This version of the form is not currently in use and is provided for reference only. Download this version of

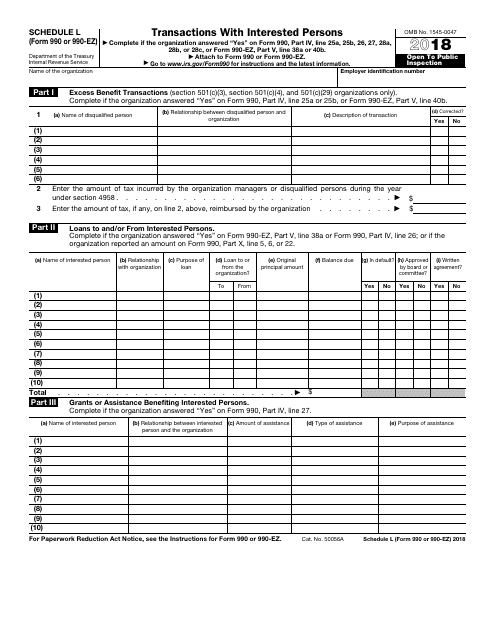

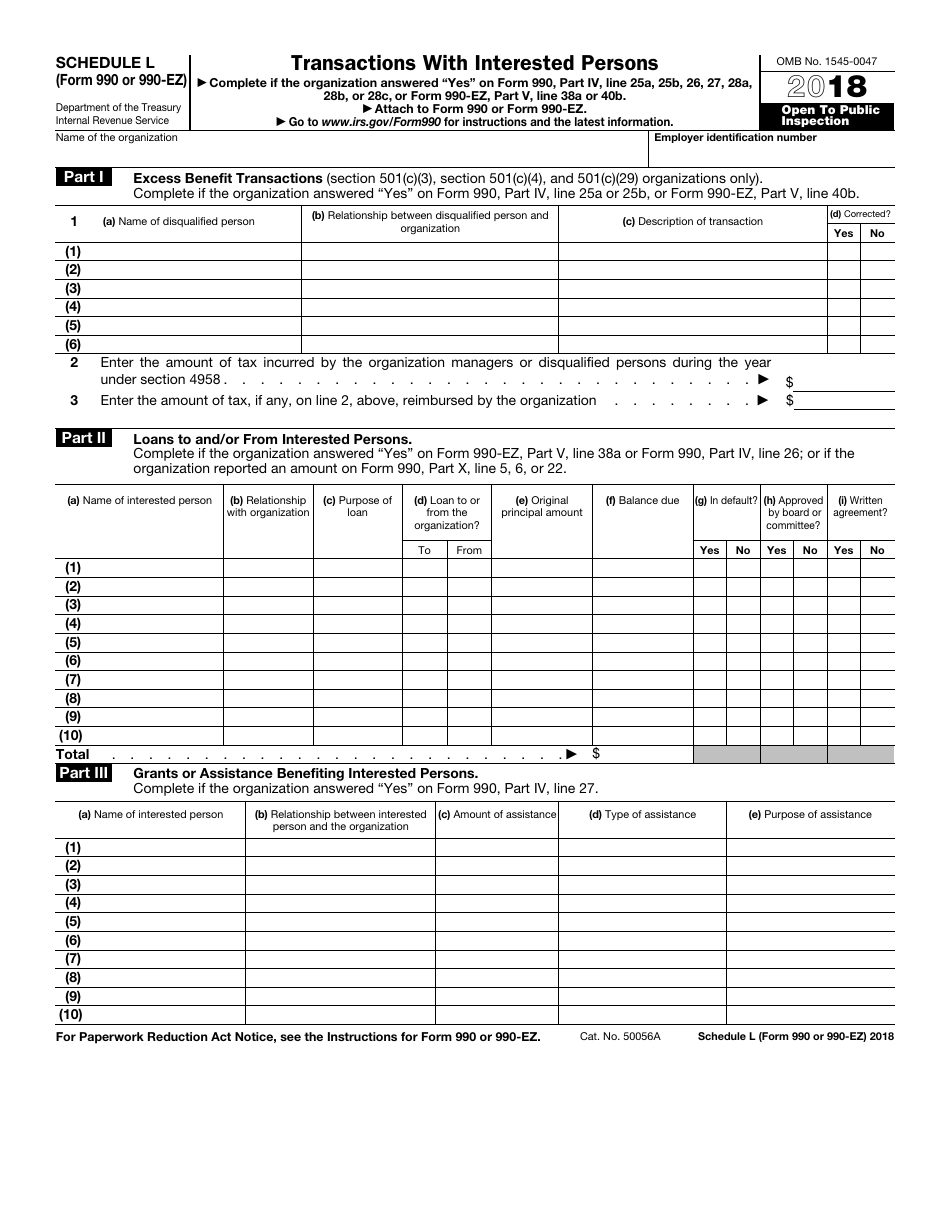

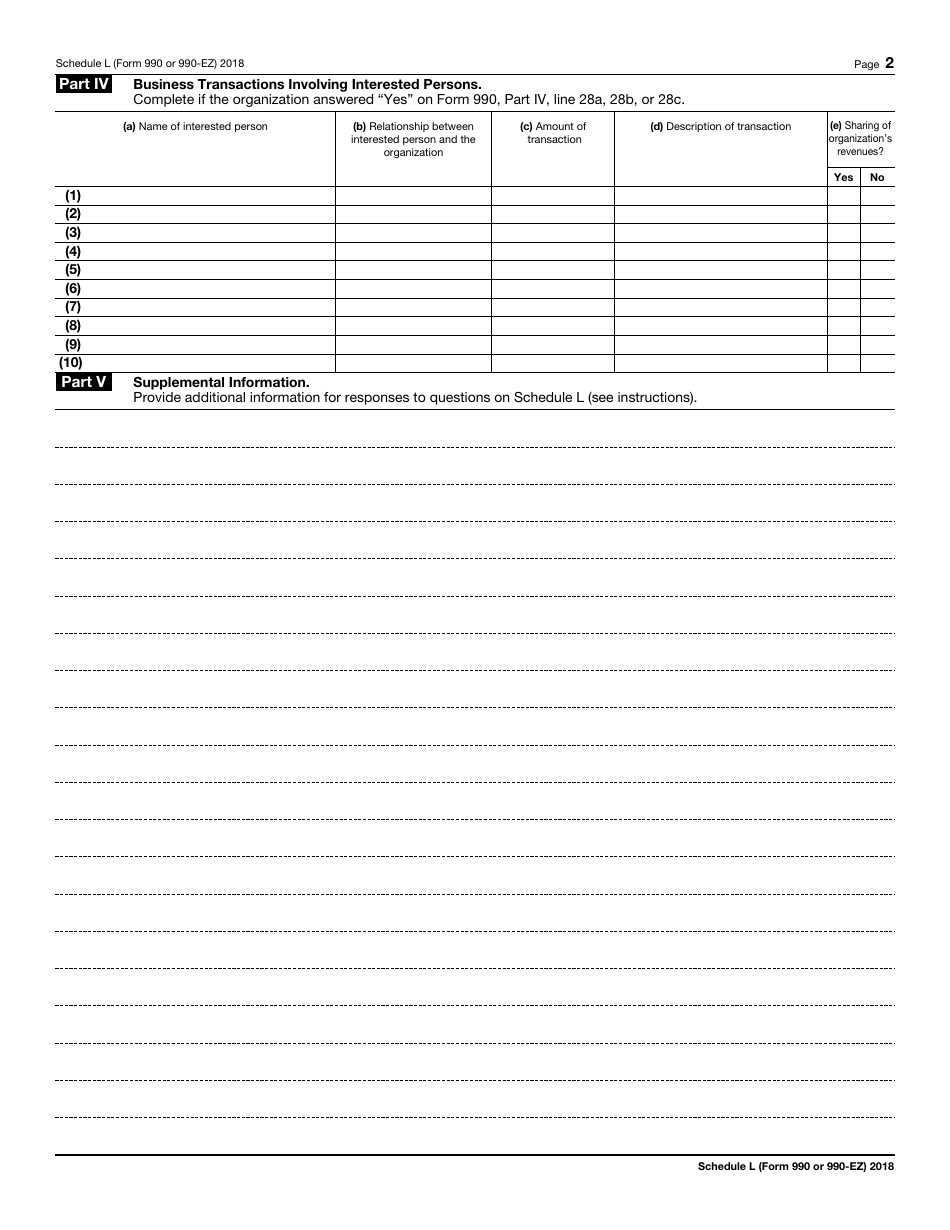

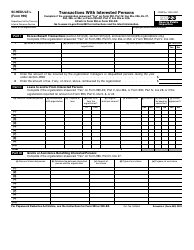

IRS Form 990 (990-EZ) Schedule L

for the current year.

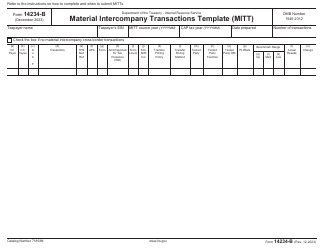

IRS Form 990 (990-EZ) Schedule L Transactions With Interested Persons

What Is IRS Form 990 (990-EZ) Schedule L?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 990, and IRS Form 990-EZ. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 990 (990-EZ)?

A: IRS Form 990 (990-EZ) is a tax form that certain tax-exempt organizations in the United States are required to file annually to provide information about their operations, finances, and transactions.

Q: What is Schedule L on Form 990 (990-EZ)?

A: Schedule L is a section of IRS Form 990 (990-EZ) that is used to report transactions between the tax-exempt organization and interested persons.

Q: Who are considered interested persons for Schedule L?

A: Interested persons include the organization's officers, directors, trustees, key employees, and certain family members.

Q: What kind of transactions are reported on Schedule L?

A: Schedule L reports various types of transactions, such as loans, grants, leases, and business transactions, between the tax-exempt organization and interested persons.

Q: Why are transactions with interested persons reported on Schedule L?

A: Transactions with interested persons are reported on Schedule L to ensure transparency and prevent conflicts of interest within tax-exempt organizations.

Q: Is Schedule L required for all tax-exempt organizations?

A: No, Schedule L is only required for tax-exempt organizations that have certain types of transactions with interested persons.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990 (990-EZ) Schedule L through the link below or browse more documents in our library of IRS Forms.