This version of the form is not currently in use and is provided for reference only. Download this version of

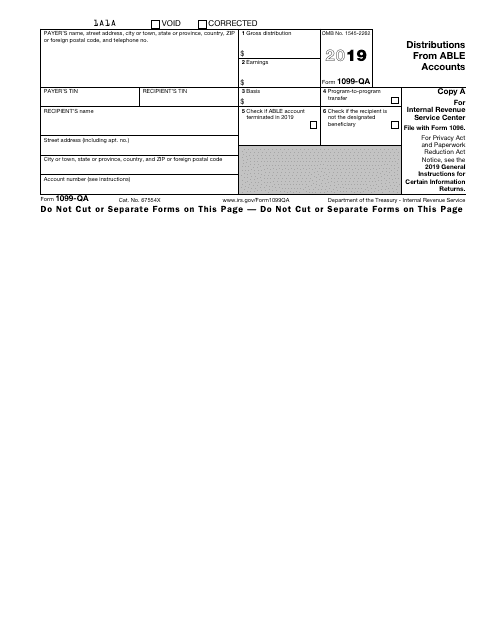

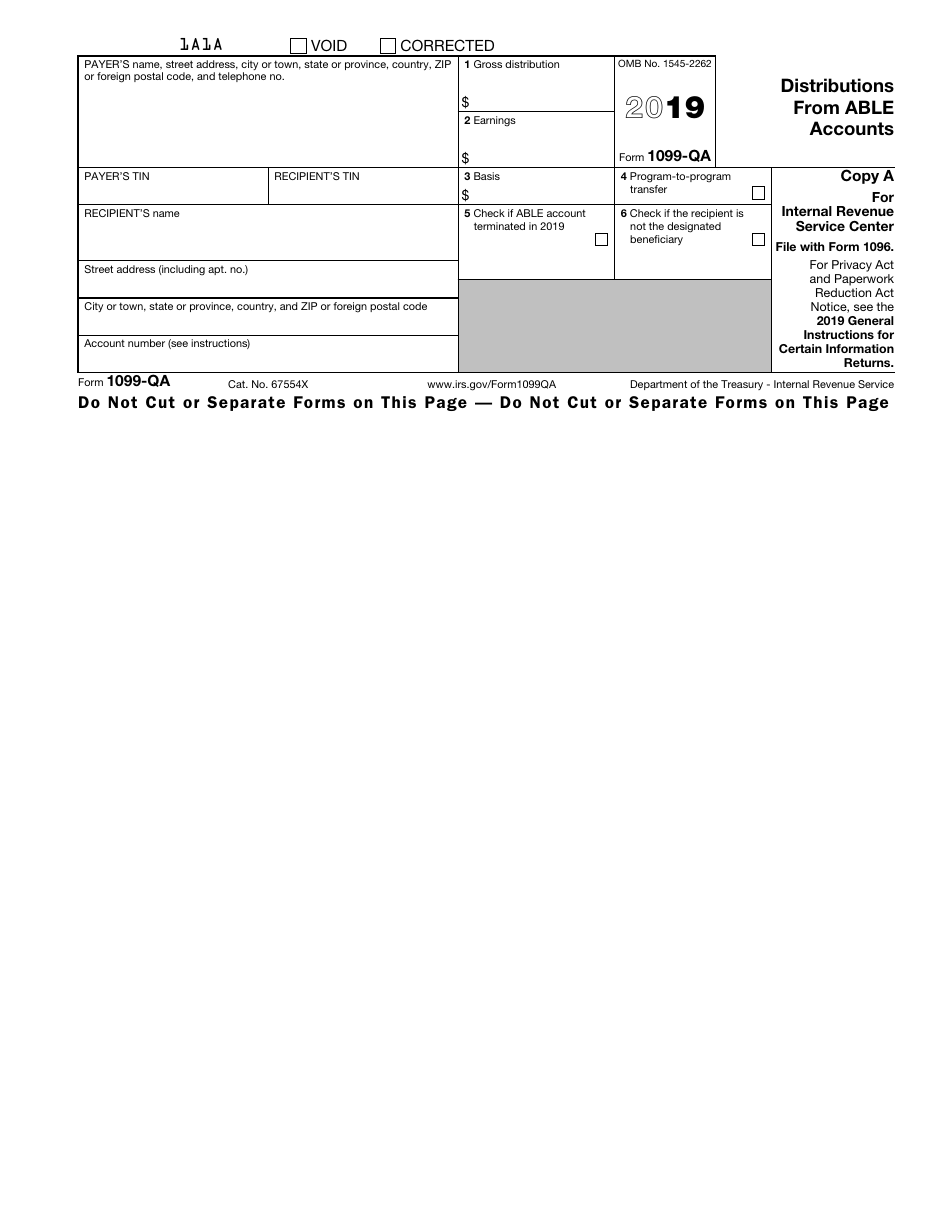

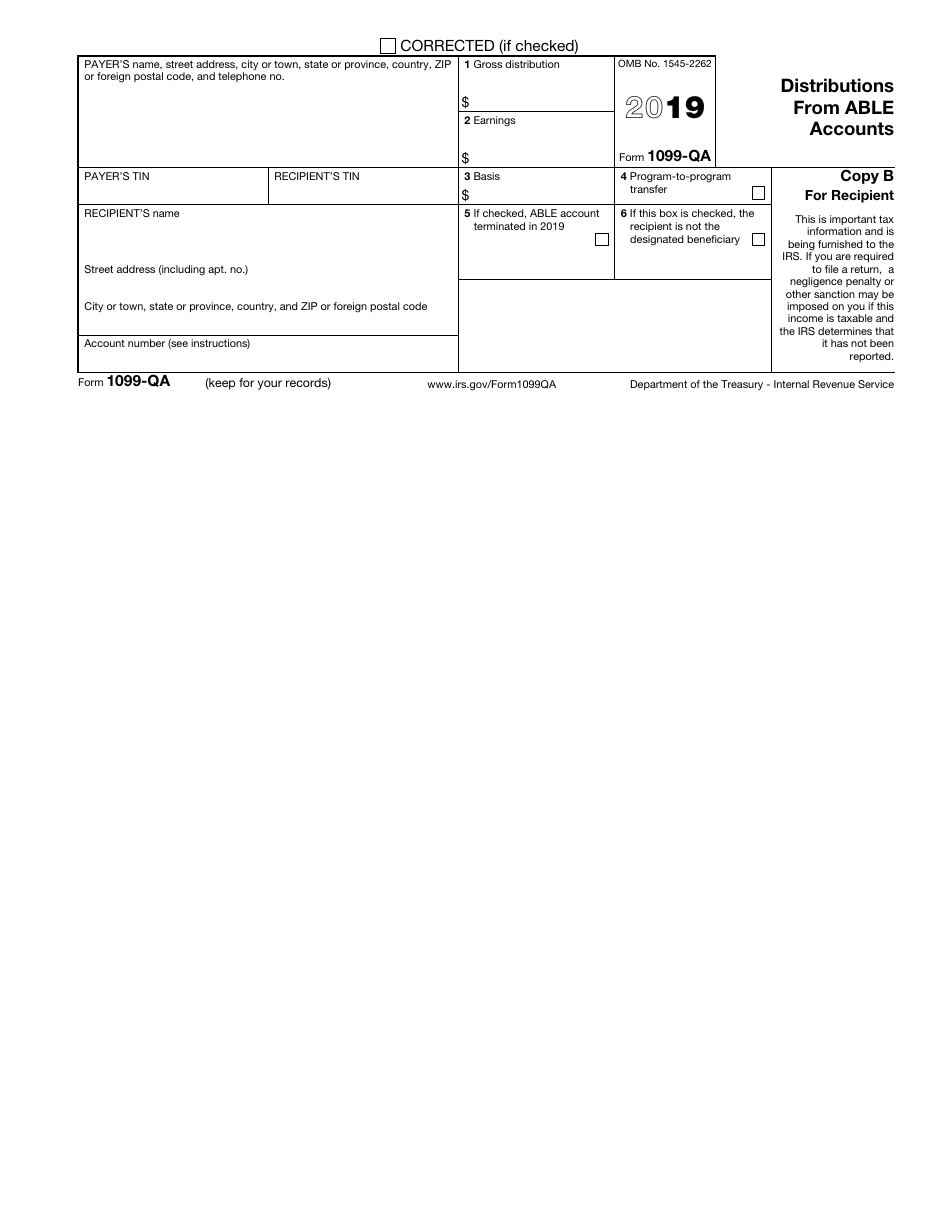

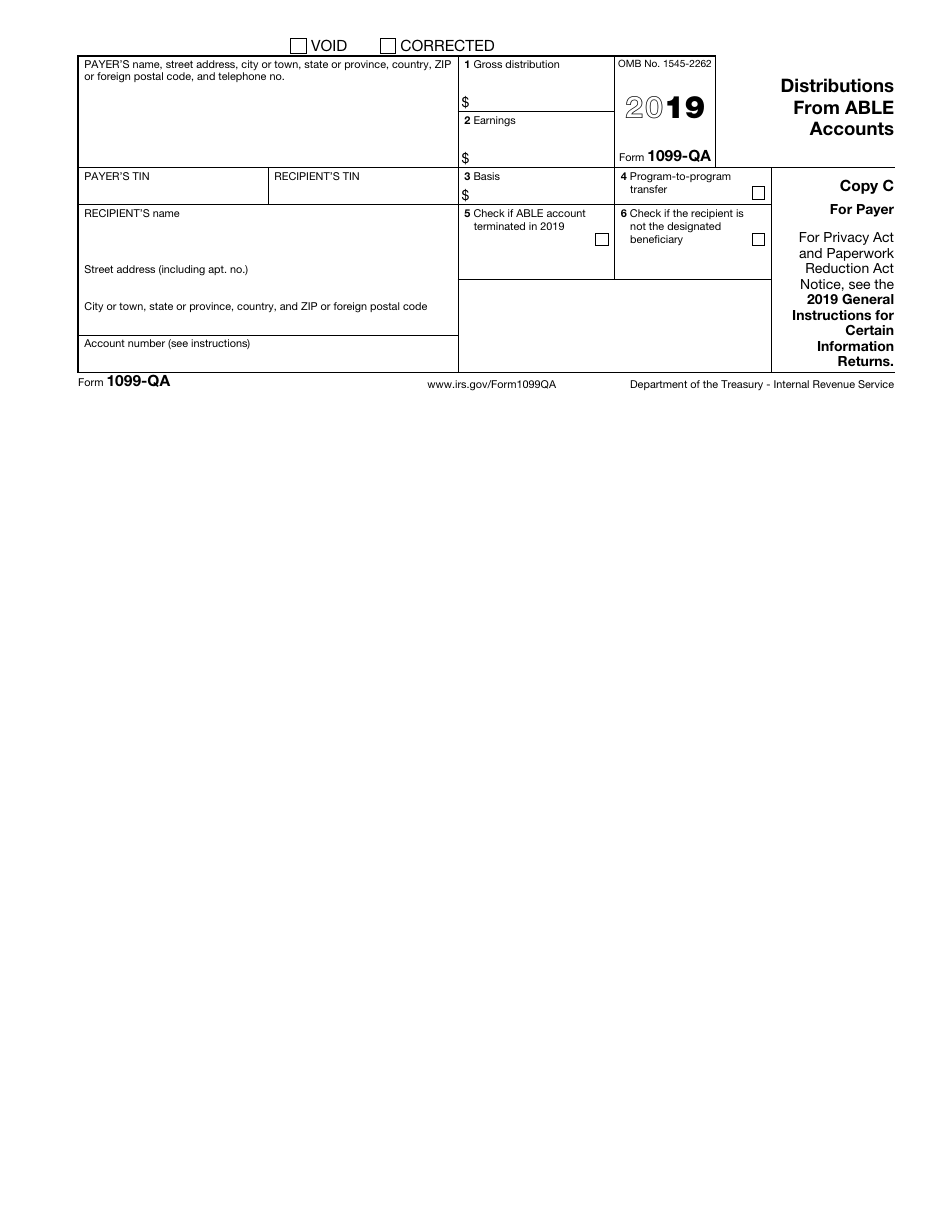

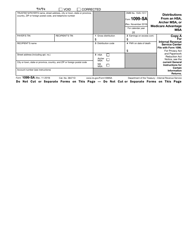

IRS Form 1099-QA

for the current year.

IRS Form 1099-QA Distributions From Able Accounts

What Is IRS Form 1099-QA?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1099-QA?

A: IRS Form 1099-QA is a tax form used to report distributions from Able accounts.

Q: What are Able accounts?

A: Able accounts, also known as Achieving a Better Life Experience accounts, are tax-advantaged savings accounts for individuals with disabilities.

Q: Who receives Form 1099-QA?

A: The account owner or the designated beneficiary of an Able account receives Form 1099-QA if there were distributions from the account.

Q: What types of distributions are reported on Form 1099-QA?

A: Form 1099-QA is used to report gross distributions, earnings, and basis for distributions made from an Able account.

Q: Do I need to report the distributions from my Able account on my tax return?

A: Yes, you generally need to report the distributions from your Able account on your tax return.

Q: Are distributions from Able accounts taxable?

A: It depends. If the distributions are used for qualified disability expenses, they are generally tax-free. However, if the distributions are not used for qualified expenses, they may be subject to income tax and penalties.

Q: When is the deadline to file Form 1099-QA?

A: Form 1099-QA must be filed with the IRS by January 31 of the following year, for the distributions made in the previous tax year.

Q: Do I need to attach a copy of Form 1099-QA to my tax return?

A: No, you do not need to attach a copy of Form 1099-QA to your tax return, but you should keep it for your records.

Form Details:

- A 5-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1099-QA through the link below or browse more documents in our library of IRS Forms.