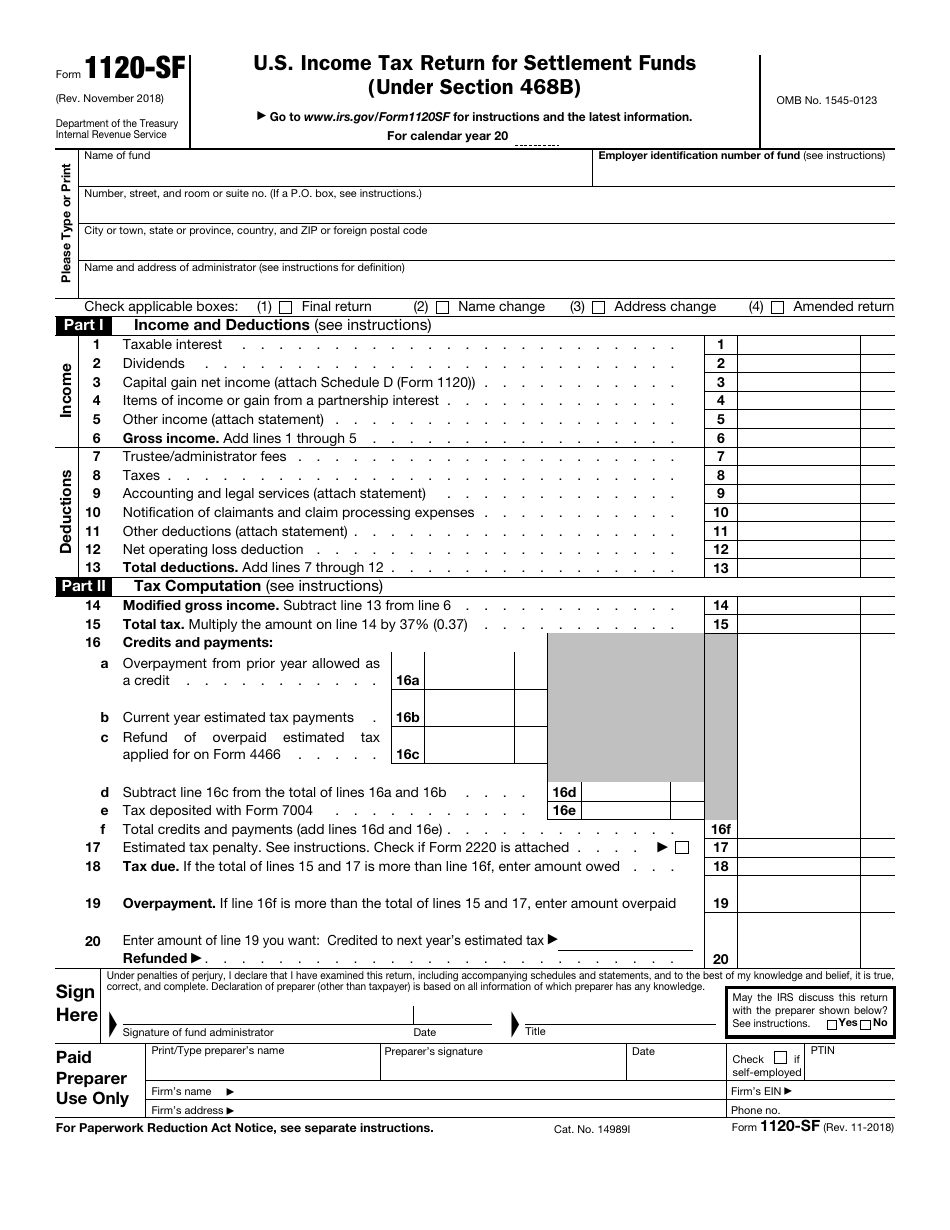

IRS Form 1120-SF U.S. Income Tax Return for Settlement Funds (Under Section 468b)

What Is IRS Form 1120-SF?

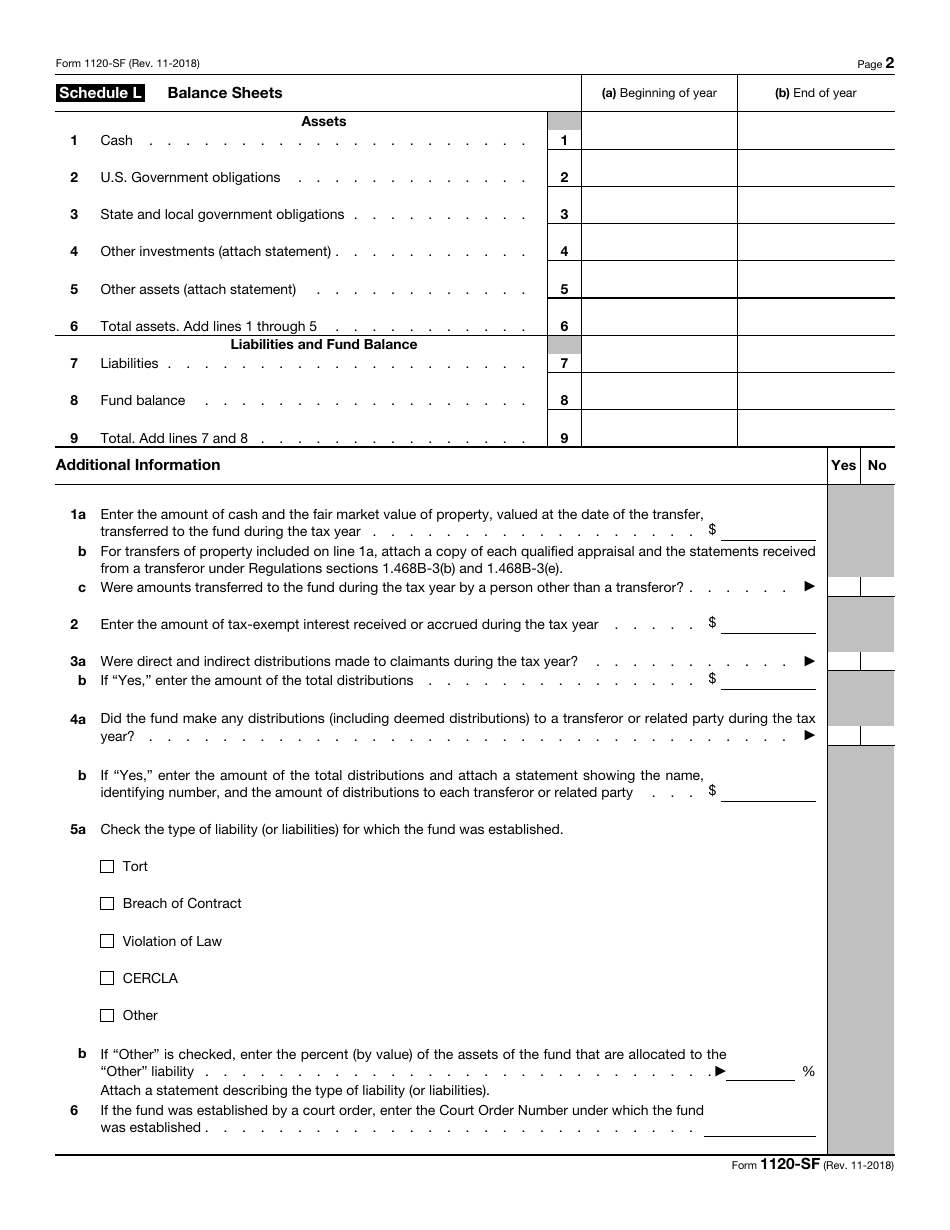

IRS Form 1120-SF, U.S. Income Tax Return for Settlement Funds , also known as the Qualified Settlement Fund Tax Return, is a form filed with the Internal Revenue Service (IRS) by Section 468B designated and qualified settlement funds, in order to report their transfers received, income earned, deductions claimed, distributions made, and to estimate their income tax liability.

This form was issued by the IRS and last revised on November 1, 2018 . A fillable version of the Form 1120-SF is available below.

IRS Form 1120-SF Instructions

Detailed information is provided in the IRS-distributed Form 1120-SF Instructions. In general terms, Form 1120-SF shall be filed by the 15th day of the 4th month after the end of the settlement fund's tax year. If the fund's tax year ends on June 30, the fund is required to file the 1120-SF Form by the 15th day of the 3rd month after the end of the fund's tax year. If the due date falls on a weekend or legal holiday, the form may be filed on the next business day. Funds may file Form 7004 to request an extension of time to file.

If a fund does not meet the filing deadline, including extensions, a penalty of 5% of the unpaid tax for each month or day the return is late, and up to a maximum of 25%, shall apply. The minimum penalty for a return that is 60 or more days late: $210 or the tax due, whichever is smaller. If the fund can demonstrate that failure to file the Form 1120-SF on time was due to reasonable cause, the penalty will not be imposed.

The 1120-SF Form must be signed and dated either by the administrator of the fund or by anyone who is paid to prepare the return.

For the funds whose principal office is located in the United States, the applicable IRS address where they must file the return is the following: Department of the Treasury, Internal Revenue Service Center, Ogden, UT 84201-0012

The funds located in a foreign country must file this return to the Internal Revenue Service Center, P.O. Box 409101, Ogden, UT 84409.

IRS 1120-SF Related Forms:

- Form 1120, U.S. Corporation Income Tax Return. This form is used by domestic corporations for reporting their losses, deductions, income, gains, and credits, and to calculate income tax liability.

- Form 1120-C, U.S. Income Tax Return for Cooperative Associations. Corporations that operate on a cooperative basis use this form to report their income, gains, losses, deductions, and credits, as well as to figure their income tax liability.

- Form 1120-F, U.S. Income Tax Return of a Foreign Corporation. This form is filed by foreign corporations with the IRS to report their income, gains, losses, deductions, and credits, and to figure their U.S. income tax liability.

- Form 1120-H, U.S. Income Tax Return for Homeowners Associations. Homeowners associations file this form to exclude the exempt function income from their gross income.

- Form 1120-L, U.S. Life Insurance Company Income Tax Return. Life insurance companies use this form to report their income, gains, losses, deductions, and credits, and to figure their income tax liability.

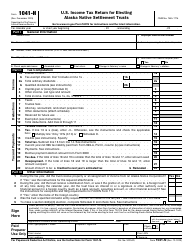

- Form 1120-ND, Return for Nuclear Decommissioning Funds and Certain Related Persons. Nuclear decommissioning funds file this form to report the income earned, the contributions received, the administrative expenses of fund operation, the tax on modified gross income, and the section 4951 initial taxes.

- Form 1120-S, U.S. Income Tax Return for an S Corporation. This form is used to report the income, gains, losses, deductions, and credits of a domestic corporation or any other entity for any tax year covered by an election to be an S corporation. 1120-FSC, U.S. Income Tax Return of a Foreign Sales Corporation. Foreign Sales Corporation (FSC) or small FSC use this form to report their income, deductions, losses, gains, credits, and income tax liability.

- Form 1120-IC-DISC, Interest Charge Domestic International Sales Corporation Return. This form is used by interest charge domestic international sales corporations (IC-DISCs), former DISCs, and former IC-DISCs.

- Form 1120-POL, US Income Tax Return for Certain Political Organizations. This form is filed with the IRS by political organizations and certain exempt organizations to report their political organization taxable income and income tax liability section 527.

- Form 1120-PC, U.S. Property and Casualty Insurance Company Income Tax Return. This form is filed to report the income, gains, losses, deductions, and credits, and to figure the income tax liability of insurance companies, apart from life insurance companies.

- Form 1120-REIT, U.S. Income Tax Return for Real Estate Investment Trusts. Corporations, trusts, and associations electing to be treated as Real Estate Investment Trusts file this form with the IRS to report their income, deductions, credits, gains, losses, certain penalties, and income tax liability.

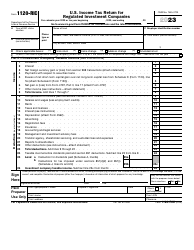

- Form 1120-RIC, U.S. Income Tax Return for Regulated Investment Companies. Regulated investment companies (RIC) file this form to report their income, deductions, gains, losses, credits, as well as to calculate their income tax liability.

- Form 1120-W, Estimated Tax for Corporations. Corporations must use this form to estimate their tax liability and to figure the amount of their estimated tax payments.

- Form 1120-X, Amended U.S. Corporation Income Tax Return. This document is used by corporations to correct Form 1120 (or Form 1120-A), a claim for refund, or an examination, as well as to make certain elections after the prescribed deadline.