRS Form 6765?

A: To use IRS Form 6765, you must first determine if you qualify for the R&D tax credit. If you do, you can fill out the form to calculate the credit amount and attach it to your tax return.

Q: What is the deadline for filing IRS Form 6765?

A: The deadline for filing IRS Form 6765 is generally the same as the deadline for filing your income tax return, which is April 15th.

Q: Is there a limit to the amount of the R&D tax credit that can be claimed?

A: No, there is no limit to the amount of the R&D tax credit that can be claimed. However, the credit is subject to certain limitations based on the taxpayer's income and the amount of qualified research expenses.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 6765 through the link below or browse more documents in our library of IRS Forms.