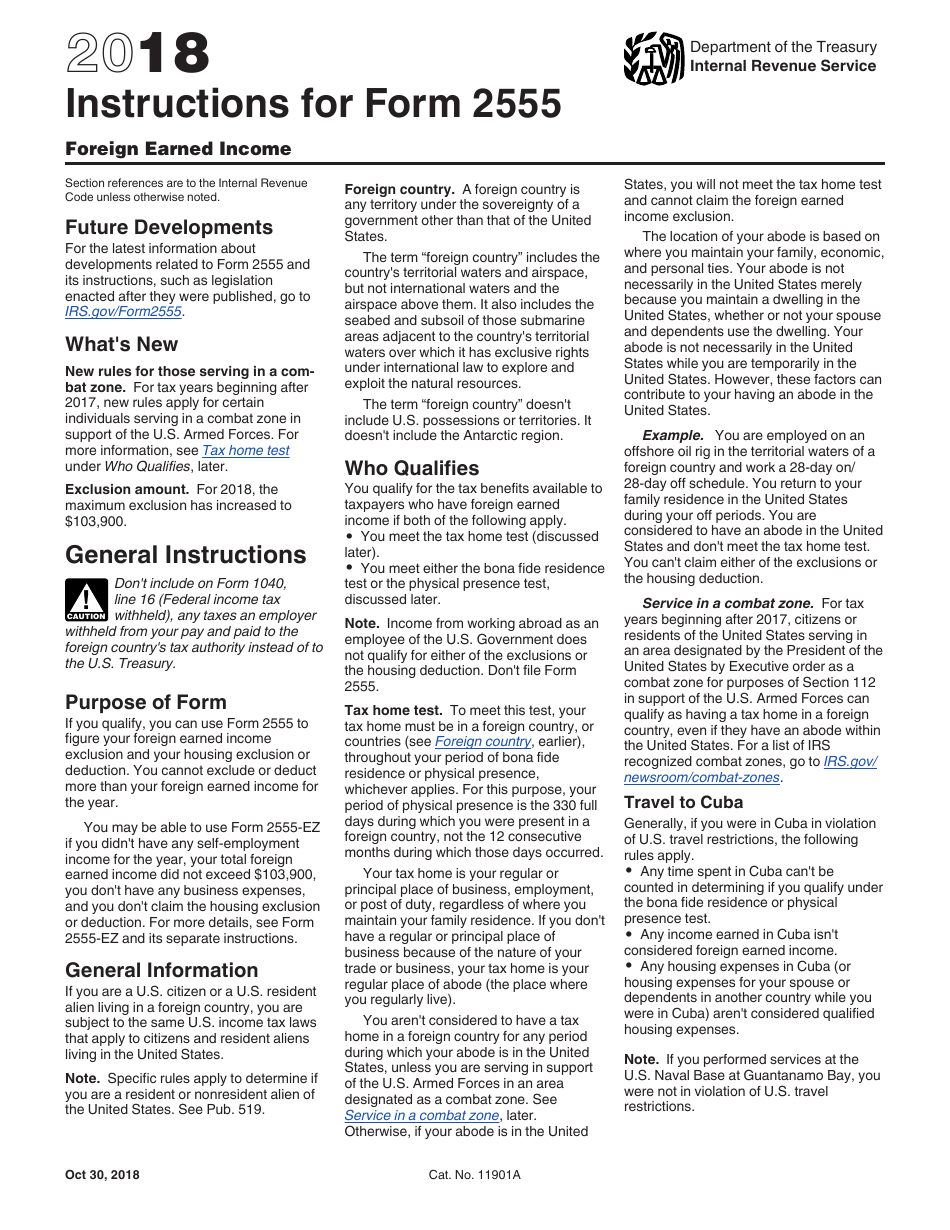

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 2555

for the current year.

Instructions for IRS Form 2555 Foreign Earned Income

This document contains official instructions for IRS Form 2555 , Foreign Earned Income - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 2555 is available for download through this link.

FAQ

Q: What is IRS Form 2555?

A: IRS Form 2555 is a tax form used to report foreign earned income.

Q: Who needs to file IRS Form 2555?

A: U.S. citizens or resident aliens who have foreign earned income may need to file IRS Form 2555.

Q: What is considered foreign earned income?

A: Foreign earned income includes wages, salaries, self-employment income, and certain allowances or reimbursements.

Q: How do I qualify for the foreign earned income exclusion?

A: To qualify for the foreign earned income exclusion, you must meet either the physical presence test or the bona fide residence test.

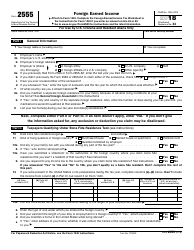

Q: How do I fill out IRS Form 2555?

A: You will need to provide information about your foreign income, qualifying days of presence in a foreign country, and claim any applicable exclusions or deductions.

Q: When is the deadline to file IRS Form 2555?

A: The deadline to file IRS Form 2555 is usually the same as the regular tax filing deadline, which is April 15th.

Q: Are there any penalties for not filing IRS Form 2555?

A: Yes, there may be penalties for not filing IRS Form 2555, including the potential for underpayment penalties and interest charges.

Q: Can I e-file IRS Form 2555?

A: No, IRS Form 2555 cannot be e-filed and must be filed by mail with the appropriate IRS processing center.

Q: Can I file IRS Form 2555 electronically if I also need to file other tax forms?

A: Yes, you can e-file other tax forms electronically while still mailing in IRS Form 2555 separately.

Instruction Details:

- This 12-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.