This version of the form is not currently in use and is provided for reference only. Download this version of

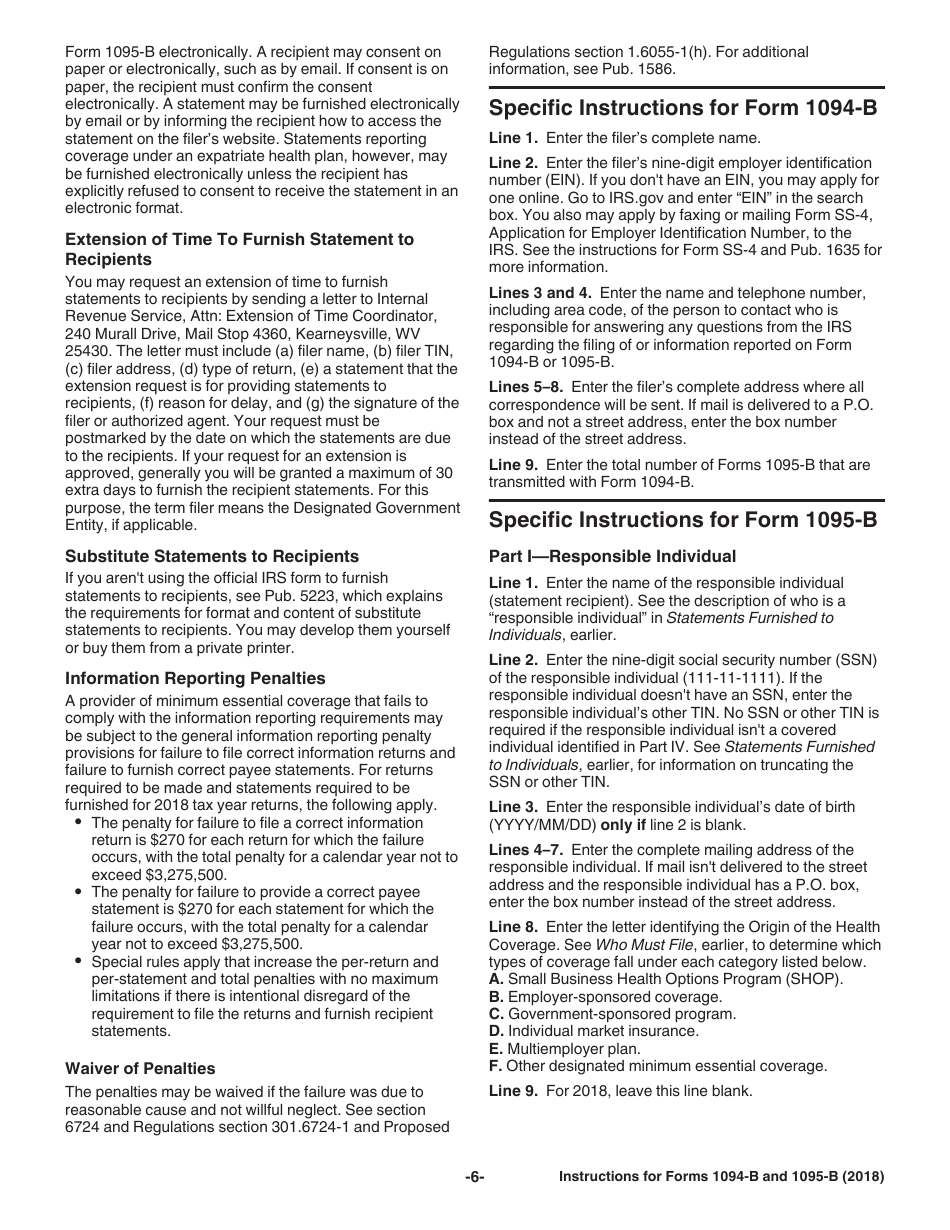

Instructions for IRS Form 1094-B, 1095-B

for the current year.

Instructions for IRS Form 1094-B, 1095-B

This document contains official instructions for IRS Form 1094-B , and IRS Form 1095-B . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1094-B is available for download through this link. The latest available IRS Form 1095-B can be downloaded through this link.

FAQ

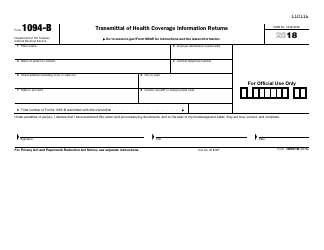

Q: What is IRS Form 1094-B?

A: IRS Form 1094-B is used by insurers, employers, and other entities to report information about health coverage offered to individuals.

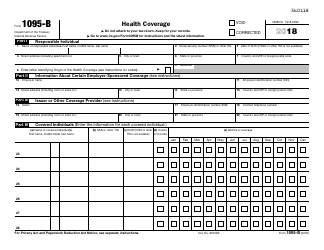

Q: What is IRS Form 1095-B?

A: IRS Form 1095-B is used by insurers, employers, and other entities to provide information about the individuals covered under a health insurance policy.

Q: Who needs to file IRS Form 1094-B?

A: Insurance companies, employers, and other entities that provide minimum essential health coverage must file IRS Form 1094-B.

Q: Who receives IRS Form 1095-B?

A: Individuals who are covered under a health insurance policy will receive IRS Form 1095-B.

Q: What information is provided on IRS Form 1094-B?

A: IRS Form 1094-B includes information about the issuer of the policy, number of covered individuals, and other details about the coverage.

Q: What information is provided on IRS Form 1095-B?

A: IRS Form 1095-B provides information about the covered individuals, including their names, social security numbers, and the months they were covered under the policy.

Q: When is the deadline to file IRS Form 1094-B?

A: The deadline to file IRS Form 1094-B is typically February 28th (or March 31st if filing electronically) of the year following the calendar year being reported.

Q: Is there a penalty for not filing IRS Form 1094-B?

A: Yes, there may be penalties for not filing or filing incorrect IRS Form 1094-B. It is important to comply with the reporting requirements.

Q: Do I need to include IRS Forms 1094-B and 1095-B with my tax return?

A: No, you do not need to include IRS Forms 1094-B and 1095-B with your individual tax return. However, you should keep a copy for your records.

Instruction Details:

- This 7-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.