This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1099-QA, 5498-QA

for the current year.

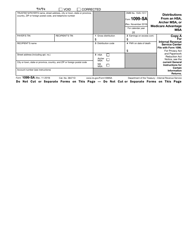

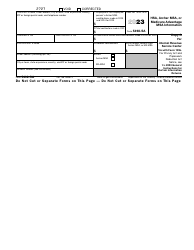

Instructions for IRS Form 1099-QA, 5498-QA Distributions From Able Accounts and Able Account Contribution Information

This document contains official instructions for IRS Form 1099-QA , and IRS Form 5498-QA . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1099-QA is available for download through this link. The latest available IRS Form 5498-QA can be downloaded through this link.

FAQ

Q: What is IRS Form 1099-QA?

A: IRS Form 1099-QA is used to report distributions from Able accounts and designated beneficiary contributions.

Q: What is IRS Form 5498-QA?

A: IRS Form 5498-QA is used to report information about Able account contributions.

Q: What are Able accounts?

A: Able accounts are tax-advantaged savings accounts for individuals with disabilities.

Q: Who needs to file IRS Form 1099-QA?

A: Financial institutions or issuers that make distributions from Able accounts need to file Form 1099-QA.

Q: Who needs to file IRS Form 5498-QA?

A: Financial institutions or issuers that receive Able account contributions need to file Form 5498-QA.

Q: What information is reported on IRS Form 1099-QA?

A: Form 1099-QA reports the total amount distributed from an Able account to the designated beneficiary.

Q: What information is reported on IRS Form 5498-QA?

A: Form 5498-QA reports the total contributions made to an Able account for the designated beneficiary.

Q: When are IRS Form 1099-QA and 5498-QA due?

A: Both forms are generally due to the IRS by February 28th (or March 31st if filing electronically) of the year following the calendar year in which the distributions or contributions were made.

Q: What are the penalties for not filing IRS Form 1099-QA or 5498-QA?

A: Penalties may apply for failure to file or for filing incorrect or incomplete forms. The specific penalties depend on the circumstances.

Instruction Details:

- This 4-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.