This version of the form is not currently in use and is provided for reference only. Download this version of

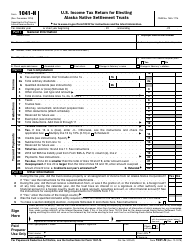

Instructions for IRS Form 1041-N

for the current year.

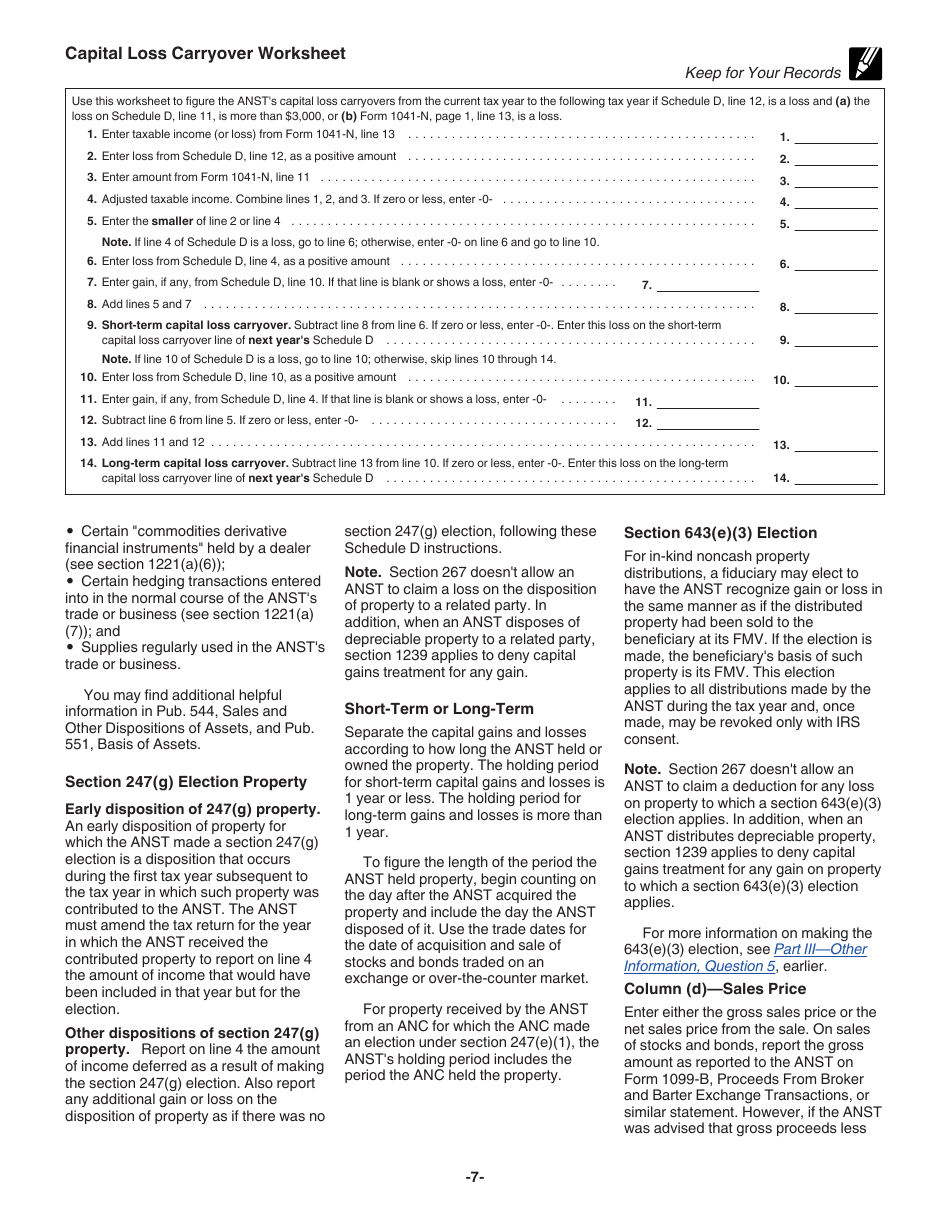

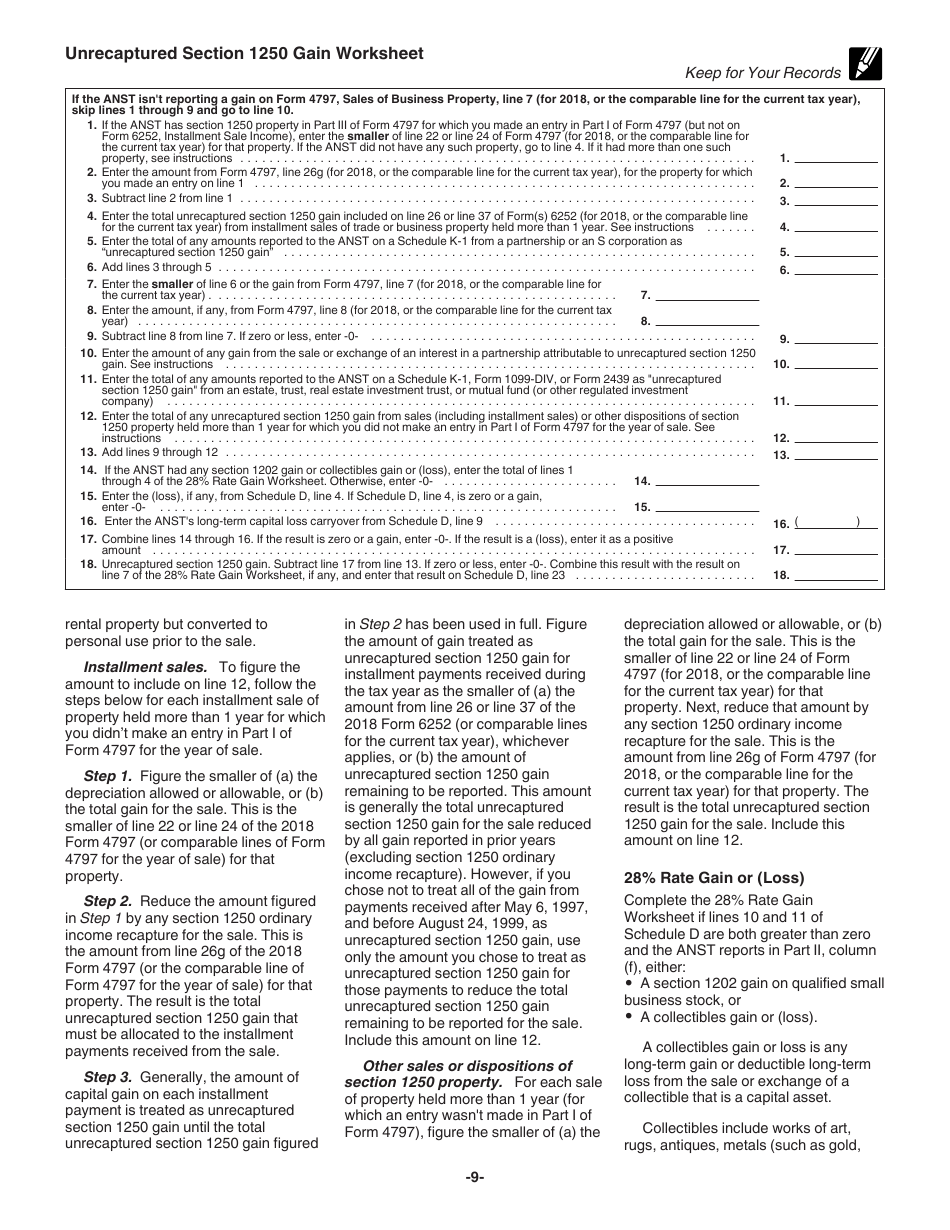

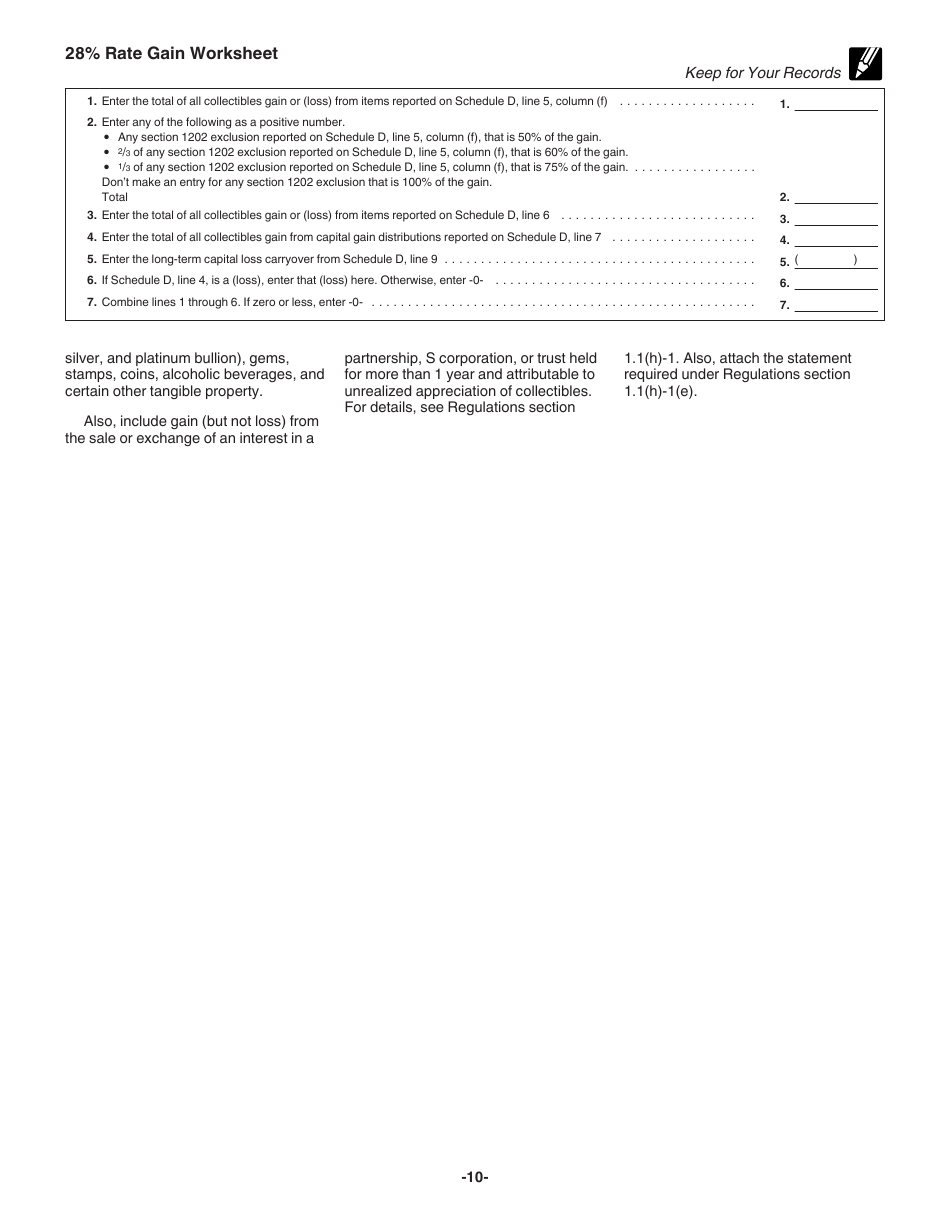

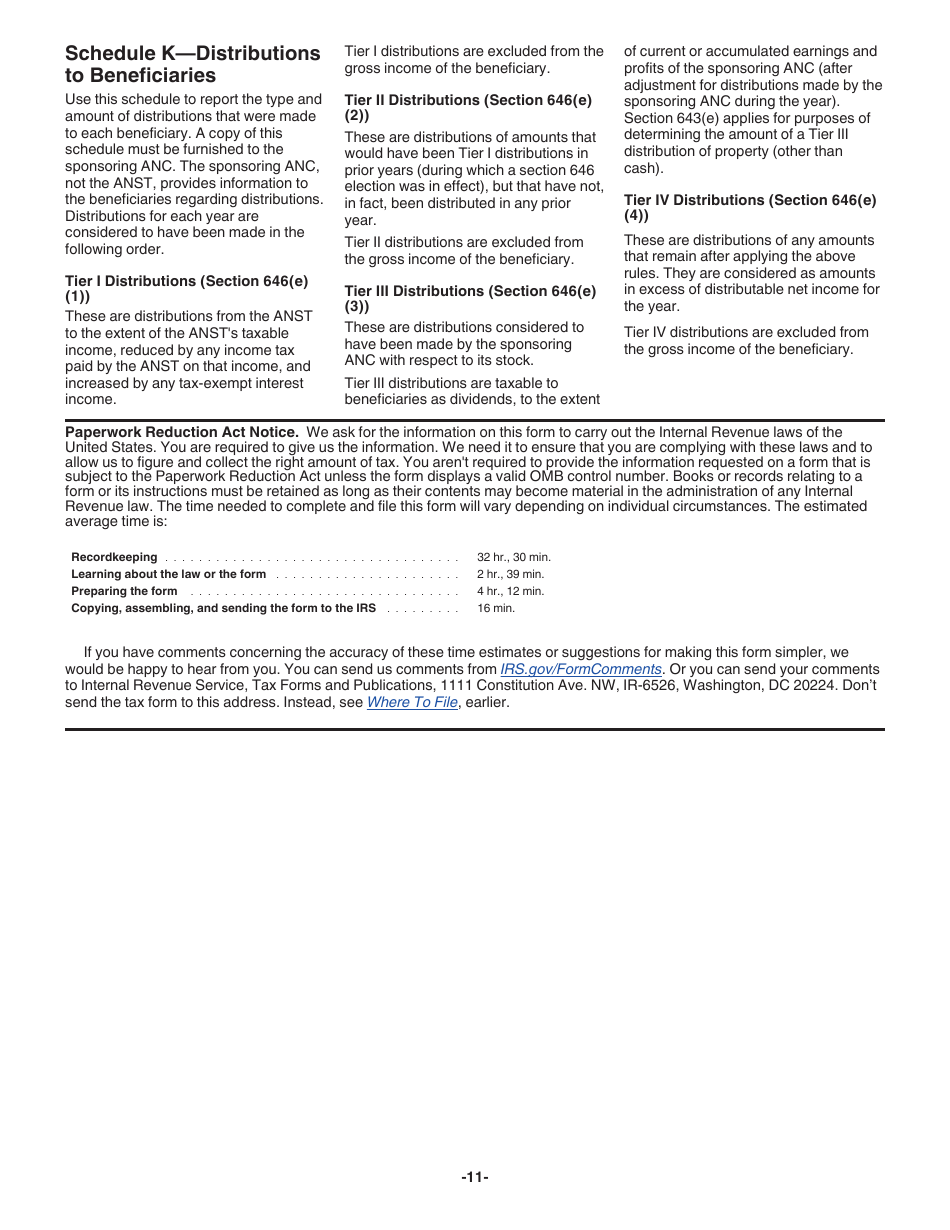

Instructions for IRS Form 1041-N U.S. Income Tax Return for Electing Alaska Native Settlement Trusts

This document contains official instructions for IRS Form 1041-N , U.S. Income Tax Return for Electing Alaska Native Settlement Trusts - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is Form 1041-N?

A: Form 1041-N is the U.S. Income Tax Return specifically for Electing Alaska Native Settlement Trusts.

Q: Who should file Form 1041-N?

A: Electing Alaska Native Settlement Trusts should file Form 1041-N.

Q: What is an Electing Alaska Native Settlement Trust?

A: An Electing Alaska Native Settlement Trust is a type of trust established by Alaska Native Corporations.

Q: What information is required for Form 1041-N?

A: Form 1041-N requires information about the trust, its income, deductions, and distributions.

Q: When is Form 1041-N due?

A: Form 1041-N is due by the 15th day of the 4th month following the end of the trust's tax year.

Q: Are there any exceptions for the due date of Form 1041-N?

A: Yes, there are exceptions for certain trusts, such as those that have a fiscal year-end other than December 31.

Instruction Details:

- This 11-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.