This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1040 Schedule F

for the current year.

Instructions for IRS Form 1040 Schedule F Profit or Loss From Farming

This document contains official instructions for IRS Form 1040 Schedule F, Profit or Loss From Farming - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 Schedule F is available for download through this link.

FAQ

Q: What is IRS Form 1040 Schedule F?

A: IRS Form 1040 Schedule F is a tax form used to report profit or loss from farming activities.

Q: Who needs to file IRS Form 1040 Schedule F?

A: Farmers who have a profit or loss from their farming activities need to file IRS Form 1040 Schedule F.

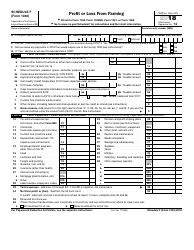

Q: What information is needed to fill out IRS Form 1040 Schedule F?

A: To fill out IRS Form 1040 Schedule F, you will need information about your farming activities, such as income, expenses, and deductions.

Q: What should be reported as income on IRS Form 1040 Schedule F?

A: Income from farming activities, such as sales of livestock, produce, or other farm products, should be reported on IRS Form 1040 Schedule F.

Q: What can be deducted as expenses on IRS Form 1040 Schedule F?

A: Expenses directly related to your farming activities, such as seeds, fertilizers, fuel, equipment maintenance, and labor costs, can be deducted on IRS Form 1040 Schedule F.

Q: What is the deadline for filing IRS Form 1040 Schedule F?

A: IRS Form 1040 Schedule F is typically filed along with your annual tax return, which is due on April 15th.

Q: Are there any penalties for not filing IRS Form 1040 Schedule F?

A: Failure to file IRS Form 1040 Schedule F when required may result in penalties and interest on any unpaid tax.

Q: Can I e-file IRS Form 1040 Schedule F?

A: Yes, you can e-file IRS Form 1040 Schedule F using tax software or through the IRS Free File program.

Q: Do I need to keep records of my farming activities?

A: Yes, it is important to keep detailed records of your farming activities and related transactions for at least three years in case of any future audits or inquiries from the IRS.

Instruction Details:

- This 12-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.