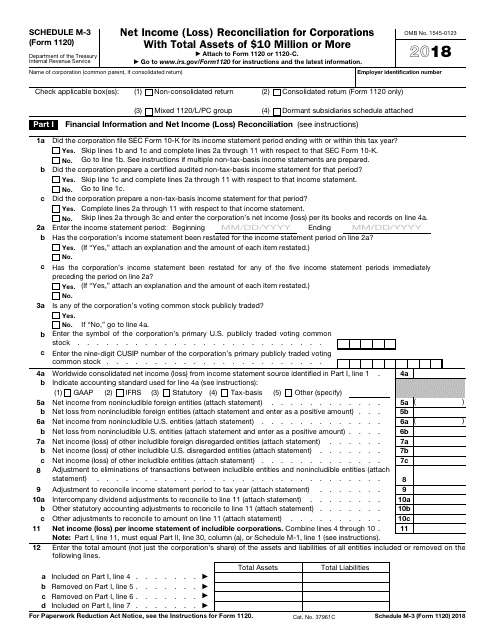

This version of the form is not currently in use and is provided for reference only. Download this version of

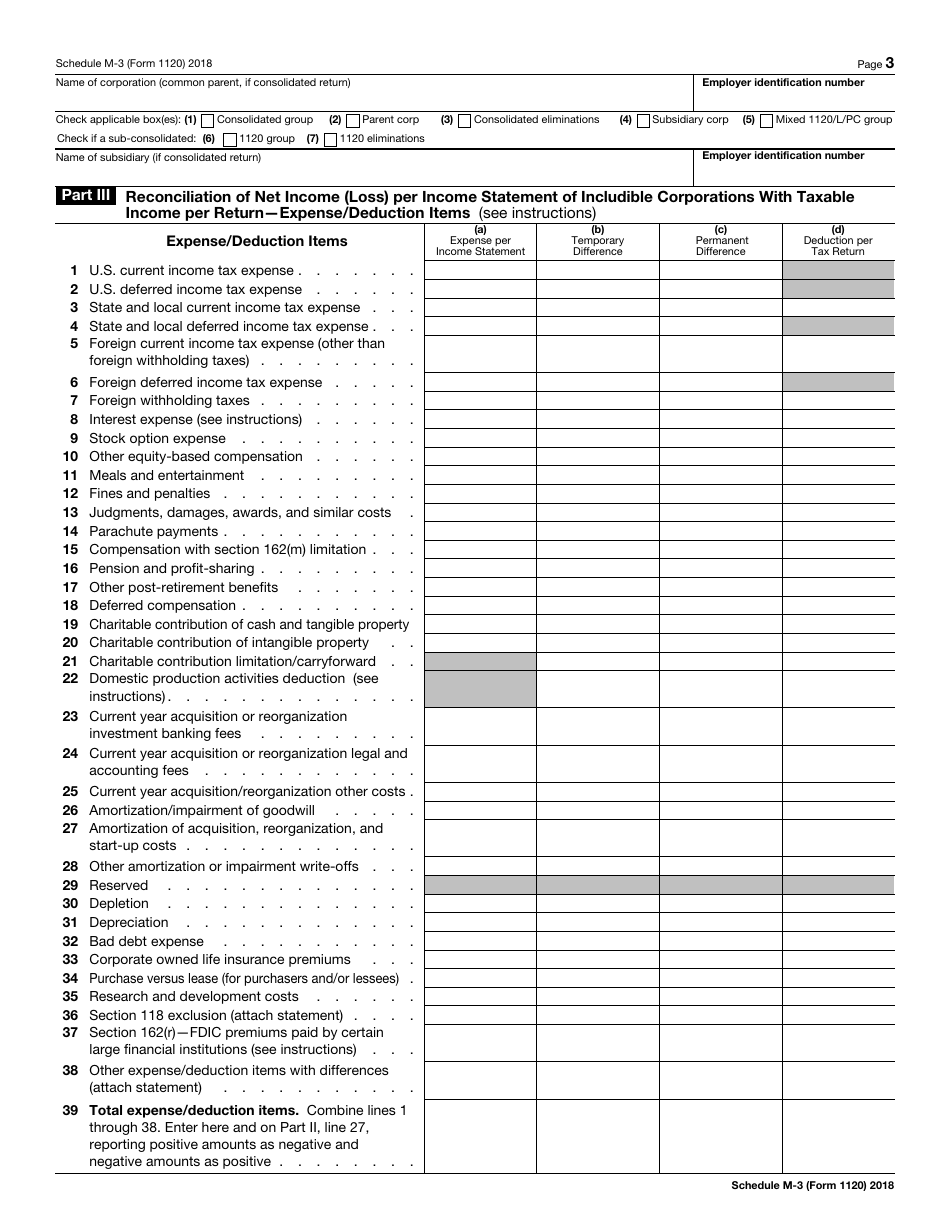

IRS Form 1120 Schedule M-3

for the current year.

IRS Form 1120 Schedule M-3 Net Income (Loss) Reconciliation for Corporations With Total Assets of $10 Million or More

What Is IRS Form 1120 Schedule M-3?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1120, U.S. Corporation Income Tax Return. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120?

A: IRS Form 1120 is the U.S. Corporation Income Tax Return.

Q: What is Schedule M-3?

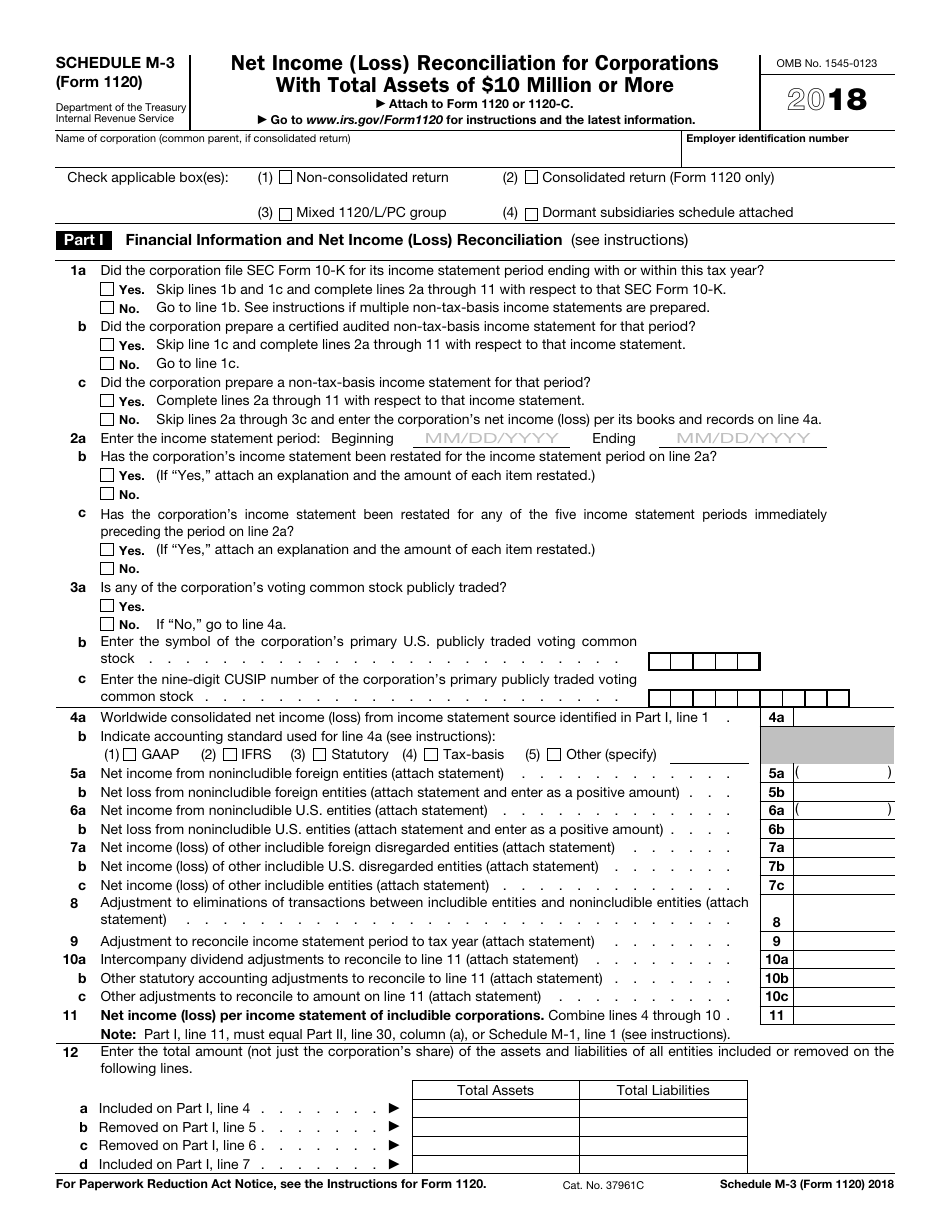

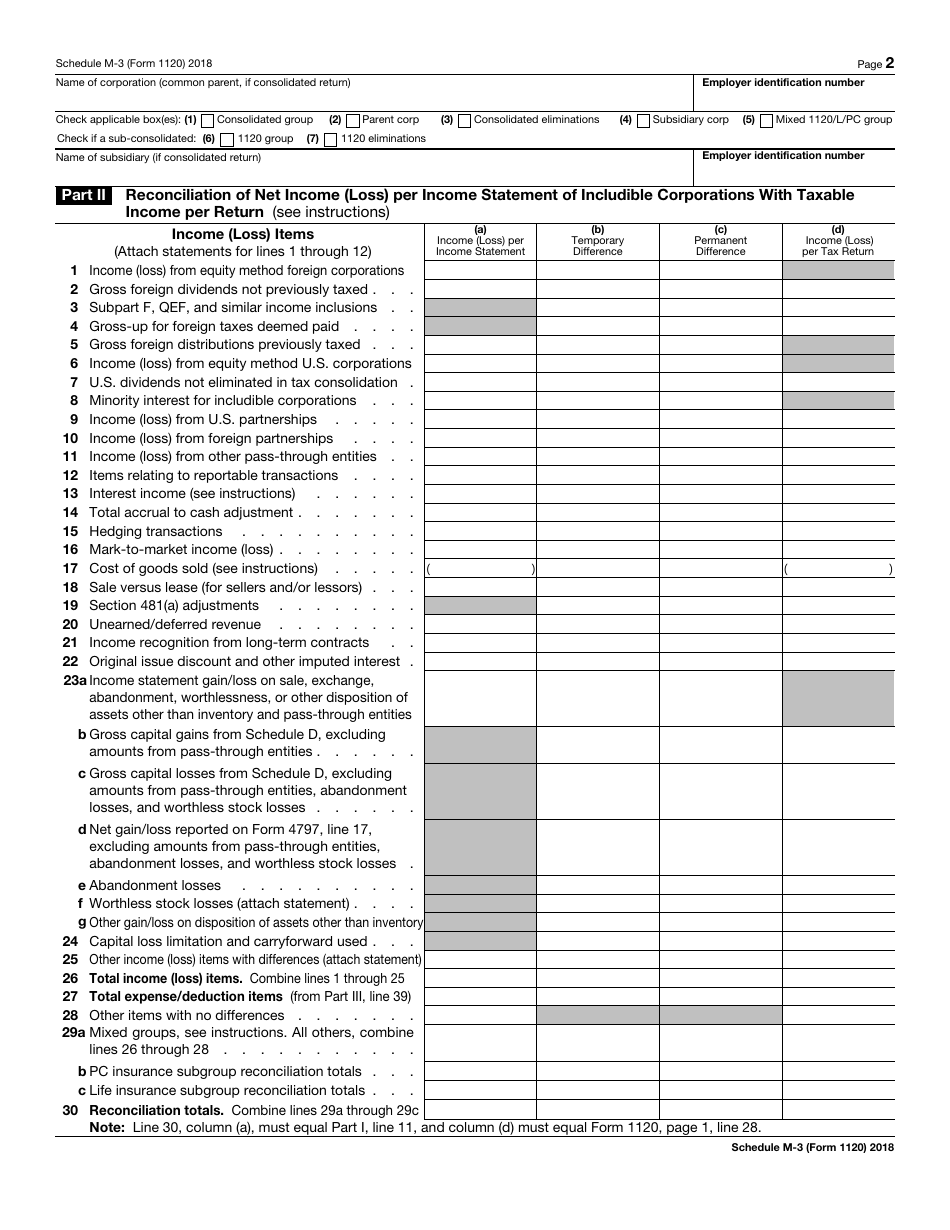

A: Schedule M-3 is a part of IRS Form 1120, used to reconcile net income (loss) for corporations with total assets of $10 million or more.

Q: Who is required to file Form 1120 Schedule M-3?

A: Corporations with total assets of $10 million or more are required to file Form 1120 Schedule M-3.

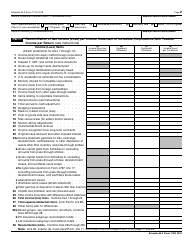

Q: What is the purpose of Schedule M-3?

A: The purpose of Schedule M-3 is to provide a detailed reconciliation of a corporation's net income (loss) for financial statement purposes to its net income (loss) for federal income tax purposes.

Q: What information is included in Schedule M-3?

A: Schedule M-3 includes certain financial data and book-to-tax reconciliations of net income (loss) for the corporation.

Q: Is Schedule M-3 mandatory for all corporations?

A: No, Schedule M-3 is only mandatory for corporations with total assets of $10 million or more.

Q: Are there any penalties for not filing Schedule M-3 when required?

A: Yes, there can be penalties for not filing Schedule M-3 when required. It is important to comply with all IRS filing requirements.

Q: Can I file Schedule M-3 electronically?

A: Yes, Schedule M-3 can be filed electronically using the appropriate tax software or through the IRS e-file system.

Q: Are there any specific instructions for completing Schedule M-3?

A: Yes, the IRS provides detailed instructions on how to complete Schedule M-3. It is important to carefully follow these instructions to ensure accurate reporting.

Form Details:

- A 3-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120 Schedule M-3 through the link below or browse more documents in our library of IRS Forms.