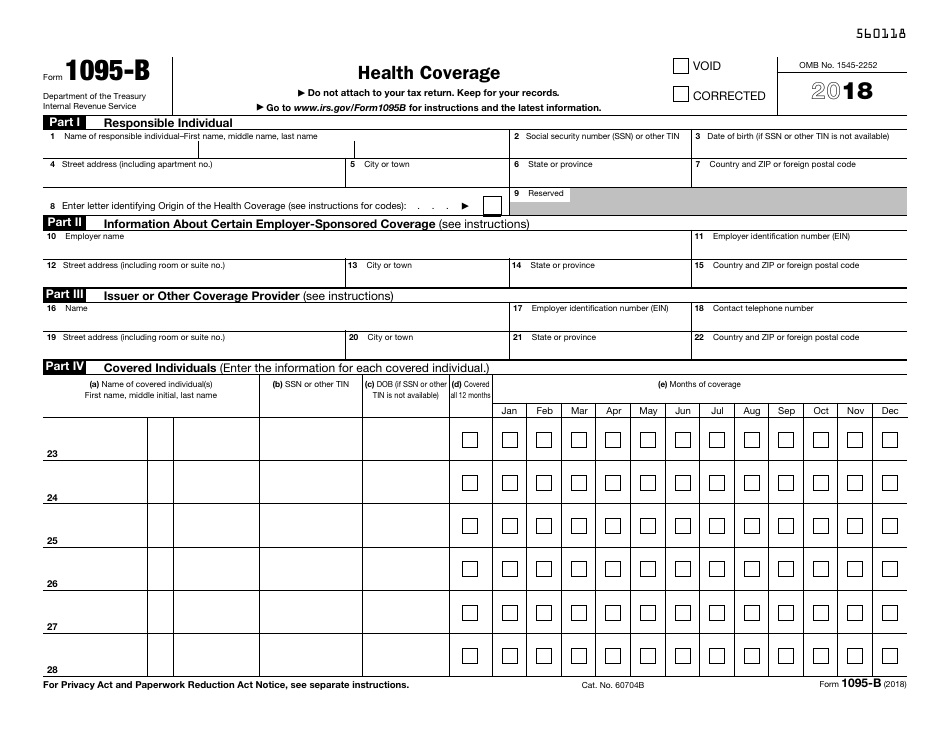

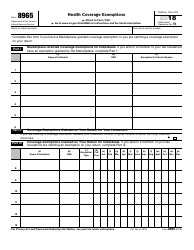

This version of the form is not currently in use and is provided for reference only. Download this version of

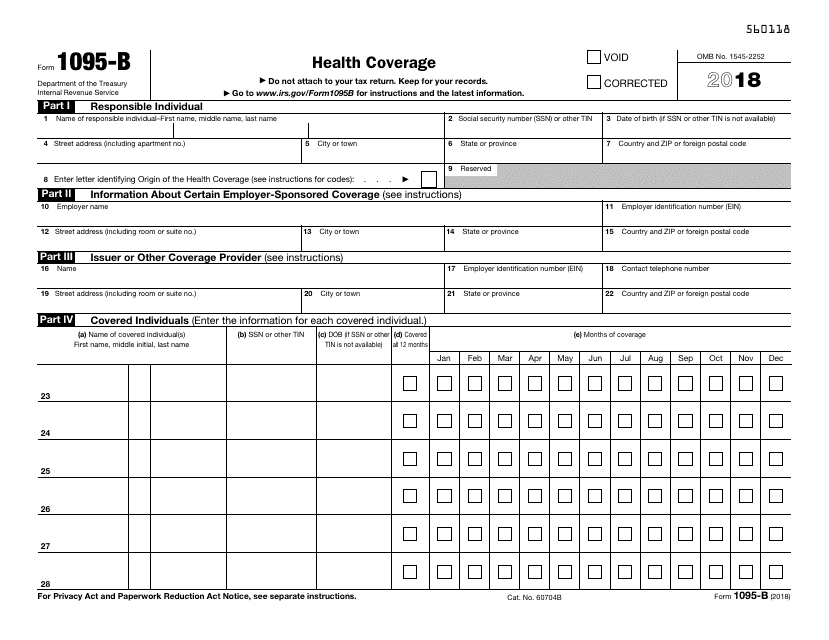

IRS Form 1095-B

for the current year.

IRS Form 1095-B Health Coverage

What Is IRS Form 1095-B?

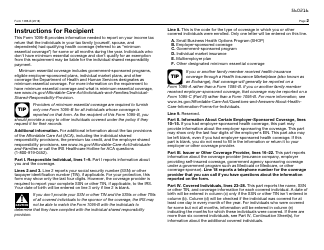

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

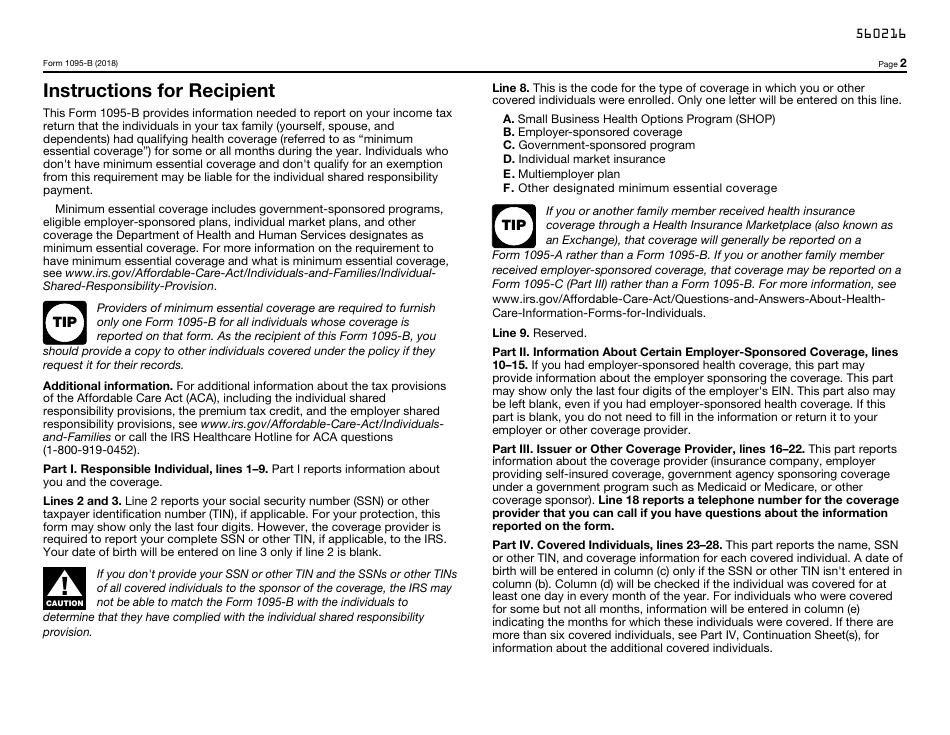

Q: What is IRS Form 1095-B?

A: IRS Form 1095-B is a tax form used to report information about an individual's health coverage.

Q: Who receives IRS Form 1095-B?

A: Individuals who have health coverage through certain government-sponsored programs or through insurance companies receive IRS Form 1095-B.

Q: What information is included on IRS Form 1095-B?

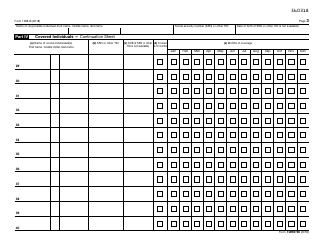

A: IRS Form 1095-B includes information about the individual and the health coverage they had during the tax year.

Q: Do I need IRS Form 1095-B to file my taxes?

A: While it is not necessary to attach IRS Form 1095-B to your tax return, you may need the information provided on the form to complete your tax return.

Q: What should I do if I did not receive IRS Form 1095-B?

A: If you did not receive IRS Form 1095-B, you should contact the entity responsible for providing your health coverage to obtain the necessary information.

Q: Is IRS Form 1095-B the same as IRS Form 1095-A?

A: No, IRS Form 1095-B is for individuals with certain types of health coverage, while IRS Form 1095-A is for individuals who purchased health insurance through the Marketplace.

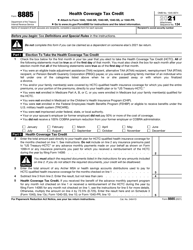

Q: How does IRS Form 1095-B affect my taxes?

A: IRS Form 1095-B provides information that may affect your eligibility for certain tax benefits, such as the premium tax credit.

Q: When do I need to receive IRS Form 1095-B?

A: You should receive IRS Form 1095-B by January 31st of the year following the tax year.

Form Details:

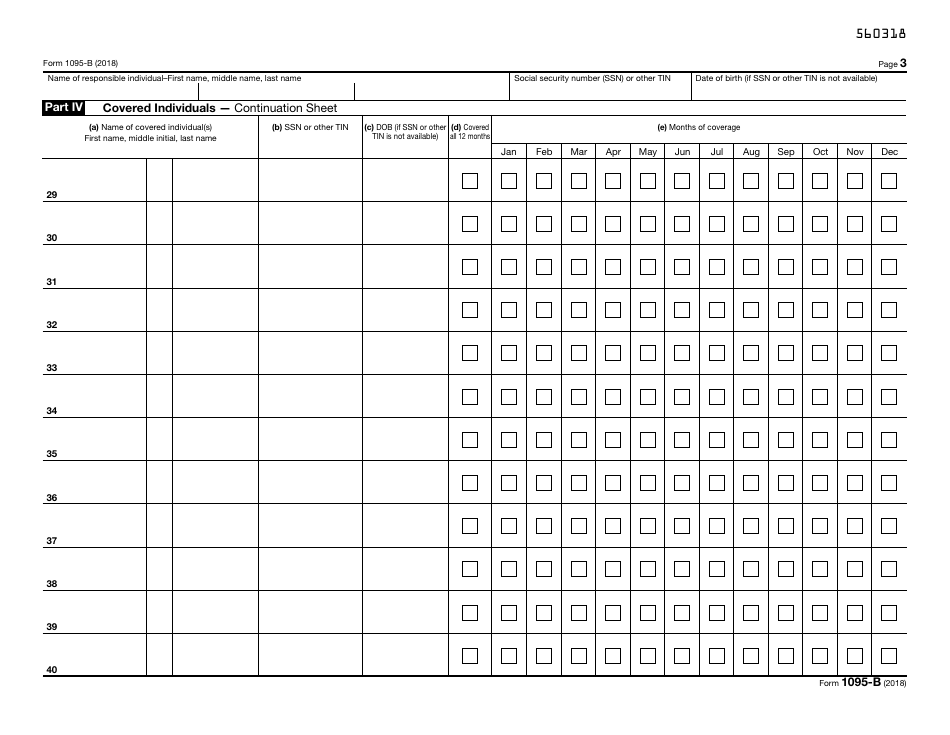

- A 3-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1095-B through the link below or browse more documents in our library of IRS Forms.