Instructions for IRS Form 1099-LTC Long-Term Care and Accelerated Death Benefits

This document contains official instructions for IRS Form 1099-LTC , Long-Term Care and Accelerated Death Benefits - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1099-LTC is available for download through this link.

FAQ

Q: What is IRS Form 1099-LTC?

A: IRS Form 1099-LTC is a tax form used to report Long-Term Care and Accelerated Death Benefits.

Q: What are Long-Term Care Benefits?

A: Long-Term Care Benefits are payments received for providing necessary medical or personal care services to qualified individuals who are chronically ill.

Q: What are Accelerated Death Benefits?

A: Accelerated Death Benefits are payments received from a life insurance policy before the insured person's death, due to a qualifying illness or terminal condition.

Q: Who should file Form 1099-LTC?

A: Insurance companies or their agents who make payments of Long-Term Care or Accelerated Death Benefits should file Form 1099-LTC.

Q: How do I report Long-Term Care Benefits on Form 1099-LTC?

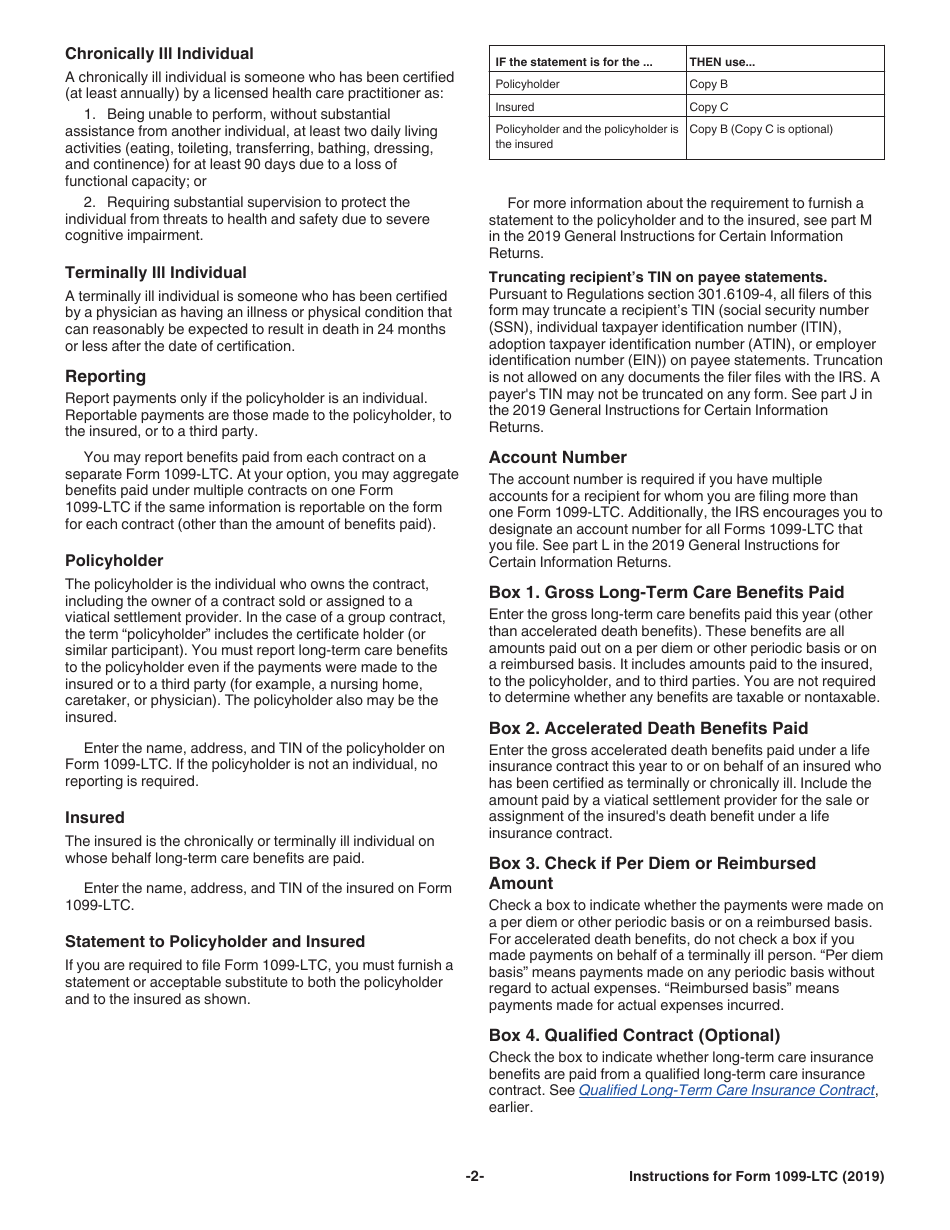

A: Report the gross amount of Long-Term Care Benefits paid during the year in Box 1 of Form 1099-LTC.

Q: How do I report Accelerated Death Benefits on Form 1099-LTC?

A: Report the gross amount of Accelerated Death Benefits paid during the year in Box 3 of Form 1099-LTC.

Q: Do I need to send Form 1099-LTC to the recipient?

A: Yes, you must furnish a copy of Form 1099-LTC to the recipient by January 31st of the following year.

Q: What if there are errors on Form 1099-LTC?

A: If you need to correct errors on previously filed Form 1099-LTC, you should file Form 1099-LTCc, Corrected Long-Term Care and Accelerated Death Benefits.

Q: Can I e-file Form 1099-LTC?

A: Yes, you can e-file Form 1099-LTC through the IRS FIRE (Filing Information Returns Electronically) system.

Instruction Details:

- This 3-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.