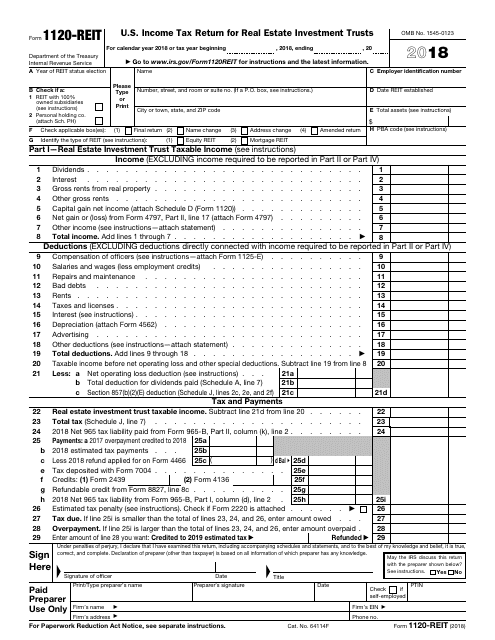

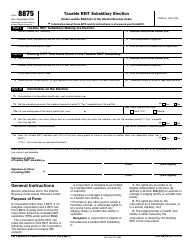

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1120-REIT

for the current year.

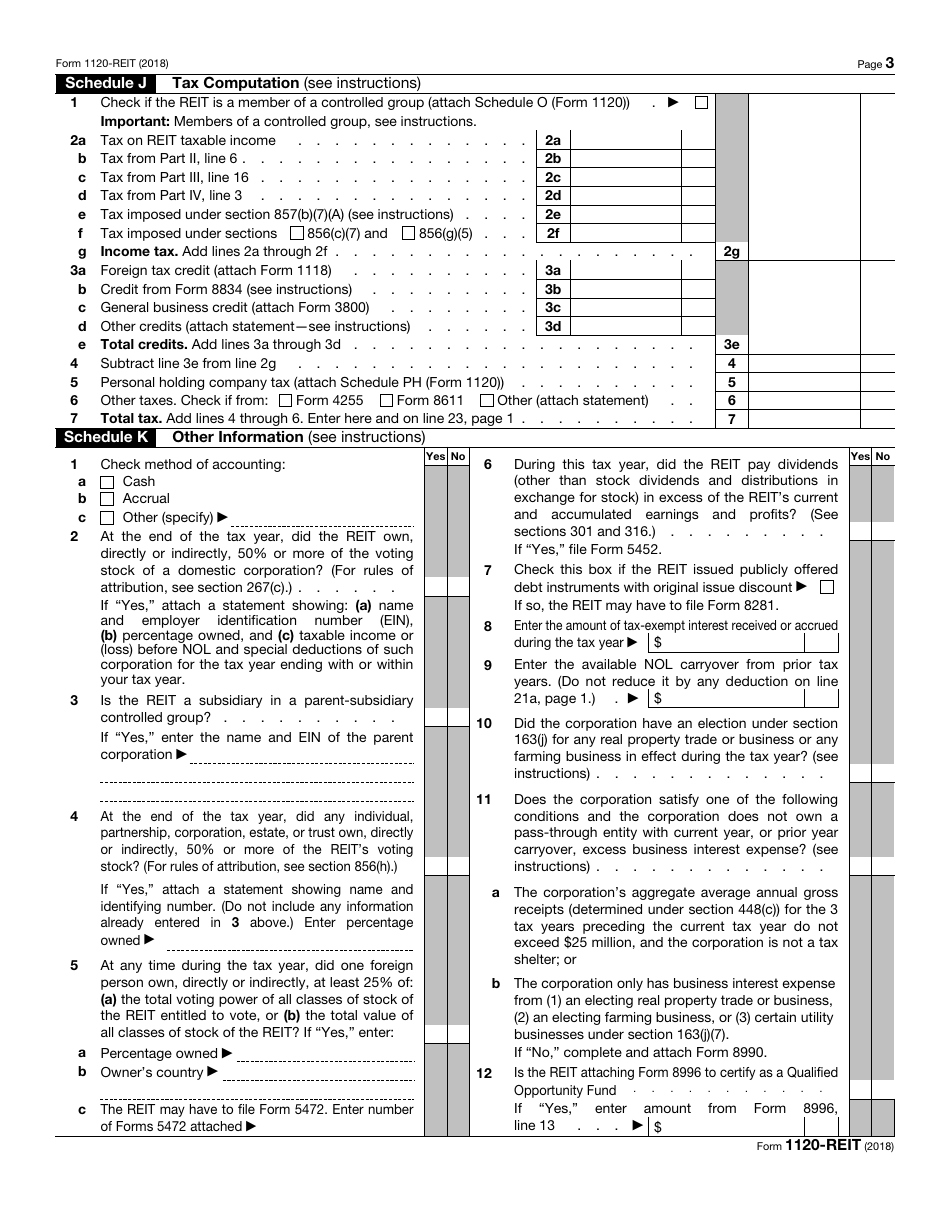

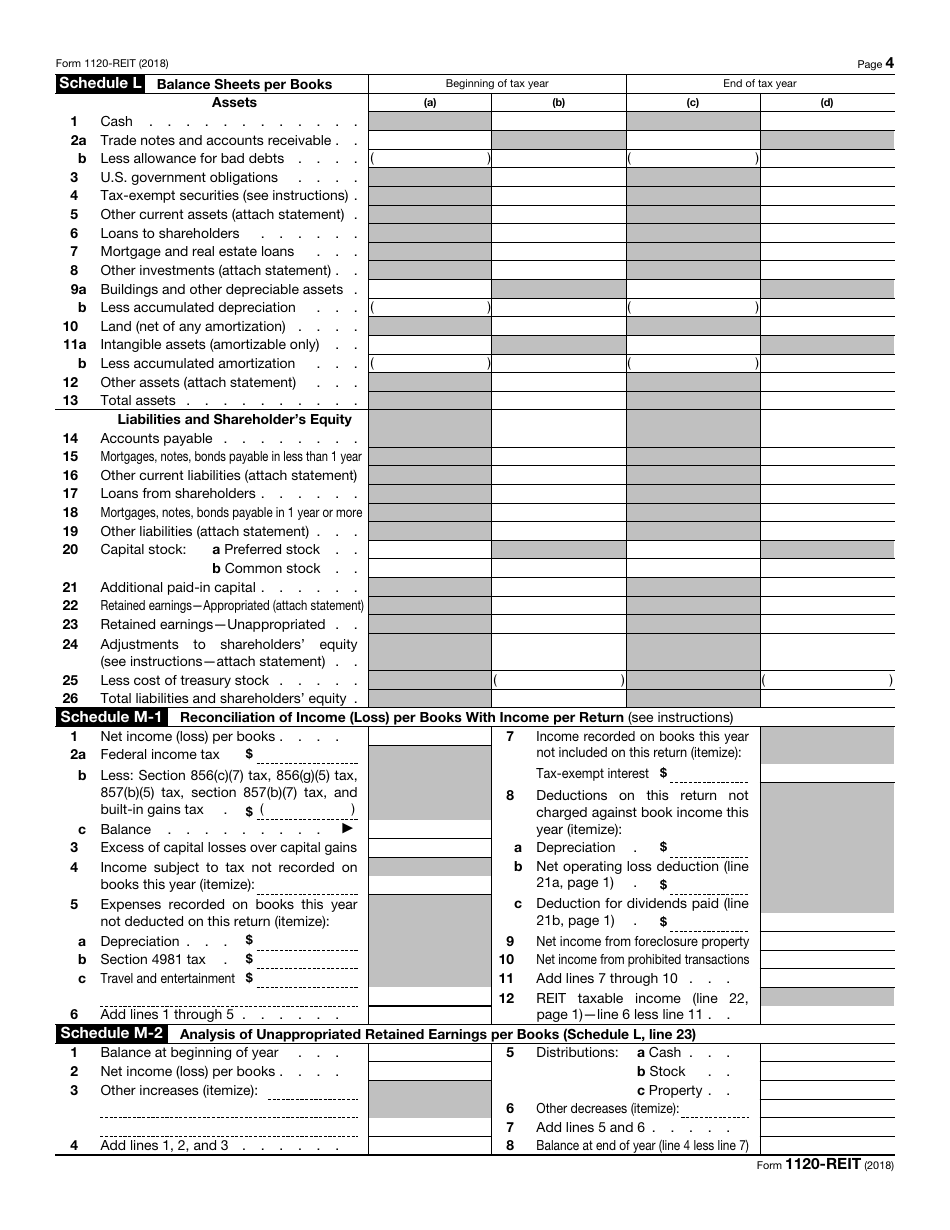

IRS Form 1120-REIT U.S. Income Tax Return for Real Estate Investment Trusts

What Is IRS Form 1120-REIT?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-REIT?

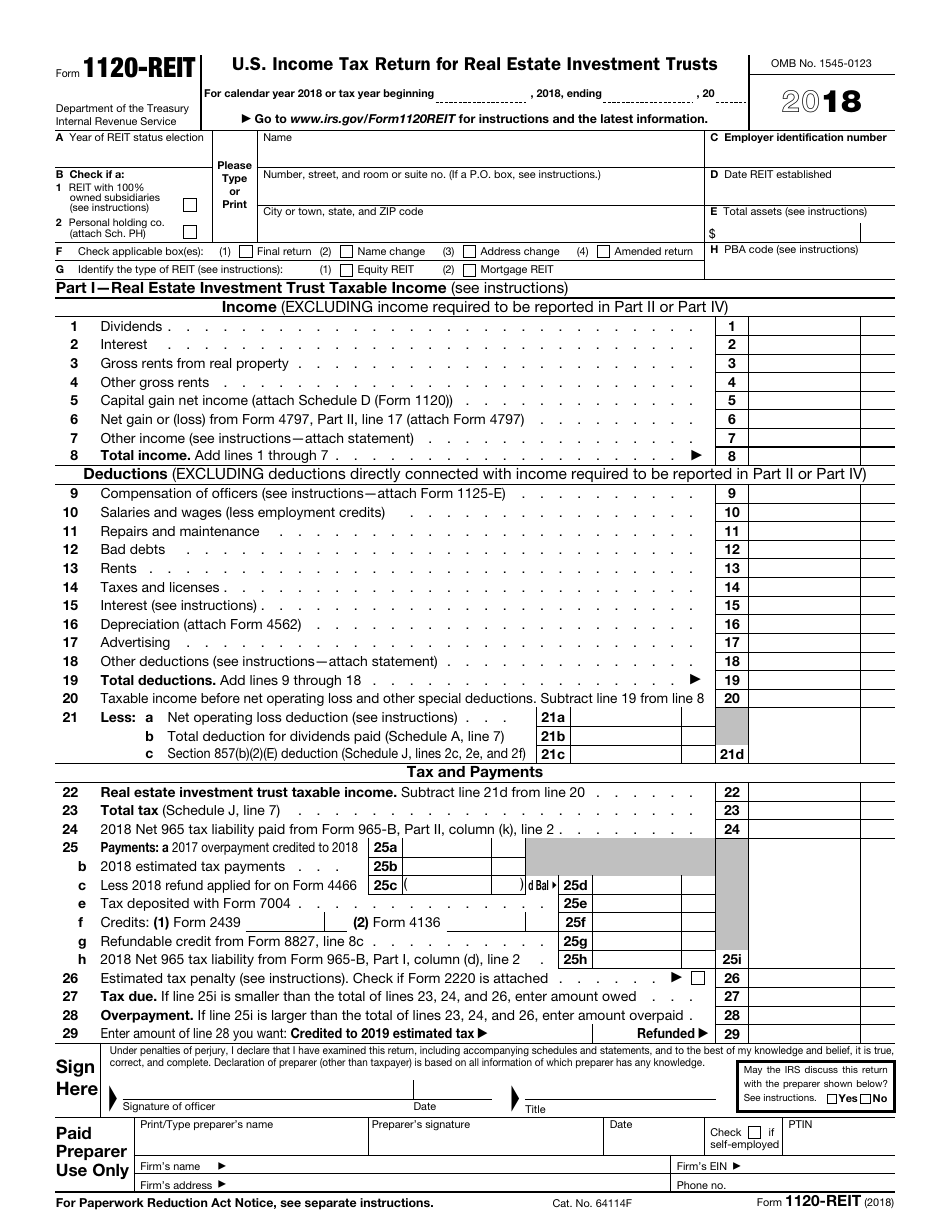

A: IRS Form 1120-REIT is the U.S. Income Tax Return for Real Estate Investment Trusts.

Q: Who needs to file IRS Form 1120-REIT?

A: Real Estate Investment Trusts (REITs) need to file IRS Form 1120-REIT.

Q: What is the purpose of IRS Form 1120-REIT?

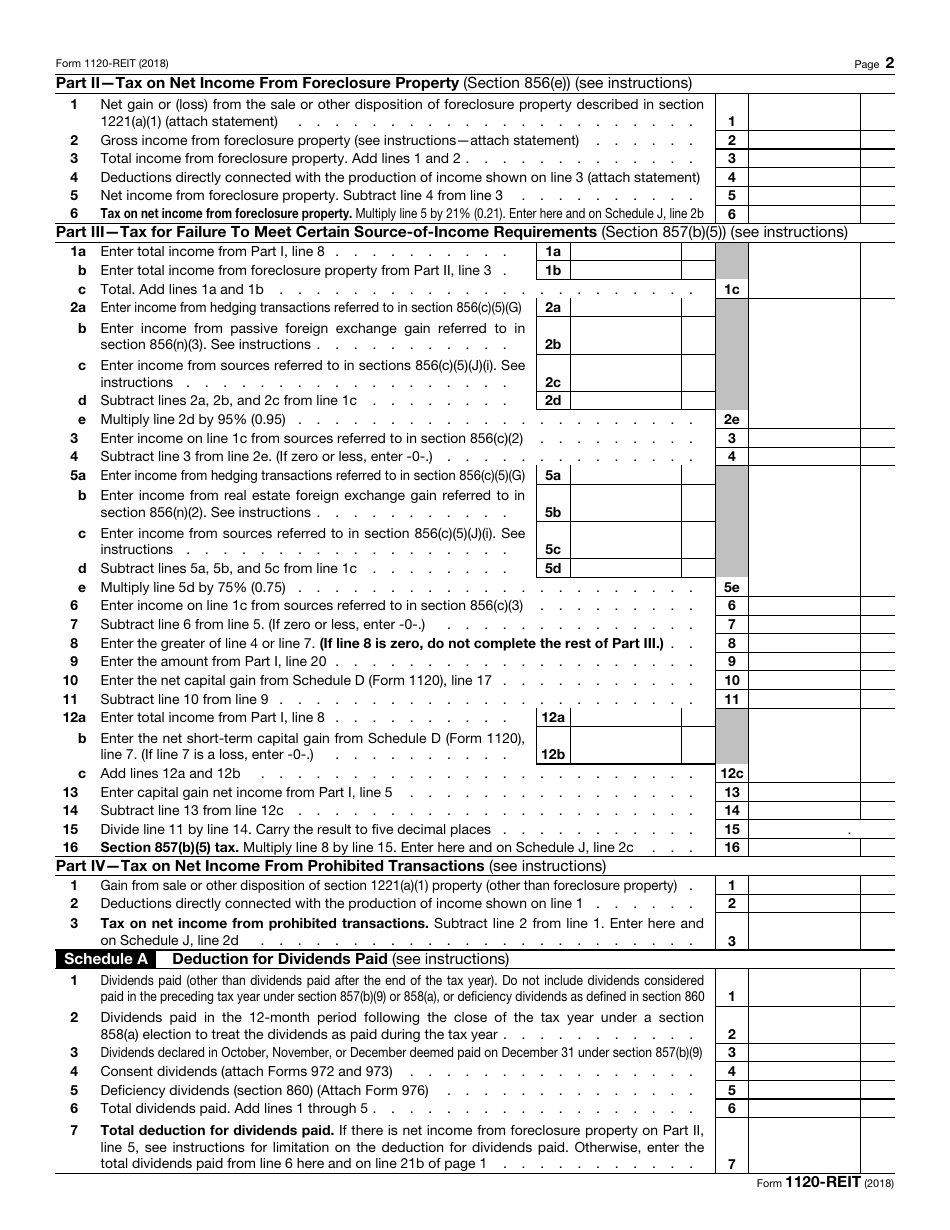

A: The purpose of IRS Form 1120-REIT is to report the income, deductions, gains, and losses of a Real Estate Investment Trust.

Q: How often do REITs need to file IRS Form 1120-REIT?

A: REITs need to file IRS Form 1120-REIT annually.

Q: What information is required on IRS Form 1120-REIT?

A: IRS Form 1120-REIT requires information about the REIT's income, deductions, and other financial details.

Q: Is there a deadline for filing IRS Form 1120-REIT?

A: Yes, the deadline for filing IRS Form 1120-REIT is usually on or before March 15th of the year following the tax year.

Q: Are there any penalties for not filing IRS Form 1120-REIT?

A: Yes, there are penalties for not filing IRS Form 1120-REIT or for filing it late. The penalties vary depending on the circumstances.

Q: Can I file IRS Form 1120-REIT electronically?

A: Yes, you can file IRS Form 1120-REIT electronically using the e-file system provided by the IRS.

Q: Do I need to attach any supporting documents with IRS Form 1120-REIT?

A: Yes, you may need to attach certain supporting documents, such as schedules and statements, depending on the information you are reporting on the form.

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-REIT through the link below or browse more documents in our library of IRS Forms.