This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120-REIT

for the current year.

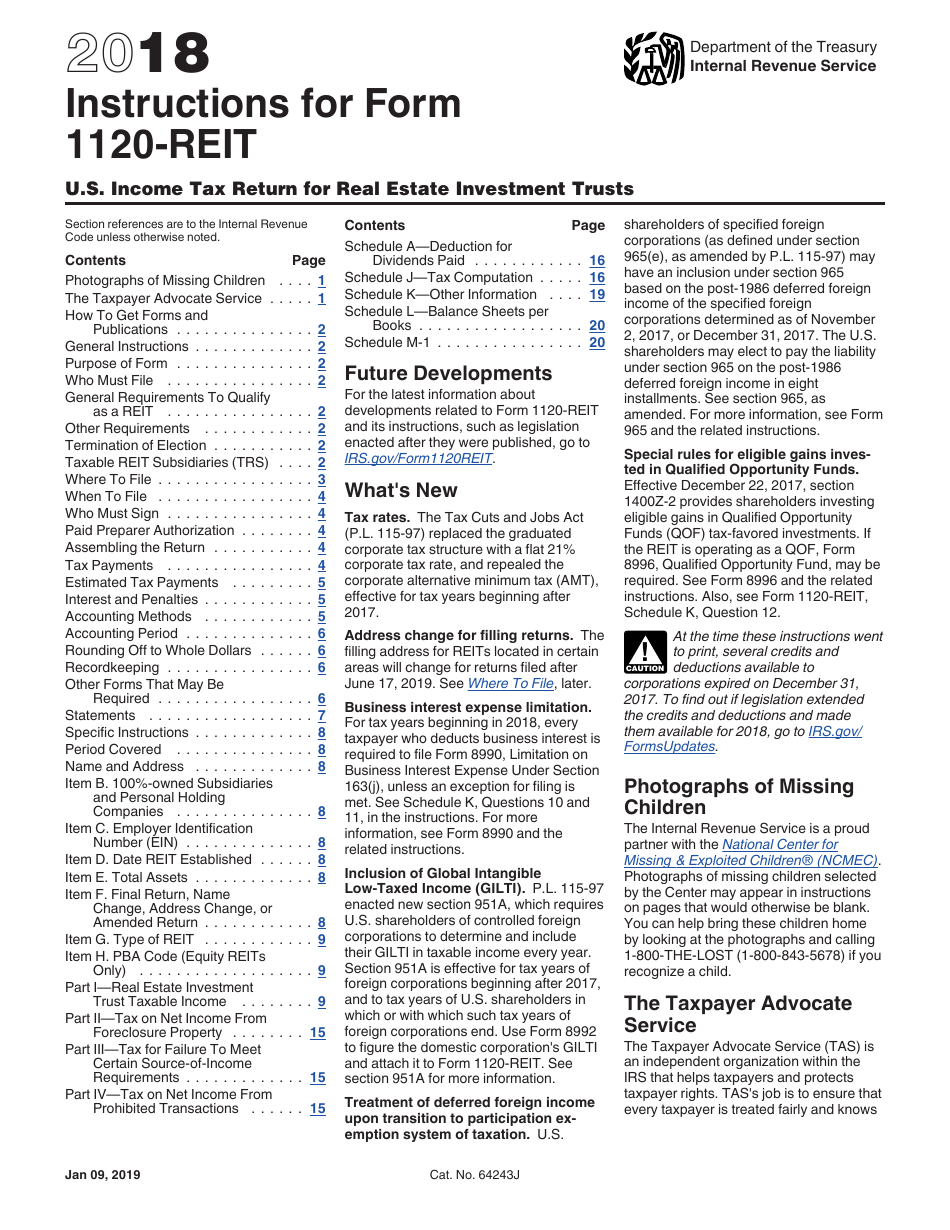

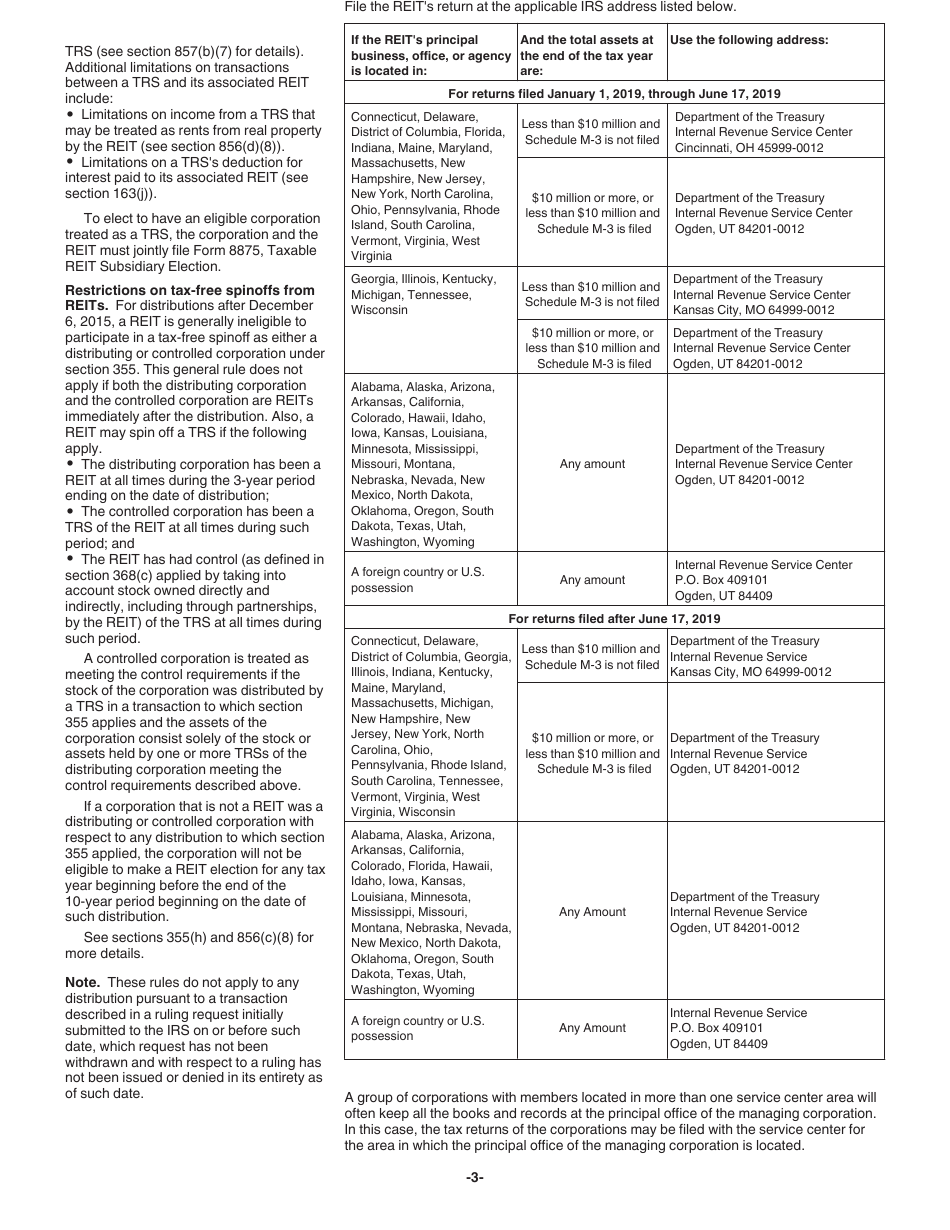

Instructions for IRS Form 1120-REIT U.S. Income Tax Return for Real Estate Investment Trusts

This document contains official instructions for IRS Form 1120-REIT , U.S. Income Tax Return for Real Estate Investment Trusts - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-REIT is available for download through this link.

FAQ

Q: What is IRS Form 1120-REIT?

A: IRS Form 1120-REIT is the U.S. Income Tax Return specifically designed for Real Estate Investment Trusts (REITs).

Q: Who needs to file Form 1120-REIT?

A: Real Estate Investment Trusts (REITs) are required to file Form 1120-REIT.

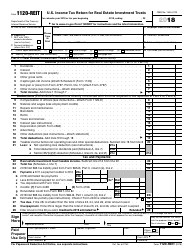

Q: What information is required to complete Form 1120-REIT?

A: To complete Form 1120-REIT, you will need information about the REIT's income, deductions, assets, and liabilities.

Q: When is the deadline to file Form 1120-REIT?

A: Form 1120-REIT must be filed by the 15th day of the 3rd month following the close of the REIT's tax year.

Q: Are there any penalties for late or incorrect filing of Form 1120-REIT?

A: Yes, there can be penalties for late or incorrect filing of Form 1120-REIT. It is important to file the form accurately and on time to avoid penalties.

Instruction Details:

- This 21-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.