This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990-EZ

for the current year.

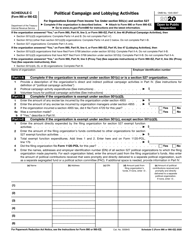

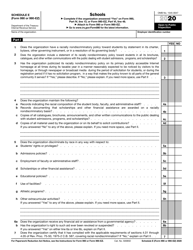

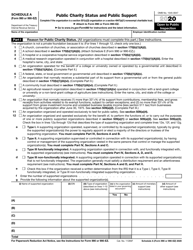

Instructions for IRS Form 990-EZ Short Form Return of Organization Exempt From Income Tax

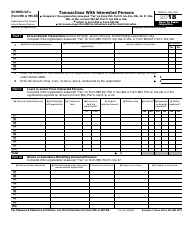

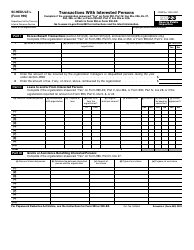

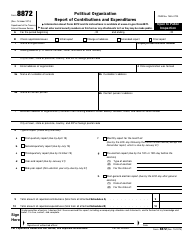

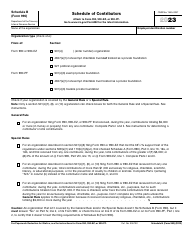

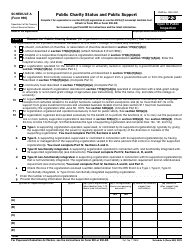

This document contains official instructions for IRS Form 990-EZ , Short Form Return of Organization Exempt From Income Tax - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 (990-EZ) Schedule L is available for download through this link.

FAQ

Q: What is IRS Form 990-EZ?

A: IRS Form 990-EZ is a simplified version of the standard Form 990 for organizations exempt from income tax.

Q: Who is eligible to file Form 990-EZ?

A: Organizations that have gross receipts less than $200,000 and total assets less than $500,000 can file Form 990-EZ.

Q: What is the purpose of Form 990-EZ?

A: The purpose of Form 990-EZ is to report financial information and provide transparency for tax-exempt organizations.

Q: What information is required on Form 990-EZ?

A: Form 990-EZ requires organizations to provide details about their revenue, expenses, assets, programs, governance, and other relevant information.

Q: When is Form 990-EZ due?

A: Form 990-EZ is due on the 15th day of the fifth month after the organization's fiscal year ends, typically on May 15 for organizations with a calendar year.

Q: Are there any penalties for late filing of Form 990-EZ?

A: Yes, there are penalties for late filing of Form 990-EZ. The penalty amount depends on the organization's average annual gross receipts.

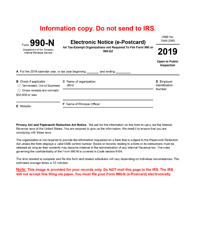

Q: Can Form 990-EZ be e-filed?

A: Yes, Form 990-EZ can be e-filed. Organizations can use the IRS' Electronic Filing System (e-File) to submit their Form 990-EZ.

Q: Do all tax-exempt organizations need to file Form 990-EZ?

A: No, not all tax-exempt organizations need to file Form 990-EZ. Some may be required to file the longer Form 990 or Form 990-PF, depending on their size and structure.

Q: What if I need more time to complete Form 990-EZ?

A: If you need more time to complete Form 990-EZ, you can request an extension by filing Form 8868 before the original due date.

Instruction Details:

- This 47-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.