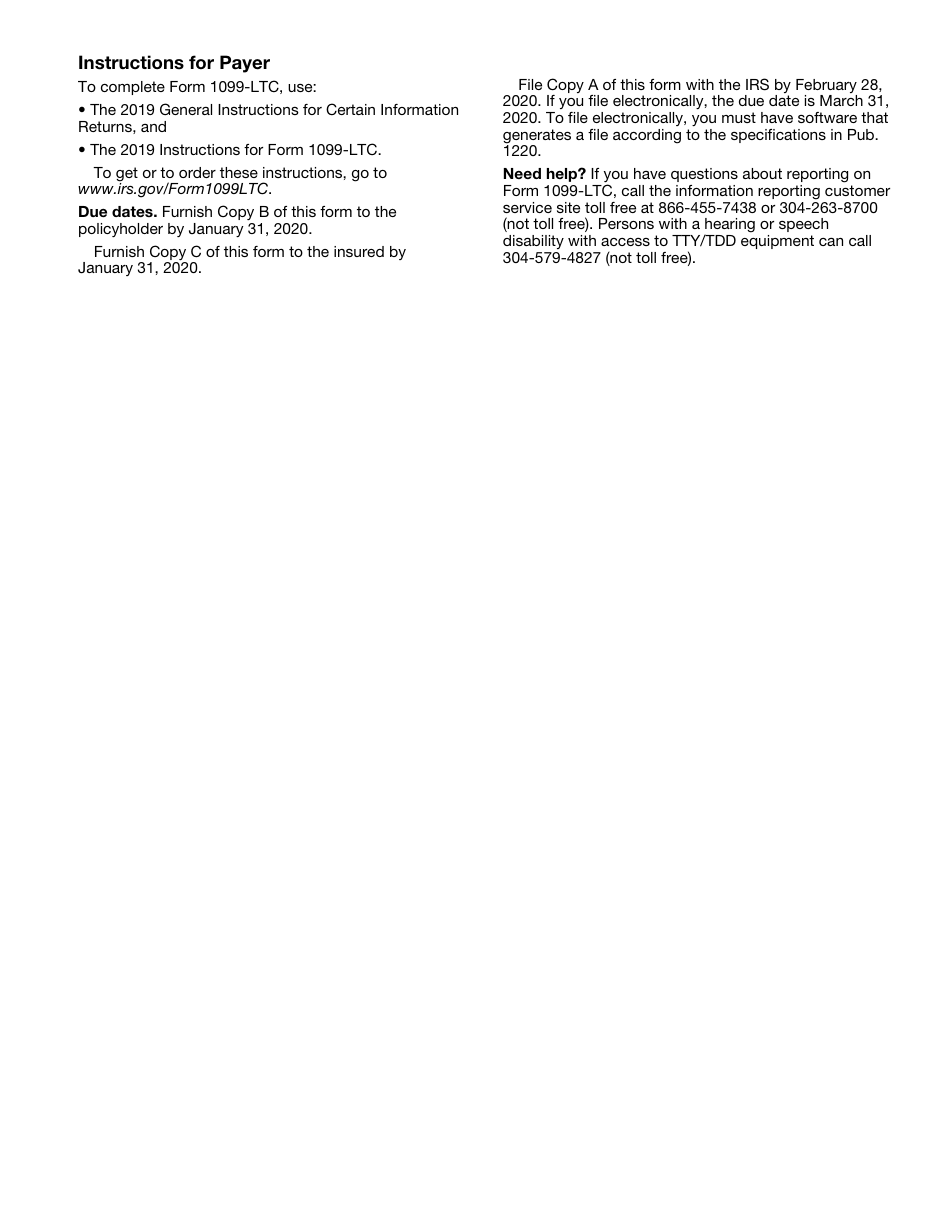

This version of the form is not currently in use and is provided for reference only. Download this version of

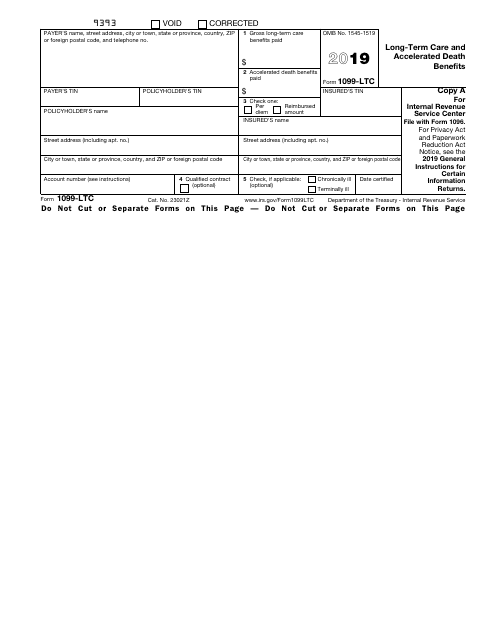

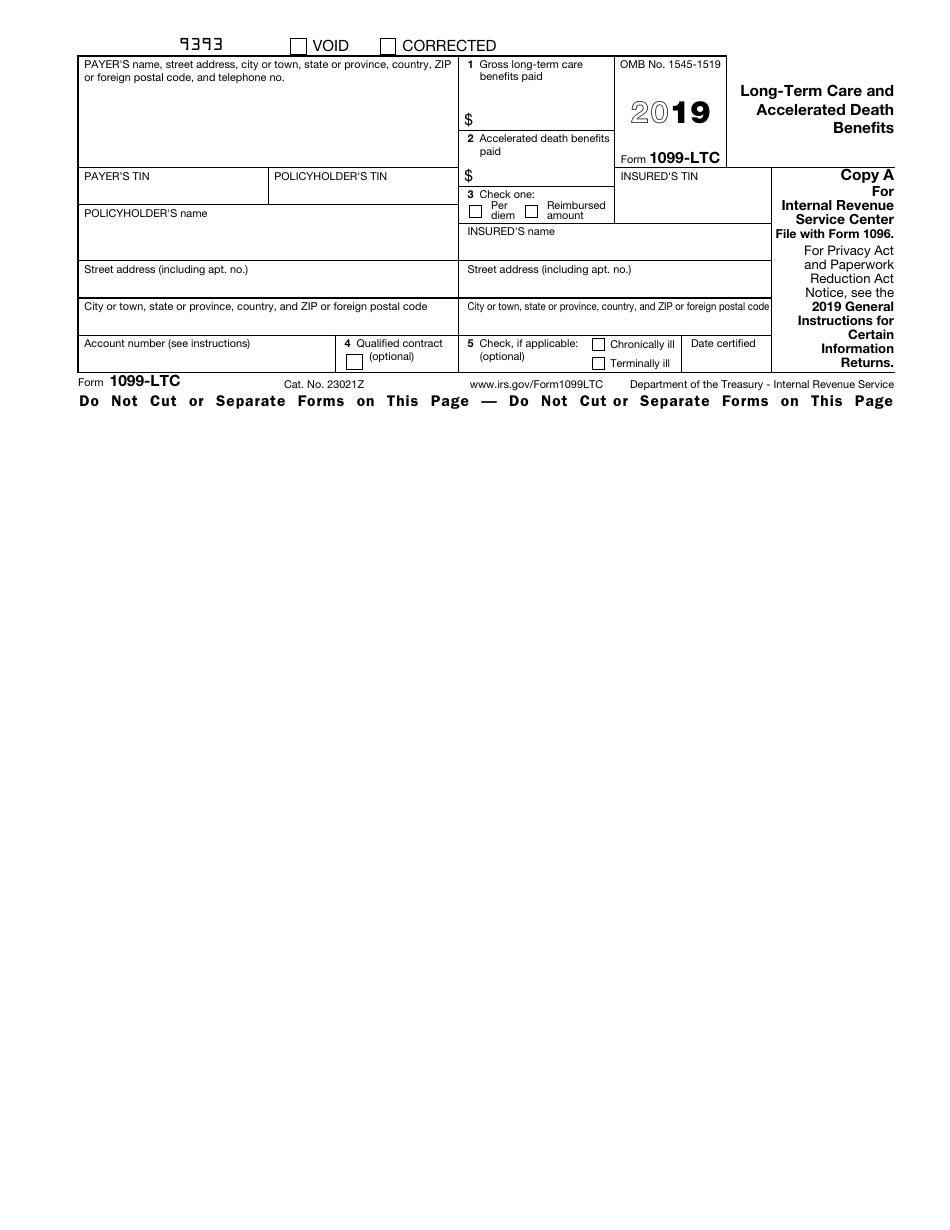

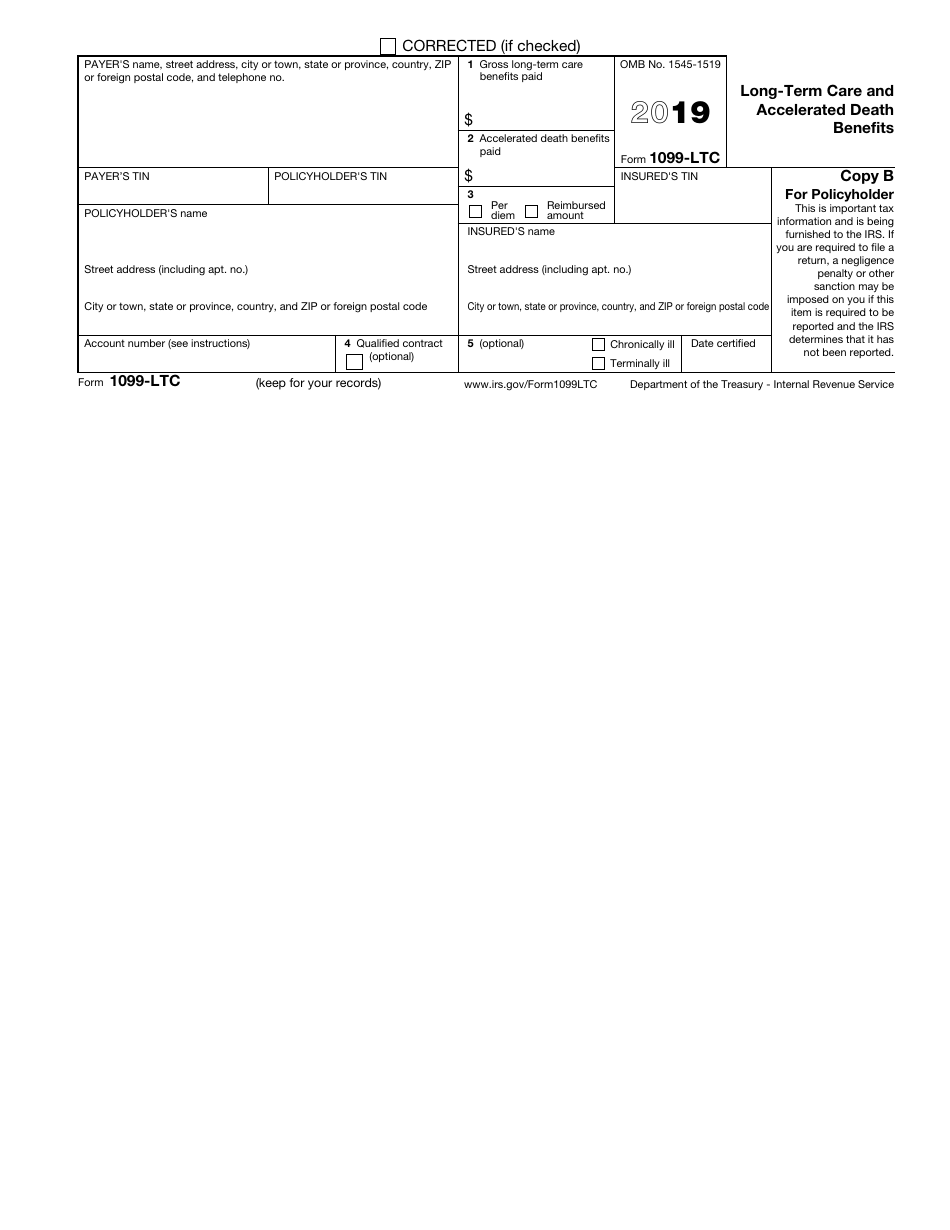

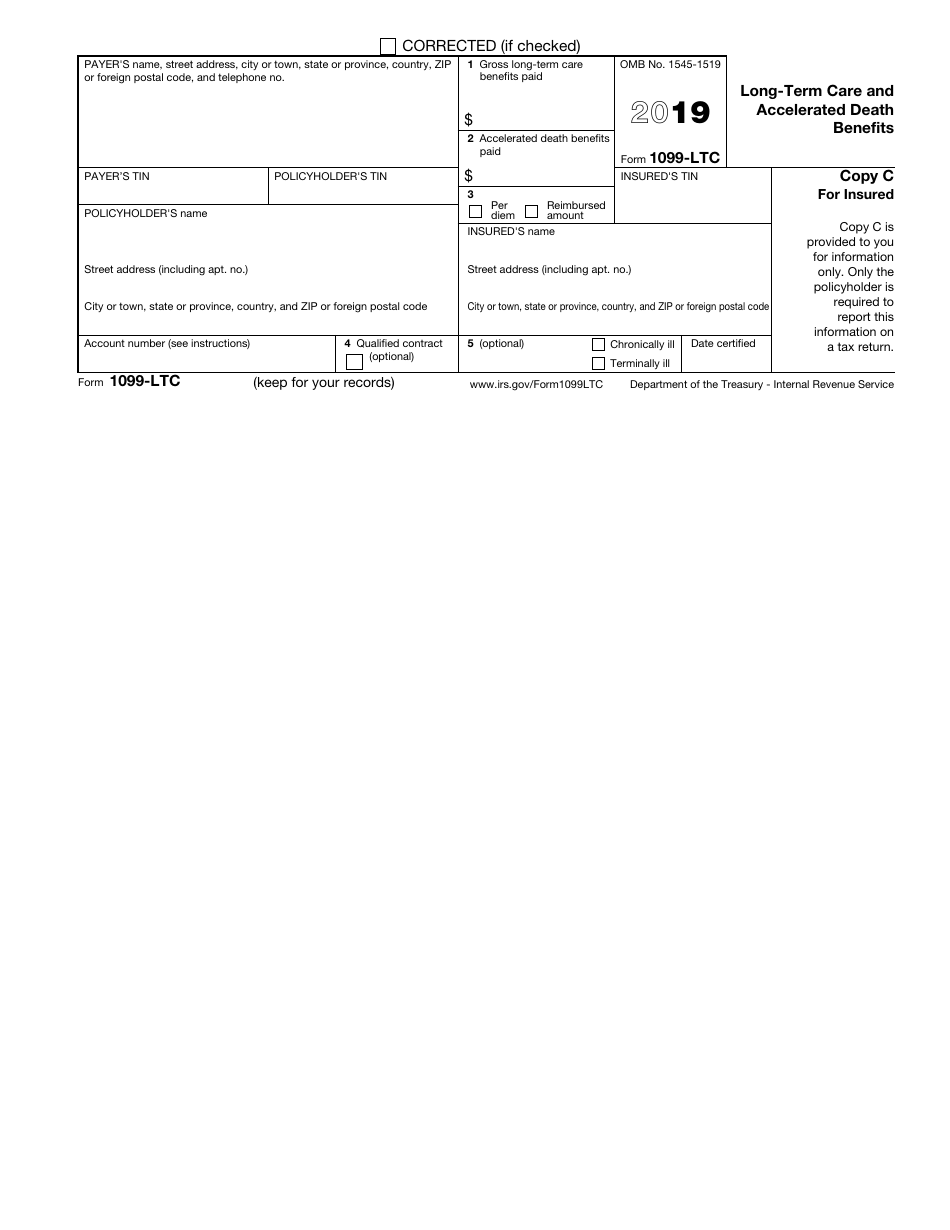

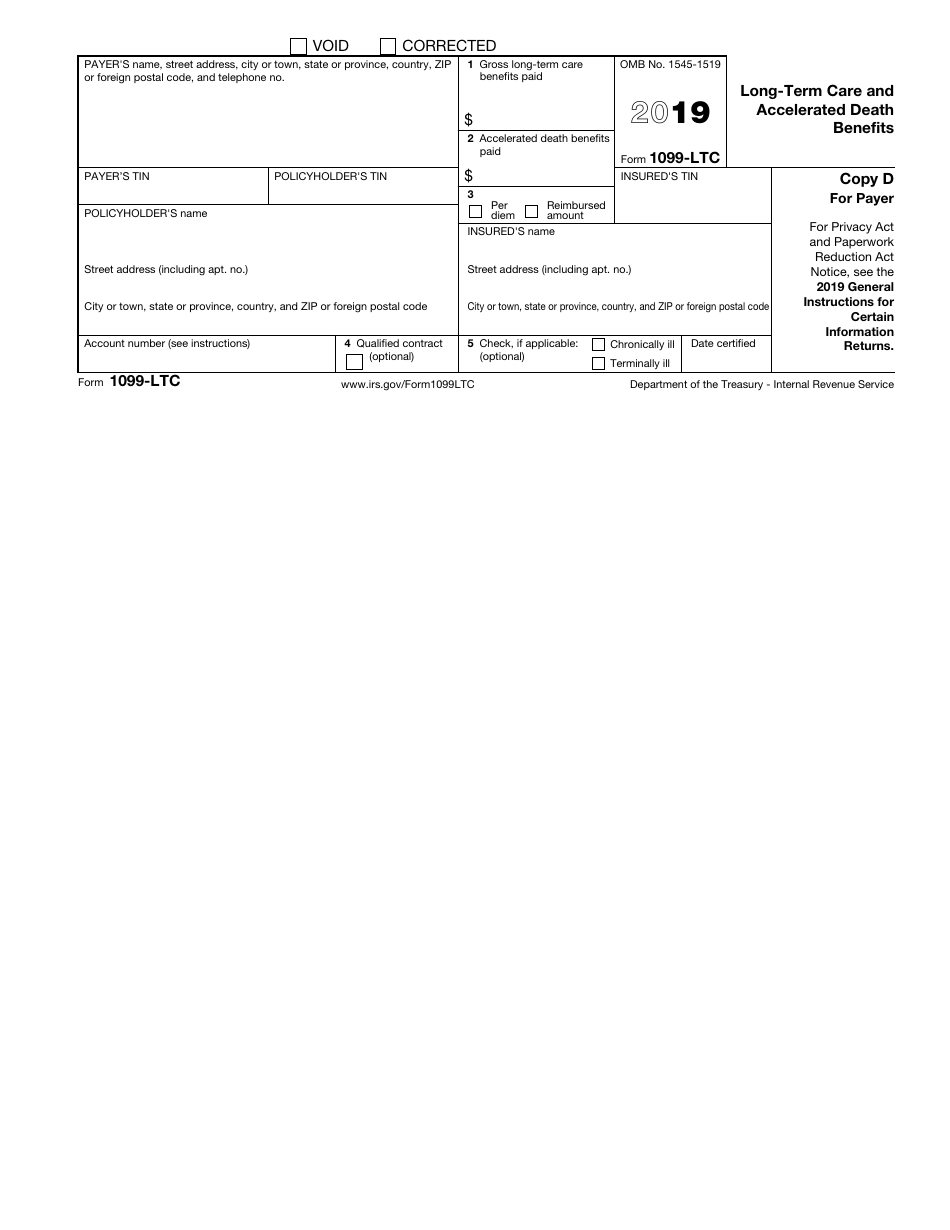

IRS Form 1099-LTC

for the current year.

IRS Form 1099-LTC Long-Term Care and Accelerated Death Benefits

What Is IRS Form 1099-LTC?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1099-LTC?

A: IRS Form 1099-LTC is a tax form used to report Long-Term Care and Accelerated Death Benefits.

Q: What are Long-Term Care benefits?

A: Long-Term Care benefits refer to the costs associated with extended care in a nursing home or assisted living facility.

Q: What are Accelerated Death Benefits?

A: Accelerated Death Benefits are payments made by a life insurance company to a policyholder who is terminally ill.

Q: Who needs to file IRS Form 1099-LTC?

A: Insurance companies, employers, or other entities that provide Long-Term Care or Accelerated Death Benefits need to file IRS Form 1099-LTC.

Q: What information is required on IRS Form 1099-LTC?

A: IRS Form 1099-LTC requires information such as the recipient's name, address, and taxpayer identification number, as well as the amount of benefits paid.

Q: When is IRS Form 1099-LTC due?

A: IRS Form 1099-LTC must be filed with the IRS by January 31st of the year following the calendar year in which the benefits were paid.

Form Details:

- A 7-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1099-LTC through the link below or browse more documents in our library of IRS Forms.