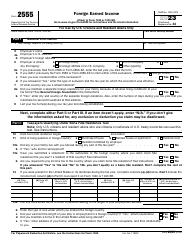

Instructions for IRS Form 2555-EZ Foreign Earned Income Exclusion

This document contains official instructions for IRS Form 2555-EZ , Foreign Earned Income Exclusion - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 2555-EZ is available for download through this link.

FAQ

Q: What is IRS Form 2555-EZ?

A: IRS Form 2555-EZ is a form used to claim the Foreign Earned Income Exclusion.

Q: What is the Foreign Earned Income Exclusion?

A: The Foreign Earned Income Exclusion allows eligible taxpayers to exclude a certain amount of their income earned abroad from their taxable income.

Q: Who is eligible to use Form 2555-EZ?

A: Taxpayers who meet specific requirements, such as having foreign earned income and a tax home in a foreign country, may be eligible to use Form 2555-EZ.

Q: What information do I need to fill out Form 2555-EZ?

A: You will need to provide details about your foreign earned income, your tax home, and other information required to claim the Foreign Earned Income Exclusion.

Q: When is the deadline to file Form 2555-EZ?

A: Form 2555-EZ should be filed with your annual tax return. The deadline to file your tax return is usually April 15th, but it may vary in certain situations.

Q: Can I claim the Foreign Earned Income Exclusion and other tax deductions/credits?

A: Yes, you can claim other tax deductions and credits in addition to the Foreign Earned Income Exclusion. However, you must meet the eligibility requirements for each deduction or credit.

Q: What happens if I don't file Form 2555-EZ?

A: If you are eligible for the Foreign Earned Income Exclusion and do not file Form 2555-EZ, you may end up paying taxes on your entire income earned abroad.

Q: Can I amend my tax return to claim the Foreign Earned Income Exclusion?

A: Yes, if you have already filed your tax return without claiming the Foreign Earned Income Exclusion, you can file an amended return using Form 1040X.

Instruction Details:

- This 4-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.