This version of the form is not currently in use and is provided for reference only. Download this version of

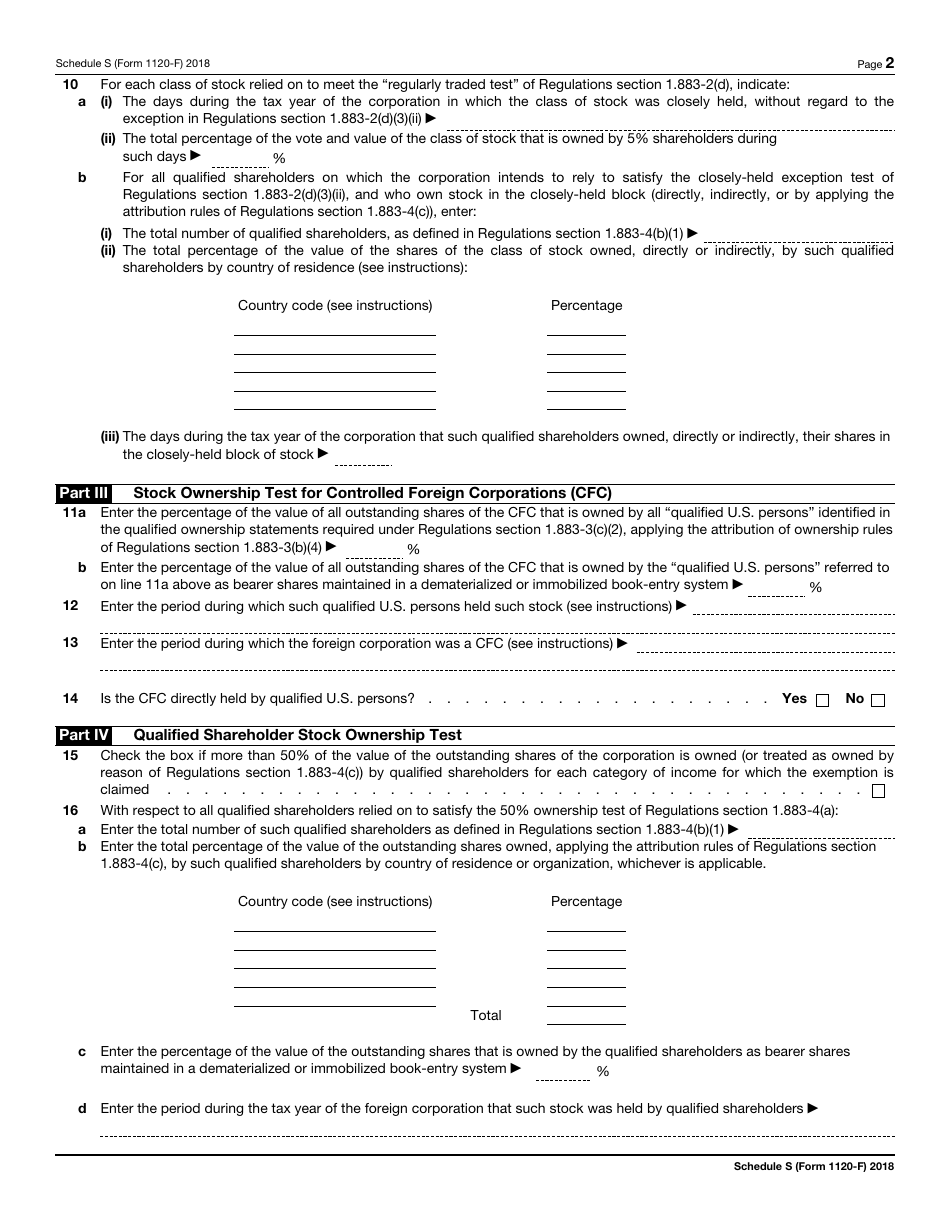

IRS Form 1120-F Schedule S

for the current year.

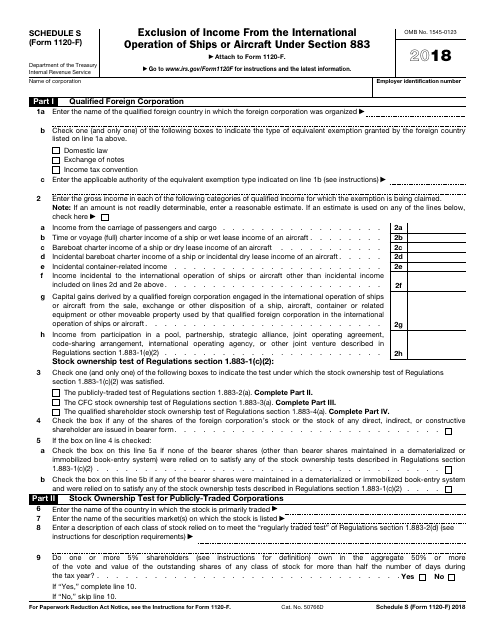

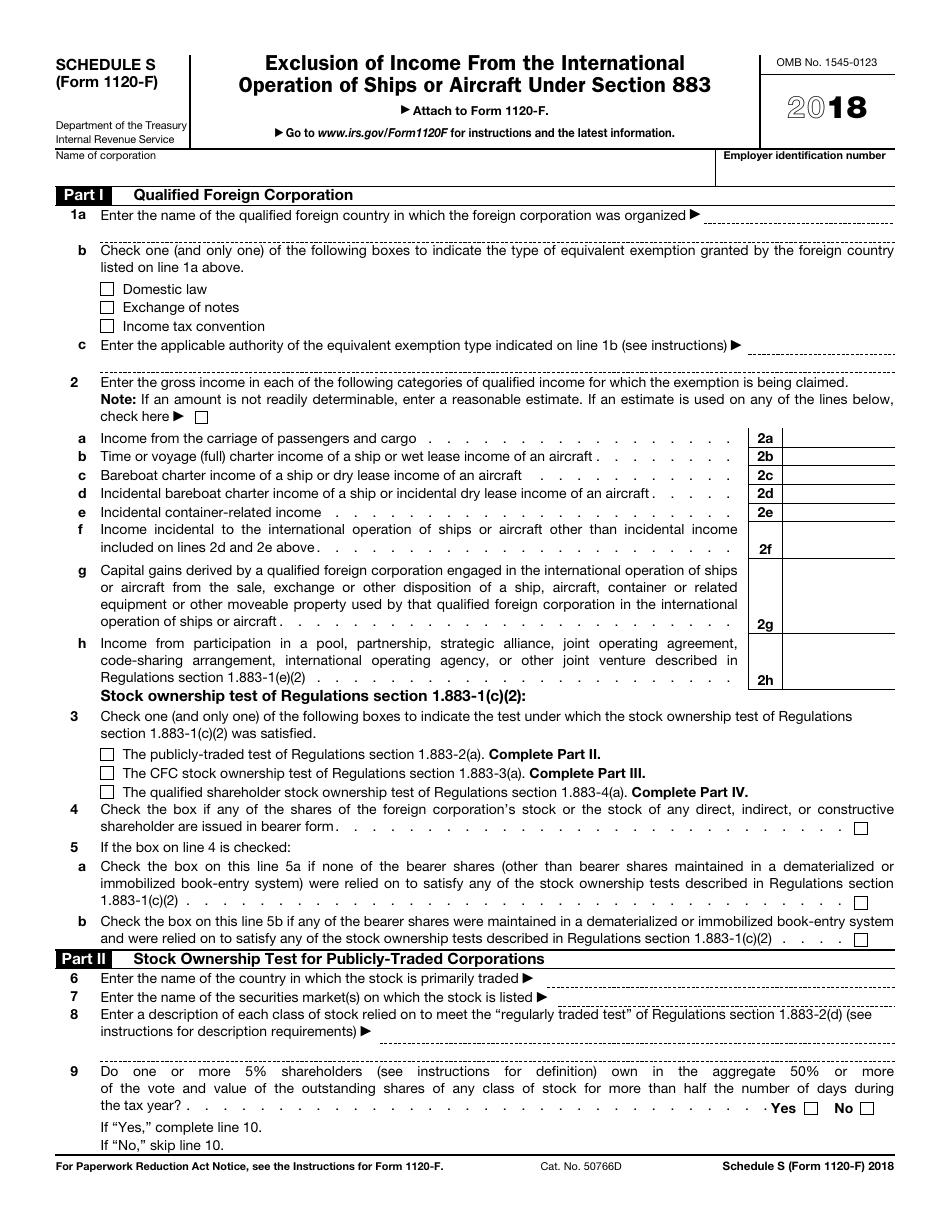

IRS Form 1120-F Schedule S Exclusion of Income From the International Operation of Ships or Aircraft Under Section 883

What Is IRS Form 1120-F Schedule S?

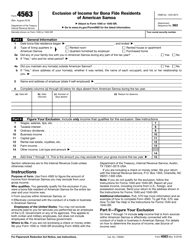

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1120-F, U.S. Income Tax Return of a Foreign Corporation. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-F Schedule S?

A: It is a schedule of Form 1120-F used to exclude income from the international operation of ships or aircraft.

Q: What does Section 883 refer to?

A: Section 883 refers to the provision in the U.S. tax code that allows for the exclusion of certain income from the international operation of ships or aircraft.

Q: Who is eligible to use Form 1120-F Schedule S?

A: Taxpayers who are engaged in the international operation of ships or aircraft and meet the requirements of Section 883 are eligible to use this form.

Q: What is the purpose of excluding income under Section 883?

A: The purpose is to provide tax relief for income derived from the international operation of ships or aircraft and to encourage U.S. competitiveness in the global transportation industry.

Q: Are there specific requirements to meet in order to qualify for the income exclusion?

A: Yes, there are specific requirements outlined in Section 883 that must be met in order to qualify for the income exclusion.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-F Schedule S through the link below or browse more documents in our library of IRS Forms.