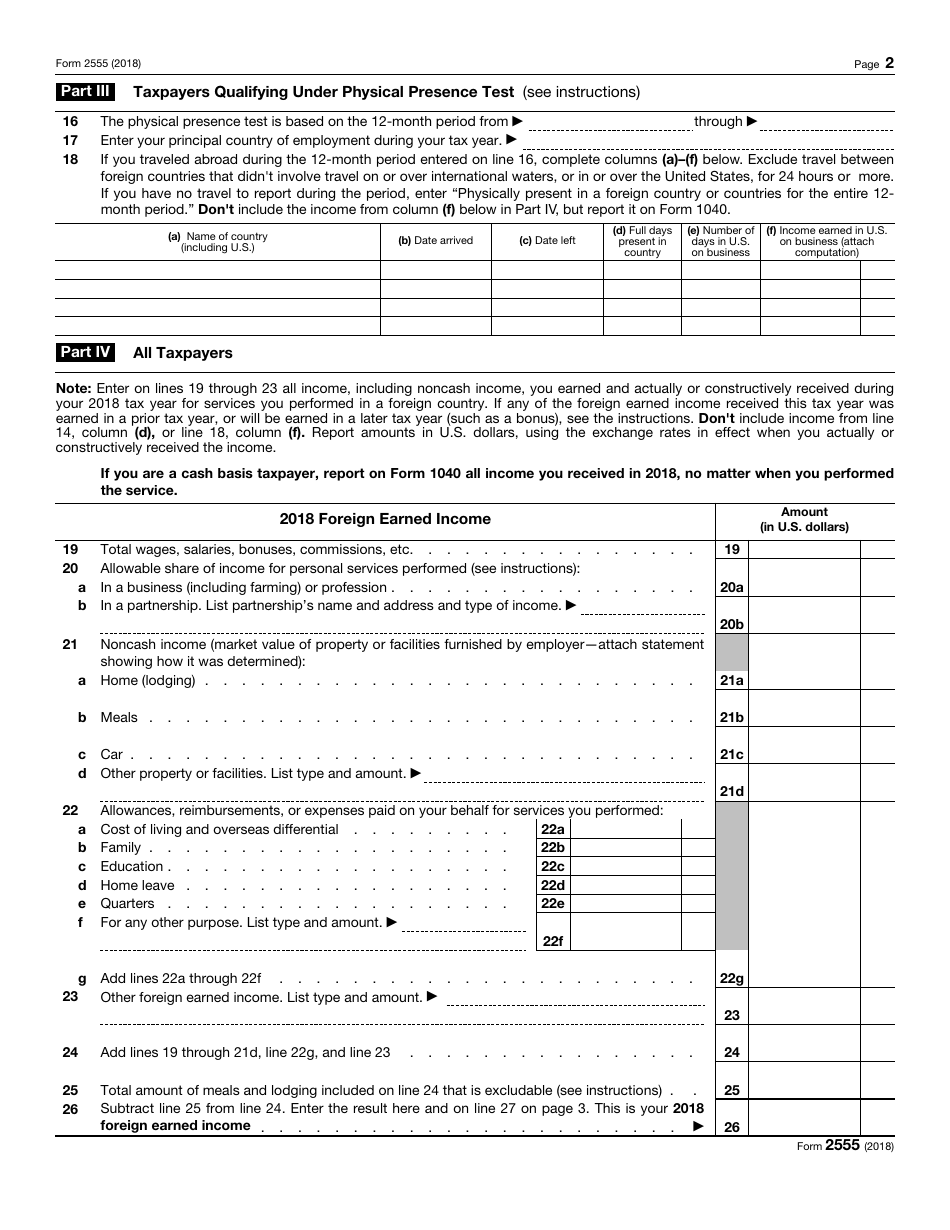

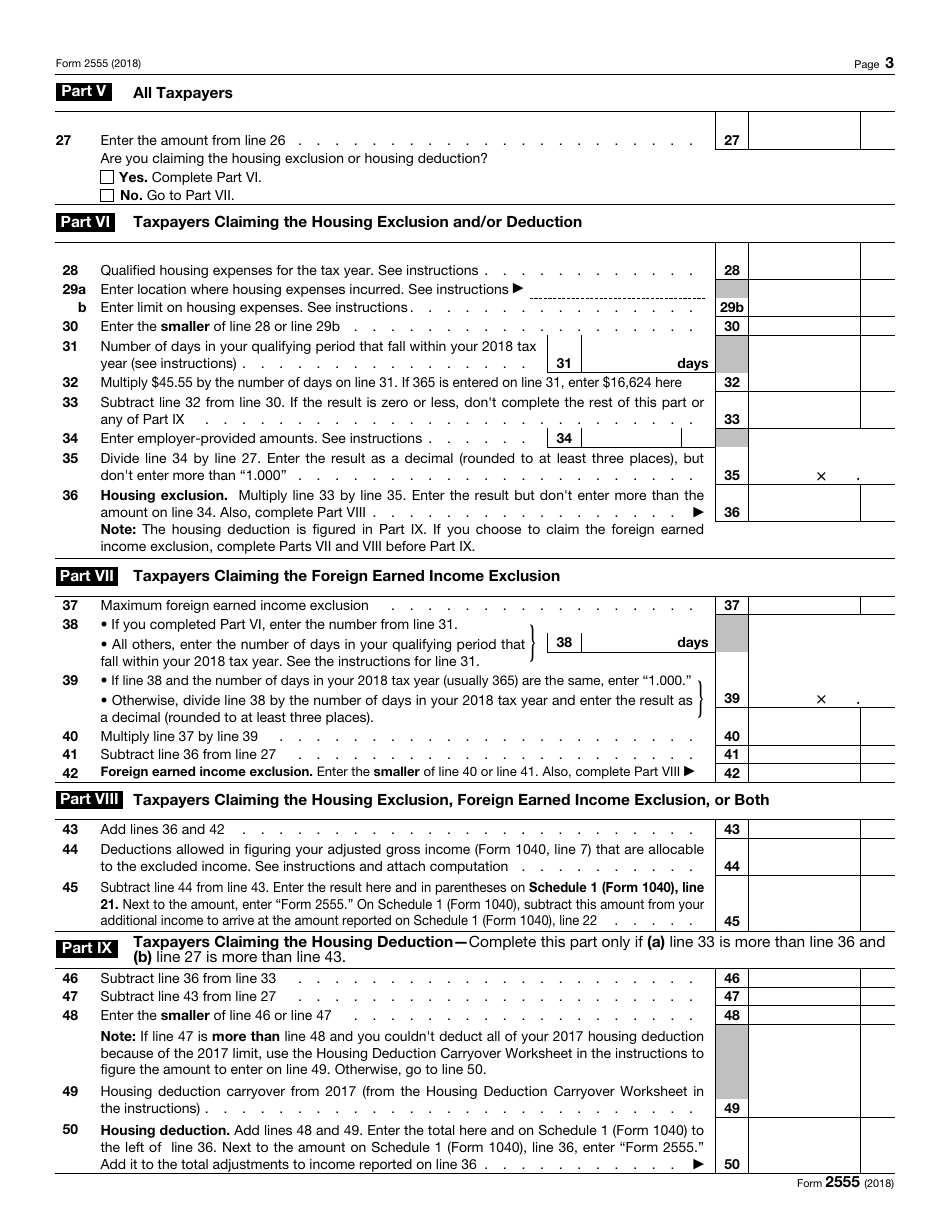

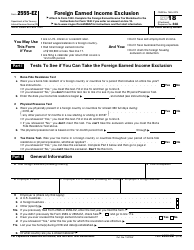

This version of the form is not currently in use and is provided for reference only. Download this version of

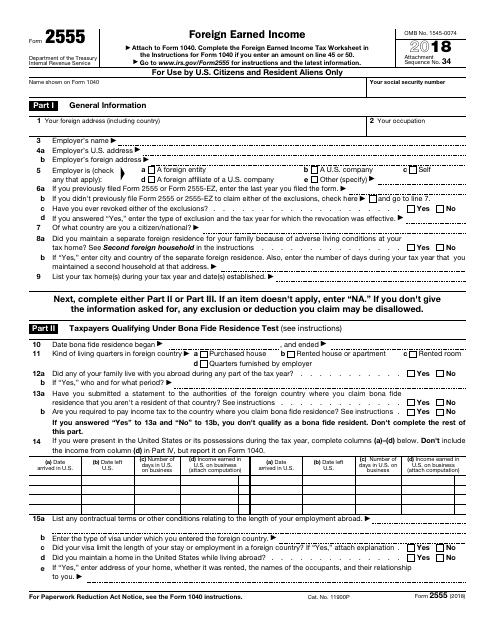

IRS Form 2555

for the current year.

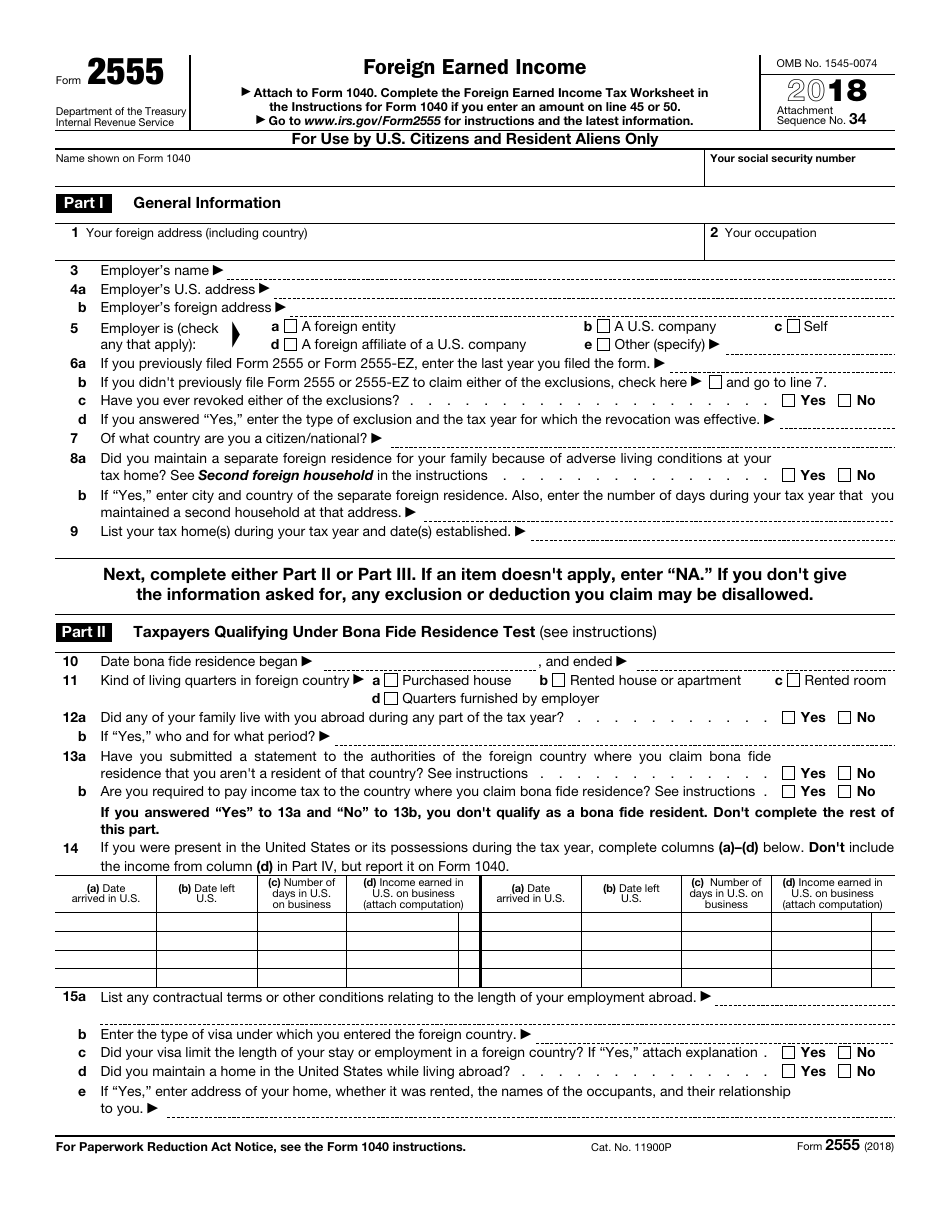

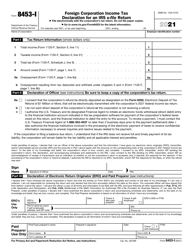

IRS Form 2555 Foreign Earned Income

What Is IRS Form 2555?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

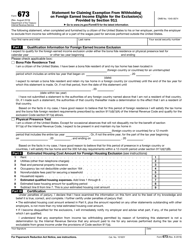

Q: What is IRS Form 2555?

A: IRS Form 2555 is a form used to report foreign earned income.

Q: Do I need to file IRS Form 2555?

A: You need to file IRS Form 2555 if you have foreign earned income and meet certain criteria.

Q: What is considered foreign earned income?

A: Foreign earned income is income earned from working in a foreign country.

Q: Can I claim a foreign earned income exclusion on IRS Form 2555?

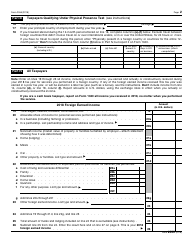

A: Yes, you can claim a foreign earned income exclusion on IRS Form 2555 to exclude a certain amount of your foreign earned income from US taxes.

Q: What are the eligibility requirements for the foreign earned income exclusion?

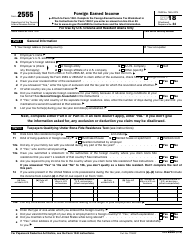

A: To be eligible for the foreign earned income exclusion, you must pass either the bona fide residence test or the physical presence test.

Q: Are there any limits on the amount of foreign earned income that can be excluded?

A: Yes, there are limits on the amount of foreign earned income that can be excluded. The maximum exclusion amount for tax year 2021 is $108,700.

Q: Can I still claim deductions and credits if I use IRS Form 2555?

A: Yes, you can still claim deductions and credits if you use IRS Form 2555.

Q: Do I need to attach any supporting documentation when filing IRS Form 2555?

A: Yes, you need to attach certain supporting documentation, such as a statement of foreign income, when filing IRS Form 2555.

Q: When is the deadline to file IRS Form 2555?

A: The deadline to file IRS Form 2555 is typically the same as the regular tax filing deadline, which is April 15th.

Q: Can I file IRS Form 2555 electronically?

A: Yes, you can file IRS Form 2555 electronically using tax preparation software or through a tax professional.

Form Details:

- A 3-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 2555 through the link below or browse more documents in our library of IRS Forms.