This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120-F Schedule S

for the current year.

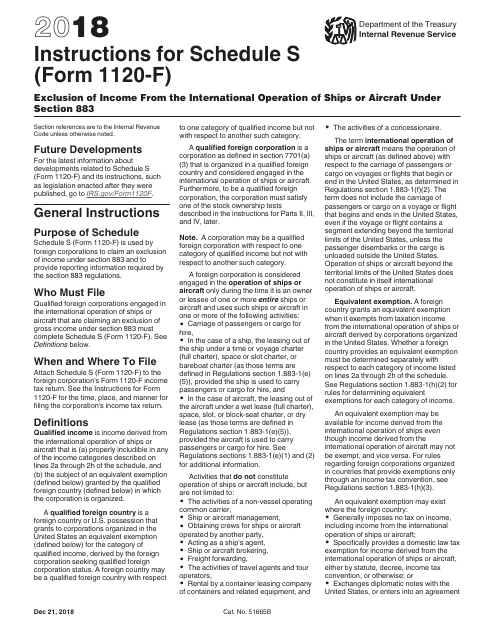

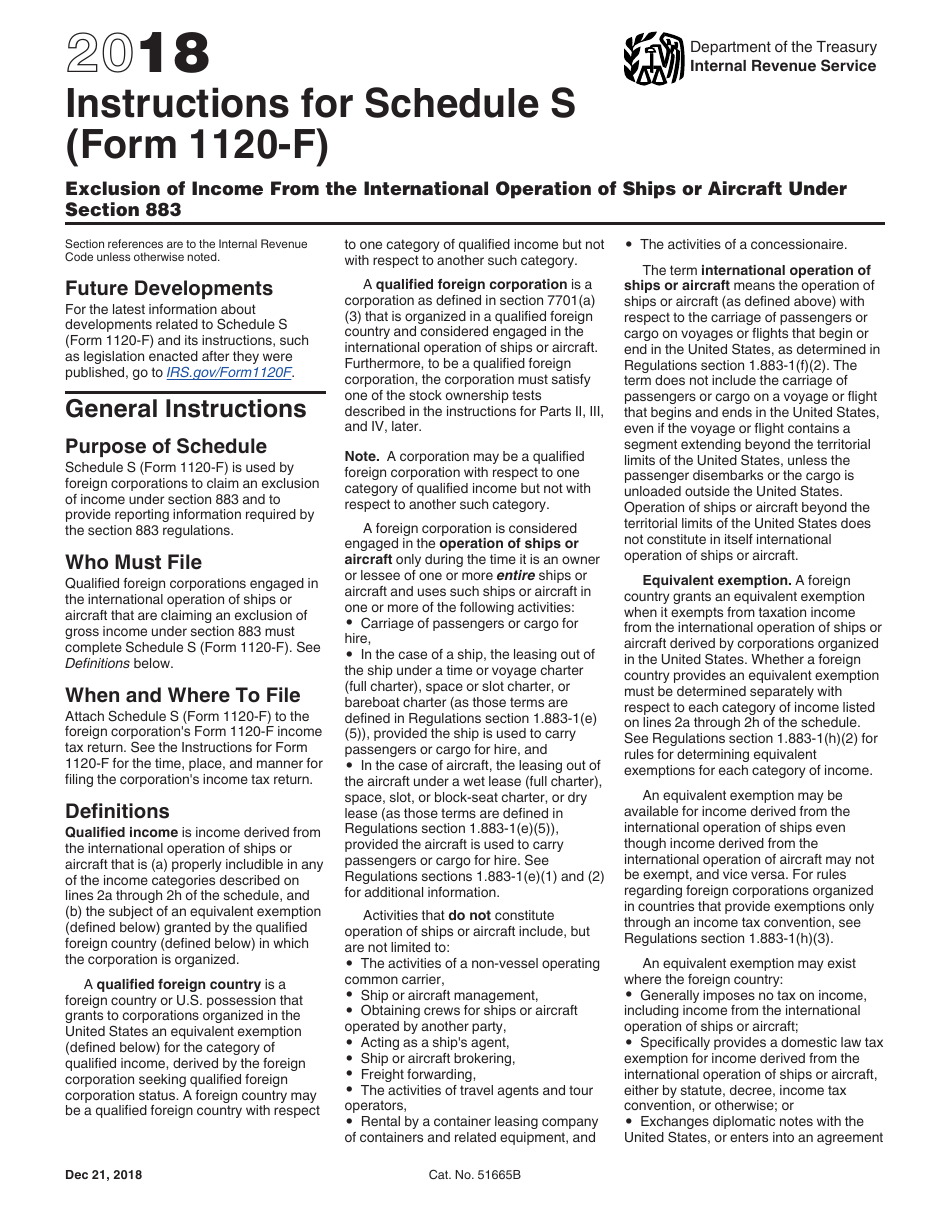

Instructions for IRS Form 1120-F Schedule S Exclusion of Income From the International Operation of Ships or Aircraft Under Section 883

This document contains official instructions for IRS Form 1120-F Schedule S, Exclusion of Income From the International Operation of Ships or Aircraft Under Section 883 - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-F Schedule S is available for download through this link.

FAQ

Q: What is IRS Form 1120-F?

A: IRS Form 1120-F is the corporate income tax return for foreign corporations engaged in a trade or business in the United States.

Q: What is Schedule S?

A: Schedule S is a supplemental schedule that allows foreign corporations to exclude income from the international operation of ships or aircraft under Section 883 of the Internal Revenue Code.

Q: Who can use Schedule S?

A: Foreign corporations engaged in the operation of ships or aircraft can use Schedule S to exclude certain income derived from these activities.

Q: What is the purpose of Section 883?

A: Section 883 of the Internal Revenue Code provides a special provision that allows foreign corporations to exclude certain income from the international operation of ships or aircraft from U.S. taxation.

Q: What income can be excluded under Section 883?

A: Under Section 883, foreign corporations can exclude income from the international operation of ships or aircraft, including income from transportation of passengers or cargo.

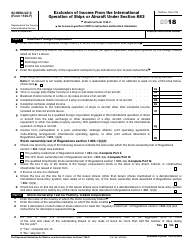

Q: What is the process for completing Schedule S?

A: To complete Schedule S, foreign corporations need to provide detailed information about their international shipping or aircraft activities, including income and expenses.

Q: Are there any limitations or requirements for claiming the exclusion?

A: Yes, there are certain limitations and requirements that must be met to claim the exclusion under Section 883. These include meeting the substantial presence test and providing documentation supporting the claim.

Q: Is there a deadline for filing Form 1120-F with Schedule S?

A: Yes, Form 1120-F with Schedule S must be filed by the due date specified by the IRS, which is usually the 15th day of the 3rd month after the end of the foreign corporation's tax year.

Q: Are there any penalties for non-compliance with Form 1120-F and Schedule S?

A: Yes, there can be penalties for non-compliance, such as failure to file or accuracy-related penalties. It is important to ensure timely and accurate filing of the form and schedule.

Instruction Details:

- This 4-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.