This version of the form is not currently in use and is provided for reference only. Download this version of

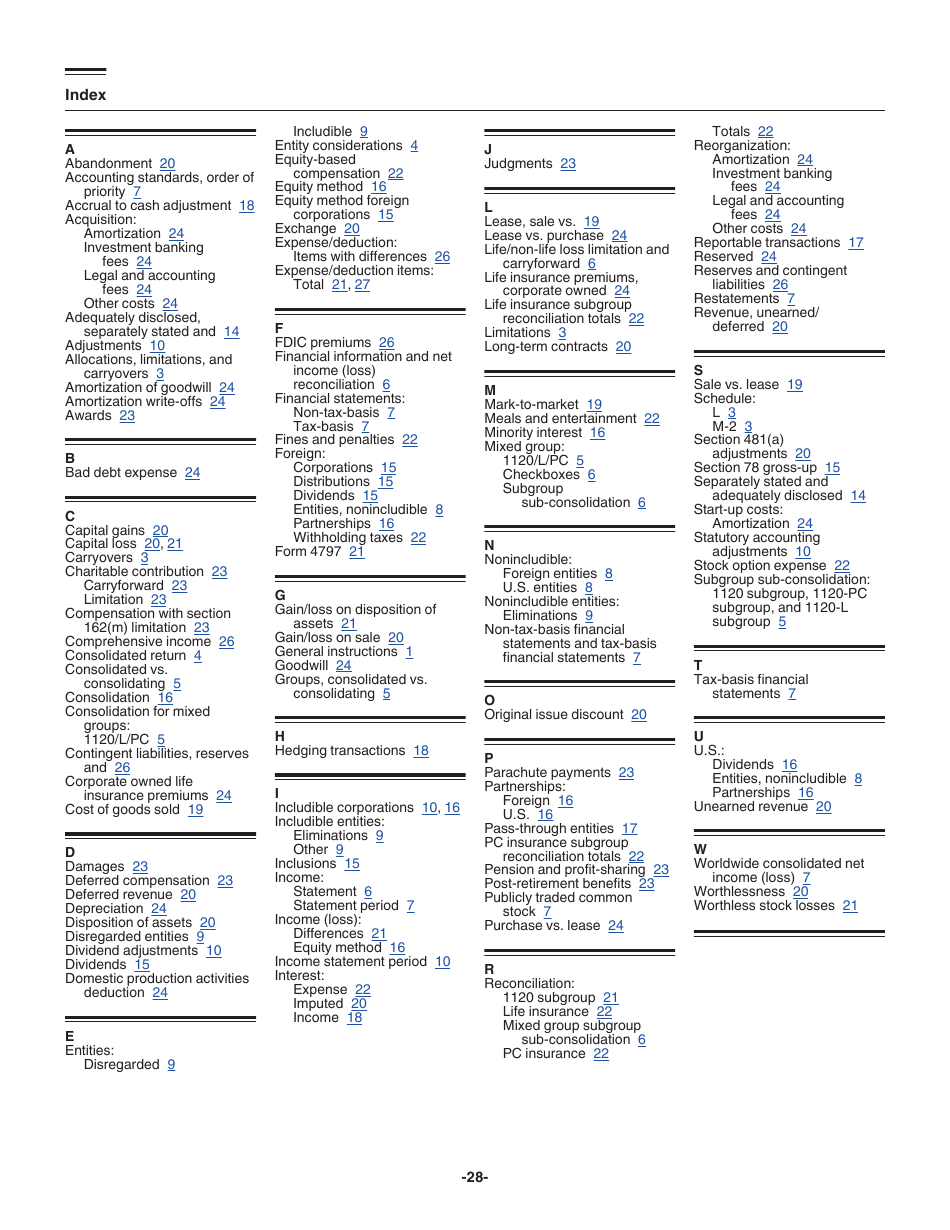

Instructions for IRS Form 1120 Schedule M-3

for the current year.

Instructions for IRS Form 1120 Schedule M-3 Net Income (Loss) Reconciliation for Corporations With Total Assets of $10 Million or More

This document contains official instructions for IRS Form 1120 Schedule M-3, Total Assets of $10 Million or More - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120 Schedule M-3 is available for download through this link.

FAQ

Q: What is IRS Form 1120 Schedule M-3?

A: IRS Form 1120 Schedule M-3 is a form used by corporations with total assets of $10 million or more to reconcile their net income (loss).

Q: Who is required to file IRS Form 1120 Schedule M-3?

A: Corporations with total assets of $10 million or more are required to file IRS Form 1120 Schedule M-3.

Q: What is the purpose of IRS Form 1120 Schedule M-3?

A: The purpose of IRS Form 1120 Schedule M-3 is to provide a reconciliation of the corporation's net income (loss) as reported on their tax return to the financial statement income (loss) as reported in their audited financial statements.

Q: What are the main sections of IRS Form 1120 Schedule M-3?

A: The main sections of IRS Form 1120 Schedule M-3 include Part I - Reconciliation of Net Income (Loss) Per Books With Income (Loss) Per Return, Part II - Reconciliation of Total Assets, Part III - Reconciliation of Shareholders' Equity, and Part IV - Reconciliation of Income (Loss) Per Books With Income (Loss) Per Return (Ended Schedules).

Q: Is IRS Form 1120 Schedule M-3 mandatory?

A: Yes, IRS Form 1120 Schedule M-3 is mandatory for corporations with total assets of $10 million or more.

Instruction Details:

- This 28-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.